Author: zhou, ChainCatcher

Since September , the crypto has witnessed a series of brutal exploits, from MYX and AIA to COAI . Market manipulators and project teams have colluded to use sophisticated control and manipulation techniques to wipe out retail investors' funds. Despite these blatant exploitation tactics, a large number of users are still hoping for the next "100x coin," fearing they'll miss out on a chance to get rich quick.

Evolution of the "harvesting template" from MYX to COAI

This story begins with MYX.Finance , a decentralized derivatives exchange based on the Arbitrum blockchain. Its token, MYX, was listed on Binance Alpha in early September with an initial market capitalization of approximately $ 100 million and relatively low trading volume. In early September , MYX suddenly surged, rapidly climbing to over $ 3 billion in market capitalization, before entering a period of high-level consolidation, characterized by intraday spikes and pullbacks, negative funding rates, and the top ten addresses holding over 95% of the shares . According to Coinglass data, on September 18th , MYX surged 298.18% in a single day , with an intraday volatility of 317.11% , resulting in $ 52.0863 million in short positions being liquidated and $ 10.5109 million in long positions being liquidated . In early October , the price experienced a sharp decline, with brief rebounds followed by further drops. Since then , MYX has steadily declined, and its market capitalization has stabilized at around $ 500 million.

Following closely behind, the first wave of copycat projects, DeAgentAI ( AIA ), quickly emerged, attracting market attention with its AI agent narrative. Its price surged more than tenfold in early October, then replicated the MYX pattern, repeatedly ripping off retail investors through multiple sharp rises and falls, achieving a 97% concentration of holdings . If AIA was a lightweight copy of the MYX template, then ChainOpera ( COAI ) pushed this model to its extreme.

On September 25th , COAI was listed on Binance Alpha and futures platforms with an initial market capitalization of only $ 15 million. Within weeks, its price surged hundreds of times, reaching a peak market capitalization of over $ 8 billion. Subsequently, the price fluctuated wildly between $ 5 and $ 25 . This dramatic rise and fall, akin to a 50% price drop, makes it one of the most eye-catching "monster coins" of the year. Several traders analyzed that the top ten holders of COAI controlled 96.5%-97% of the circulating supply. Market makers lured retail investors to follow suit by pumping the price (such as the 81 % surge on October 15th ) and then dumped their holdings by crashing the price (such as the 58% drop on October 25th ) , leaving retail investors with almost no way to cope.

It is important to note that newly launched tokens tend to have a high concentration of holdings because their initial issuance is dominated by project teams, institutional investors, or market makers (MMs ) (it is common for the top 10 addresses to hold 30%-60% of the tokens). In contrast, for Alpha tokens, the top 10 addresses typically hold 50%-80% of the tokens , with 95% representing an extremely concentrated state.

From MYX to COAI , the tactics employed by market manipulators have become increasingly sophisticated: first, they create hype around trending topics, then easily manipulate the price by leveraging highly concentrated holdings and their control over the market. Next, they amplify the capital effect through contracts to unload their holdings at high prices. If retail investors concentrate on shorting, market manipulators can not only earn funding fees but also use liquidation proceeds to pump the price, further solidifying their manipulation.

FOMO- driven "control is justice"

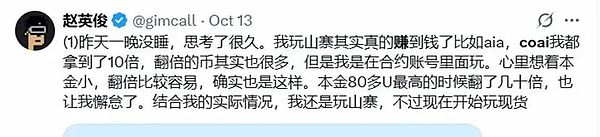

Recently, many users on X have been posting screenshots to show off their short-term trading results. Survivorship bias has masked a large number of losses from margin calls, creating an illusion of high returns with low expectations.

The community's attitude has also changed: from initially criticizing MYX as a "three-no project" (no code maintenance, no buyback commitment, and no community foundation) and questioning the rationality of its rise to a market value of billions; to now, some investors, swayed by FOMO , are gradually accepting that "market manipulation is justice ," dreaming of getting rich overnight and the story just happening to them.

Crypto investor @huahuayjy stated that the emergence of MYX is epoch-making for the crypto . It forcefully broke through the ceiling for Altcoin, making market makers and project teams realize the potential for huge profits from price pumps. Subsequent imitators may drive a mini-bull market in altcoins. However, opposing opinions point out that a true altcoin boom depends on overall liquidity easing and the entry of new funds, rather than a few projects playing a game of musical chairs . Some even believe that the MYX model may signal the end of the bull market , making it increasingly difficult for smaller projects to gain mainstream acceptance.

Furthermore, KOL sanyi.eth reflected that after losing short MYX , they had proactively avoided volatile coins. COAI rose from $ 0.3 to $ 61 and then retreated to $ 18 . Although the project had previously received approximately $ 17 million in funding and was backed by Binance Labs , and positioned itself in the AI sector, its fundamentals weren't weak. However, compared to its valuation, market sentiment was clearly overheated. Retail investors participating in such volatile coins often ended up with liquidations or paying exorbitant fees.

The fact that a large number of retail investors are still flocking to MYX and COAI shows that the market's pursuit of fairness has gradually given way to the pursuit of speculative returns. In other words, as long as they can still gamble on contracts, many people don't care whether the project team and market makers are manipulating the market behind the scenes.

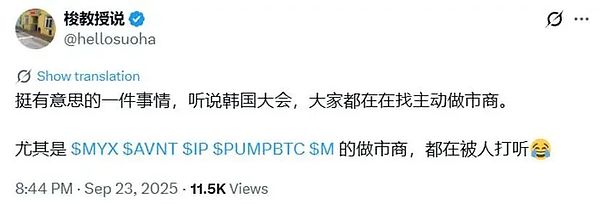

It's worth mentioning that, according to user @hellosuoha , at the KBW 2025 conference held in Seoul, South Korea last month , the trading depth of projects such as MYX , AVNT , and IP attracted attention, and the market makers behind them have become key contacts for potential token issuance projects.

Similar models are being copied like crazy, and more MYX- style projects may emerge in the future. In this ecosystem, retail investors who are addicted to FOMO will only face more frequent liquidation lines.

Does Alpha narrative amplify the harvesting effect?

Essentially, the large fluctuations in these cryptocurrencies after their listing stem from two main reasons: firstly, the direct manipulation by market makers and project teams; and secondly, the Alpha platform narrative, which accelerates retail investor entry , provides market makers with a wider " hunting ground , " evolving into a standardized script that allows for faster replication and more ruthless exits.

This may also reveal one of Binance Alpha 's design intentions: to attract speculators with its low circulating supply and high volatility. After all, there will always be someone willing to pay for volatility — some come for the profit, some stay for short-term gains, and ultimately, some pay the price for the volatility.

Besides highly controlled cryptocurrencies like MYX , AIA , and COAI , the Alpha platform has also seen a number of irregularities: some projects went to zero or crashed immediately after listing, while others were involved in false narratives or code plagiarism. Overall, the platform's motivation to attract speculative funds far outweighed its motivation to incubate projects.

To put it another way, Alpha 's emergence was not inherently wrong; it was merely a high-volatility experimental field focusing on early-stage new products. However, when narrative, structure, and human nature are combined, volatility becomes a harvesting machine. According to CoinMarketCap data, Binance Alpha's 24- hour trading volume exceeded $ 8 billion, far surpassing many small and medium-sized crypto exchage, demonstrating that this " wild growth " was not accidental but rather a product of the combined effects of capital and traffic.

Conclusion

On one hand, market manipulators and project teams are using the high volatility of the Alpha platform to create a smooth exit strategy; on the other hand, retail investors remain obsessed with the fantasy of the next " 100x coin . " Greed and fear intertwine—human nature has always been like this. Instead of blindly chasing the next COAI , it's better to consider where you stand in this game.