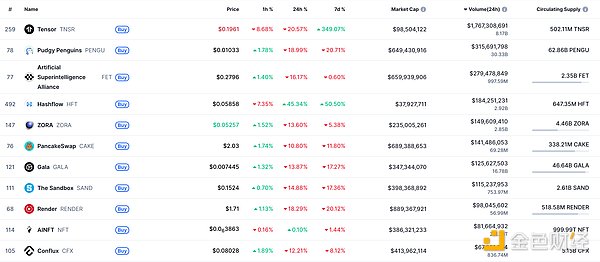

DeFi data

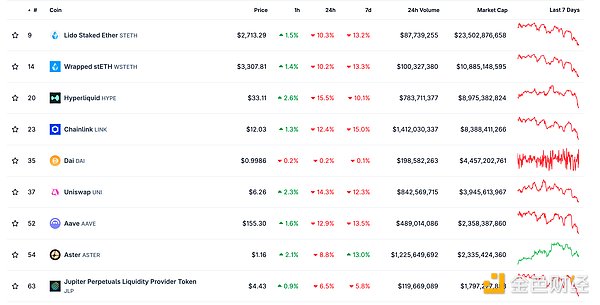

1. Total market capitalization of DeFi tokens: $104.193 billion

DeFi total market capitalization data source: coingecko

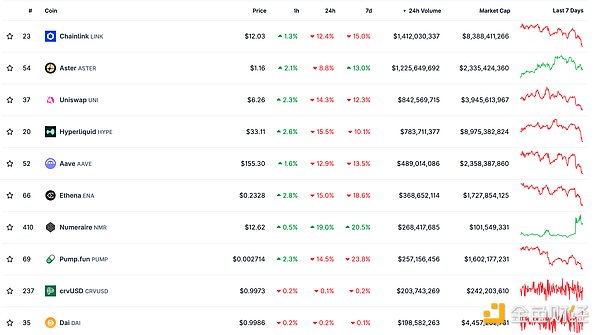

2. The trading volume on decentralized exchanges in the past 24 hours was $111.67.

Trading volume data for decentralized exchanges in the past 24 hours. Source: coingecko

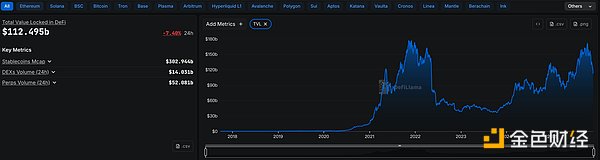

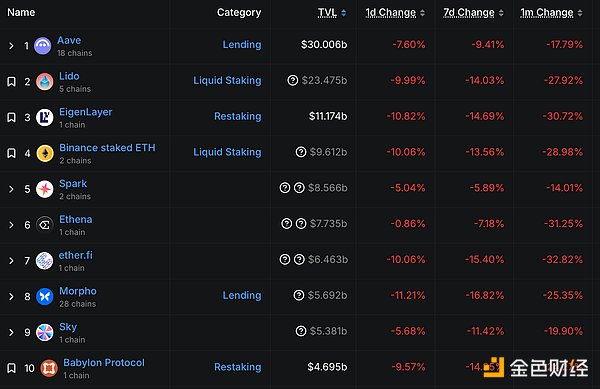

3. Total assets locked in DeFi: $112.495 billion

Top 10 DeFi projects by locked assets and total value locked (Data source: defillama)

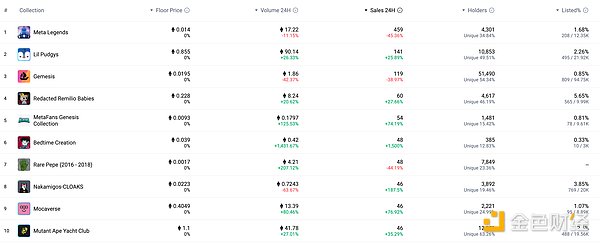

NFT data

1. Total market capitalization of NFTs: $11.475 billion

NFT total market capitalization and top ten market capitalization data source: Coinmarketcap

2.24-hour NFT transaction volume: $ 4.7 billion

NFT total market capitalization and top ten market capitalization data source: Coinmarketcap

Top NFTs within 3.24 Hours

Top 10 NFTs by Sales Growth in the Last 24 Hours. Data Source: NFTGO

Headlines

Tether's gold reserves surge to 116 tons

According to a CoinDesk report, a recent report from investment bank Jefferies indicates that stablecoin giant Tether has quietly become one of the most influential new buyers in the gold market. The report estimates that Tether currently holds at least 116 tons of gold, with 12 tons backing its XAUt token (worth approximately $1.57 billion) and approximately 104 tons backing USDT (worth approximately $13.67 billion), making it the world's largest non-sovereign gold holder, comparable in size to a small central bank. It added approximately 26 tons in the third quarter alone, equivalent to 2% of global demand. Analysts point out that with the growth of USDT and Tether CEO Paolo Ardoino's projection of $15 billion in profits by 2025, the company may continue to increase its gold reserves. Gold prices have risen by more than 50% this year and are currently trading at approximately $4,080 per ounce.

MEME Hot Topics

1. Bubblemaps: The BULLISH meme token exhibits severe pegging issues.

Blockchain analytics platform Bubblemaps tweeted that the meme token BULLISH suffers from severe pegging, with 70% of the token supply held by new wallets on Binance. Between September 13th and 24th, over 150 wallets received funds within a tight timeframe. Each wallet transferred SOL to a new wallet and then completed the purchase within the first 30 minutes of BULLISH's launch (October 2nd).

DeFi Hot Topics

1. A whale has made a floating profit of $19.51 million by short ETH and SOL on Hyperliquid.

According to Onchain Lens monitoring, a whale has made a floating profit of $19.51 million by short ETH and SOL on Hyperliquid. Its short ETH position is 1,204.67 ETH, worth $3.23 million, and its short SOL position is 462,374.2 ETH, worth $57.3 million.

2. RateX, the revenue-sharing protocol for Solana, completes a $7 million funding round.

According to Techinasia, RateX, a yield trading protocol on the Solana blockchain, has completed three funding rounds totaling $10.4 million over the past two years. The latest round raised $7 million from investors including Animoca Ventures, ECHO, GSR, Crypto.com Capital, Gate, Rzong Capital, BGX Capital, and Summer Capital. RateX operates a protocol that allows users to trade and manage yields on Solana through tokenized financial products. The company recently launched an upgraded version called Mooncake, which supports leveraged token trading without liquidation.

3. DWF Head: A new fund of $30 million to $75 million will be launched, focusing on DeFi/CeDeFi products.

Andrei Grachev, head of DWF Labs, posted on the X platform that DWF Labs will soon announce a new fund with a size between $30 million and $75 million, using only DWF Labs' cash and focusing on DeFi/CeDeFi products.

4. The US Solana spot ETF saw a total net inflow of $23.66 million in a single day.

According to SoSoValue data, the Solana spot ETF saw a total net inflow of $23.66 million. The SOL spot ETF with the largest single-day net inflow was the Bitwise SOL ETF (BSOL), with a net inflow of $20.12 million, bringing its historical total net inflow to $444 million. This was followed by the Fidelity SOL ETF (FSOL), with a single-day net inflow of $2.34 million, bringing its historical total net inflow to $9.84 million. As of press time, the Solana spot ETF had a total net asset value of $745 million, representing a net asset value ratio of 1%, and a historical cumulative net inflow of $500 million.

5. Irys announces token economics: 8% will be used for airdrops and future incentives.

On November 21st, Irys, a programmable data chain, announced the IRYS token economics. The IRYS token supply is 10 billion, with 20% in circulation. Of this, 30% will be allocated to the ecosystem, 9.9% to the foundation, 8% for airdrops and future incentives, 8% to liquidity and launch partners, 18.8% to the team and advisors, and 25.3% to investors. Tokens held by the team and investors will be locked for the first year. The official team will distribute 2% of the tokens as rewards to validators/miners annually, halving every four years. Furthermore, 50% of execution fees and 95% of regular storage fees will be burned.

Disclaimer: Jinse Finance, as a blockchain information platform, publishes articles for informational purposes only and should not be considered actual investment advice. Please establish sound investment principles and be sure to enhance your risk awareness.