- Technical indicators suggest that BTC may accelerate its upward trend after breaking through the upper Bollinger Band at $116,187.

- Institutional funding continues to flow in, with Metaplanet and Trump Media planning to invest a combined total of over $2.5 billion.

- Market sentiment has turned positive, supported by an improved regulatory environment and infrastructure development.

BTC Price Prediction

Bitcoin technical analysis shows the bullish pattern is solid.

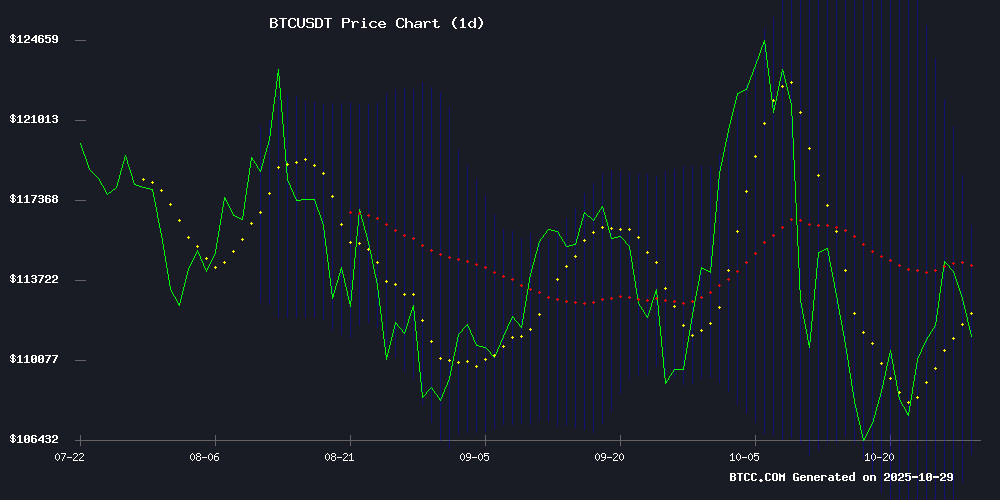

According to Robert, a financial analyst at BTCC, the current BTC price of $111,041.84 is slightly above the 20-day moving average of $110,976.14, indicating a short-term bullish trend. Although the MACD indicator is negative at -1,213.75, the narrowing histogram suggests a potential shift in momentum. The Bollinger Bands show the price above the middle band, with the upper band at $116,187.99 acting as significant resistance.

Robert points out: "Technical analysis shows that Bitcoin is at a crucial position. If it can break through the upper Bollinger Band, it will open up a new round of upward potential."

Continued inflows of institutional funds support Bitcoin's fundamentals.

Robert, a financial analyst at BTCC, stated: "Metaplanet's issuance of $210 million in zero-coupon bonds to increase its Bitcoin holdings, coupled with Trump's media approval of a $2.3 billion Bitcoin reserve program, demonstrates the continued rise in institutional investor acceptance of cryptocurrencies ."

Despite VanEck's warnings about the strategic risks of corporate Bitcoin holdings, positive news such as the establishment of a regional hub in Dubai and the BitMEX trading competition injected positive sentiment into the market. These developments align with technical predictions, reinforcing Bitcoin's long-term investment value.

Factors affecting the price of BTC

Metaplanet plans to issue $210 million in zero-coupon bonds to increase its Bitcoin holdings.

Japanese listed company Metaplanet has decided to issue $210 million in zero-coupon bonds exclusively to the EVO Fund, with all proceeds to be used to purchase Bitcoin . The bonds will mature in December 2025 and include an early redemption option linked to future financing. This move is expected to have a minor impact on Metaplanet's fiscal year 2025 financial statements.

Earlier this year, Metaplanet approved the issuance of 21 million stock options to its EVO fund, exercisable in five tranches, with the exercise price to be adjusted based on market conditions. The company also announced ambitious plans to raise $5.4 billion through stock offerings by 2027, aiming to further increase its Bitcoin holdings.

VanEck warns of strategic risks for companies holding Bitcoin.

Matthew Sigel, head of digital asset research at VanEck, issued a stern warning to publicly traded companies that have adopted a Bitcoin reserve strategy. This warning comes as companies like Semler Scientific face the risk of value dilution due to their continued issuance of shares to raise funds to purchase BTC.

"When the share price is close to net asset value, ATM capitalization will destroy rather than create value," Sigel pointed out on social media. Semler Scientific currently holds 3,808 BTC , worth $404.6 million, which was accumulated through multiple fundraisings since May 2024.

This warning highlights a growing tension in corporate Bitcoin strategies: while cryptocurrency holdings can drive up stock prices, the underlying funding mechanisms can damage shareholder value during market downturns. No large BTC holding company has yet traded below net asset value for an extended period, but Semler is approaching that threshold.

Trump media approves $2.3 billion Bitcoin reserve plan; cryptocurrency dividends surge.

The Trump Media & Technology Group's S-3 registration statement has been approved by the U.S. Securities and Exchange Commission (SEC), unlocking $2.3 billion in funding. A significant portion of this will be allocated to Bitcoin reserves, placing DJT alongside Micro Strategy as an enterprise-level BTC holder.

According to documents disclosed by the U.S. Government Office of Ethics, former President Trump personally earned $57.35 million from the cryptocurrency platform World Liberty Financial in 2023. This cryptocurrency-related income far exceeded his total revenue of approximately $6.35 million from his traditional licensing business.

The filings show its portfolio spans nearly 145 pages, highlighting the increasingly close intersection between politicians and digital assets. "We are rapidly advancing our expansion plans," said Devin Nunes, CEO of Trump Media, hinting at a larger ambition internally known as the "Patriot Economy" strategy.

Bitcoin.com establishes regional hub at Dubai DMCC Crypto Hub

Bitcoin.com is expanding its global footprint by opening a new regional office in Dubai, aligning with the city's ambition to become a hub for Web3 and blockchain innovation. The platform will be located within the DMCC crypto hub, an ecosystem that already houses over 650 crypto and blockchain companies.

"Dubai offers an advantage in regulatory clarity that is difficult for other jurisdictions to match," emphasized Belal Jassoma of the DMCC. This move not only allows bitcoin.com to leverage Dubai's regulatory framework that supports digital asset innovation, but also strengthens the DMCC's position as a gateway for Web3 companies to enter global markets.

BitMEX launches June short-term trading competition with a prize pool of up to 3 BTC.

Seychelles-based cryptocurrency exchange BitMEX has announced a June short-term trading competition, giving participants the chance to share a 3 BTC prize pool. The month-long event will begin on June 6, 2025, with rewards distributed based on three performance metrics: trading volume (80% of the prize), profit/loss (10%), and return on investment (10%).

New traders will have an additional chance through a separate 10,000 USDT prize pool. This competition highlights BitMEX's position in the derivatives market as crypto asset volatility rises again. Michael Saylor's recent bullish comments on Bitcoin accumulation strategies seem to align with the timing of this liquidity incentive program.

How high can the price of BTC rise?

According to a comprehensive analysis by Robert, a financial analyst at BTCC, Bitcoin has the potential for further gains, supported by both technical and fundamental factors. From a technical perspective, if it can effectively break through the upper Bollinger Band at $116,187, the next target could be the $120,000 level.

From a fundamental perspective, the continued investment from institutional investors provides solid support for the market. The following is a summary of key data:

| Indicator Categories | Current value | Key level |

|---|---|---|

| Current price | $111,041.84 | - |

| 20-day moving average | $110,976.14 | support level |

| Bollinger Bands Upper Rail | $116,187.99 | resistance level |

| Institutional planned investment | More than $2.5 billion | Fundamental support |

Robert concludes: "In the current environment, Bitcoin is poised to test the $120,000 level, but investors need to pay attention to whether it breaks through the upper Bollinger Band and changes in market liquidity."