MegaETH will refund all funds raised from the Pre-Deposit round after a series of technical errors led to a loss of control, forcing the project to halt the entire plan.

MegaETH Refunds All Pre-Deposits After Deployment Issue

MegaETH Refunds All Pre-Deposits After Deployment Issue

On the morning of November 28, the Layer 2 MegaETH project, one of the most anticipated names on Ethereum , announced that it would refund all funds raised from the Pre-Deposit Bridge after admitting that the implementation process was sloppy and did not meet the set technical goals.

We've decided to return all funds raised from the Pre-Deposit Bridge.

— MegaETH (@megaeth)November 27, 2025

Execution was sloppy and expectations weren't aligned with our goal of preloading collateral to guarantee 1:1 USDm conversion at mainnet.

How this decision impacts you:

What is Pre-Deposit Bridge?

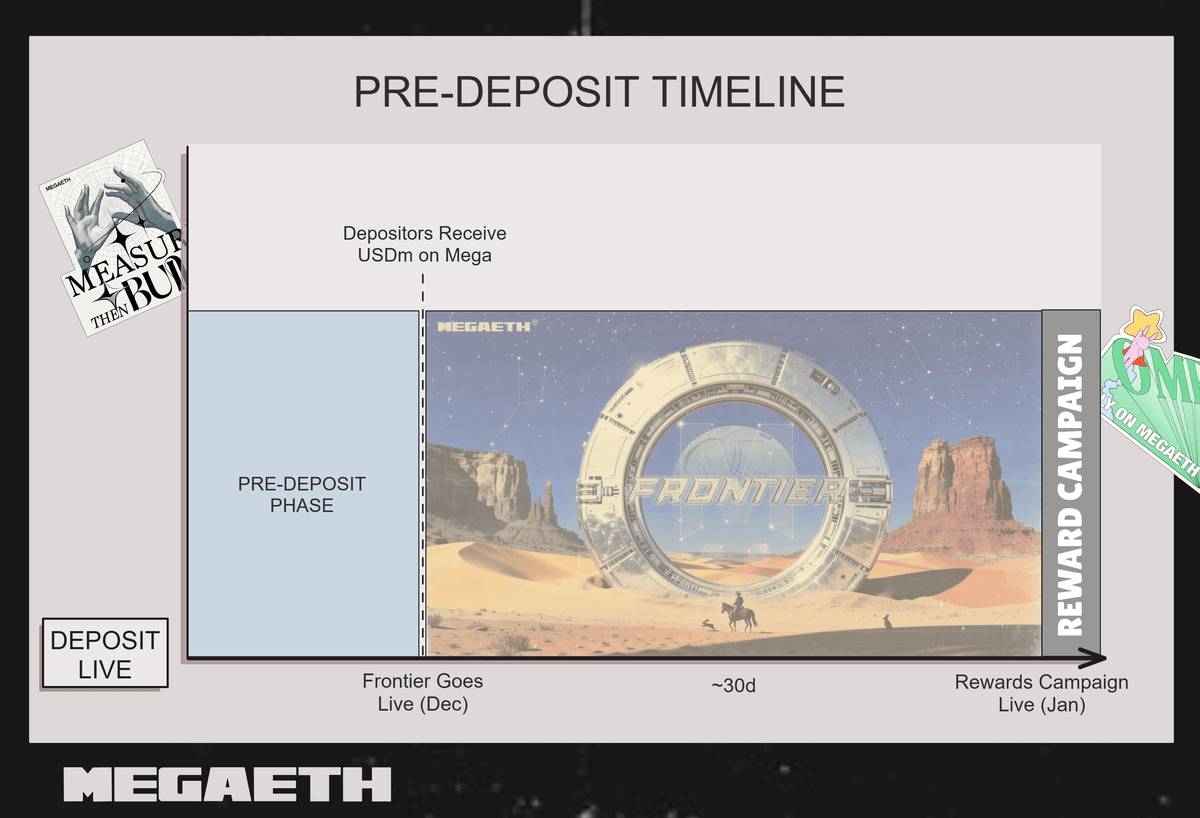

- Pre-Deposit Bridge is the Capital mobilization and liquidation preparation phase before mainnet that MegaETH deploys to ensure the USDm ecosystem operates stably from the first day of launch.

Pre-Deposit Bridge is Live

— MegaETH (@megaeth)November 25, 2025

It will remain open until either:

→ $250M cap is hit

→ Frontier launches pic.twitter.com/kl36O6Z026

- In this campaign, users will transfer USDC on Ethereum via Pre-Deposit Bridge and will receive USDm back in full when the Frontier mainnet officially launches in December.

- The event is scheduled for 9:00 PM on November 25 (Vietnam time) with a limit of 250 million USD, in which the website will open about an hour before for users to complete the KYC verification process through Sonar, the verification system operated by Echo.

Technical and operational issues during Pre-Deposit deployment

- According to a post titled "Pre-Deposit Bridge Retro" published by MegaETH, the entire incident in the recent Pre-Deposit Bridge was the result of a complex chain of technical and operational errors, stemming from incorrect parameter settings, KYC verification system issues, multisig configuration errors, and the decision to raise the mobilization limit too quickly.

— MegaETH (@megaeth)November 25, 2025

- First of all, MegaETH's Pre-Deposit mechanism is Chia into three main components: the Pre-Deposit website (operated by MegaETH), the Sonar API (powered by Echo) for KYC verification, and the Pre-Deposit smart contract operated by the Safe multisig 4/6 mechanism.

- The Pre-Deposit smart contract is responsible for storing parameters such as sale opening time, mobilization limit (cap) and identification code (SaleUUID). All deposit transactions must go through KYC verification API and are only valid with a signature from the official website to ensure fairness and prevent automatic bots from participating.

- However, as soon as the campaign started, all transactions were rejected. The reason was that the SaleUUID code in the contract and the data on Sonar did not match, causing all deposit orders to be blocked. The development team had to manually edit this information, prolonging the launch process by more than 30 minutes.

- Shortly after, another issue arose with the Sonar API being blocked due to a misconfigured rate-limit, causing the majority of KYC verification requests to be rejected. The system only allowed a small amount of access, preventing users from completing KYC.

- When everything was fixed, MegaETH decided to redeploy at a random place to avoid users watching the clock, but this created an opportunity for those who kept refreshing the website. They accidentally caught the moment the pre-deposit opened and successfully deposited, causing the entire $250 million limit to be filled in just a few minutes.

- Despite this, many other users have yet to pass KYC, leading to backlash in the community with accusations of unfairness.

Multisig issue and Transaction Triggers vulnerability

- To remedy the situation, MegaETH decided to raise the fundraising cap to $1 billion at the beginning of the next hour. However, a serious error in the multisig configuration caused things to spiral out of control.

- The ceiling-raising transaction was incorrectly set up with a 4-of-4 signature requirement instead of a 3-of-4 signature requirement, which created a dangerous consequence in the Safe multisig mechanism where once the transaction had gathered the required number of signatures, anyone on the network, even non-multisig members, could execute the transaction.

- Due to accidentally getting enough signatures from the team earlier than expected, an external user Transaction Triggers on behalf of the operating team , causing the new fundraising limit to unlock about 30 minutes earlier than the announced time.

- The early opening of the deposit bridge created a wave of users participating, causing the amount of Capital poured in to exceed the 400 million USD mark in a very short time, much higher than the limit that the team wanted to control.

- When the situation was discovered to be out of control, MegaETH raised the limit to 500 million USD to “lock the cap” at the level that the money flow had reached. This transaction was successfully executed and the new limit was applied but was also filled immediately when the money flow continued to pour in without control.

- In the context of the transaction speed being too fast, many users still encountering KYC errors and the verification process not being completely fixed, MegaETH determined that continuing to raise the cap to 1 billion USD would only make the situation worse. Finally, the project decided to completely cancel the plan to raise the cap, and at the same time, temporarily suspend the entire pre-deposit campaign.

100% refund to users

- According to the latest announcement, MegaETH confirmed that all the amount users deposited in the Pre-Deposit Bridge will be refunded 100%, without holding any amount. To do this transparently and securely, the project had to deploy a completely new refund smart contract, separate from the original pre-deposit contract.

- This contract is currently being audited by a third party, to ensure that the refund process is risk-free, unhackable, and that all refunds are made to the correct amount and address.

- MegaETH said that refunds will begin immediately after the audit is completed, which is expected to take place in the near future. To help users track and withdraw Capital easily, the project will announce its own website in the next few days. Here, users can check their balances, confirm their refund wallet address, and track transaction status.

- MegaETH also reaffirms that:

“No user assets are at risk. All deposits are absolutely safe and will be fully refunded.”

- In an official apology, MegaETH acknowledged that seemingly small technical errors added up to create a less than satisfactory experience, and thanked the community for their patience and support during the project's downtime.

- In addition, MegaETH also emphasized that USDm, the ecosystem's native stablecoin, still plays a fundamental Vai , the backbone for trading, payment and DeFi applications on Frontier mainnet.

- To ensure USDm maintains liquidation and increases reliability before Frontier goes live, the project said it will reopen the USDC-USDm conversion bridge before the official launch.

USDm is integral to the MegaETH economy and will be supported by many Frontier applications.

— MegaETH (@megaeth)November 27, 2025

For this reason, we will re-open the $ USDC <> $USDM conversion bridge ahead of Frontier mainnet to deepen renewal, easing user onboarding prior to launch.

Coin68 synthesis