The investment expands Ondo Finance’s online Treasury reserves and comes amid a resurgence in crypto-backed lending across fintechs, lenders and exchanges.

Ondo Finance has purchased $25 million in YLDS, the yield-yielding stablecoin issued by Figure Technology Solutions, to diversify the assets backing its tokenized U.S. Treasury bond fund.

The company said on Monday that YLDS will be added to a reserve portfolio that already includes tokenized Treasury products from major asset managers, including funds issued by BlackRock, Fidelity, Franklin Templeton and WisdomTree.

Designed for institutional investors, the Ondo Short-Term US Government Bond Fund (OUSG) offers online exposure to Treasuries with 24/7 redemptions and an estimated annual return of 3.68%. As of this writing, this tokenized fund has a Total Value Locked of approximately $777 million.

Figure operates lending and Capital markets infrastructure on the Provenance blockchain and has facilitated over $19 billion in loans across home mortgages, mortgage products, and crypto-backed credit. The deal comes after Figure completed its IPO on Nasdaq earlier this year. According to defillama data, its stablecoin YLDS has a market Capital of around $100 million.

Ondo Finance is a US-based platform founded in 2021 that specializes in Tokenize traditional financial assets. In October, the company expanded its Tokenize asset portfolio to BNB Chain, adding more than 100 Tokenize Wall Street stocks and exchange-traded funds (ETFs) to the chain.

On Wednesday, the platform received regulatory approval from the Liechtenstein Financial Market Authority (FMA) to offer tokenized shares in Europe.

Figure's stock price rose nearly 4% in early trading Monday, according to Yahoo Finance data.

You may not know: BingX exchange is offering many incentives for new users when registering an account.

Cryptocurrency-backed lending is booming

Cryptocurrency-backed lending is growing in popularity globally and this trend is set to accelerate in 2025 as more lenders revive and expand crypto-collateralized lending products.

In July, Block Earner introduced Bitcoin-backed home loans in Australia, providing borrowers with cash worth up to half the value of a property, with the crypto collateral protected by Fireblocks.

On Tuesday, stablecoin issuer Tether announced an investment in Ledn, a platform that offers Bitcoin-backed consumer loans. In Q3, Ledn reported generating over $390 million in BTC backed loans.

Centralized exchanges are also expanding into this space and expanding their services beyond Bitcoin.

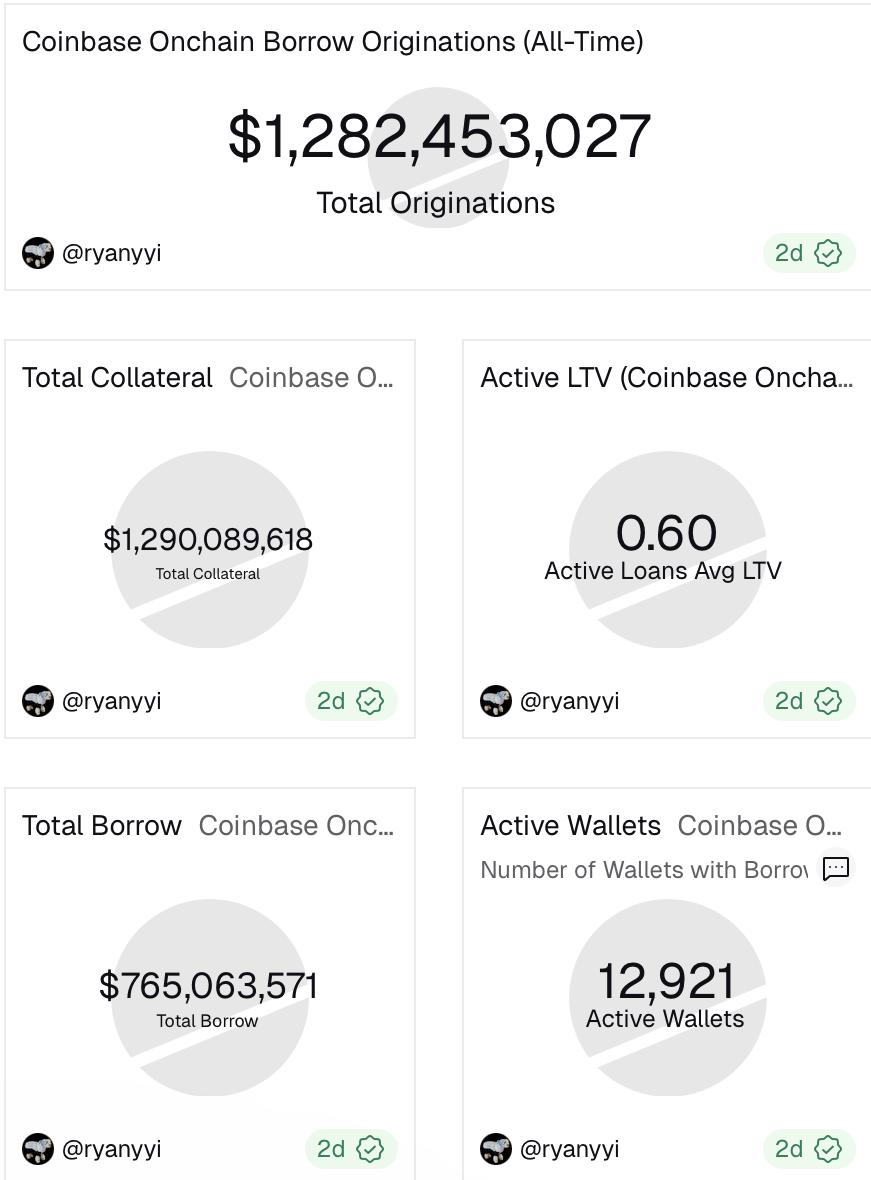

On Thursday, Coinbase rolled out Ether-backed loans to US customers, allowing users to borrow up to $1 million in USDC against their Ether holdings.

Coinbase's online lending marketplace has processed about $1.28 billion in loans since launching earlier this year, according to data from Dune.

Source: Cointelegraph