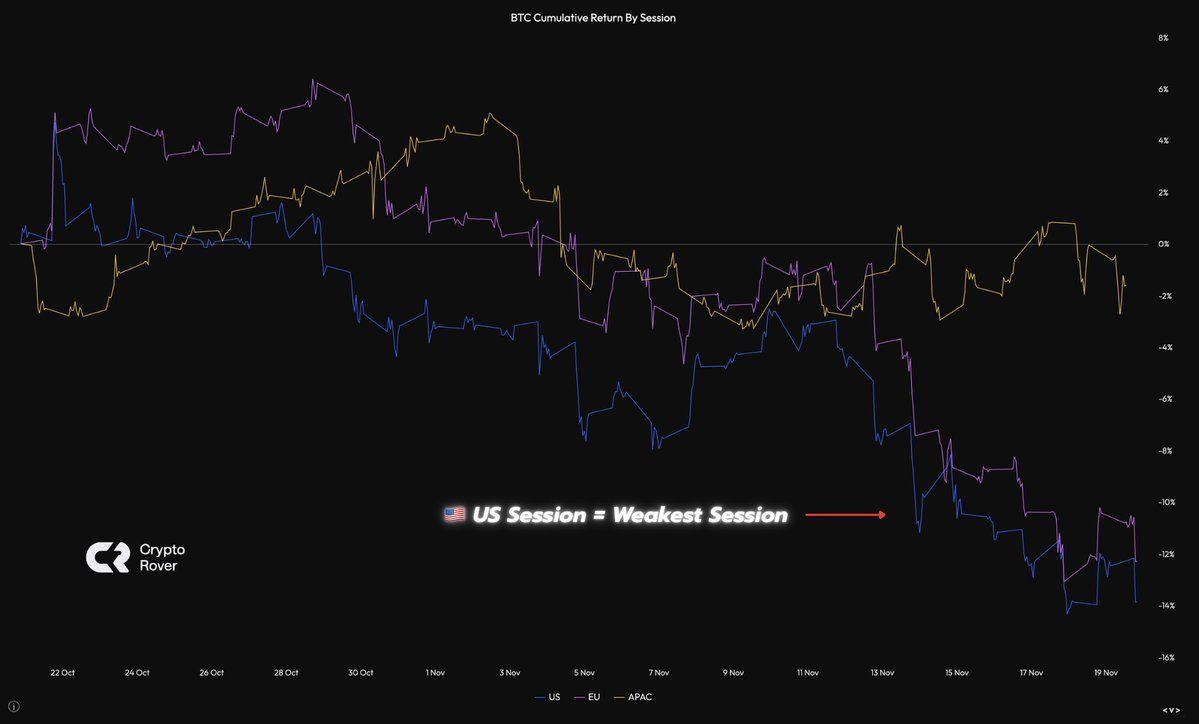

Bitcoin’s recent price decline has seen a clear split in trading, with US sessions leading to sell-offs while Asian traders are buying steadily. Data shows that US sessions have become the weakest period for Bitcoin prices.

This split highlights the difference in risk appetite and fuels debate over whether Bitcoin is experiencing a healthy correction or facing a deeper structural problem.

US trade fuels Bitcoin sell-off, Asia absorbs supply

This week’s price action reflects a clear trend: US trading hours show continued losses, while European sessions suffer smaller declines. In contrast, Asia-Pacific markets have remained more stable and generally supported price recoveries. Data Snapshot highlight the central Vai US trading hours have played in recent price declines.

Bitcoin's cumulative gains by trading session show US weakness. Source: CryptoRover

Bitcoin's cumulative gains by trading session show US weakness. Source: CryptoRoverOne X user commented : “Every US session is a non-stop sell-off for hours. Then the Asians wake up and buy it all back until the Americans wake up. Like clockwork.” This interaction has become a regular feature of the current trading dynamics.

The split may stem from differences in risk sentiment across regions. The sell-off in the US could be due to concerns about macroeconomic signals, policy changes, or liquidation. In contrast, many Asian traders see the dips as buying opportunities, either because of confidence in Bitcoin's prospects or because of diversified investment approaches.

Liquidation and market depth also come into play. US trading generates large volumes, so widespread selling can have a strong impact on global price movements. When US traders prioritize selling, global prices fall until Asian buyers step in and restore balance.

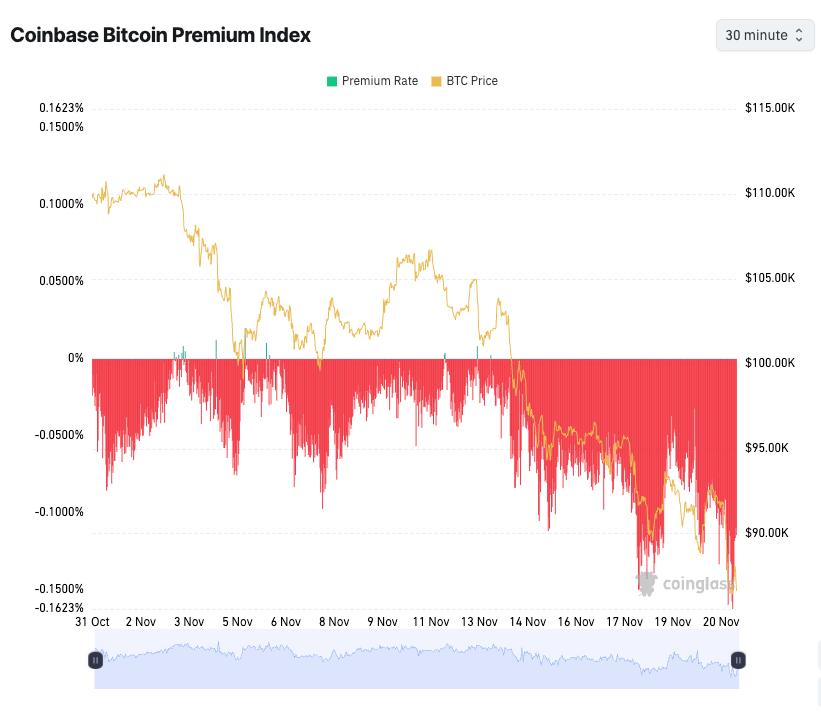

The Coinbase Premium index, which reflects sentiment among US institutions, has been in negative territory for most of November. Source: Coinglass

The Coinbase Premium index, which reflects sentiment among US institutions, has been in negative territory for most of November. Source: CoinglassIt is also worth noting that retail investors are generally bearish, while whales are bullish and US institutions are bearish. The Coinbase Premium index, which reflects US institutional sentiment, was in negative territory for most of November.

Institutional Players Change the Traditional Bitcoin Cycle

Chain analyst Ki Young Ju provided a detailed look at today’s market landscape. He noted that Bitcoin’s bull run technically ended in early 2024 after hitting $100,000. According to traditional cycle theory, the price could drop to $56,000 to establish a new cycle Dip .

Institutional absorption creates a virtual price floor, as large holders with stable confidence are unlikely to sell during downturns. Traditional models assume that most participants can accept during downturns, but corporate strategic treasury challenges that assumption.

Still, some warn that concentration creates new risks. If institutions run into financial trouble or change strategies, any large sell-off could disrupt the market. But so far, they remain committed to holding and accumulating Bitcoin .

Experts see healthy correction in current bull market

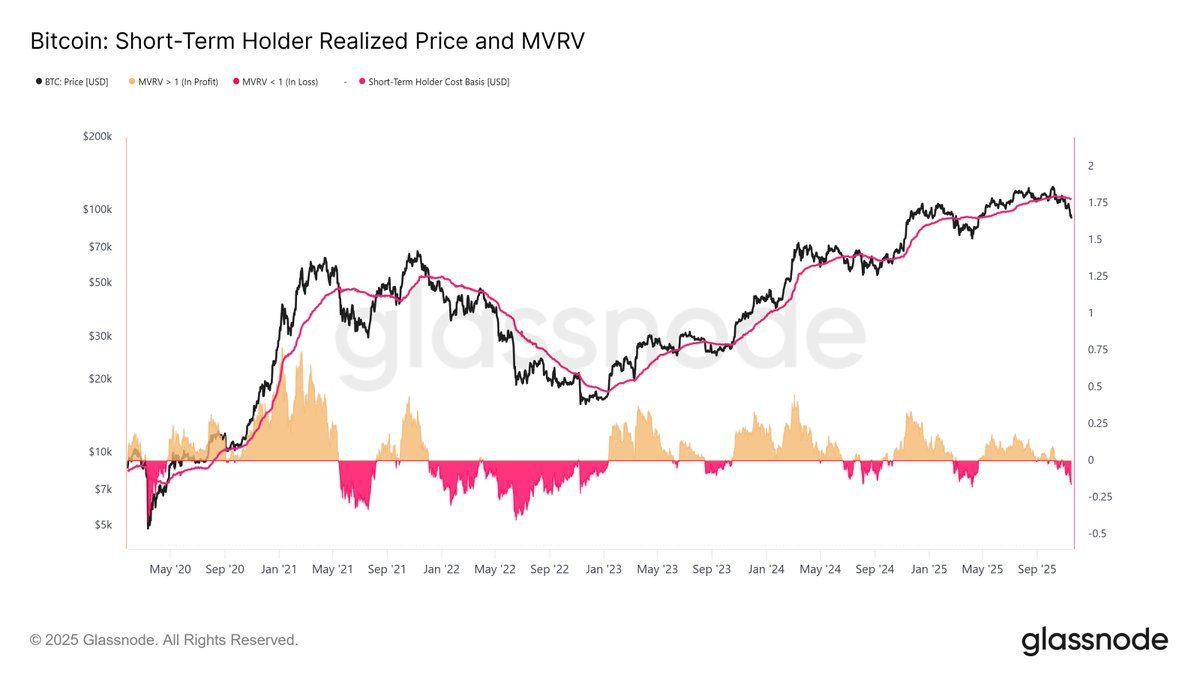

Chris Kuiper, vice president of research at Fidelity Digital Assets, sees the recent correction as a positive. He describes the decline as a standard correction in a larger bull market , not a sign of the end of the cycle.

Kuiper’s analysis uses on- chain signals, such as the MVRV ratio for short-term investors. These statistics indicate that the current price is testing the confidence of recent buyers, just as previous corrections have preceded stronger gains. It shows that recent buyers are taking unrealistic losses before the market resets and trends higher.

Short-term investor MVRV ratio shows typical bull market correction. Source: Glassnode via Chris Kuiper

Short-term investor MVRV ratio shows typical bull market correction. Source: Glassnode via Chris KuiperThe lack of significant negative events supports his interpretation. No significant regulatory action, exchange failure, or macroeconomic shock triggered the drop. Instead, profit-taking and leverage liquidation after Bitcoin’s run to $100,000 seem to be the main culprit.

Traders are now weighing two scenarios. The split between bullish Asian buyers and cautious US sellers could resolve if US sentiment improves, or persist if global market structure changes further. Broader macroeconomic trends – such as government liquidation measures and regulatory changes – will likely determine the direction of the market in the coming months.