Bitcoin’s recent fall below $100,000 tested investor sentiment and confidence, but the largest cryptocurrency quickly rebounded, confirming its new psychological threshold.

Analysts generally agree that, despite the continued short-term volatility, Bitcoin’s structural trend remains solid and likely to continue rising. Most experts believe that the US government shutdown is a factor holding back prices in the current period.

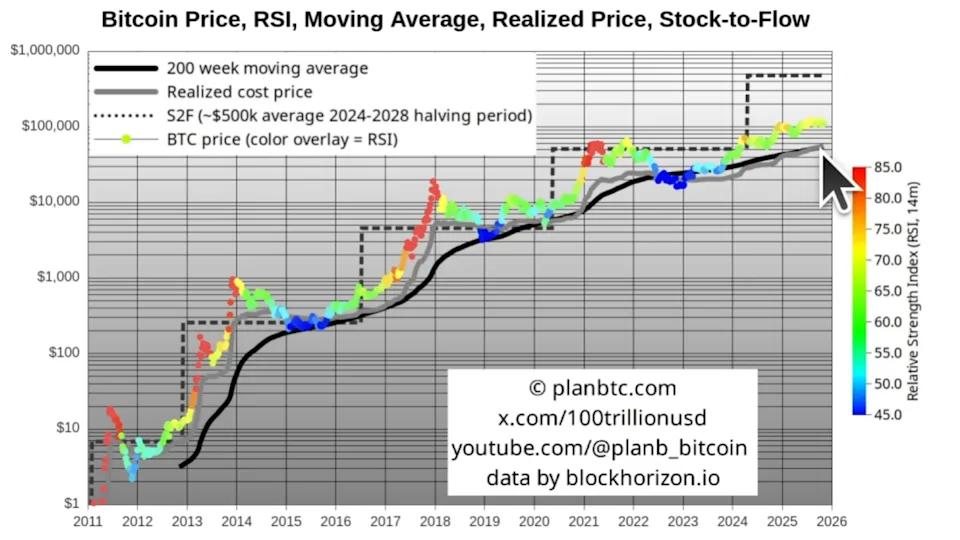

PlanB: Mid-cycle, not the “crazy” phase yet

PlanB, the creator of the Stock-to-Flow (S2F) model, XEM this correction as a mid-cycle break. His data shows that Bitcoin has held above $100,000 for six straight months — a crucial transition from resistance to support.

He argues that the market is not yet in a euphoric phase, with the RSI around 66 — well below the 80+ threshold at previous cycle peaks.

“Without the madness,” he said, “it's hard to call this the final peak.”

PlanB expects the next major rally could be towards the $250,000–$500,000 region, as long as Bitcoin continues to decouple from the actual price — a familiar sign of ongoing bull cycles.

Arthur Hayes: “Hidden” QE is coming

Arthur Hayes believes that Bitcoin's short-term weakness comes from tightening USD liquidation . Since the US debt ceiling was raised in July, the Treasury Account (TGA) has increased sharply, sucking liquidation from the market.

Hayes noted that both Bitcoin and USD liquidation indicators fell in tandem.

However, he predicts the coming reversal — when the US government reopens and begins spending the massive amounts of money in the TGA — will mark the beginning of a form of “hidden quantitative easing.”

According to him, the Fed will indirectly inject liquidation through the Standing Repo Facility tool, expanding the balance sheet without calling it official QE.

“When the Fed starts to disburse politicians’ spending, Bitcoin will rise,” he said.

Raoul Pal: Liquidation Flood Ahead

Raoul Pal's liquidation model paints a similar picture. His GMI liquidation index — which tracks global money and credit supply — remains in a long-term uptrend.

Pal calls the current period a “Window of Pain” — a time of tight liquidation and fear testing investor confidence. But he predicts a sharp reversal is coming.

The US Treasury spending will pump $250–350 billion into the market, the QT program will end and interest rate cuts will follow.

As liquidation rebounds globally — from the US to China and Japan — Pal stressed: “When this number goes up, every other number goes up.”

Outlook: Accumulate before expanding

According to the models, the overall conclusion is clear: Bitcoin has overcome the correction due to lack of liquidation. Whales are buying, technical support holds, and the macro backdrop is tilted towards easing liquidation again.

Short-term volatility may continue as fiscal and monetary policy realigns, but the overall structure favors a recovery and accumulation phase.

If liquidation indicators start to rise again in Q1 2026, both Hayes and Pal argue that Bitcoin's next rally could start right from the base it just successfully defended — the test of falling below $100,000.

Whale money flow: Strong accumulation during retail panic

Data from CryptoQuant shows that large wallets — holding 1,000 to 10,000 BTC — have amassed around 29,600 BTC over the past week, worth approximately $3 billion.

Their total BTC holdings have increased to 3.504 million BTC — marking the first major accumulation since September.

The buying spree came as retail sentiment plunged and the ETF recorded $2 billion in outflows.

Analysts XEM this divergence as a sign that institutions are quietly buying, strengthening Bitcoin's support zone around $100,000.