Author: Nancy Lubale Source: cointelegraph Translation: Shan Ouba, Jinse Finance

The Bitcoin MACD indicator has shown a bearish crossover, and a certain amount of time has passed since the last halving. Does this mean the Bitcoin bull market of 2025 has ended? Or will the situation be different this time?

Key points

On the Bitcoin weekly chart (three-week cycle), a bearish MACD crossover and a bearish engulfing pattern appeared simultaneously, signaling a top in the cycle.

Market analysts point out that 558 days have passed since the Bitcoin halving in 2024, a point that suggests the peak of the Bitcoin bull market cycle is approaching.

Other analysts believe that Bitcoin's price still has room to rise, and the target price of $180,000 is still achievable.

Bitcoin fell 3% on Thursday, down 13% from its all-time high of $126,000 reached on October 6. Some traders believe this high may have marked the top of Bitcoin's current cycle.

Bitcoin's technical indicators suggest a top has formed.

A cryptocurrency analyst stated that the Bitcoin price action appears to have confirmed a "MACD bearish crossover," which, based on historical trends, could signal the end of the Bitcoin bull market.

Analyst Jesse Olson posted on the X platform on Wednesday that "a bearish MACD crossover is about to form on the three-week Bitcoin chart," adding, "The histogram also shows a long-term bearish divergence."

As shown in the figure below, when the Moving Average Convergence Divergence (MACD, blue curve) – a technical indicator used by traders to identify trend changes and momentum shifts – breaks below the signal line (orange curve), a bearish crossover pattern is confirmed.

It should be noted that the last two times the MACD issued such a bearish signal, it was at the peak of the bull market cycles in 2017 and 2021, respectively, both indicating that the price of Bitcoin had peaked.

A bearish engulfing pattern also appeared on the same three-week chart, similar to the patterns observed at the peaks of the bull markets in 2017 and 2021.

In another blog post on Thursday, Jesse Olson stated that these signals, along with "multiple other warning signs, suggest that a top has been reached."

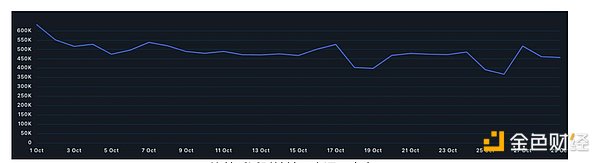

Other signals include declining network activity, indicating reduced on-chain demand. Nansen data shows that the number of daily active addresses on the Bitcoin network fell by 30% in October, from 632,915 to 447,225.

A decrease in daily active addresses indicates reduced network engagement and weakened user demand, which is often a precursor to price corrections or prolonged consolidation.

Bitcoin cycle top near

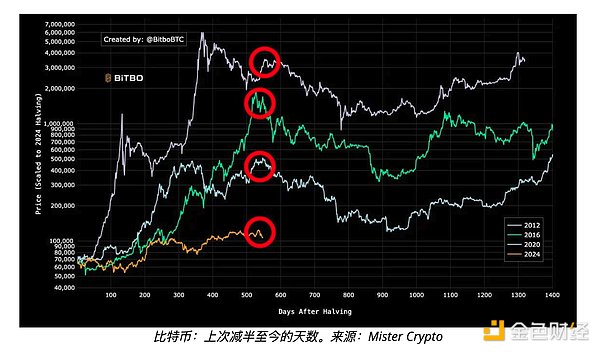

Anonymous trader and investor Mister Crypto supports the "cycle top theory," arguing that Bitcoin's quadrennial halving cycle has placed it at a point that "historically tends to peak."

Looking back at the Bitcoin halving cycles of 2012 and 2016, a similar trend does exist: the price gradually accumulates momentum, typically peaking within 518 to 580 days after the halving event (as shown in the figure below).

558 days have passed since the 2024 Bitcoin halving, which means that the current Bitcoin market is within ±40 days of the historical peak window (518-580 days).

Mister Crypto posted on the X platform, stating, "We are currently near a period when Bitcoin typically peaks," and then asked rhetorically, "Will this time be an exception?"

Analyst CryptoBird also stated that, following historical patterns of halving cycles, the current Bitcoin price surge may only last a few days.

In its latest Bitcoin analysis, CryptoBird points out that Bitcoin is "consolidating before a breakout, and the top window has opened."

As previously reported by Cointelegraph, analysts such as former BitMEX CEO Arthur Hayes believe that Bitcoin's four-year cycle has become invalid, and the current price is driven more by monetary policy and liquidity than by the halving event.

Another viewpoint suggests that the impact of the halving event is gradually diminishing. They argue that the current upward trend in interest rates, the gradual entry of institutions through ETFs and Bitcoin treasury companies, and the increasing maturity of Bitcoin as a mainstream asset could drive further price increases for Bitcoin in 2026.

Has Bitcoin's upside potential truly run out?

Besides the view that the four-year cycle of Bitcoin no longer determines the duration of a bull market, some analysts believe, based on technical indicators, that Bitcoin still has room to rise.

Analyst Jelle, referring to Bitcoin's daily price action, stated that Bitcoin "has formed higher lows and the trading range remains intact," and that "if it recovers the $116,000 level, the upward trend will resume."

Analyst Mags pointed out that Bitcoin is currently in a "bullish megaphone pattern," which historically has often led to a breakout rally, and "a significant breakout is on the horizon."

As Cointelegraph reports, Bitcoin's Meyer multiples indicate that the current price level is still close to the "oversold" range, meaning that the $180,000 target price is still achievable.