Gold (XAU/USD) remained under downward pressure and hit its weakest level since early October, below $4,000, due to cautious comments from Federal Reserve Chairman Jerome Powell on policy easing and easing trade tensions between the United States and China.

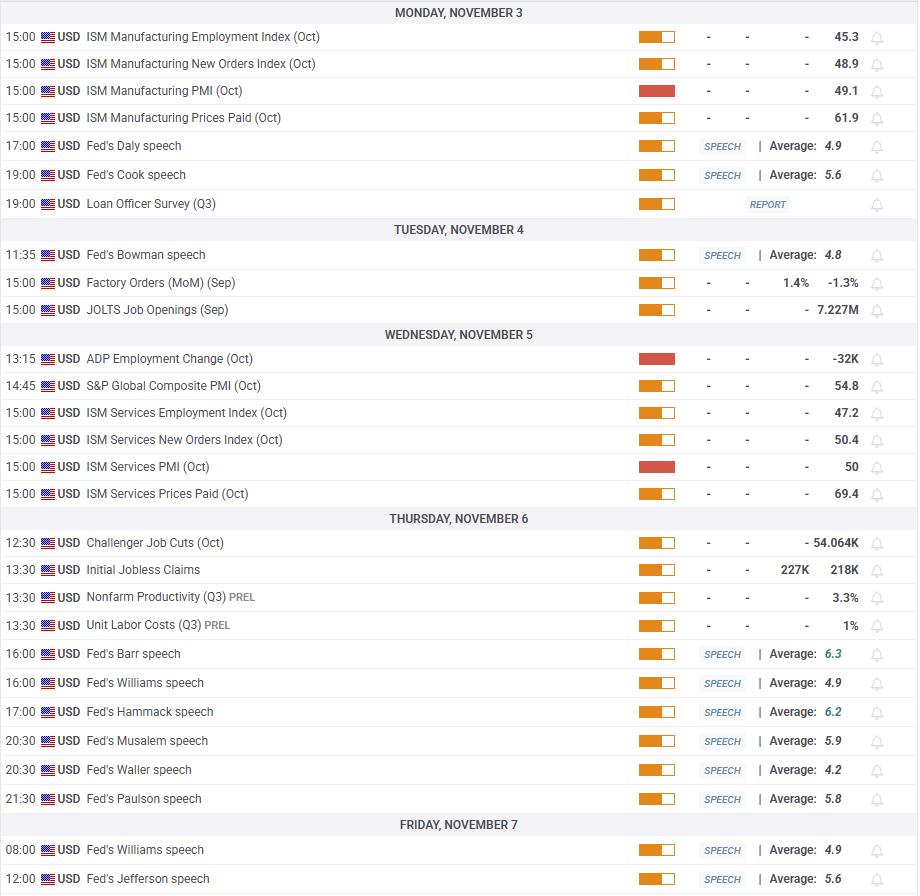

Upcoming macroeconomic data from the US and comments from Fed officials could influence the value of gold in the short term.

Gold prices continue to correct from record peak

Gold started the week in sharp declines and lost more than 3% on Monday. Growing optimism about a trade deal between the United States and China has allowed risk-on sentiment to dominate the market, making it difficult for gold to find demand as a safe-haven asset.

After a high-level meeting with Chinese officials, US Treasury Secretary Scott Bessent said over the weekend that China was ready to make a trade deal to avoid a new 100% tariff on imports from China, adding that a framework was being prepared for a meeting between US President Donald Trump and Chinese President Xi Jinping.

Gold remained at a disadvantage as Trump signed framework trade agreements with several countries, including South Korea, during his Asia tour, falling to its lowest level since early October, below $3,900, on Tuesday.

After a recovery attempt in the first half of Wednesday, gold turned lower in the US session and closed in negative territory for the fourth consecutive day.

The Fed decided to cut its policy rate by another 25 basis points (bps) to a range of 3.75%-4% after its October policy meeting, as expected. The US central bank also announced that it would end its asset purchase program on December 1.

Responding to questions at a post-meeting press conference, Fed Chairman Jerome Powell noted that another rate cut in December was “not a certainty” and explained that the outlook for jobs and inflation had not changed much since the September meeting. Powell stressed that the central bank needed to manage the risk of inflation lingering longer. The yield on the 10-year US Treasury note crossed 4% after Powell’s cautious comments on policy easing, and the USD strengthened, putting pressure on XAU/USD.

A negative shift in risk sentiment helped gold recover on Thursday. After recovering above $4,000, the precious metal moved into a consolidation phase on Friday.

Gold investors await US data, Fed comments

The US economic calendar will feature a variety of macroeconomic data that could provide insight into labor market conditions and the overall economic situation, as some releases are postponed or canceled due to the ongoing US government shutdown.

On Monday, the Institute for Supply Management (ISM) will release its Manufacturing Purchasing Managers’ Index (PMI) for October. A significant improvement in the headline PMI, and/or the Employment component of the survey, could support the USD with an immediate reaction and send XAU/USD lower.

On Wednesday, Automatic Data Processing (ADP) will release private payroll data for October. Earlier in the week, ADP reported on Tuesday that private payrolls increased by an Medium of 14,250 jobs in the four weeks ended October 11, and announced that it will begin publishing a weekly preliminary estimate, which will present a four-week moving Medium of total private sector employment change.

Therefore, the market reaction to the upcoming ADP data is likely to be short-lived. Later in the day, the ISM Services PMI data for October could trigger a clear reaction, with a better-than-expected headline PMI and a significant rebound in the Employment component pushing the USD higher while pressuring XAU/USD and vice versa.

Investors will also be paying attention to comments from Fed officials . According to the CME FedWatch tool, the probability of another Fed rate cut in December fell below 70% on Friday from 90% before the Fed meeting.

If policymakers echo Powell’s tone by refraining from committing to another rate cut before year-end, the USD could continue to strengthen, along with rising Treasury yields, opening the door for another decline in gold. Conversely, if Fed officials indicate they are on track to cut policy rates further unless they see convincing signs that tariffs are boosting inflation, XAU/USD could hold its ground.

Gold technical analysis

The Relative Strength Index (RSI) on the daily chart remains near 50 and gold continues to trade below the 20-day Simple Moving Medium (SMA), while holding within the upper half of the upward regression channel that started at the start of the year.

On the downside, $3,970 (38.2% Fibonacci retracement of the August-October rally) is an interim support ahead of $3,900 (midpoint of the rising channel, round number) and $3,850-3,820 (50% Fibonacci retracement, 50-day SMA).

If gold breaks above $4,090 (20-day SMA) and stabilizes there, $4,130 (23.6% Fibonacci retracement) could be considered as the next resistance before $4,200 (round number).