Bitcoin was never the future of currency. It was merely a battering ram in a regulatory war. Now, the war is nearing its end, and the capital that forged this ram is quietly leaving.

For 17 years, we've been convincing ourselves that "Magic Internet Money" is the ultimate form of finance. But it isn't. Bitcoin is a regulatory "battering ram," a single-purpose siege weapon built specifically to smash down a particular wall: the zero-tolerance policy of governments towards "digital bearer assets."

Now, this work is basically complete. Tokenized US stocks are already being issued; tokenized gold is not only legal but also growing; and the market capitalization of tokenized US dollars (stablecoins) has reached hundreds of billions of dollars.

In wartime, battering rams are priceless. But in peacetime, they become cumbersome and expensive antiques.

Today, financial rails are being upgraded and legitimized, the narrative of "Gold 2.0" is collapsing, and we are returning to what we really wanted in the 1990s: tokenized ownership of real assets .

I. Prehistory: E-GOLD (Electronic Gold)

To understand why Bitcoin is becoming obsolete, you must understand why it was created in the first place. It wasn't "immaculately conceived" (born out of thin air), but rather born from the shadow of countless attempts at digital currency being crushed in the same way.

E-gold launched in 1996. By the mid-2000s, it had approximately 5 million accounts and was handling billions of dollars. It proved something important: the world craved digital bearer assets backed by hard value.

Then, the state apparatus crushed it.

In December 2005, the FBI raided E-gold. In July 2008, its founder pleaded guilty. The message was clear: destroying a centralized digital gold currency is incredibly easy. Knock on a door, seize a server, prosecute someone, and it's all over.

Three months later, in October 2008, Satoshi Nakamoto published the Bitcoin white paper. He had spent several years pondering these issues. In his own writings, he stated that the fundamental flaw of traditional and early digital currencies lay in their excessive reliance on trust in central and commercial banks. Experiments like E-gold demonstrated just how easy it was to attack these points of trust.

Satoshi Nakamoto just witnessed a true innovation in cryptocurrency being "beheaded." If you want digital bearer assets to survive, you can't let them perish because "a door has been knocked on."

Bitcoin was specifically designed to remove the attack vectors that would kill E-gold. It wasn't built for efficiency; it was built for survival.

II. War: A Necessary Illusion

In the early days, getting someone to use Bitcoin was almost like magic. We'd tell people to download a wallet on their phones. When their first coin arrived, you could see the look of realization on their faces. They'd just opened a financial account and instantly received value, without permission, paperwork, or regulatory oversight.

This was a resounding slap in the face. The banking system suddenly seemed outdated and inadequate. You suddenly realized how much repression you had unknowingly endured.

At the Money 20/20 conference in Las Vegas, a speaker put up a QR code on the big screen and started a live Bitcoin lottery. Audience members sent Bitcoin, creating a prize pool in real time. A traditional finance (TradFi) guy sitting next to me leaned over and said the speaker had probably just broken fifteen laws. He might be right. But nobody cared. That's the point.

This isn't just finance; it's rebellion . An early pinned post on Bitcoin Reddit perfectly captured this sentiment: Buy Bitcoin because "it's a 'fuck you' to the scammers and robbers who profit from and suck the fruits of my labor."

This cold start mechanism is perfect. By fighting for your cause, posting, shill, debating, and recruiting new users, you directly increase the value of the coins in your own and your friends' wallets. Rebellion pays off.

Because the network cannot be shut down, it continues to grow after every crackdown and every negative news story. Over time, everyone begins to act as if the "magical internet currency" is the real destination, not just a stopgap measure (hack).

This illusion grew so strong that even the establishment joined the game. BlackRock filed for an ETF. The US president discussed making Bitcoin a reserve asset. Pension funds and universities bought exposure. Michael Saylor persuaded convertible bond buyers and shareholders to fund billions of dollars in corporate Bitcoin purchases. Mining scaled up until its electricity consumption rivaled that of a medium-sized country.

Ultimately, with over half of the campaign funds coming from the crypto space, calls to legalize these financial tracks were heard. The irony is simple: the government's crackdown on banks and payment processors helped create a three-trillion-dollar "battering ram," forcing them to surrender.

III. Rout: When Victory Kills the Deal

Track upgrade, monopoly broken

Bitcoin's advantage has never been merely its resistance to censorship; it's its monopolistic nature .

For years, if you wanted tokenized, anonymous value, Bitcoin was the only option. Accounts were shut down, and fintech companies feared regulators. If you wanted the benefits of instant, programmable money, you had to accept Bitcoin as a whole package.

So we accepted it. We love it and support it because we had no other choice.

That era is over.

Look at Tether, and you'll understand what happens when there's more than one available track. USDT initially ran on the Bitcoin track (Omni), then most of its circulation migrated to Ethereum because it was cheaper and easier to use. When Ethereum gas fees exploded, retail investors and emerging markets pushed issuance to Tron. Same dollars, same issuers, different pipelines.

Stablecoins are not loyal to any chain. They treat the blockchain as a disposable conduit . Assets and issuers are what matter; the track is merely a mixture of fee schedules, reliability, and connectivity with the rest of the system. In this sense, the "blockchain not Bitcoin" group has actually won.

Once you understand this, Bitcoin's position looks completely different. When there's only one working track, everything is forced to run on it, and you might confuse the value of the asset with the value of the pipeline. When there are many tracks, value flows to the cheapest, most connected places.

This is where we are now. Most of the world's population outside the US can now own tokenized debt to US stocks. Perpetual futures, once considered a killer app for cryptocurrencies, are being cloned into onshore markets by venues like CME. Banks are starting to support USDT deposits and withdrawals. Coinbase is evolving into a conglomerate of bank and brokerage accounts where you can send money, write checks, and buy stocks alongside your cryptocurrency. The network effects that once protected Bitcoin's monopoly are dissolving into general-purpose pipeline infrastructure.

Once the monopoly disappears, Bitcoin will no longer be the only way to profit. It will become a product that competes with regulated, high-quality products, which are closer to what people originally really wanted.

Technical Reality Test

During the war, we overlooked a simple fact: Bitcoin is a terrible payment system.

We're still transferring value by scanning QR codes and pasting long, meaningless strings of characters. There are no standardized usernames. Transferring value across layers and chains is like an obstacle course. Once you can't figure out which address belongs to which, your money is gone forever.

By 2017, the cost of sending Bitcoin had skyrocketed to nearly $100. Bitcoin cafes in Prague had to accept Litecoin to stay afloat. I once had dinner in Las Vegas and it took 30 minutes to pay with Bitcoin because people were clumsily operating their mobile wallets, and the transaction got stuck.

Even today, wallets frequently malfunction in basic ways. Balances don't show. Transactions hang. People send funds to the wrong addresses and let them vanish. In the early days, almost everyone who received a gift of coins lost them. I personally lost over a thousand bitcoins. This is the norm in the crypto world.

Pure on-chain finance is terrifying when used on a large scale. People click "sign" in their browsers but can't understand or comprehend the gibberish. Even complex organizations like Bybit could have billions of dollars stolen by hackers with no effective recourse.

We told ourselves these user experience (UX) issues were temporary growing pains. Ten years later, real UX improvement wasn't some elegant protocol, but centralized custodians . They gave people passwords, account recovery capabilities, and fiat currency deposit and withdrawal channels.

On a technical level, this is the ironic ending : Bitcoin has never learned how to work without reinventing the intermediaries it claims to replace.

This deal is no longer worth the risk.

Once the trajectory improves elsewhere, all that's left is "trading" (investment logic).

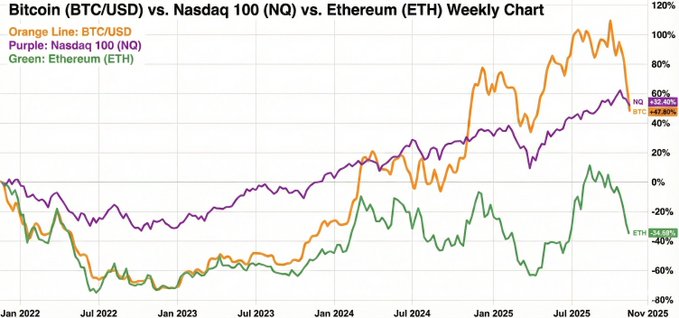

Look at the returns over this entire crypto cycle, exactly four years back. The Nasdaq outperformed Bitcoin. You took on life-or-death regulatory risks, endured brutal drawdowns, and tolerated constant hacks and exchange collapses, yet your returns lagged behind a typical tech index. The risk premium has vanished.

Ethereum is in an even worse situation. This part of the technology stack, which should be giving you the highest returns because of the risks you take, has become a direct tax on performance, while a boring exponential line is steadily rising.

Part of the reason is structural. There's a large group of original holders (OGs) whose entire net worth is in cryptocurrency. They're now older. They have families, real expenses, and normal risk-averse needs. They sell coins every month to fund a normal wealthy lifestyle. Among tens of thousands of holders, this represents billions of dollars in "lifestyle selling pressure" every month.

New inflows of funds are a different beast altogether. ETF buyers and wealth managers mostly allocate only 1% or 2% as a kind of "box checking." This money is sticky, but not aggressive. These modest allocations must contend with relentless OG sell-offs, exchange fees, miner issuances, fraudulent tokens, and hacks, all just to keep the price from falling.

The era of "earning huge Alpha by taking the bullet for regulators" is over.

The builders sensed the stagnation

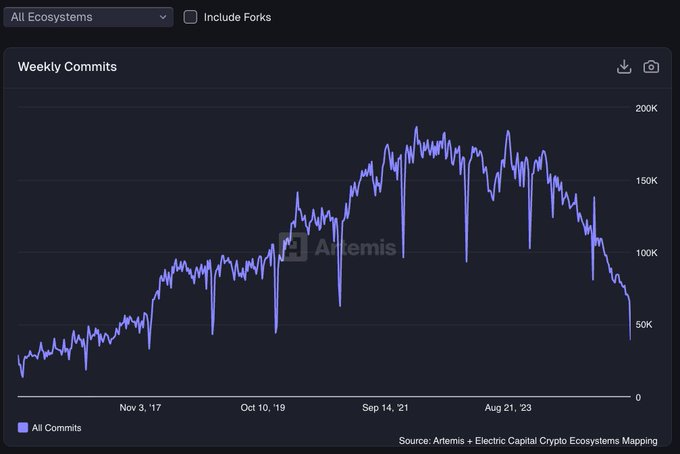

Builders aren't stupid. They can sense when technology will lose its edge. Developer activity has already plummeted to 2017 levels.

Meanwhile, the codebase has essentially stagnated. Changing a decentralized system is inherently difficult by design. Ambitious engineers who once saw cryptocurrency as the forefront have drifted off to robotics, space, artificial intelligence, and other fields where they can do things far more exciting than simply "moving numbers."

If the return on investment is poor, the user experience is even worse, and talent continues to leave, then the future path is not hard to see.

IV. Error correction mechanisms outperform pure decentralization.

The decentralized cult tells a simple story: code is law. Uncensorable currency. No one can stop transactions or reverse them.

Most people don't actually want that. They want working tracks, and they want someone to fix them if something goes wrong.

You can see this in how people treat Tether. When funds were stolen by North Korean hackers, Tether was willing to freeze those balances. When someone mistakenly sends a large amount of USDT to a contract or burn address, if it's still possible to sign from the original wallet, pass KYC, and pay the fees, Tether will blacklist the stuck tokens and remint them to the correct address. There will be paperwork and delays, but there is a process. There is a human layer that can acknowledge the mistake and fix it.

This is counterparty risk, but it's the kind of risk people take seriously. If you lose money due to a technical error or are hacked, at least you have a chance to recover. With on-chain Bitcoin, there's no such chance. If you paste the wrong address or sign an incorrect transaction, the loss is permanent. There are no appeals, no help desks, and no second chances.

Our entire legal system is built on counterintuitive principles. Courts have appeals. Judges can overturn judgments. Governors and presidents can grant pardons. Bankruptcy exists so that a wrong decision doesn't ruin a life forever. We like living in a world where obvious mistakes can be reversed. Nobody really wants a system where a bug like the Parity multisignature vulnerability can freeze $150 million in Polkadot's coffers, and everyone can only shrug and say "code is law."

We also trust issuers more than we did in the past. Back then, "regulation" meant early crypto businesses losing their bank accounts because banks feared regulators would revoke their licenses. Just recently, we witnessed an entire network of crypto-friendly banks being shut down in a single weekend. The state felt like the executioner, not the referee.

Today, the same regulator acts as a safety net. It mandates disclosures, confines issuers to audited structures, and provides politicians and courts with leverage to punish blatant theft. Cryptocurrency and political power are now intertwined enough that regulators cannot simply flatten the entire space; they must tame it. This makes coexisting with the risks of issuers and regulators feel far more sensible than living in a world where losing a seed phrase or encountering a malicious signature prompt could lead to utter ruin with no recourse.

Nobody really wants a completely unregulated financial system. A decade ago, a fragmented regulated system made the chaos of unregulated systems seem attractive by comparison. But as regulated tracks have modernized and become more functional, that trade-off has reversed. The preference is clear: people want strong tracks, but they also want a referee on the field.

V. From Magical Internet Currency to Tokenized Real Assets

Bitcoin has done its job. It was the battering ram that smashed down the wall that blocked E-gold and every similar attempt. It made it politically and socially impossible to forever ban tokenized assets.

But this victory created a paradox. When the system finally agreed to the upgrade, the high value of the battering ram collapsed.

Cryptocurrencies still have a place. But we no longer need a three-trillion-dollar rebel army. Hyperliquid, with its lean team of just 11 people, was able to prototype features and force regulators to respond. When something works in a sandbox, traditional finance (TradFi) will clone it with regulatory wrapping.

The primary trading logic is no longer about investing a large portion of your net worth in a "magical internet currency" for ten years and praying. That only makes sense when the track breaks down and the upside potential is clearly enormous. "Magic internet currency" has always been a strange compromise: a perfect track wrapped around assets that have nothing but a story. In later articles, we'll see what happens when the same track carries claims on things that are truly scarce in the real world.

Capital is already shifting. Even unofficial central banks for cryptocurrencies are moving on. Tether holds more gold on its balance sheet than Bitcoin. Tokenized gold and other real-world assets (RWAs) are growing rapidly.

The era of "magical internet currencies" is ending. The era of tokenized real assets is beginning. Now that the door is open, we can stop worshipping the battering ram and start focusing on the truly important assets and transactions on the other side.