The Trump administration has appointed Michael Selig, a pro-crypto lawyer and SEC counsel, as head of the CFTC.

The US Commodity Futures Trading Commission (CFTC) may finally have a chairman as President Donald Trump's nominee, Michael Selig, begins the due diligence process.

The CFTC is currently led by Acting Chairwoman Caroline Pham, who assumed the Vai in April 2025. She was nominated to the position by President JOE Biden in 2022 and unanimously confirmed by the Senate.

The Trump administration initially selected former CFTC Commissioner Brian Quintenz, who also served on the board of the gambling platform Kalshi. However, his nomination was withdrawn in September, reportedly at the request of the Winklevoss brothers, who were concerned that he was not sufficiently pro-crypto.

Selig, who has previous government experience at the CFTC and Securities and Exchange Commission, has pledged to prioritize cryptocurrencies.

Who is Michael Selig and what is his view on cryptocurrencies?

Selig, a graduate of George Washington University Law School, began his government career in the office of former CFTC Commissioner J. Christopher Giancarlo from 2014 to 2015.

After leaving the CFTC, Selig was an associate at Cadwalader, Wickersham & Taft and Perkins Coie, where he became of counsel. In April 2022, he joined Willkie Farr & Gallagher and became a partner in January 2024.

In March 2025, he became chief counsel of the SEC's Cryptocurrency Task Force and senior advisor to the chairman.

Selig made his support for cryptocurrencies clear in a post on X on Saturday, confirming his nomination. He said that “A Golden Age for American Financial Markets and a World of New Opportunities awaits us,” adding that he would “help the President make the United States the Cryptocurrency Capital of the World.”

David Sacks, the White House’s AI and cryptocurrency expert, said Selig is “passionate about modernizing our regulatory approach to maintaining U.S. competitiveness in the digital asset era.”

“[Selig] not only played a key Vai in advancing the President’s cryptocurrency agenda as Chief Counsel of the SEC Cryptocurrency Task Force, but he also brings extensive experience in traditional commodities markets from his time at the CFTC under former Chairman Chris Giancarlo.”

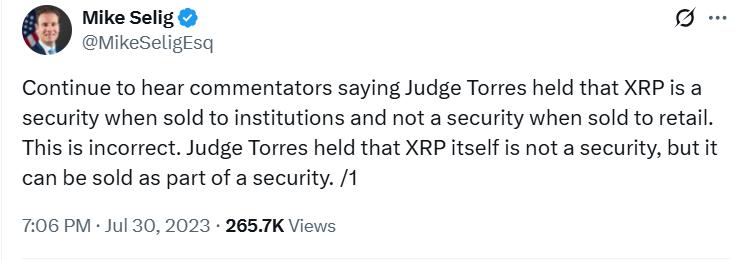

Industry observers have noted Selig’s insightful analysis of the SEC’s lawsuit against Ripple. In 2023, he argued that XRP is “simply computer code.” He called it “a fungible commodity, like gold or whiskey—both of which can be sold as part of investment programs that fall under securities law.”

“The SEC cannot argue for a $2 billion fine against Ripple any more squarely than they can argue for the security of XRP,” he said. Ripple’s price on BingX is currently at $2.35.

This move toward XEM digital assets as commodities, rather than securities, is especially important as Congress considers overhauling cryptocurrency regulation.

CFTC and SEC Rebalance Crypto Regulation, But Closure Threat Is Near

In the U.S. Senate, lawmakers are currently discussing the Responsible Finance Innovation Act. The bill, which passed the House of Representatives in a simpler form called the “CLARITY Act” earlier this year, would reclassify many cryptocurrencies as commodities.

Correspondingly, responsibility for regulating a large number of cryptocurrencies, such as Bitcoin, will fall to the CFTC, which currently Vai as the primary regulator for cryptocurrency Derivative and has anti-fraud jurisdiction over the industry's spot market.

The bill is still under XEM , but the government shutdown and increased bipartisanship have slowed progress significantly, exceeding the late September deadline that Sen. Tim Scott had hoped for.

The SEC and CFTC have taken separate initiatives to unify their approach to cryptocurrencies. In September, SEC Chairman Paul Atkins announced a roundtable with the CFTC to unify cryptocurrency regulation and “ensure the SEC and CFTC work in tandem so American innovation and investment can thrive.”

In recent years, “the relationship between our agencies could be described as more competitive than cooperative,” Mr. Pham said.

“That's not what we want. And that's not the best way to serve the American people who rely on us.”

Pham noted that the agencies are making joint recommendations to the administration’s Digital Asset Markets Working Group through the SEC’s Crypto Project and the CFTC’s Crypto Sprint Program. The CFTC Chairman said the collaboration between the agencies will “foster innovation, eliminate jurisdictional ambiguity, and enhance market access and choice for customers and investors.”

Even these efforts are limited in their capabilities and scope as long as the government shutdown continues, former CFTC Chairman Giancarlo previously told Cointelegraph. He said it would be “very difficult for the CFTC to undertake the regulatory mandate required by the CLARITY Act under an acting chairman without a full commission, or at least a partial commission.”

Federal agencies are operating with skeleton staff, and Democrats and Republicans continue to argue over funding. The overall staffing shortage not only affects the CFTC and SEC’s ability to enforce new regulations, but also hinders the SEC’s ability to XEM listings of cryptocurrency exchange-traded funds.

With Selig's nomination, the CFTC is ready to take on the role of cryptocurrency regulator. But first, the government must agree on a budget, and influential crypto industry politicians like Cameron and Tyler Winklevoss must approve it.

Source: Cointelegraph