ether.fi spends $50 million to buy back Token amid a $1.4 billion buyback wave. Photo: CoinDesk

ether.fi spends $50 million to buy back Token amid a $1.4 billion buyback wave. Photo: CoinDesk

ether.fi plans

- ether.fi DAO, the leading reStaking protocol on Ethereum, plans to spend up to $50 million from its treasury to buy back ETHFI Token . The move shows that decentralized protocols are increasingly using buybacks as a Capital management and price support tool, similar to how traditional businesses maintain shareholder confidence through stock buyback programs.

- According to the governance proposal published on November 2, the ether.fi Foundation will be authorized to buy ETHFI on the open market whenever the price is below $3 . Unlike fixed budget or cycle buyback models, this plan activates dynamically based on price thresholds, allowing the protocol to react immediately when the Token is undervalued.

- The program will begin immediately upon approval by the DAO and will remain in effect until one of three conditions is met:

The $50 million ceiling has been spent;

ether.fi Foundation assesses the program as having achieved its goals;

Or a new governance vote changes or terminates the plan.

- In the proposal, ether.fi emphasized: “The Foundation will scale buybacks in line with protocol revenue, especially when ETHFI remains below $3, to effectively utilize surplus resources, strengthen market confidence, and reduce the number of Token in circulation.”

- At press time, ETHFI's price has fallen more than 89% from its 2024 peak, currently trading around $0.93, which means it is still within the program's activation zone if the proposal is approved.

ETHFI price movement since listing, screenshot on Coingecko at 11:20 AM on 11/03/2025

ETHFI price movement since listing, screenshot on Coingecko at 11:20 AM on 11/03/2025

DAO support is almost absolute

- The voting on the Snapshot platform lasted 4 days, starting from last Friday. According to initial statistics, the support rate from the ether.fi community was almost absolute .

- If approved, this will be the project's third buyback program, following two previous proposals (#8 and #10) that also aimed to support market liquidation .

- All buybacks will be recorded publicly on-chain and transparently reported via the project's official Dune Analytics dashboard.

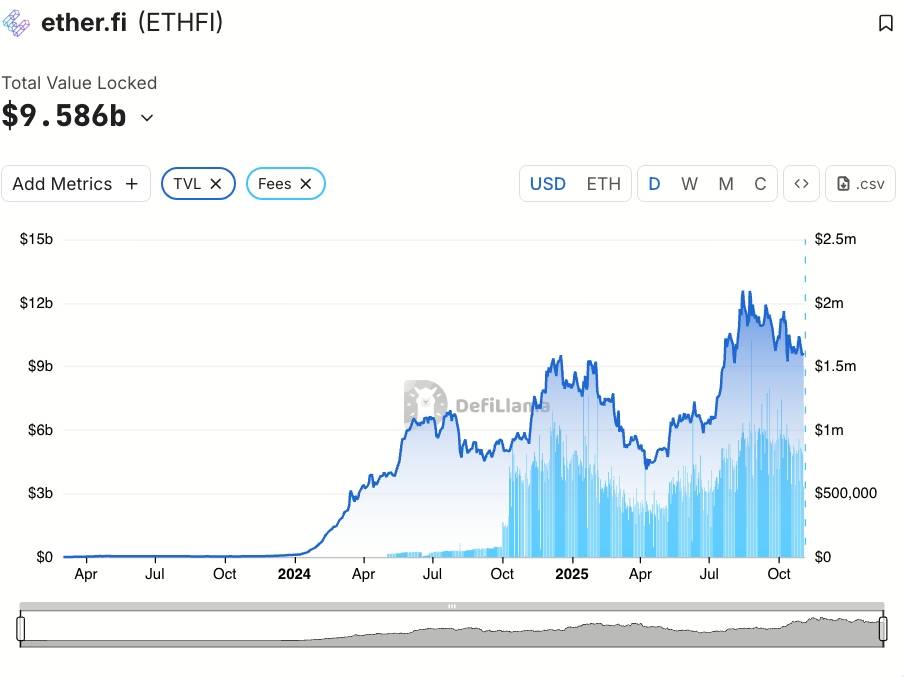

Revenue 360 million USD/year, TVL reaches 10 billion USD

- ether.fi is a liquidation reStaking and Liquid Staking Staking built on Ethereum, allowing users to Stake ETH and reStaking tradable representative Token , while the assets continue to generate interest both within and outside the core Staking ecosystem.

- ether.fi currently holds nearly $10 billion in total value locked (TVL) and generates an estimated $360 million in annual fee revenue, providing it with the resources to execute a large-scale buyback program without financial stress.

ether.fi TVL statistics. Source: DefiLIama (November 3, 2025)

ether.fi TVL statistics. Source: DefiLIama (November 3, 2025)

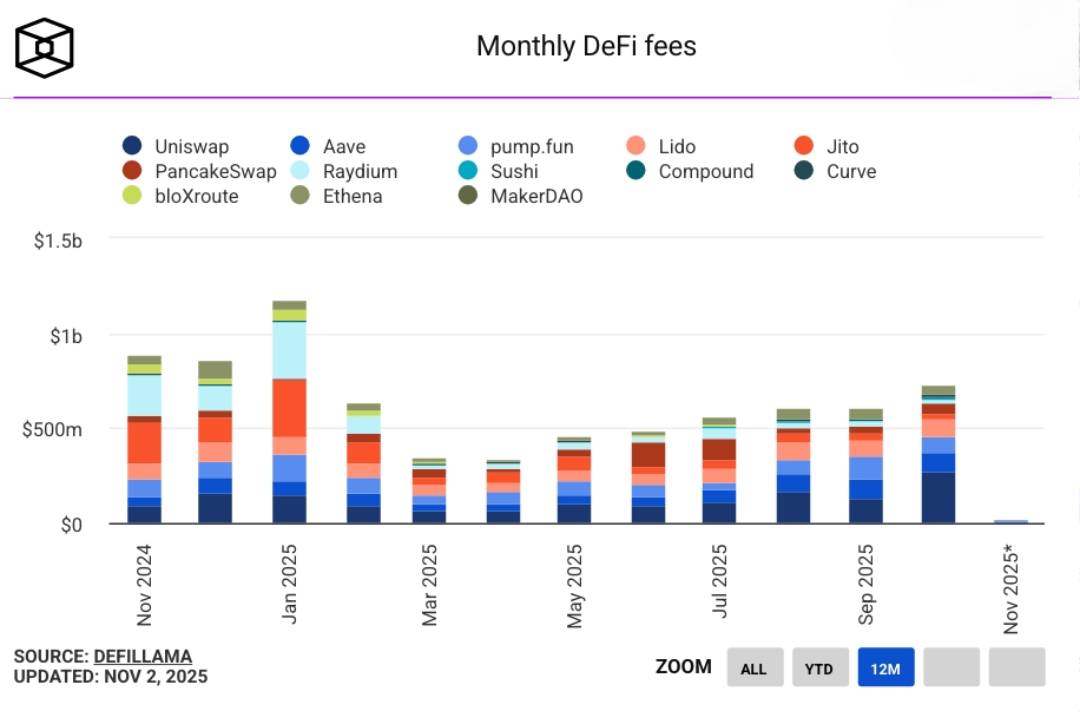

$1.4 billion buyback is a test for DeFi

- The buyback wave is spreading across the DeFi ecosystem in 2025. Many protocols are moving to reinvest on-chain revenue for Token buybacks, both to support prices and reaffirm platform value.

Transaction fee revenue of top DeFi platforms. Source: The Block (November 3, 2025)

Transaction fee revenue of top DeFi platforms. Source: The Block (November 3, 2025)

- In the recent quarter, Uniswap and AAVE helped DeFi revenue recover past $600 million, creating abundant Capital for the new buyback cycle.

- Some typical examples:

AAVE DAO : Proposed $50 million/year buyback program, taken directly from protocol revenue, to increase liquidation depth and support AAVE Token price.

OpenSea : plans to allocate 50% of revenue to the SEA Token buyback program, tied to the Token Issuance in Q1/2026.

World Liberty Financial (affiliated with the Trump family): uses a liquidation fee model to buy back and burn Governance Token , reducing circulating supply.

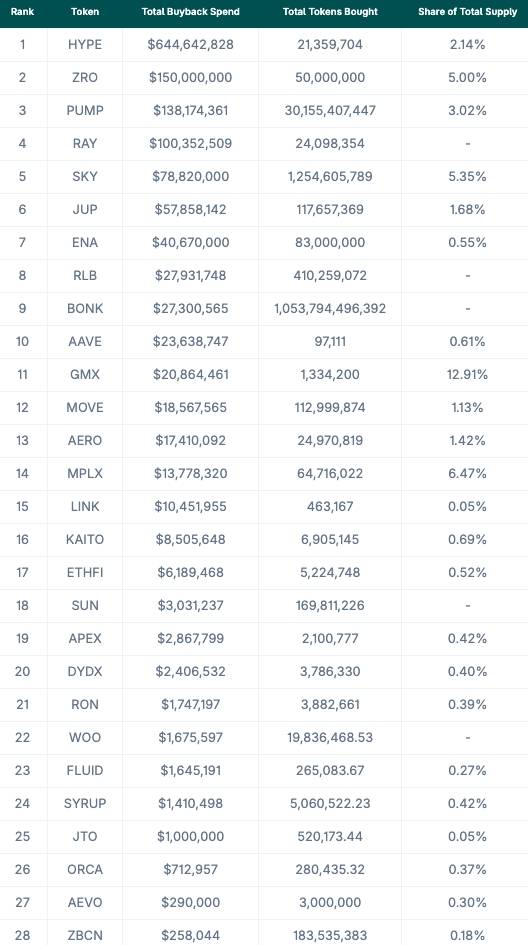

- According to the latest statistics from CoinGecko, the total value of DeFi Token buyback programs in 2025 has exceeded 1.4 billion USD, led by Hyperliquid (HYPE), LayerZero (ZRO) and pump.fun (PUMP).

Top 28 projects applying the Token buyback model in 2025. Source: CoinGecko

- However, experts warn that the actual effectiveness of buybacks is not always clear, especially in an environment of limited liquidation and the Token supply is constantly diluted from unlocks.

- Some analysis from DLNews emphasizes that buybacks are just the tip of the iceberg. Without TVL growth, product improvements, and actual profits, these programs may just be a short-term psychological boost. Furthermore, the Token buyback strategy also has the potential risk of attracting attention from global regulators.

Coin68 synthesis