XRP is trading near $1.90, down about 9% in the past 24 hours and extending its 30-day decline to about 19%. Some Dip signals have emerged, especially from short-term retail investors.

However, XRP price has not shown any signs of recovery. This article explains why the recovery has not happened.

Short-term Capital have emerged, but recovery is still lacking

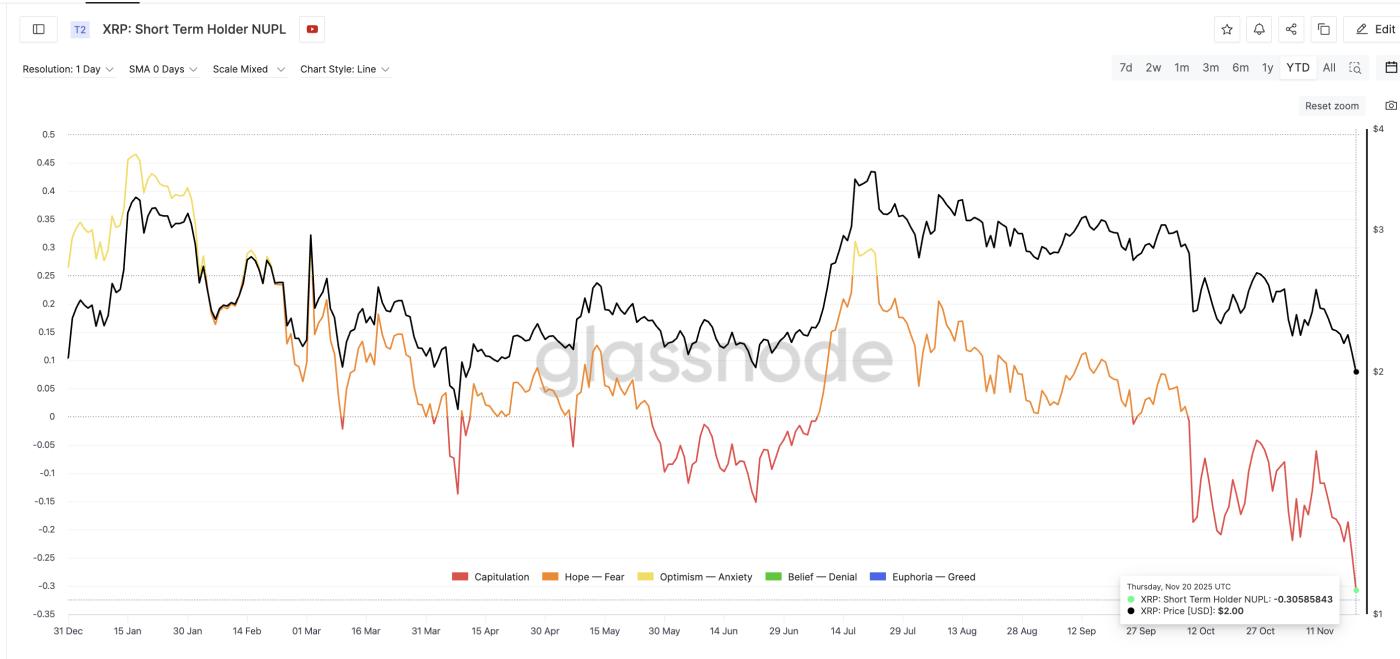

The retail investor NUPL index, which measures unrealized gains or losses, fell to -0.30, its lowest level this year. This level marks capitulation, a stage where most recent buyers take losses and are forced out or emotionally shaken.

Previous XRP local Dip signals like this have resulted in smooth bounces.

In April, NUPL dropped to –0.13 and XRP bounced back.

In June, NUPL dropped to –0.15 and XRP bounced back up again.

Important Dip Signal: Glassnode

Important Dip Signal: GlassnodeWant more details on Token like this? Subscribe to Editor Harsh Notariya's Daily Crypto Newsletter here .

This time, despite the deeper capitulation signal, XRP is still sliding. The missing factor comes from the spent Token data.

Spent coins show capitulation peak not yet fully in place

The age band of Token spent shows how much XRP Token from different age groups are being moved. When Token are spent more while the price is down, it shows real capitulation pressure. This metric not only includes short-term investors but can also show how long-term and mid-term investors are moving XRP .

A clear example occurred earlier this month.

From November 2 to November 5, the price fell from $2.54 to $2.15. During the same period, the number of Token spent increased from 20.32 million to 104.85 million. This is an increase of about 416%, marking a clear capitulation event. This ensured the formation of a local Dip on November 5.

XRP Token Still Moving During Bearish Times: Santiment

XRP Token Still Moving During Bearish Times: SantimentCurrent structure, Token is still moving while price adjusts, similar but much smaller.

From November 17 to now, the price of XRP has decreased from $2.27 to $1.96. Token spent increased from 45.87 million to 97.31 million, an increase of about 112%.

Since the 112% increase is much lower than the previous 416%, the capitulation phase may not be complete. If the number of Token spent continues to increase to early November levels, the XRP price may continue to decline before forming a final Dip .

This explains why the short-term capitulation indicator has not triggered a recovery. And why XRP price could fall further.

XRP Price Suggests Another Bearish Zone

XRP is currently near $1.95, a key support level. Losing this level would expose the next zone near $1.57, which could mark the final Dip for XRP if the capitulation continues. The price is currently below support, but a clear daily close below $1.95 is needed to confirm a breakout.

Another risk is forming on the chart. The 100-day exponential moving Medium (EMA) is moving closer to the 200-day Medium . If the 100 moves below the 200, traders will consider it a bearish cross. And that could be the catalyst for a larger short-term correction.

XRP Price Analysis : TradingView

XRP Price Analysis : TradingViewThe exponential moving Medium (EMA) gives more weight to recent prices, so it reacts more quickly than a simple Medium and helps confirm short-term pressure.

For XRP price to show strength soon, it must first reclaim $2.08, then $2.26. That would invalidate the short-term downtrend.