- ZEC’s 13x Rally Reflects a Broader Revival of Privacy Coins

Its explosive growth signals renewed investor interest in privacy-focused crypto assets amid tightening global regulation.

- Regulatory Pressure Fuels Demand for On-Chain Anonymity

As governments expand blockchain surveillance, both users and developers turn toward zk-SNARKs and private Layer 2 solutions.

- Scarcity and Celebrity Endorsements Amplify Momentum

The 2025 halving and support from top crypto figures are reigniting ZEC’s role as a central force in the privacy narrative.

ZEC’s 13x surge marks the comeback of Privacy Coins. From regulatory backlash to halving hype, ZEC’s rise shows that demand for financial privacy is stronger than ever.

ZEC IGNITES THE REVIVAL OF PRIVACY COINS

Over the past two months, ZEC has staged an incredible comeback — soaring from $35 to nearly $450, a 13x surge. Just half a year ago, it was among Binance’s “community delisting” candidates. So how did a nearly forgotten coin turn into one of the year’s hottest assets?

📌 Reimagining Digital Cash Privacy

Before the DeFi Summer era, crypto innovation was largely focused on extending Bitcoin’s vision — building better digital cash, decentralized governance, or total freedom of expression. Zcash (ZEC) emerged from that pursuit.

Launched on October 28, 2016, by scientist Zooko Wilcox and his team, ZEC forked from Bitcoin’s codebase with a mission to make digital cash truly private. Unlike Bitcoin’s transparent ledger, it introduced zero-knowledge proofs (zk-SNARKs), allowing users to verify transactions without revealing any details.

This innovation enabled shielded transactions, where sender, receiver, amount, and timestamp remain completely hidden. Users can move funds between transparent addresses (t-addr) and shielded ones (z-addr), achieving selective privacy — compliant when necessary, but confidential by choice.

📌 Iteration and Adoption

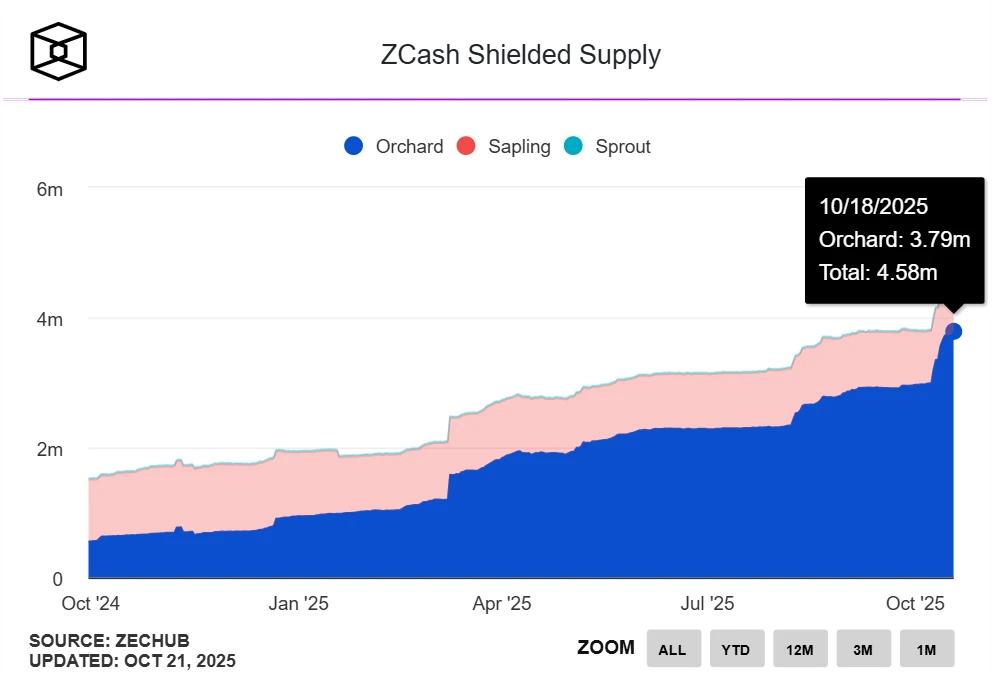

Since launch, ZEC has undergone three major protocol upgrades — Sprout, Sapling, and Orchard — each introducing a new shielded pool with backward compatibility.

According to The Block, over 4.5 million ZEC (about 27.5% of total supply) now reside in shielded pools — a record high. Recent weeks have seen a sharp rise in adoption, driven largely by the Orchard protocol, whose shielded transactions verify within seconds while revealing zero metadata.

✏️ ZEC’s resurgence isn’t just a price story — it’s a signal that privacy, once sidelined, is becoming a defining narrative of crypto’s next chapter.

>>> More to read: What is Zcash (ZEC)? How Privacy Protection Works

THE SURGE OF PRIVACY DEMAND: A COUNTERFORCE UNDER REGULATORY SHADOWS

If the previous data revealed the result, the real question is — why now?

On October 14, the U.S. Department of Justice (DOJ) announced criminal charges against Cambodian Prince Group founder Chen Zhi, seeking forfeiture of 127,271 BTC worth roughly $15 billion — the largest judicial Bitcoin seizure in history.

From a legal standpoint, it was a landmark victory for law enforcement. But from a crypto perspective, it underscored Bitcoin’s pseudo-anonymous nature. Even without breaking encryption, U.S. authorities managed to legally transfer assets through a judicial process. Using on-chain tracking and international coordination, investigators traced multiple Bitcoin addresses linked to Chen Zhi, seized them under court order, and moved the assets into government-controlled wallets — a stark reminder of how traceable transparent blockchains truly are.

Yet we must confront an uncomfortable truth — gray-market actors have long been the invisible driving force behind the adoption of Privacy Coins. While they are far from the only users, they undeniably amplify the demand for on-chain anonymity. As regulatory pressure tightens, their survival instinct drives them toward privacy strongholds like ZEC, seeking refuge in zk-SNARK-based “digital black boxes” that conceal financial flows beyond traditional oversight.

But the privacy revival extends far beyond the “dark corners” of crypto. On September 14, the Ethereum Foundation unveiled a new end-to-end privacy roadmap, aiming to make privacy a core public infrastructure rather than a niche defense tool. The plan focuses on three pillars:

- Private Writing – enabling private transactions as efficiently as public ones.

- Private Reading – allowing blockchain data access without revealing identity or intent.

- Private Proofs – ensuring fast and secure generation and verification.

The team is developing PlasmaFold, an experimental Layer 2 design set to debut at Devconnect Argentina (Nov 17), alongside the launch of privacy-focused RPC services and a report titled “State of Privacy Voting 2025.”

Ethereum co-founder Vitalik Buterin has echoed this vision, urging developers to build with zero-knowledge (ZK) and fully homomorphic encryption (FHE) technologies. In his view, “The true blockchain revolution begins when ZK and FHE reach mainstream adoption.” He predicts a shift where, in five years, “People won’t ask why to use ZK — they’ll ask why not.”

Now rebranded as the Ethereum Privacy & Scaling Explorations (PSE), the team’s focus has moved from theoretical research to practical solutions and ecosystem-wide implementation.

In this context, ZEC’s explosive rise may not be mere market speculation — it reflects a broader awakening of privacy demand across the blockchain landscape. The same momentum could soon lift other Privacy Coins, as the push for digital confidentiality reclaims its place at the heart of crypto’s ethos.

>>> More to read: Privacy Coins in Crypto | A Complete Guide

HALVING AND HYPE: FUELING ZEC’S SCARCITY STORY

On the price front, ZEC’s recent surge also ties closely to one of crypto’s oldest and most powerful storylines — the halving narrative.

The third ZEC halving is projected to occur in November 2025, reducing miner rewards from 1.5625 ZEC per block to 0.78125 ZEC. This change will effectively cut the issuance rate in half, lowering annual inflation from roughly 8% to 4%. The logic mirrors Bitcoin’s monetary blueprint — a programmatic tightening policy where scarcity is enforced not by central banks but by immutable code. Within this cyclical scarcity framework, markets tend to price in the future reduction of supply well ahead of time.

Historically, crypto markets have responded enthusiastically to the classic sequence: halving → increased scarcity → value repricing. ZEC’s last halving on November 18, 2020, demonstrated this dynamic vividly. Its price rose from around $50 two months prior to a $370 peak six months after the event — a more than sevenfold gain. If this cycle repeats, it raises a tantalizing question: is the current rally only the beginning?

Meanwhile, celebrity influence remains a potent catalyst in crypto price movements. Renowned investor Naval Ravikant publicly called ZEC “Bitcoin’s insurance policy” when it was trading near $80. Arthur Hayes, co-founder of BitMEX, boldly declared on social media, “Nothing can stop this train,” predicting ZEC could eventually reach $10,000. Other industry veterans such as 0xMert_, founder of Helius Exchange, and Chris Burniske, partner at Placeholder, have also voiced strong support.

Fueled by this narrative compound of scarcity and celebrity backing, ZEC has reclaimed both attention and cultural relevance. As its price and story reinforce one another, ZEC is steadily transforming from a forgotten legacy asset into a centerpiece of the modern privacy narrative — a symbol of how conviction, code, and culture can collide to resurrect a digital legend.

And yet, despite the explosive rally, we have not seen any significant capital outflows — suggesting that investors may still be HODLing, positioning for the next leg of ZEC’s story-driven ascent.

📌 Conclusion

ZEC’s explosive rise proves that privacy was never a discarded narrative — merely one submerged under the tides of regulation and compliance. Today, that long-suppressed sentiment is resurfacing, reminding the crypto world that the desire for true financial privacy has never truly faded.

ꚰ CoinRank x Bitget – Sign up & Trade!

〈Zcash Leads a 13x Comeback | Privacy Coins Rise Again〉這篇文章最早發佈於《CoinRank》。