The cryptocurrency market has taken a huge hit over the past month. Total market Capital fell from $4.27 trillion on October 6, 2023, to $2.98 trillion on November 19, 2023, a drop of about 30%. Despite the recovery to $3.12 trillion, the controversy is far from over — traders are still Chia .

One group believes a deeper bear market is forming. Another group believes the correction represents a final sign of weakness. This article focuses on the latter group. Several early signs suggest that the crypto bull market may begin sooner than expected.

The five reasons below reflect one of three things: peak weakness, peak retracement, or renewed buying power. Together, they can create one of the strongest early-cycle bull structures ever seen.

Short-term selling pressure shows signs of exhaustion

Short-term investors have been selling at the fastest pace in months, and this often happens near Dip.

Bitcoin Munger pointed to a surge in coins being deposited into exchanges at a loss, while JA Maartunn also highlighted a similar surge on CryptoQuant, with over 60,000 Bitcoins being moved at a loss in a matter of hours. This type of panic selling often marks the “clean-up” phase before a trend change from a bear market.

Want more Token news like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

Short-term investor withdrawal: X

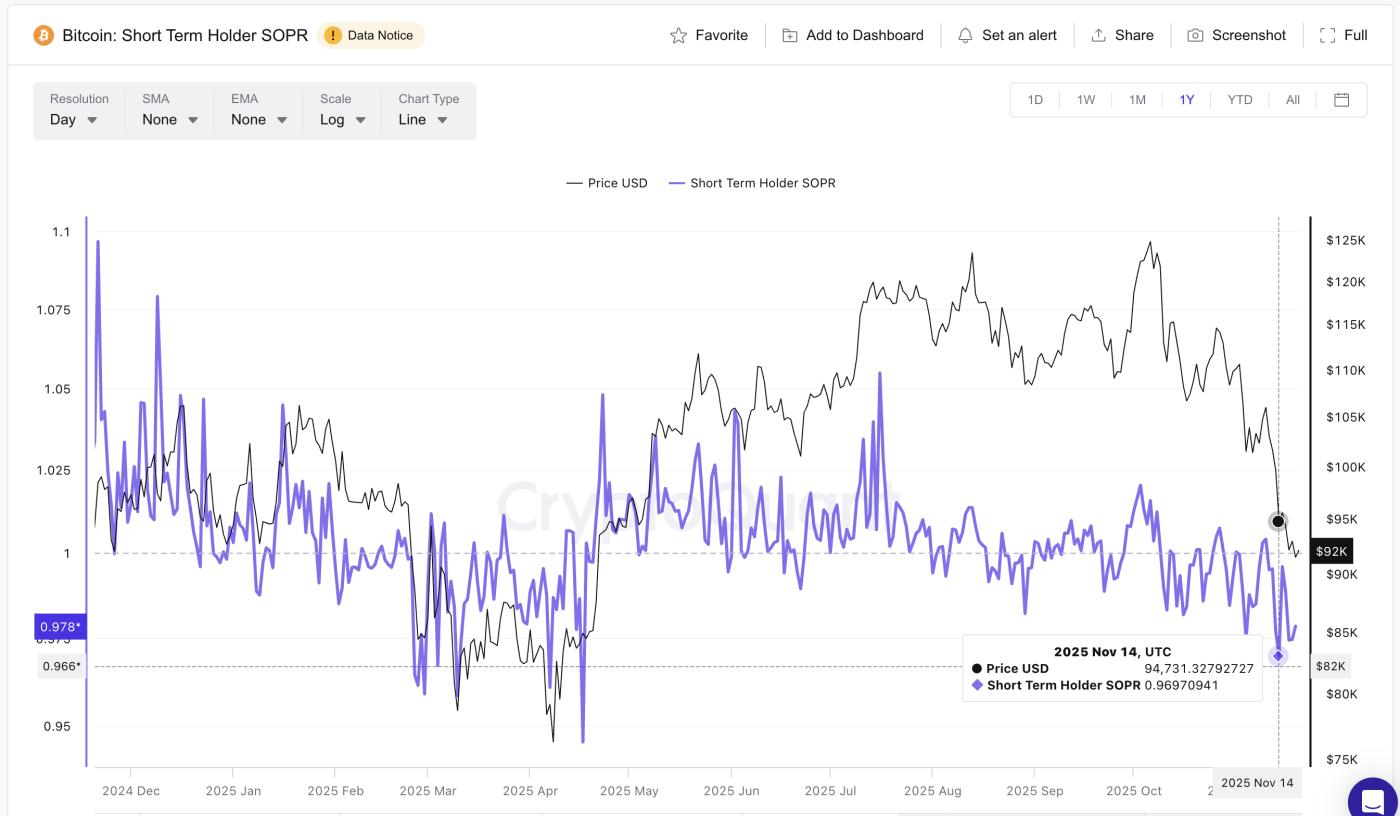

Short-term investor withdrawal: XOn- chain data confirms this. The short-term investor SOPR dropped to 0.96 on November 15, 2023, the same level as April 7, 2023. SOPR, or Spent Output Profit Ratio, shows whether coins spent on- chain are being sold at a profit or a loss. When it drops below 1 and then stabilizes, it usually signals that weak holders have exited.

Bullish Market Signals via STH SOPR: CryptoQuant

Bullish Market Signals via STH SOPR: CryptoQuantShort-term investors are important because they are the quickest to react to corrections. They panic sell earlier, mark their stops faster, and often sell out of weakness. This is why short-term selling pressure almost always peaks near market Dip .

After a correction in April 2023, Bitcoin rose from $76,270 to $123,345 in a few months, a gain of nearly 62%. With the SOPR now back at 0.97, the latest decline suggests that selling pressure may be nearing exhaustion.

The next question is: Is new buying power being built elsewhere? That's where the next indicator comes in.

Stablecoin power is on the rise again

If short sellers are running out, the next question is: Is there enough new buying power to push prices up?

For now, stablecoin data says there is enough.

The Stablecoin Supply Ratio (SSR) has dropped to 11.59, its lowest level in over a year. SSR compares Bitcoin’s market Capital to the total supply of stablecoins. When SSR falls, it means that stablecoins have more purchasing power than Bitcoin. Traders sometimes refer to this as “dry powder.”

Stablecoin Supply Rate Hits Record Low of the Year: CryptoQuant

Stablecoin Supply Rate Hits Record Low of the Year: CryptoQuantThis is even lower than the 12.89 seen on April 8, 2023, the same period when Bitcoin Dip near $76,276 before rising for months. A lower SSR means that stablecoins can buy more Bitcoin per unit of supply, which often happens near market Dip .

The second confirmation comes from SSR’s RSI, highlighted by analyst Maartunn. It is near 26, a level that has matched Bitcoin’s Dip multiple times in previous bear markets. The low RSI here means that stablecoin buying power is “oversold” relative to Bitcoin’s size — a rare configuration that often appears before a trend change.

SSR RSI Is Dip: X

SSR RSI Is Dip: XCombined with the rising stablecoin reserves and the deep drop in SSR shows that the market has the liquidation needed for a crypto bull market recovery.

SSR and selling pressure

Short-term speculation and low SSR have shown that selling pressure is almost exhausted. The next layer is altcoins, where the correction is even deeper.

The latest data from Glassnode shows that only about 5% of the altcoin supply remains profitable, a level typically seen in the final stages of capitulation. When nearly all holders are at a loss, the market is often very reluctant to sell more.

Bitcoin Underwater

This is similar to Bitcoin's decline, where 95% of all coins bought in the last 155 days are now in the red — higher than the COVID and FTX shocks.

Altcoins may be preparing

This combination is important because altcoins tend to stabilize before Bitcoin when returns drop so sharply. Although Bitcoin dominance is still close to 60% , the gap between Bitcoin's declining returns and altcoins' near-zero returns suggests that altcoins may be approaching a period of stabilization.

If a bull market starts from a deep correction, altcoins are often the first to react simply because they no longer have price pressure. This could increase the likelihood that an altcoin-led phase could start first.

Market psychology

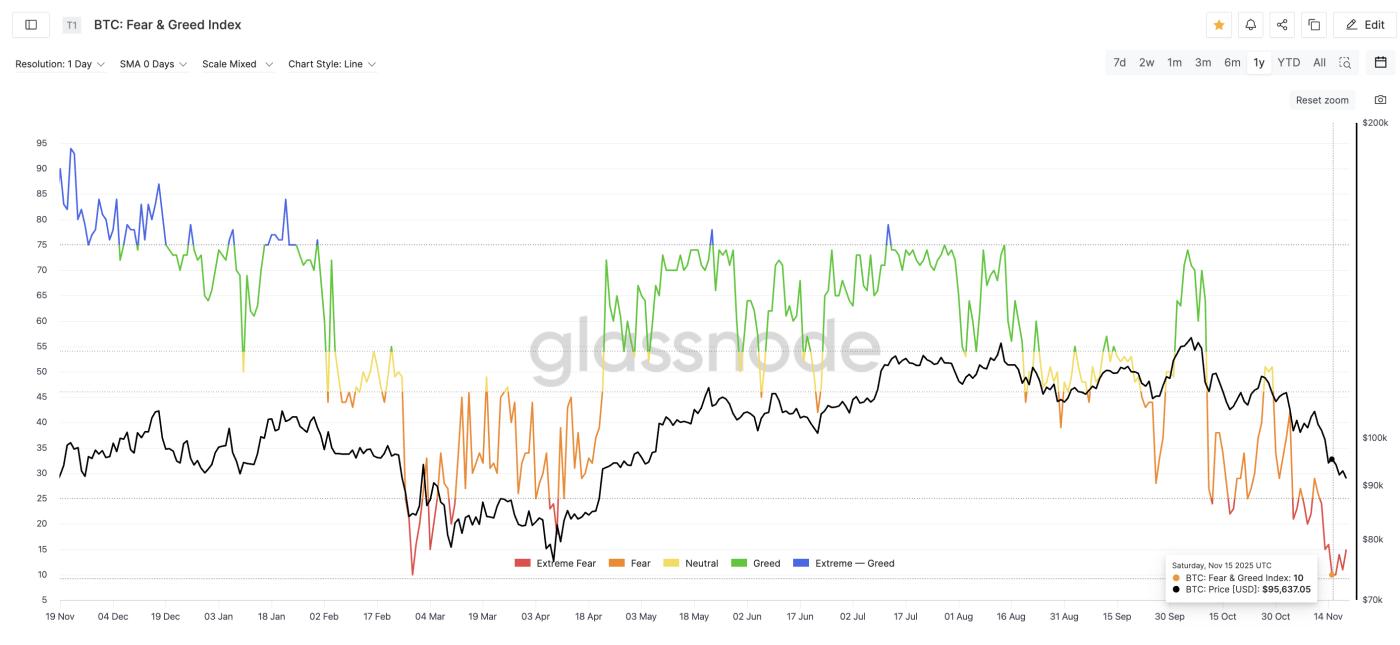

After XEM the altcoin losses and the underwater Bitcoin supply, the next Shard of the crypto bull market story is sentiment. The Bitcoin Fear & Greed Index dropped to 10 on November 15, marking its lowest reading since February 27, when Bitcoin was trading near $84,718. The previous reading came just weeks before Bitcoin Dip in April and began the rally we mentioned earlier — from $76,276 on April 8 to $123,345 on August 13, a 62% increase.

Fear And Greed Index Reset: Glassnode

Fear And Greed Index Reset: GlassnodeThe new drop to 10 is important because extreme fear usually sets in after most of the selling has ended. Even during the April rally, the index only reached 18 and never dropped to 10. The drop to this level suggests that the market has gone through its emotional purging.

Industry leaders like Thomas Chen, CEO of Function, also describe this period as cleansing and emotionally stressful:

“Allocator behavior has tilted toward selling with over $2.8 billion in outflows… it almost feels like it’s back to the question: do I really want to hold BTC in this environment? With the Fear and Greed Index at extreme fear, this looks similar to the Luna 2022 crash,” he said.

Coming on the heels of altcoin capitulation and record low stablecoin rates, this fear reset reinforces the notion that the foundation for the next crypto bull market may be forming.

The final signal

The final signal that points to a possible crypto bull market is the new Death Cross that formed on November 15. A Death Cross occurs when the 50-day moving Medium falls below the 200-day moving Medium . Moving Medium show the Medium closing price over a period of time, so this cross usually highlights trend exhaustion rather than the start of a long-term decline.

Bitcoin fell about 17% during the “incoming cross” phase leading up to the final signal. This move was almost identical to the 16% drop seen during the April Death Cross setup. The April structure was fully developed, clearing the weak momentum, and then the April-August rally began.

Crypto Market Analysis And Death Cross: TradingView

Crypto Market Analysis And Death Cross: TradingViewThis time, something similar is happening under the surface. Prices have made lower lows in these two market phases, but RSI has made lower lows. RSI tracks momentum, and this hidden bullish divergence often signals that sellers are losing momentum. It acts as a final release of pressure before the uptrend that has already begun resumes. And this fits with the capitulation top theory Chia earlier.

Fred Thiel, CEO of MARA Holdings, pointed out that the recent decline reflects a macro-driven cleanup, not just a chart event.

“Bitcoin’s drop below $90,000 reflects a perfect storm of macro waves and profit-taking. Long-term holders have allocated over 815,000 BTC in the past month, the most aggressive selling since 2024,” he noted.

If Bitcoin holds above recent lows , the Death Cross could end up being just a reset rather than a breakout.

Bullish market signals

That was the case earlier this year, and is one reason traders believe that the crypto bull market base is quietly forming again. However, if Bitcoin price does not react soon to this recent crossover, the bull market may have to wait longer.