The translation is from @AlanaDLevin's "Crypto Trends Report 2025 Edition".

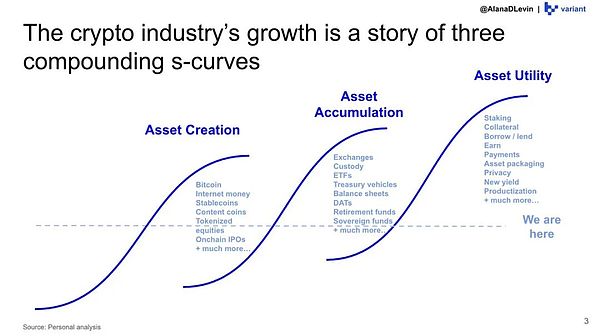

The industry's growth follows a "three-stage S-curve":

A composite spiral of creation, accumulation, and application

If we stretch the development of the crypto industry over the past fifteen years into a long timeline, we can find a highly explanatory main axis: the growth of the entire industry can actually be broken down into three overlapping and mutually reinforcing S-curves—asset creation, asset accumulation, and asset application . These three curves mesh together like three gears, with each breakthrough propelling the next leap forward, forming a compound acceleration curve for the blockchain industry.

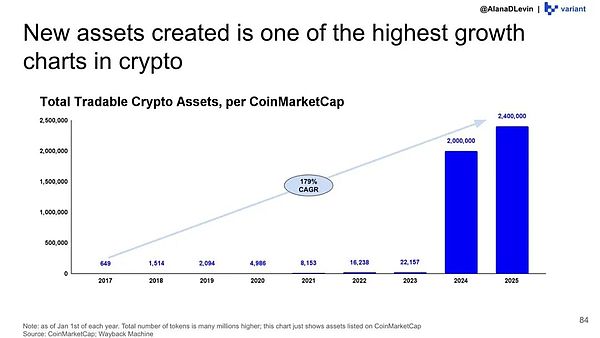

The first stage is "creation"—the on-chaining and tokenization of value. Since the birth of Bitcoin in 2009, the crypto world has entered a fifteen-year asset creation cycle. From the initial single-type monetary asset, it has expanded to Layer 1 tokens, protocol tokens, stablecoins, content tokens, MEME, NFTs, and then to the rapidly rising on-chain stocks, tokenized treasuries, and other various real-world assets in the last two years. Especially during 2024–2025, the entire industry entered the steepest section of the asset creation S-curve: the number of tradable assets increased from approximately 20,000 to millions, at an unprecedented speed. Although new innovations will continue to emerge in the future (such as on-chain credit, structured products, and more RWAs), the most impactful "0 to 1" moment has already arrived.

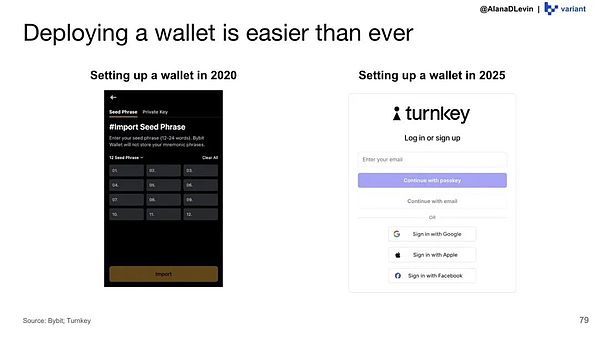

The second stage is "accumulation"—the more assets one has and the higher their value, the more willing people are to hold them. This trend is extremely evident across multiple sub-sectors of the industry: from custody products to trading platforms, from security solutions to wallet infrastructure, every link is rapidly expanding around the "growing demand for asset holding." Different types of users use different custody methods: stablecoin products prefer embedded wallets like Turnkey, institutions use compliant custody services, and on-chain high-frequency users rely on "hyper-application" wallets like Phantom. Meanwhile, the growth in demand for asset holding further drives the proliferation of trading channels: mature exchanges (such as Coinbase) continue to see soaring trading volumes, traditional fintech platforms (such as Robinhood) are increasing their crypto support, and new platforms offering novel trading experiences are experiencing explosive growth. Asset management institutions are beginning to offer crypto allocations in pension funds, listed companies are including Bitcoin and stablecoins on their balance sheets, and even some sovereign wealth funds are joining the ranks of long-term crypto asset allocations. It can be said that in the S-curve of "asset accumulation," we have only just entered the steepest growth phase.

The third stage is "application"—making assets truly functional. Once people have accumulated enough assets, they naturally want to put them to use. Crypto assets are by far the most composable, accessible, and programmable financial assets, resulting in a strong divergence in innovation surrounding asset applications. We are already seeing a range of robust and scalable applications: stablecoin payments, lending and borrowing in protocols like Morpho, providing liquidity to on-chain exchanges, and staking rewards at the network layer. However, this is only the beginning of the application S-curve; there is still significant room for growth before true large-scale adoption. In the coming years, the design space surrounding "asset utilization" is likely to become one of the most promising and commercially viable areas in the crypto space.

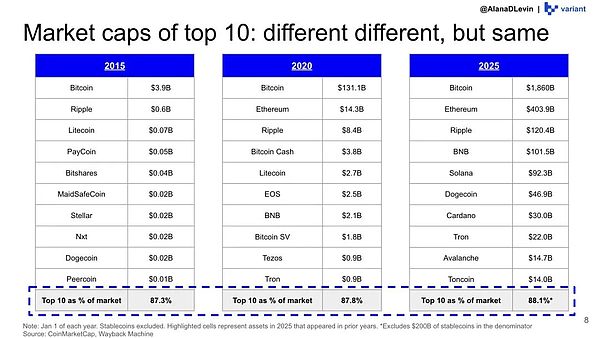

Although new tokens are constantly emerging in the market, the concentration of value remains remarkably stable, with the market capitalization share of the top ten assets remaining almost unchanged. This means that among the vast sea of tokens, only a very limited number can truly weather market cycles and maintain sustained market recognition.

The stable position of these top assets is no accident. The crypto world also exhibits a positive feedback loop of "cumulative effect": the more people hold an asset, the higher its value, the more likely it is to form a Lindy effect—the longer it exists and the wider its use, the more self-consolidating it becomes. In the past few years, we have hardly seen any new tokens jump into the top five; this is not due to a lack of innovation, but rather because the "stickiness" of top assets is becoming stronger than ever before.

Entering the "Exponential Era"

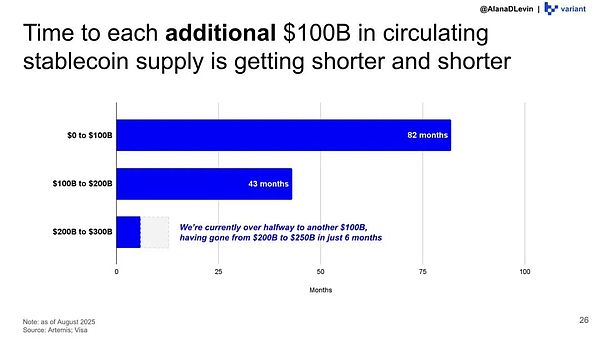

Stablecoins in a frenzy

Beyond these market capitalization rankings, there is a type of asset that is quietly accelerating its growth: stablecoins.

The expansion of stablecoins has entered an "exponential era":

The industry took more than 80 months to deliver the first batch of $100 billion worth of supplies.

The second 100 billion took more than 40 months;

The third 100 billion is expected to be achieved within 12 months.

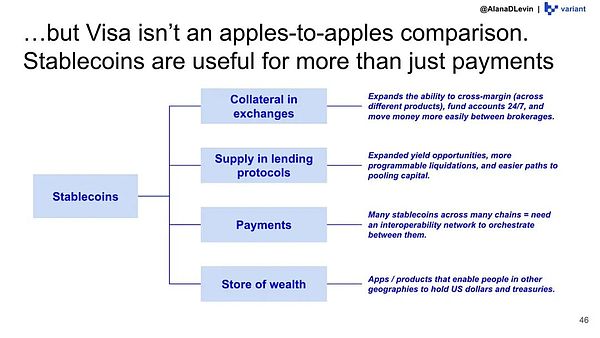

This not only reflects strong demand but also demonstrates that stablecoins are no longer merely "assistive tools for transactions" but are becoming tangible financial infrastructure. From payments, lending protocols, and trading platforms to cross-border remittances and wealth storage, stablecoins are penetrating an increasingly wide range of product scenarios . It is foreseeable that the "creation → accumulation → use" chain of stablecoins has become the main battleground for the next wave of entrepreneurship and product innovation.

The industry is just beginning to show some initial signs of productization, such as stablecoin-based yield products, lending and consumption scenarios, and payment solutions for merchants, but this may only be the beginning.

The next promising directions include credit systems built on stablecoins, privacy payments, automated fund allocation, and even new financial models such as BNPL (buy now, pay later) – areas that traditional finance struggles to cover quickly but which blockchain technology is naturally suited to.

The most obvious winner in the "asset accumulation" trend

CEX

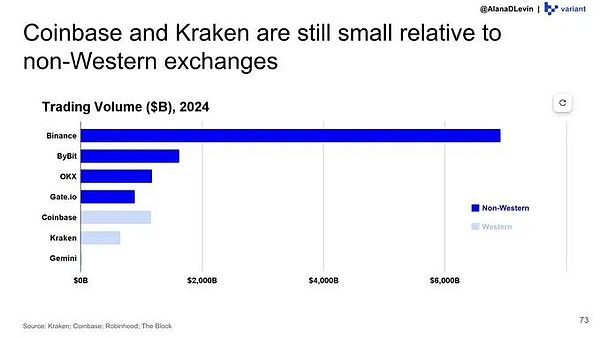

As more and more people want to buy, sell, and hold crypto assets, exchanges are benefiting significantly. Among them, centralized exchanges are undoubtedly one of the most obvious winners in the "asset accumulation" trend.

The primary mission of exchanges is to enable users to easily trade crypto assets. As more and more people begin to accumulate assets, exchanges assume the role of providing access and distribution channels. At the same time, more traditional platforms are also looking to offer crypto asset trading services. We have already seen many traditional brokerages begin supporting the buying and selling of crypto assets, and behind them are a group of infrastructure companies responsible for routing, matching, and ensuring order security.

Meanwhile, centralized exchanges (CEXs) have also benefited significantly from this "cumulative effect" as asset size and user numbers have grown. With more people flocking to the crypto market for buying, selling, storing, and investing, the majority of crypto transactions still occur on CEXs—contributing trillions of dollars in trading volume annually. Despite the ongoing evolution of decentralized finance, CEXs remain dominant in terms of user access, compliance services, asset custody, and liquidity.

Beyond its primary need for users to trade and stay on the platform, Coinbase has built other, more robust business lines, including custody, staking services, and yield products. Many new ways to leverage crypto assets will be built directly on-chain, but may gain wider adoption through centralized exchanges such as Coinbase, Robinhood App, and Kraken.

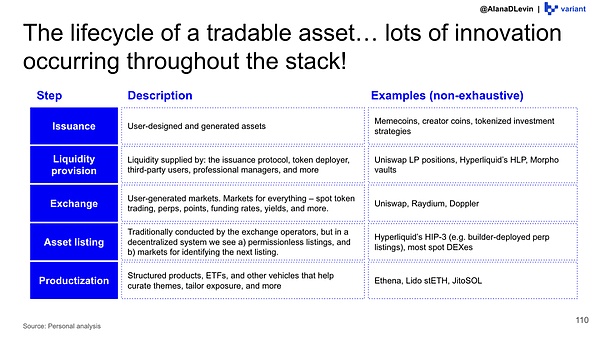

So why will future applications of higher asset utilization be built on-chain? On-chain activity is a hotbed of innovation. Every stage of an asset's lifecycle can be experimented with on-chain (whereas in traditional finance, these steps are mostly restricted and permissioned).

Today, it's easier than ever for new users to get started with on-chain transactions— meaning anyone, anywhere, and of any age can start creating, accumulating, and using crypto assets .

The number of newly created tokens is one of the fastest-growing metrics in the cryptocurrency space.

As a result, total trading volume surged, and decentralized exchanges (DEXs) continued to grow. The market share gained by DEXs in the first half of 2025 exceeded the total for the entire years from 2021 to 2023.

Another area where we can see early signs of utilization in the on-chain lending space is in lending protocols like Morpho, where assets have grown more than fivefold in the past few years (and continue to grow!).

Against the backdrop of continuous asset accumulation and rapid growth of stablecoins, another main theme of on-chain innovation is beginning to emerge clearly: the infrastructure trend of "built on-chain, used across the entire network" is accelerating. Protocols like Morpho are representative of this model—the core logic is executed entirely on-chain, but users and applications are found in every corner of the ecosystem, truly realizing an expansion path of "native on-chain, ubiquitous scenarios".

More importantly, while mainstream assets are stabilizing, there are still significant gaps in the "asset creation curve." The next batch of assets with structural growth potential is likely to be emerging on-chain, with institutionally issued on-chain assets being the most typical example.

Finding future trends

Back on the chain

Over the past year, we have seen an increasing number of institutions begin to deploy tokenized treasuries. This is the first wave of institutional assets going on-chain, but it certainly won't be the last. As regulation and technology mature, on-chain assets will extend from government bonds to a wider range of categories, including corporate bonds, structured notes, and even more complex financial instruments.

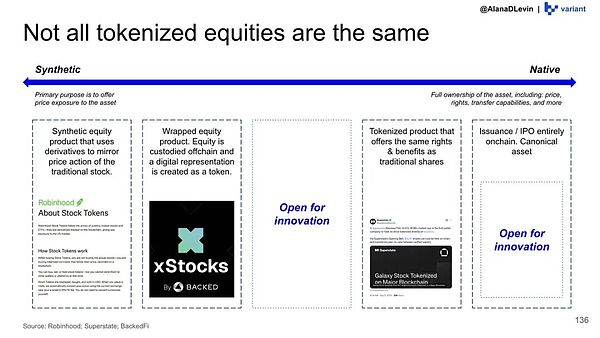

Meanwhile, experiments with onchain equities are rapidly unfolding. The industry is testing various technical approaches and design patterns, and in the future, it is likely that a spectrum of different types of onchain equity products will emerge, ranging from native "fully on-chain" equity to hybrid structures with specific regulatory attributes. Each of these could become an important vehicle for institutional assets to be put on-chain.

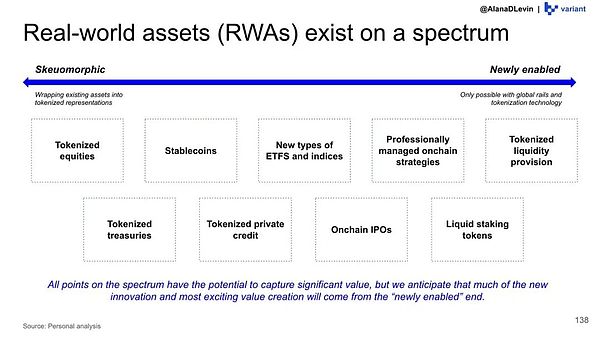

As asset classes continue to expand, the scope of the term "RWA (Real World Assets)" will be redefined. Future RWA will no longer be limited to government bonds, US dollar cash, or real estate, but will encompass a wider range of asset types, derivative structures, and financial products. These new assets not only increase supply-side possibilities but will also continuously trigger new rounds of accumulation and usage demand, forming the next growth flywheel.

In cutting-edge fields, prediction markets are also a key case study in this research. While prediction markets are not inherently new, when combined with on-chain mechanisms, they evolve from a single product into an open platform, automatically bringing together liquidity, price discovery, and market participants. This ability to "leap from product to platform" is precisely the most unique innovation model in the crypto world.

In fact, this leap has already occurred in perpetual contracts (such as Hyperliquid) and lending protocols (such as Morpho): from initial functional products, they gradually attract developers, strategies, users and external builders, and eventually evolve into independent ecosystems.

On-chain trends, global perspective:

Finding the real growth drivers for the next phase of the crypto industry

Therefore, if you're looking for the next real trend, the answer has always been there—look back at the blockchain. Whether it's growth drivers, user needs, or innovative breakthroughs at the asset level, the most crucial changes are constantly brewing and accelerating on-chain. When large-scale on-chain asset creation coincides with the market's continuously rising willingness to hold these assets, the industry will naturally see broader accessibility: more new users, lower barriers to entry, more diverse entry channels, and an increasingly mature asset distribution system.

However, if the perspective remains solely focused on the top Western exchanges, it's easy to miss the true narrative of this industry. Real trading volume, real user growth, and real demand surges are actually happening in a broader market "outside the system"—those regions with rapid growth, strong demand, and abundant structural opportunities are where the future growth of the crypto world lies.

The crypto industry is never an isolated phenomenon in any one region, but rather a restructuring of global financial infrastructure. Therefore, to understand the future of crypto, we must transcend limited perspectives and embrace a truly global view. Only by connecting on-chain changes with global needs can we see the vast potential for the industry's next phase.