Author: Anthony Pompliano , Founder and CEO of Professional Capital Management

Over the past few days, bears have dominated the financial markets. The S&P 500 has fallen 2.5% in the past five days, the Nasdaq has fallen 4% in the same period, and Bitcoin has fallen 5% in the past week.

For a whole week, the screen flashed red numbers.

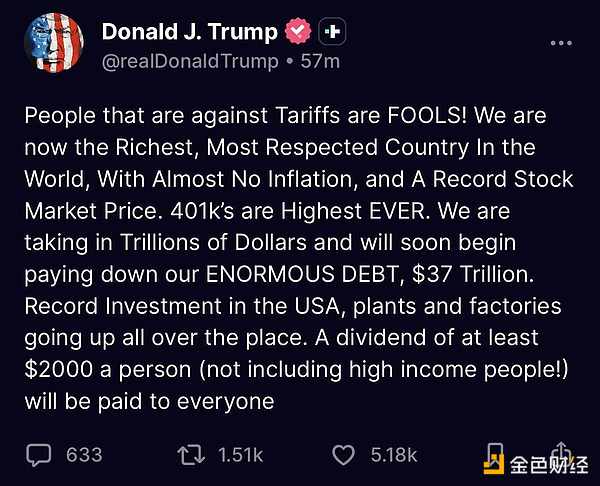

But don't worry, Trump's bailout is here . President Trump posted on Truth Social Sunday morning, promising a $2,000 "tariff bonus" to all non-high-income U.S. citizens .

Do you really think that president, who measures the health of the U.S. economy by stock market performance, will stand idly by and let the short sellers celebrate their victory?

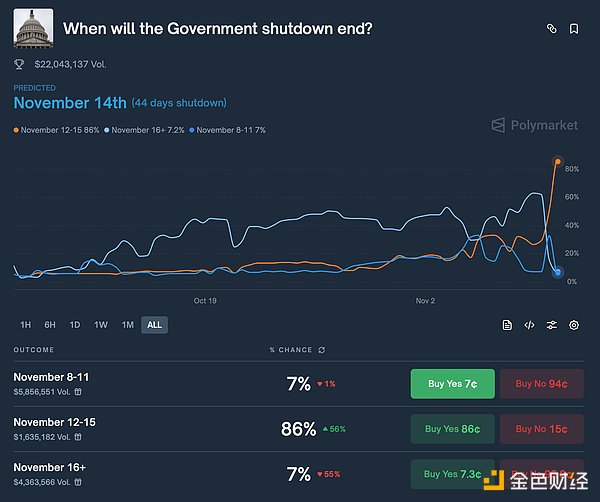

Will the tariff benefits eventually materialize? I don't know. Currently, Polymarket's odds are only 15% .

Another question is whether the tariff benefits will actually materialize? I don't think it matters. The "Trump put option" has already achieved its intended effect .

A single social media post completely altered the trajectory of asset prices. With the return of market enthusiasm, stock and Bitcoin prices surged .

This is the "Trump put option." He always manages to make statements that influence the stock market at the perfect time. You might recall that in April, before the stock market bottomed out, he posted on social media, "Now is a great time to buy!" A few weeks ago, on Sunday evening, about an hour before the futures market opened, Trump dropped his threat to impose 100% tariffs on China. And yesterday, amidst panic and fear, the most encouraging news was Trump's promise to distribute billions of dollars in economic stimulus checks.

In the long run, are economic stimulus checks beneficial to the healthy development of the US economy? Of course not. But does anyone care now? Actually, no. People are overly focused on short-term concerns, such as a stock market bubble or an impending Bitcoin bear market .

Most people believe that if President Trump wants to give millions of citizens $2,000, especially after the New York City mayoral election agenda over housing affordability issues, then let him do it. This approach completely ignores the long-term robustness of the economy and the depreciation of the dollar.

Remember, inflation can only be created by Washington, and distributing thousands of dollars to hundreds of millions of people is a way to quickly increase the chances of high inflation .

However, the "Trump put option" is not the only factor that could push up asset prices before the end of the year. We already know that the prospects for a US-China trade agreement are becoming clearer. We've also seen the Federal Reserve cut interest rates for the second time in two meetings. And now, Polymarket data shows that the likelihood of the government shutdown being resolved before November 15th is increasing.

On Sunday morning, the general consensus was that there was a 62% chance the government shutdown would be resolved after November 16, but in the past 24 hours, that probability has plummeted to just 7%. A major reason for this shift is reports last night that the Senate reached an agreement that enough Democrats would defect and vote to reopen the government.

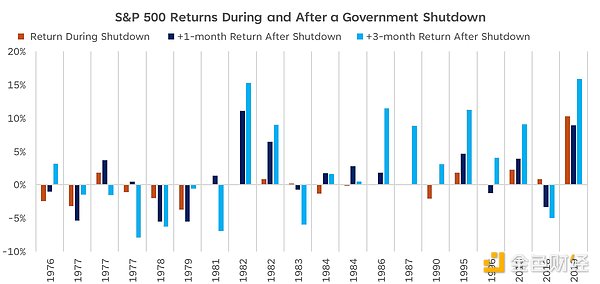

Stocks and Bitcoin are poised for a rapid rise if the government shutdown ends . Phil Rosen of Opening Bell Daily writes, “In the past 50 years, the U.S. has experienced 21 government shutdowns, with the S&P 500 rising an average of 1.2% after a month and 2.9% after three months. The stock market almost always rises after a government shutdown.”

According to Altcoin Gordon data, Bitcoin also rose by 50% in the three months following the last government shutdown .

So what will happen next? Nobody knows. We're all trying to predict an unknowable future. But what I've learned in the last five or six years is to trust your intuition, your feelings, and your animal instincts.

Whatever you call it, people's perceptions of the market often determine its performance. Last week was a prime example. Panic and negativity permeated the market. People were predicting the next bear market for Bitcoin or the end of the stock market rally.

But this week is different. We just need the promise of some stimulus checks to get everyone excited again. If everyone gets excited, money will flood the market and drive up asset prices.

I'm not the smartest person in the world, but I know that the impact of "Trump put options" should not be ignored.

Yesterday morning , "Trump put options" appeared, and asset prices are reacting, indicating that the bull market is back .