MicroStrategy CEO Michael Saylor has hit back at MSCI's assessment of the company's classification, arguing that his company is an incorporated business, not an investment fund.

The clarification comes amid a formal consultation on how digital asset managers (DATs) should be treated in leading equity indices, a decision that could have major consequences for MSTR.

Michael Saylor Speaks Out: “MicroStrategy Is Not a Fund or Trust” Amid MSCI Scrutiny

In a detailed post on X (Twitter), Saylor emphasized that MicroStrategy is not a fund, not a trust, and not a holding company.

“We are a $500 million publicly traded software company with a unique treasury strategy using Bitcoin as productive Capital ,” he explained .

This statement positions MicroStrategy as more than a Bitcoin holder , with Saylor noting that funds and trusts hold assets passively.

“The parent companies just hold the investments. We create, structure, issue and operate,” Saylor added, emphasizing the firm’s proactive Vai in digital finance.

This year, MicroStrategy completed five public offerings of digital credit securities: STRK, STRF, STRD, STRC, and STRE. The total notional value was over $7.7 billion.

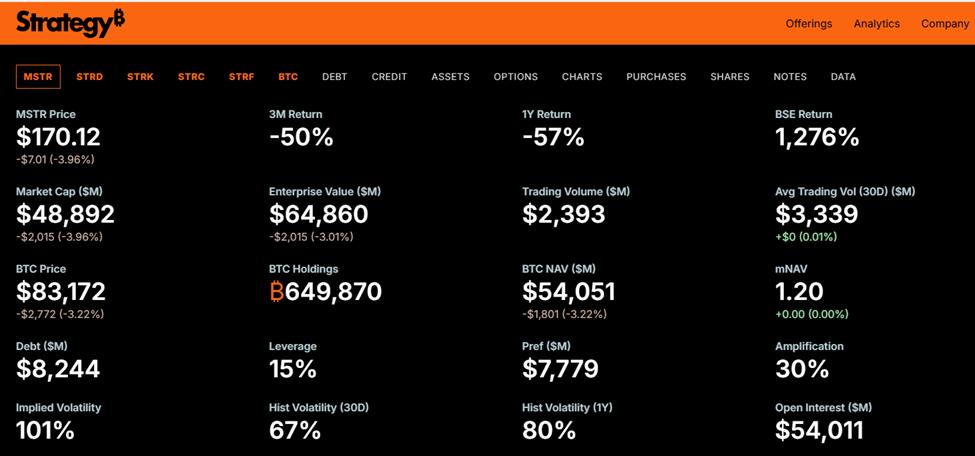

MicroStrategy's public offerings. Source: Strategy Website

MicroStrategy's public offerings. Source: Strategy WebsiteNotably, Stretch (STRC) is a Bitcoin-hedged treasury instrument that offers monthly variable USD yields to both institutional and retail investors.

Saylor describes MicroStrategy as a Bitcoin-backed structured finance company operating at the intersection of Capital markets and software innovation.

“No passive vehicle or parent company can do what we do,” he said, emphasizing that the index classification does not define the company.

Why MSCI's decision matters

MSCI's consultation could reclassify companies like MicroStrategy as investment funds, making them ineligible for inclusion in major indexes like MSCI USA and MSCI World.

The removal could trigger billions in passive cash outflows and increase volatility in $MSTR, which is already down about 70% from its All-Time-High.

These risks extend beyond MicroStrategy. Saylor’s argument challenges traditional financial (TradFi) standards , questioning whether Bitcoin-based companies can maintain access to passive Capital without being labeled as funds.

MicroStrategy holds 649,870 Bitcoins, at an Medium price of $74,430 per coin. The company has an enterprise value of $66 billion, and it has relied on Capital and structured debt issuances to fund its Bitcoin accumulation strategy.

MSCI's ruling, expected on January 15, 2026, could test the viability of such hybrid treasury models in public markets.