Daily market data review and trend analysis, produced by PANews.

1. Market Observation

With the end of the 43-day US government shutdown and the imminent resumption of operations by the SEC and CFTC, some crypto companies have already filed for IPOs and ETFs. Grayscale , which manages approximately $35 billion in assets, has also officially submitted its IPO application to the SEC. However, the market has not found respite. Hawkish comments from Federal Reserve officials have fueled investor concerns about a December rate cut, leading to the biggest one-month drop in all three major US stock indices. Disney, with weaker-than-expected quarterly revenue, led the Dow Jones decline, while chip stocks and AI concept stocks also suffered heavy losses. Although Michael Burry, the inspiration for the movie "The Big Short," denied that his actual investment in short Nvidia and Palantir was only $9.2 million, far from the $912 million reported by the media, his warnings about an AI bubble and his decision to close his Scion Asset Management fund exacerbated market tensions.

The aftereffects of the government shutdown are beginning to emerge. White House officials have confirmed that some key economic data, including the October unemployment rate, may be permanently lost , posing an unprecedented challenge to the Federal Reserve's efforts to assess the economic situation and determine the path of interest rates. Against this backdrop, several officials, including Minneapolis Fed President Kashkari, have expressed uncertainty or opposition to the necessity of a December rate cut, and the market's expected probability of a rate cut has fallen to 47% . The current macroeconomic environment is characterized by high uncertainty: pressure on AI investment returns, controversy surrounding high stock market valuations, the aftereffects of the government shutdown and the data vacuum, widening FOMC disagreements, and an unclear outlook on the Fed's policy direction. In this context, the market is adopting a more cautious outlook for the coming months, particularly anticipating further clarity on inflation, labor force, and growth trends after data normalization.

Amid a complex macroeconomic environment, Bitcoin's price has fallen below the $100,000 mark, and the Fear & Greed Index has dropped to 15, indicating extreme panic. Wintermute analyst Jasper De Maere points out that while Bitcoin maintains a high correlation of approximately 0.8 with the Nasdaq index, it exhibits an unusual negative skew: Bitcoin falls more sharply when the stock market declines, but its reaction is relatively muted when the stock market rises. This is attributed to investors shifting their attention to high-growth tech stocks and the weakening liquidity in the crypto market itself. Most analysts believe the short-term correction will continue, focusing on the key support level of $92,000 to $94,000. KillaXBT, pschmitt, Kyle Reidhead, and Crypto Auris, among others, consider this a potential endpoint of the correction or an ideal entry point. Renowned trader Eugene points out that BTC breaking below $100,000 symbolizes the first breach of the high-timeframe bullish structure since 2022, and that $100,000 has transformed from support to resistance. He considers the $90,000 area a key focus zone and does not consider buy the dips in the short term. Analyst Ayl o pointed out that 65% of the BTC cost base is above $95,000, so a break below this level could lead to stronger selling pressure. Analyst Ali stated that if Bitcoin (BTC) falls below $95,930, the next key support levels are at $82,045 and $66,900.

However, there are also long-term optimists in the market. Haseeb Qureshi, managing partner of Dragonfly , believes that the current fundamentals remain solid compared to the industry-wide collapse in 2022, calling it the "easiest bear market ever." McKenna, CEO of Arete Capital , predicts that although it is unlikely to reach new highs this year, the trend of institutional adoption will not change, and the price of Bitcoin is expected to break through $150,000 in the second half of 2026 and reach $200,000 before the end of Trump's term.

Ethereum was not spared either, with its price falling by more than 10% at one point, making its path back to $4,000 increasingly difficult. Analyst Marcel Pechman pointed out that Ethereum is facing four major challenges: First, on-chain activity remains weak, with transaction volume and the number of active addresses declining by 23% and 3% respectively over the past 30 days; second, network fees have plummeted by 88%, weakening staking rewards; third, pressure from competing public chains such as Solana and BNB Chain, as well as emerging Altcoin ETFs, is increasing daily; and finally, the pace of institutional fund inflows has slowed. These factors have collectively suppressed its price performance. Despite the short-term pressure, many investors see this pullback as a good opportunity to buy. Analyst Donald Dean believes that the price may continue to fall to the strong support zone of $2,800 to $3,000, but the risk-reward ratio is gradually improving, and the current period can be seen as an "accumulation" phase, with long-term target prices of $4,955 and $5,766 respectively. LD Capital founder Yi Lihua also clearly stated that $3,000 to $3,300 is the best opportunity to buy the dips, and revealed that his team is consistent with their words and actions in increasing their spot positions, patiently waiting for the market to recover.

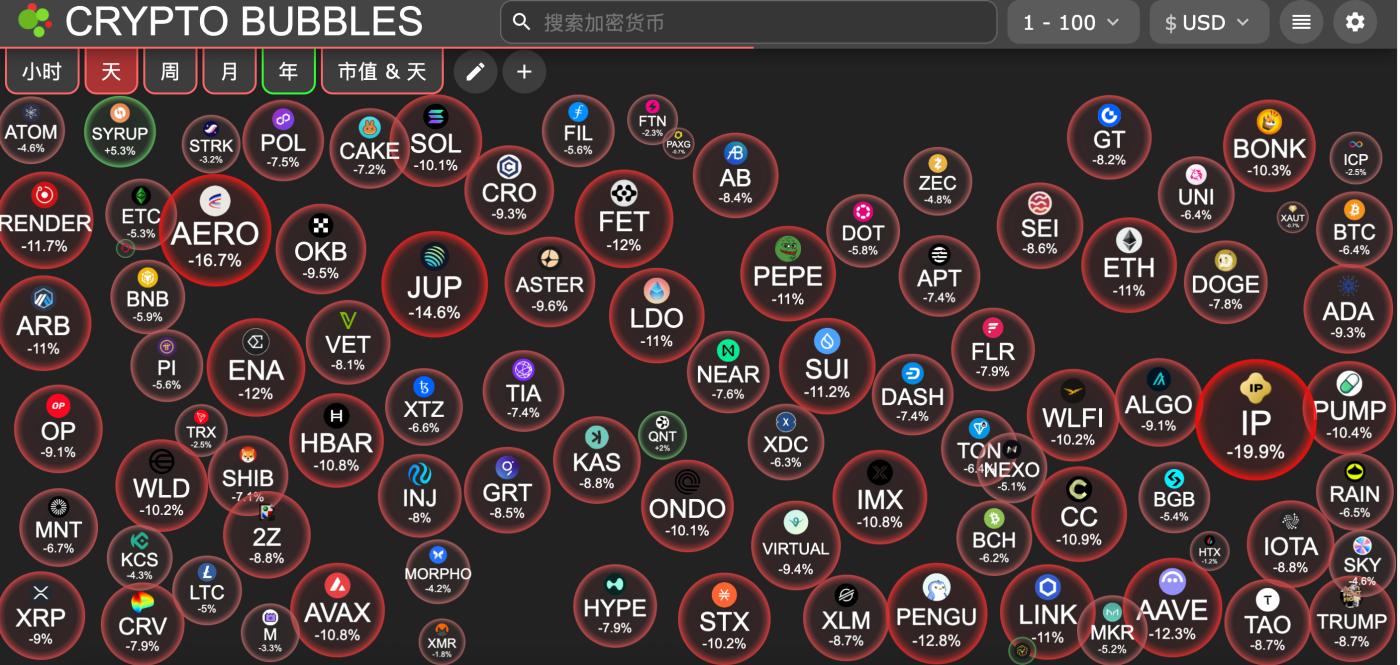

The Altcoin market declined along with the broader market, with positive news from many projects failing to stem the widespread sell-off. For example, dYdX announced it would use 75% of its protocol fees for buybacks, and NFT marketplace Magic Eden announced it would use 30% of its secondary market revenue for token and NFT buybacks, but the prices of ME and DYDX still fell. Although Solana has seen inflows for 13 consecutive days since its spot ETF launch, its price has still fallen below $140, and its probability prediction of reaching a new all-time high before 2026 has plummeted from 56% a month ago to 6%. Renowned DeFi analyst Ignas has sold SOL and bought ZEC, stating that this move was influenced by Mert, CEO of Solana ecosystem service provider Helius . While Mert stated he still holds SOL, he has become another industry opinion leader, besides BitMEX co-founder Arthur Hayes, who strongly supports Zcash recently. Amidst the market downturn, there are bright spots. The Canary XRP ETF has been listed on Nasdaq, with its first-day trading volume reaching $59 million, slightly higher than BSOL's $58 million, setting one of the highest records for new ETFs this year.

2. Key Data (as of 13:00 HKT, November 14)

(Data source: Coinglass, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $97,308 (year-to-date +3.92%), daily spot trading volume $107.48 billion.

Ethereum: $3,178 (-4.8% year-to-date), daily spot trading volume $49.08 billion.

Fear of Greed Index: 15 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 59.2%, ETH 11.7%

Upbit 24-hour trading volume rankings: XRP, BTC, ETH, SOL, AVNT

24-hour BTC long/short ratio: 48.11%/51.89%

Sector Performance: Ethereum ecosystem down 10.6%, NFT blocks down 9.88%.

24-hour liquidation data : A total of 237,999 people worldwide were liquidated, with a total liquidation amount of $1.023 billion. This included $447 million in BTC liquidations, $260 million in ETH liquidations, and $68.39 million in SOL liquidations.

3. ETF Flows (as of November 13)

Bitcoin ETF: -$870 million, second highest ever.

Ethereum ETF: -$260 million, marking the third consecutive day of net outflows.

Solana ETF: +$1.49 million, marking the 13th consecutive day of net inflows.

Hedera ETF: +$5.37 million

Litecoin ETF: +$698,000

4. Today's Outlook

Binance will remove spot trading for C/BNB, C/FDUSD, DOGE/TUSD, and NIL/BNB on November 14th.

Binance Alpha will launch Play Solana (PLAYSOLANA) airdrop on November 14th.

Binance will delist MYROUSDT and 1000XUSDT perpetual contracts on November 14th.

Solomon will conduct a SOLO token ICO on MetaDAO on November 15.

Starknet (STRK) will unlock approximately 127 million tokens on November 15th at 8:00 AM, representing 5.34% of the current circulating supply, worth approximately $17.7 million.

WalletConnect Token (WCT) will unlock approximately 124.9 million tokens at 8:00 AM on November 15th, representing 65.21% of the current circulating supply, with a value of approximately $15 million.

Sei (SEI) will unlock approximately 55.56 million tokens at 8 PM on November 15th, representing 1.11% of the current circulating supply, with a value of approximately $9.6 million.

The biggest drops among the top 100 cryptocurrencies by market capitalization today were: Story down 19.9%, Aerodrome Finance down 16.7%, Jupiter down 14.6%, Pudgy Penguins down 12.8%, and Aave down 12.3%.