Bitcoin fell below $87,000 on November 20, 2025, amid concerns about quantum security and a $1.3 billion sell-off by a 'whale', wiping out nearly $220 million in long-term investments in the process.

The sharp decline extended a two-day pattern with rebounds from Asia being overshadowed by a sell-off in US markets, with traders confused by mixed signals from institutional buyers and panic from retail investors.

Quantum computer panic causes fear throughout the market

The recent sell-off accelerated after billionaire Ray Dalio raised concerns about Bitcoin's vulnerability to advances in quantum computing .

His remarks sparked debate in the cryptocurrency community, drawing attention to crypto security risks .

“I have a small percentage of Bitcoin that I have held for a long time, about 1% of my portfolio. I think the problem with Bitcoin is that it will not become a reserve currency for major countries because it can be tracked and can be controlled, hacked, etc.,” Ray Dalio said .

However, market analysts disagree with the quantum security panic. Mel Mattison, a financial expert, believes these concerns are overblown and ignore the robustness of Bitcoin encryption compared to traditional banking.

“If people are selling BTC because of quantum encryption, they should dump every bank in the world. JPM should take a 20% cut. Every account should be hackable. BTC is SHA-256, much stronger than RSA,” Mel Mattison countered .

The debate reflects a broader Chia in how investors assess long-term technological risks. While Dalio highlights theoretical vulnerabilities as quantum computers develop, critics point out that Bitcoin's SHA-256 offers stronger security than the RSA standard used by most banks.

If quantum computers pose a threat to Bitcoin, the global banking system could face even greater risks.

Bitcoin Users Exit the Market Early with $1.3 Billion Selloff

Adding to concerns about quantum security, blockchain analytics firm Arkham reported a major sell-off. Owen Gunden, a longtime Bitcoin investor who has been accumulating since 2011, sold all of his 11,000 BTC for about $1.3 billion.

Gunden's decision to leave comes at a crucial time for market sentiment . According to data from BeInCrypto , Bitcoin was trading at $86,767 at the latest update, down 2.55% over the past 24 hours.

Bitcoin Price (BTC). Source: BeInCrypto

Bitcoin Price (BTC). Source: BeInCryptoThe whale's decision to sell after 14 years underscores a shift away from the usual long-term holding mentality. Its reasons are unclear, whether it is profit-taking, portfolio rebalancing, or concerns about Bitcoin's prospects.

Still, the selling injected more supply into an oversold market and exacerbated the decline.

Large liquidation flows accelerate decline

Quantum security concerns and 'whale' sell-offs have triggered a massive wave of liquidations on exchanges. Data from CoinGlass shows that more than $910 million in crypto positions were liquidated in 24 hours, pushing 222,008 traders out of the market.

During the morning trading hour in the US, long liquidations surged to $264.79 million while short liquidations reached $256.44 million.

Cryptocurrency liquidations in the past hour. Source: Coinglass

Cryptocurrency liquidations in the past hour. Source: CoinglassThese forced closes demonstrate the significant leverage in the crypto market and how positions can be liquidated quickly during strong market movements.

The crash also exposed weaknesses in crypto Derivative . As Bitcoin fell from above $91,000 to $86,000 in 48 hours, leveraged traders faced margin calls and automatic position closures.

This automatic selling creates further bearish momentum and additional liquidations, fueling a cycle of violent volatility.

Institutional buyers return despite retail investor panic

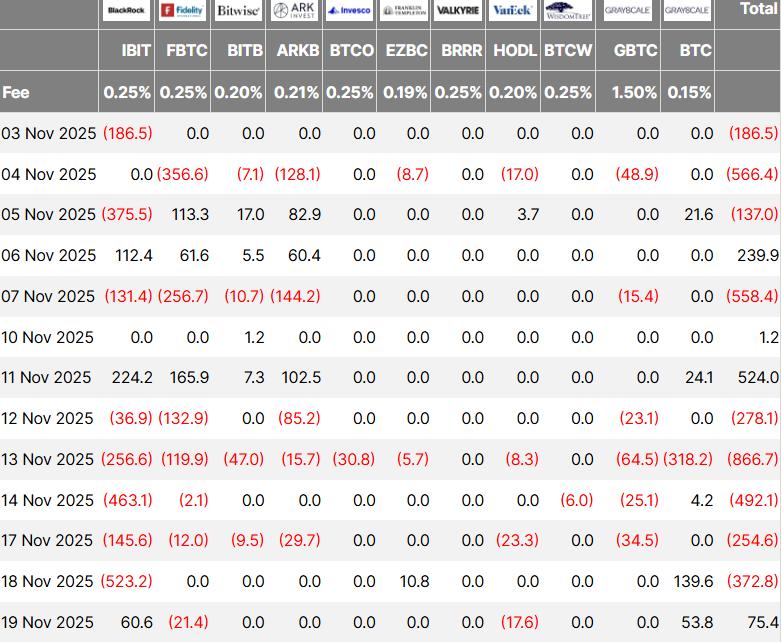

Despite the sell-off, US Bitcoin ETFs (exchange-traded funds) attracted a net inflow of $75 million on Wednesday, ending a five-day chain of declining inflows.

BlackRock's IBIT and Grayscale's mini ETF were the two destinations for all this money, suggesting some institutional investors saw the dip as a buying opportunity.

Sentiment among ETF issuers, however, remains mixed, with VanEck, Fidelity and other major issuers reporting flat or negative flows, suggesting cautious optimism.

Bitcoin ETF Flows as of November 19. Source: Farside Investors

Bitcoin ETF Flows as of November 19. Source: Farside InvestorsThis divergence highlights the mixed outlook on the Bitcoin market, with some institutions viewing current prices as valuable, while others are hesitant due to short-term volatility.

The combination of whale selling, concerns about quantum security and institutional buying has led to a surge in volatility, with investors now wondering whether the quantum narrative signals real risk or is just profit-taking after Bitcoin’s rally this year.

The coming days will show whether institutional support will keep prices stable, or if there will be more downside as the market processes these risks and supply from long-term holders.