As the Hyperliquid ecosystem continues to grow and the launch of HyperEVM has seen the emergence of many native DeFi protocols that leverage the hybrid infrastructure of centralized Order Book and decentralized smart contracts. Among them, Felix Protocol, a protocol that XEM as HyperEVM’s on-chain bank, allows users to borrow, lend, and mint native stablecoins with strict risk management mechanisms.

So what is Felix Protocol? Let's learn about the Money Markets project on HyperEVM with Coin68 through the article below!

What is Felix Protocol? Money Markets Project on HyperEVM

What is Felix Protocol?

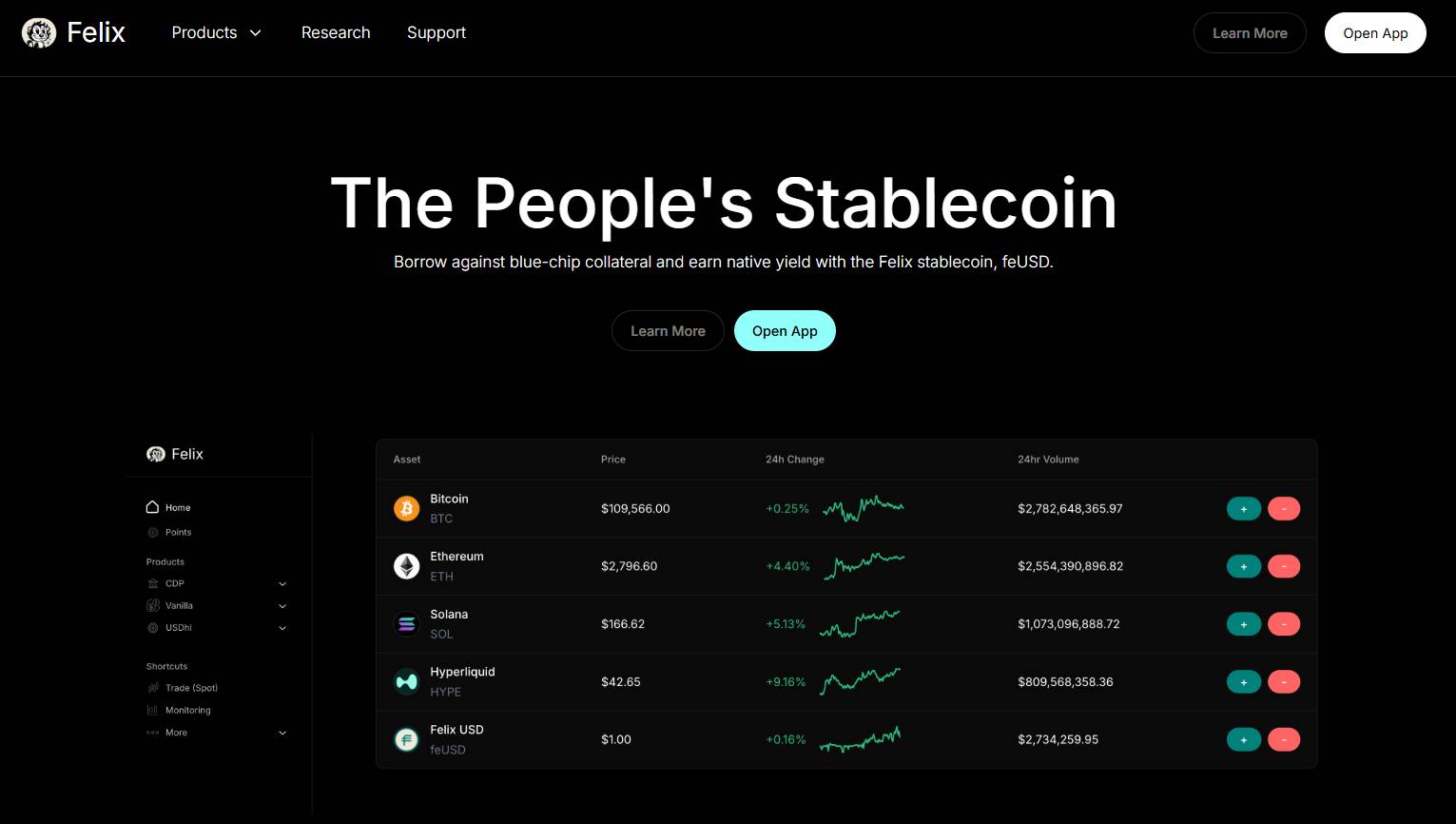

Felix Protocol is a money market platform on HyperEVM, part of the Hyperliquid ecosystem, that allows users to borrow, lend, and issue stablecoins such as FEUSD and USDHL.

Felix Protocol Homepage

With over $300 million in TVL , Felix is on-chain Hyperliquid ’s on-chain bank , combining Liquity v2 and Morpho Lending Stack models to optimize efficiency and reduce risk. With direct integration with CoreWriter, Felix has the ability to liquidate on the HyperCore Order Book , providing a transparent and efficient trading experience for users.

What's special about Felix Protocol

Felix Protocol’s Dual- Asset Architecture is one of the core elements that makes it stand out in the Hyperliquid ecosystem. Instead of focusing on just one product, Felix operates two parallel asset classes, CDP Stablecoin (FEUSD) and Vanilla Lending Markets, to create a financial ecosystem that balances stability and profitability.

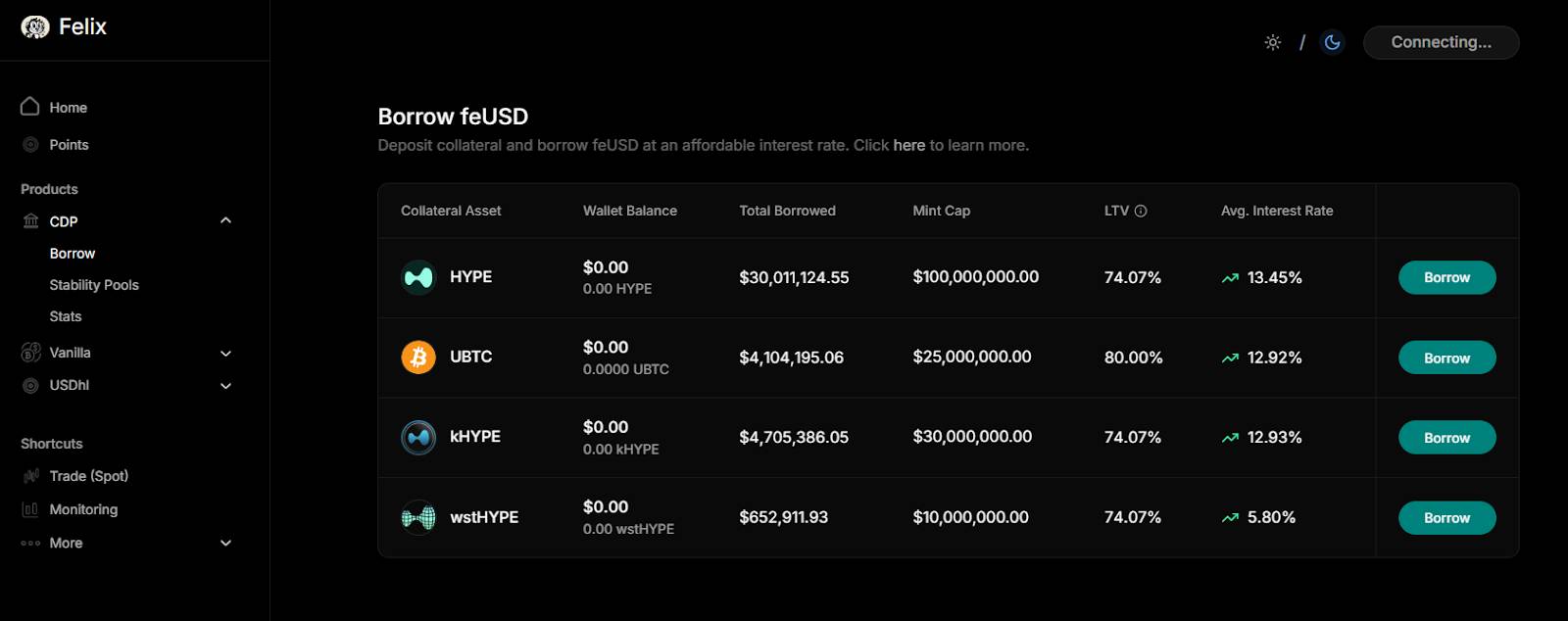

The first layer is the CDP Stablecoin (FEUSD) system, which Vai as the stability pillar of the entire protocol. Users can collateralize on-chain assets such as HYPE, kHYPE, or BTC to mint FEUSD stablecoins, which are Peg at $1. This mechanism is built on the Liquity v2 architecture, allowing the formation of collateralized debt positions (CDPs) with a conservative LTV ratio of only 40%. When the asset value drops and exceeds the safety threshold, the system automatically liquidates the position, transferring the collateral to the Stability Pool, where FEUSD depositors receive rewards. This way, Felix maintains the stability of FEUSD and limits the risk of bad debt in the long term.

The second layer is Vanilla Markets , which Vai as the yielding backbone of the dual-asset architecture. Built on the Morpho Lending Stack, Vanilla markets allow users to deposit stablecoins such as USDHL, USDe, USDT0, or USDH to earn interest, while borrowers can collateralize assets such as HYPE, kHYPE, or UBTC. All loans are Over-Collateralization -collateralized, and interest rates are adjusted dynamically based on the supply and demand of each pool. This mechanism helps users optimize Capital efficiency and take advantage of native yields in the Hyperliquid ecosystem.

These two asset classes are tightly linked together, creating a circular liquidation cycle. Users can collateralize assets to mint FEUSD, then use this FEUSD in the Vanilla market to lend or earn yield. The yield generated further drives the demand for holding and using FEUSD, reinforcing the intrinsic strength of the entire protocol. Thanks to this dual asset architecture, Felix Protocol becomes a true on-chain bank, where stability, efficiency, and yield coexist harmoniously in a fully integrated financial ecosystem on HyperEVM.

Features of Felix Protocol

Felix Protocol Products

- CDP Market : Allows users to mint stablecoin FEUSD pegged to 1 USD by collateralizing on-chain assets such as HYPE, kHYPE or BTC.

- Liquity v2 Architecture: Apply the same CDP mechanism as Liquity v2 but extended with Mint caps, flexible treasury parameters (trove parameters) and protocol pause function to control risk.

- Conservative LTV ratio 40%: Helps reduce the risk of liquidation and bad debt during periods of high volatility.

- Stability Pool : Absorbs liquidated positions and redistributes collateral and profits to FEUSD depositors.

- Vanilla Markets: Offers variable interest rate lending pools built on Morpho's lending stack, allowing stablecoin deposits such as USDHL, USDe, USDT0, USDH to earn interest.

- Automatic borrowing and liquidation mechanism : Borrowers mortgage HYPE, kHYPE or UBTC, all positions are Over-Collateralization, interest rates adjust according to supply and demand, and automatic liquidation when the health index falls below

- Multi-tier liquidation network : Including internal bots, professional partners like Manhattan Research, and community bots, ensuring liquidation is fast and efficient.

- Advanced Risk Modeling : Use Agent-Based Simulations, Monte Carlo, and GARCH models to simulate tail risk and test resilience to extreme events.

- New Asset Monitoring : Keep a close eye on Token like HYPE and LST HYPE due to low liquidation risk, high oracle volatility and Slashing potential.

Detailed parameters of the project's stablecoin

Technical specifications of the project's stablecoin

Project name | Felix FEUSD |

Ticker | FEUSD |

Blockchain | HyperEVM |

Contract | 0x02c6a2fa58cc01a18b8d9e00ea48d65e4df26c70 |

Total supply | 8,928,372,843 FEUSD |

Max Supply | Unlimited |

Uses of stablecoin FEUSD

- Borrowing and liquidation : Users can collateralize assets such as HYPE, kHYPE or BTC to mint FEUSD, creating liquidation without selling the original assets.

- Stable trading tool : FEUSD is used as a payment unit and store of value in the HyperEVM ecosystem, making transactions unaffected by crypto price fluctuations.

- Efficient Capital utilization : Users can use FEUSD to participate in other Felix markets such as Vanilla Markets or integrated DeFi dApps, thereby earning additional yield.

- Stabilizing the CDP system : FEUSD is the center of the Collateralized Debt Position mechanism, helping to balance collateral and loans, ensuring safety for the entire system.

- Hyperliquid ecosystem connection : FEUSD is designed to interact directly with HyperCore, serving liquidation and liquidation management activities across the network.

Development Roadmap of Felix Protocol Project

Currently, the development roadmap of the Felix Protocol project has not been announced in detail. Coin68 will update immediately if there is information.

Felix Protocol Development Team

- Charlie Ambrose (Charlie.hl / @0xBroze) : Core member and public face of Felix Protocol, and founder of Anthias Labs. A Dartmouth graduate, he is responsible for security, risk, and system development, as well as regular technical and risk updates for Felix.

- Technical team : Including many former Three Sigma auditors, focusing on developing the protocol towards safety and anti-exploitation, building internal liquidation bots and automatic risk monitoring systems.

- Anthias Labs : Acts as an advisor and risk manager for Felix, responsible for setting LTV ratios, Mint caps, and monitoring vaults in the ecosystem.

Investors in the Felix Protocol project

Felix Protocol is backed by many investment funds and strategic partners in the DeFi space. The project raised early stage Capital in June 2025 from Hash3 and Tioga Capital Partners. These are two well-known investment funds focusing on Web3 infrastructure projects and decentralized finance. Hash3 appreciated Felix's expansion potential on the Hyperliquid ecosystem, while Tioga Capital was particularly interested in the risk management model and technical platform built by the Anthias Labs team.

In addition, Felix also has a strategic partnership with Hyperion DeFi to develop perpetual futures (HIP-3) products and expand liquidation on HyperEVM. In terms of security and technology, the project cooperates with Three Sigma and Anthias Labs in auditing and risk monitoring, helping to strengthen the trust and safety of the ecosystem.

Summary

Above is an article summarizing information about the Felix Protocol project. Coin68 hopes that readers will grasp the basic information to better understand the project and how it works. Wish you have more useful knowledge!

Note : The information in the article is for informational purposes only and should not be XEM investment advice. Coin68 is not responsible for any of your investment decisions.