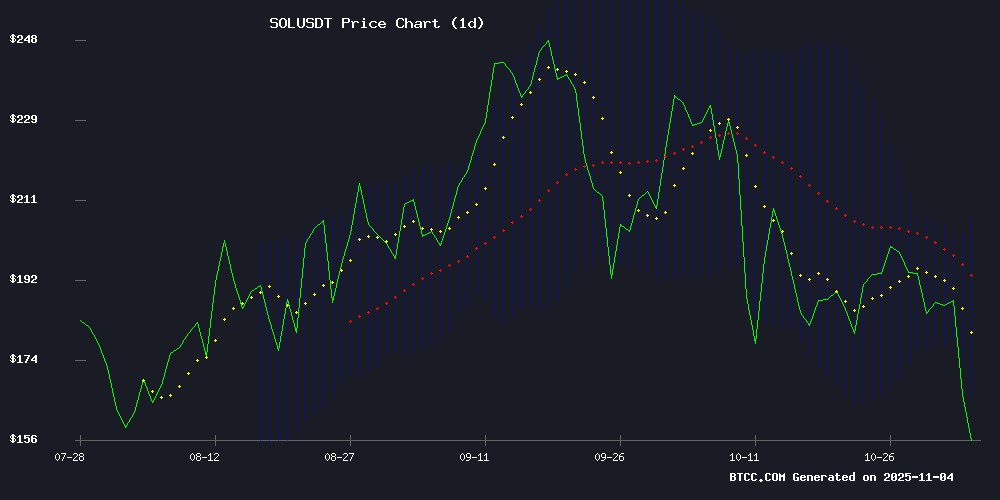

- Technically, there is short-term downward pressure, but the lower Bollinger Band at 169.65 USDT is a key support level.

- ETF inflows and institutional adoption will become medium- to long-term price drivers.

- The development of blockchain financial infrastructure may drive ecosystem value growth before 2030.

SOL Price Forecast

SOL Technical Analysis

According to technical analysis by BTCC financial analyst Olivia, SOL is currently priced at 165.47 USDT , below the 20-day moving average of 187.0350, indicating short-term weakness. The MACD indicator is negative (-2.3549), suggesting weak momentum. The Bollinger Bands show the price approaching the lower band at 169.6507, potentially testing the support level. Failure to hold the lower band could lead to further declines.

Market sentiment and news impact

BTCC analyst Olivia points out that the Solana spot ETF's four consecutive days of net inflows indicate growing institutional interest, but dYdX's decision to exclude derivatives from its US market entry may limit liquidity. ChainLink 's SmartCon 2025 agenda strengthens the narrative of blockchain financial applications, which is beneficial for ecosystem development in the medium to long term.

Factors affecting SOL prices

Chainlink's SmartCon 2025 will explore how blockchain is reshaping the global financial system.

ChainLink 's flagship event, SmartCon 2025, will be held in New York from November 4th to 5th, bringing together leaders from the finance, Web3, and government sectors. This year's conference focuses on connecting traditional finance with decentralized systems, building on the success of last year's Hong Kong event.

Notable speakers included U.S. Representative Bryan Steil, Patrick Witt of the White House Digital Assets Advisory Council, and David Mills of the Federal Reserve. Institutional participants ranged from JPMorgan Chase and Citigroup to DeFi projects such as Aave and Solana .

As a pioneer in integrating blockchain with traditional finance, Chainlink has facilitated on-chain collaborations with central banks and major financial institutions. This year's agenda will continue to explore how blockchain technology can transform markets, public services, and the global economy.

The US Solana ETF saw net inflows for the fourth consecutive day.

The US-based Solana spot ETF recorded a net inflow of $44.48 million on October 31, marking its fourth consecutive day of positive performance. Bitwise's BSOL led the inflows throughout the day, bringing its historical net inflow to $197 million. Grayscale's GSOL remained flat, with no visible fund activity.

The Solana ETF now has total assets under management of $502 million, with a net asset value ratio of 0.49%. Since its launch, it has seen cumulative inflows of $199 million, reflecting the continued growth in institutional investor interest in Solana investment products.

dYdX announced plans to launch spot trading in the US market by 2025, excluding derivatives.

Decentralized exchange dYdX plans to enter the US market by the end of 2025, offering spot trading of mainstream cryptocurrencies such as Solana, but will prohibit US users from using derivatives such as perpetual contracts . This move marks a strategic shift for the platform, which has previously banned US users from participating.

The platform offers a competitive fee structure of 50 to 65 basis points, aiming to attract liquidity from established exchanges like Coinbase and Kraken. The president of dydx described this move as a strategic development for this derivatives-focused platform within a crypto-friendly political environment.

Unlike centralized exchanges, DYDX enables direct peer-to-peer trading through a blockchain network, eliminating the need for intermediaries. Its historical trading volume of $1.5 trillion demonstrates the platform's influence in the crypto derivatives market; however, US users will initially only be able to participate in spot market trading.

What will the trend of SOL be in the next 10 years?

According to BTCC Olivia's comprehensive analysis, SOL may exhibit three stages of development over the next decade:

| stage | Time range | Expected price range | Driving factors |

|---|---|---|---|

| Adjustment period | 2025-2027 | 120-300 USDT | ETF approval progress, Layer 1 competition |

| Growth period | 2028-2032 | 400-900 USDT | Institutional adoption, DeFi TVL growth |

| Maturity | 2033-2035 | 1,200+ USDT | Mainstream financial integration, stablecoin adoption |

It should be noted that the cryptocurrency market is highly volatile, and actual price movements may vary depending on regulatory changes and technological breakthroughs.