Daily market data review and trend analysis, produced by PANews.

1. Market Observation

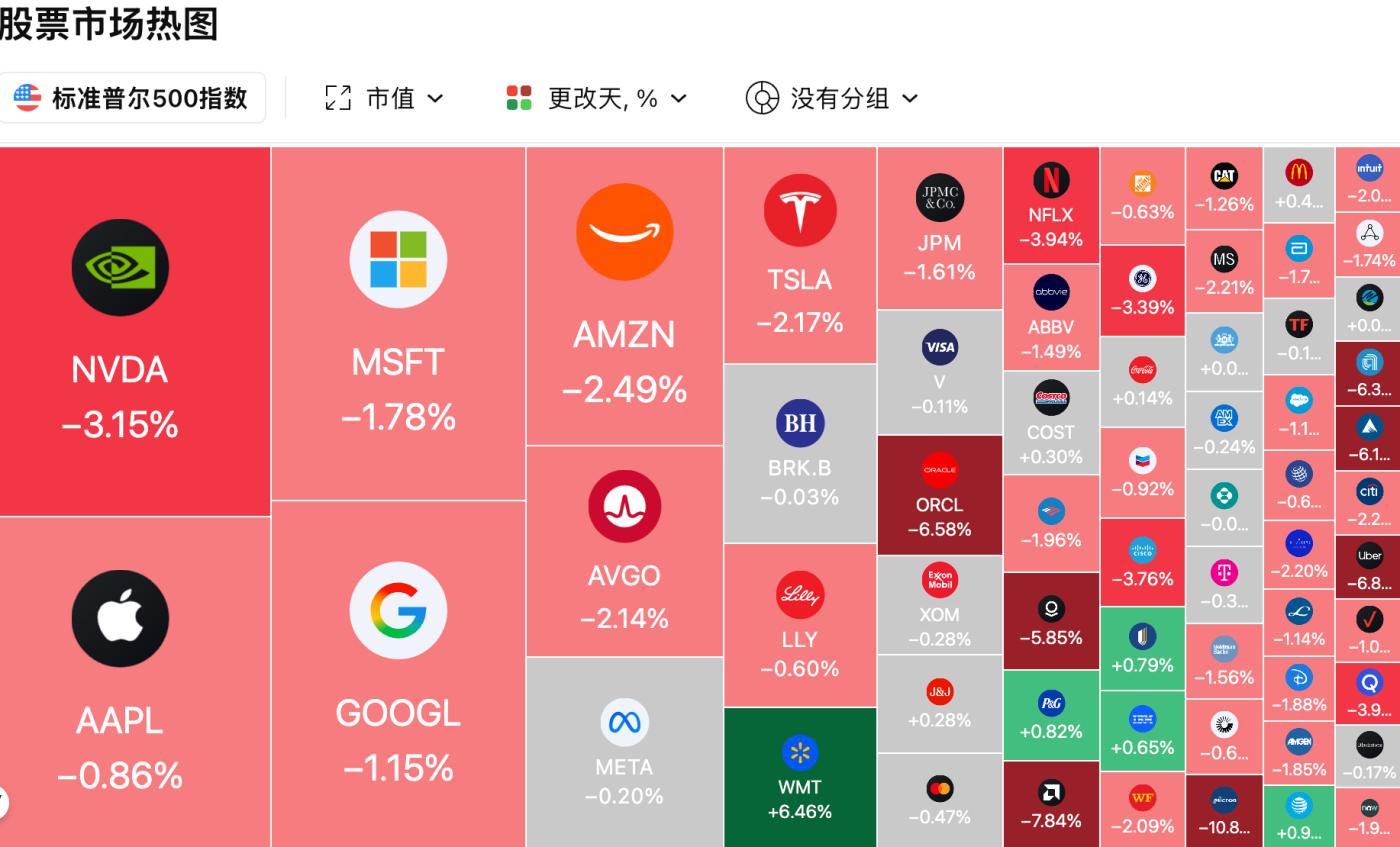

Despite Nvidia's better-than-expected earnings and the US September non-farm payroll report showing both stronger-than-expected job growth and a 4.4% unemployment rate—a double boost—the market unexpectedly staged its most dramatic intraday reversal since April. The S&P 500 opened more than 1.4% higher but ultimately closed lower, while Nvidia also rose more than 4.5% before closing down nearly 3%, exacerbating the sell-off in risk assets. Analysts believe that when positive news fails to drive the market higher, it itself constitutes a strong bearish signal.

The Federal Reserve's hawkish stance has clouded expectations for further rate cuts, with Chairman Powell stating that another rate cut in December is "far from a certainty." Meanwhile, the rapid development of artificial intelligence has raised concerns about the labor market and corporate capital expenditures. Bridgewater Associates founder Ray Dalio warned that the current vast gap between financial wealth and real currency has placed the market in a bubble zone similar to that of 1929 and 2000, pointing out that the AI boom has exacerbated wealth inequality. Looking ahead, market sentiment is extremely fragile. Investors, under pressure from technical sell-offs, liquidity shortages, and a massive number of options expiring, have entered "profit and loss protection mode," becoming exceptionally sensitive to any disturbance.

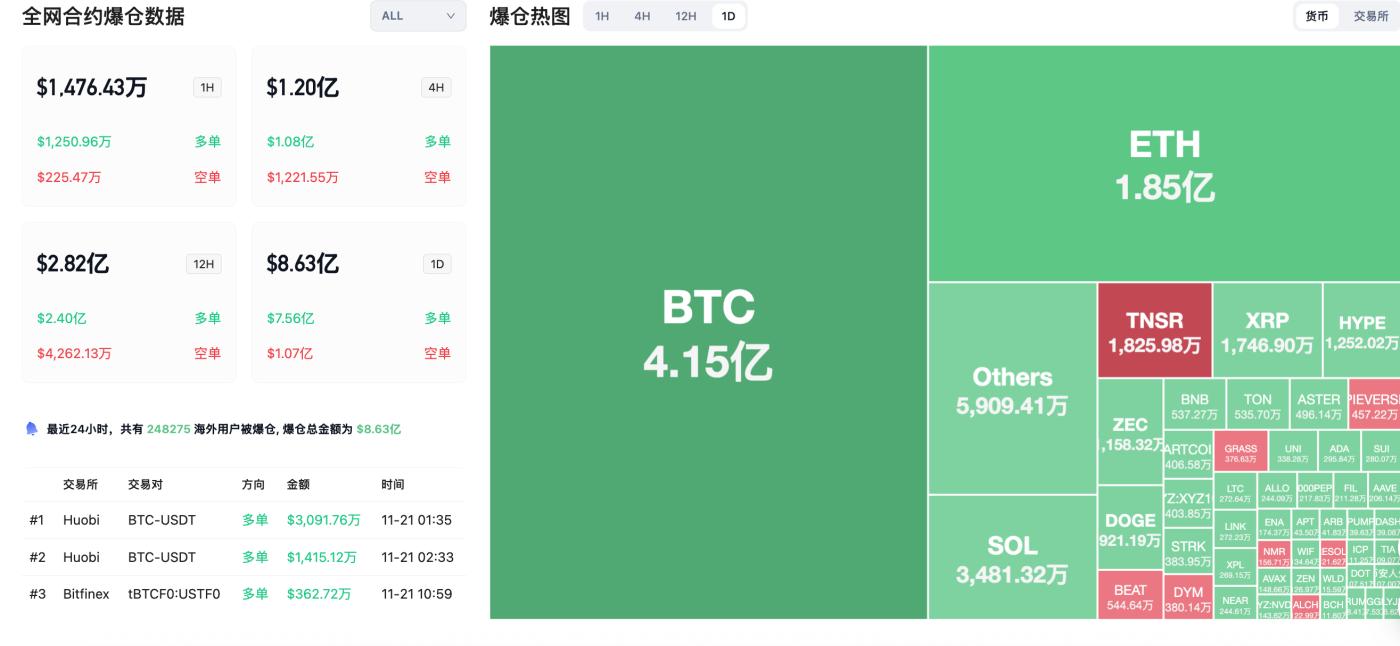

In the cryptocurrency market, Bitcoin has been at the forefront, with its price fluctuations closely linked to the macroeconomic environment and market sentiment. After breaking below the psychological threshold of $90,000, the price even dipped below a multi-month low near $86,000. Regarding its future direction, the majority of the market is bearish. Gareth Soloway, a 27-year Wall Street trader, predicts that Bitcoin could fall to the $73,000-$75,000 range in the short term. He believes Bitcoin's underperformance compared to tech stocks is due to reduced volatility, decreased institutional buying, and the overall market's risk-averse trend. Analyst Hanmu Xia offers two hypotheses, both predicting a short-term drop to $78,000-$81,000, and even if it rebounds to $110,000-$120,000 early next year, it is unlikely to reach a new all-time high. Ali points out a significant decrease in whale activity and gives a key support level of $82,045. However, bullish views and those advocating accumulation also exist. Analyst Pentoshi believes that the rapid decline of over 30% has made the market partially oversold, and the $83,000-$85,000 area presents a good opportunity to buy on a rebound. CryptoQuant founder Ki Young Ju also stated that due to institutions like Strategy holding onto their tokens for an extended period without selling, the market is unlikely to return to the cyclical bottom of $56,000, and the current range represents a reasonable long-term accumulation phase. Technically, Material Indicators points out that a large number of buy orders have accumulated in the $82,600 to $78,000 range, historical data showing this typically foreshadows a price recovery. Bitwise analyst André Dragosch defines the area between BlackRock's IBIT cost price of $84,000 and Strategy's cost price of $73,000 as the market's "pain point," and a potential "sell-off" bottoming zone. Overall, market sentiment is generally bearish, and traders are divided on the bottom level.

Ethereum is also facing significant pressure, with its price falling 30% in the past month, breaking below the four-month low of $2,800. Veteran trader Gareth Soloway believes the $2,700-$2,800 range is a key support level for swing trading. However, market sentiment is generally more pessimistic, with some analysts pointing to a repeat of the 2022 bear market fractal, suggesting ETH may further decline to the 200-week moving average around $2,450 for final support. Analyst EliZ emphasizes that while the price has paused near the 0.75 Fibonacci level, this is more like a "breathing out" during the downtrend than a "serious rebound." The continued decline in on-chain volume indicates that real demand has not yet entered the market, and any narrative about a bottom is premature. The significant weakening of institutional demand is a key factor in ETH's weakness; data shows that global Ethereum investment products, including US spot ETFs, experienced their largest weekly outflows since February. More seriously, companies holding ETH as reserve assets are suffering huge unrealized losses, with average returns on investment ranging from -25% to -48%, causing their market capitalization relative to net asset value (mNAV) to fall below 1, weakening their refinancing capabilities. According to Ted, BlackRock has sold $1.1 billion worth of ETH this month, further exacerbating the selling pressure in the market.

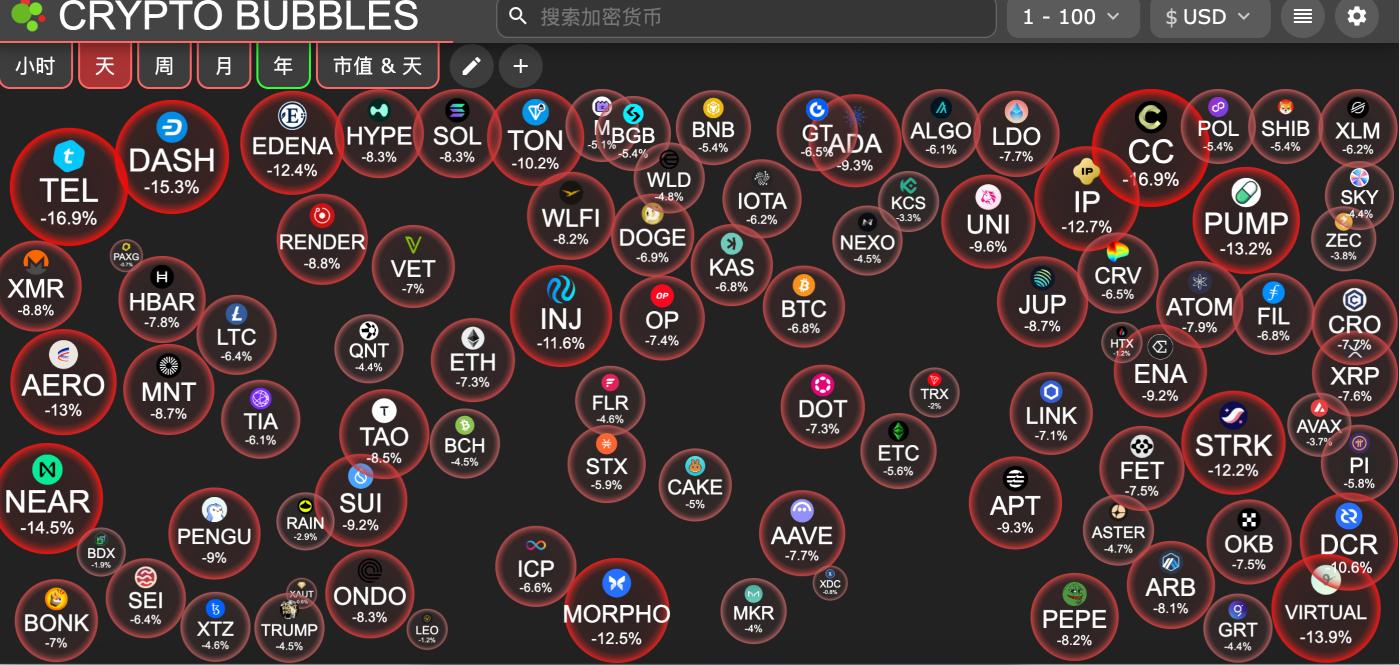

While some Altcoin are still rising, the top 100 tokens by market capitalization have all capitulated and are currently declining. Notably, the price of Nillion tokens plummeted by over 60% yesterday. The project team blamed this on unauthorized selling by a market maker, stating they have used their funds for buybacks and are preparing legal action. Furthermore, the highly anticipated parallel EVM project MegaETH announced a $250 million pre-deposit cross-chain bridge program to attract initial liquidity for its mainnet launch on November 25th. Meanwhile, amidst increased market volatility, crypto exchage Bullish has attracted the attention of JPMorgan Chase due to its better-than-expected third-quarter results. Although the target price has been slightly adjusted, it is still considered to have significant upside potential, and Ark Invest, founded by [Cathie Wood of Investor], has been buying Bullish shares for three consecutive days.

2. Key Data (as of 13:00 HKT, November 21)

(Data source: CoinAnk, Upbit, Coingecko, SoSoValue, CoinMarketCap)

Bitcoin: $85,611 (year-to-date -8.46%), daily spot trading volume $100.9 billion

Ethereum: $2,792 (year-to-date -16.35%), daily spot trading volume $43.12 billion.

Fear of Greed Index: 15 (Extreme Fear)

Average GAS: BTC: 1.02 sat/vB, ETH: 0.067 Gwei

Market share: BTC 58.7%, ETH 11.9%

Upbit 24-hour trading volume rankings: BTC, XRP, ETH, SOL, DOGE

24-hour BTC long/short ratio: 48.18% / 51.82%

Sector Performance: SocialFi sector fell 9.88%, L2 sector fell 8.4%.

24-hour liquidation data: A total of 248,275 people worldwide were liquidated, with a total liquidation amount of $863 million. This included $415 million in BTC liquidations, $185 million in ETH liquidations, and $34.81 million in SOL liquidations.

3. ETF Flows (as of November 20)

Bitcoin ETF: -$903 million, the second highest in history

Ethereum ETF: -$262 million, marking the 8th consecutive day of net outflows.

Solana ETF: +$23.66 million

XRP ETF: +$118 million

4. Today's Outlook

Binance will delist XCN, FLM, and PEP perpetual contracts on November 21st.

Binance will delist spot trading pairs such as LA/FDUSD and SAHARA/BNB on November 21.

Binance Alpha will list ULTILAND (ARTX) ,MineD, and Kyuzo's Friends.

The biggest drops among the top 100 cryptocurrencies by market capitalization today were: Telcoin down 16.9%, Canton Network down 16.1%, Dash down 15.2%, NEAR Protocol down 14.3%, and Virtuals Protocol down 13.7%.

5. Hot News

A Bitcoin whale short a floating profit of over $57 million.

Bitmine purchased another 17,242 ETH, worth approximately $49.07 million.

ANPA, a US-listed company, plans to purchase up to $50 million worth of EDU tokens within 24 months.

ETHZilla disclosed that it currently holds 94,060 ETH, worth $285 million.