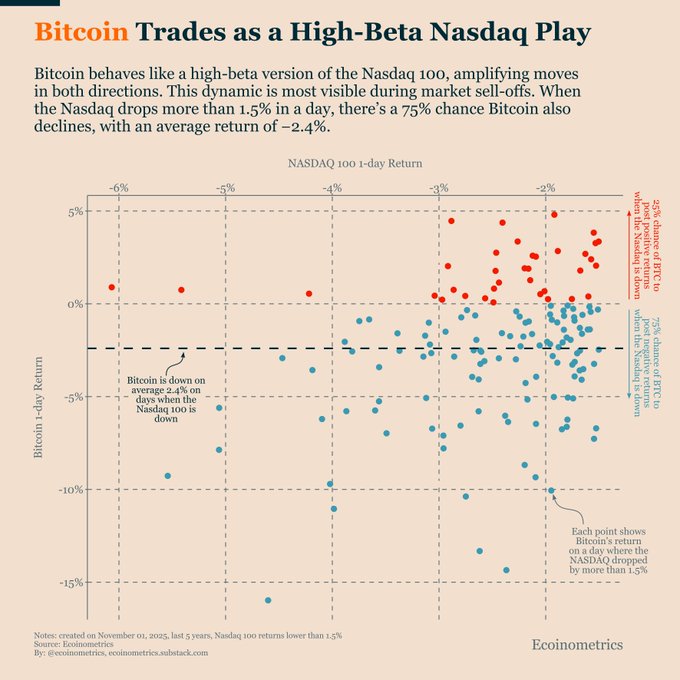

Days like this are a reminder that Bitcoin still trades as a high-beta Nasdaq 100 play most of the time.

When the Nasdaq drops more than 1.5% in a day,

• Bitcoin has a 75% chance of posting a negative return.

• On average, Bitcoin falls –2.4%.

So it’s no surprise that with the Nasdaq 100 selling off, Bitcoin is taking a hit too.

Over the past few weeks, Bitcoin’s weakness hasn’t been fully justified by fundamentals.

Financial conditions remains loose, risk-on assets have been printing new highs, and ETF flows haven’t shown any persistent outflows.

In short, Bitcoin has been underpriced relative to the

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content