This article is machine translated

Show original

🤔 Tom Lee: “ETH is too cheap compared to BTC"🔥

Tom Lee argues that Ethereum is significantly undervalued compared to Bitcoin, and the most accurate way to look at it is not by looking at the USD price, but by looking at the ETH/ BTC ratio.

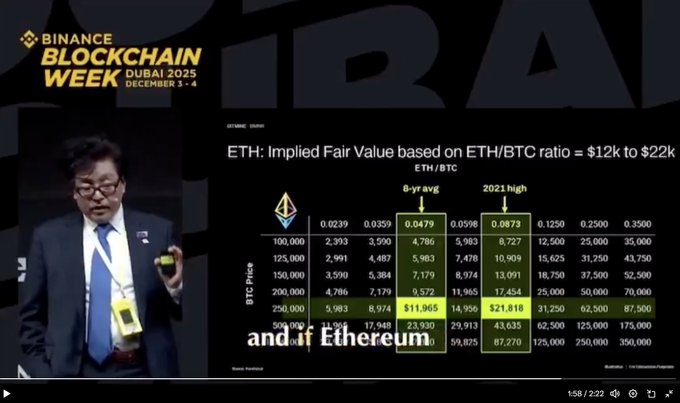

Over the past 8 years, the Medium ETH/ BTC ratio has been around 0.0479, and the 2021 peak was 0.0873.

Currently, the ratio is just ~0.033, lower than both the Medium and the historical high, meaning ETH is trading at a huge discount to BTC.

When he combines these ratios with the assumption that BTC is priced in the $100,000 to $250,000 range, ETH ’s “fair” price range falls between $12,000 and $22,000.

👇👇👇

Upside GM

@gm_upside

12-04

💸 $ETH của bạn "đi về đâu" sau khi bạn bấm nút GỬI?

Theo chia sẻ từ Dhaiwat @dhaiwat10- Ethereum Developer

Khi bạn gửi tiền trong thế giới bình thường, có một công ty như Stripe đứng giữa và lo hết.

Trên Ethereum thì không có ai đứng giữa - mỗi giao x.com/gm_upside/stat…

Tom Lee believes that 2025 has many tailwinds for ETH/ BTC to bounce: clearer policies, stronger institutional participation, and Ethereum's infrastructure factors continue to strengthen long-term confidence.

According to him, ETH/ BTC has the potential to return to the 8-year Medium or even move higher than the 2021 peak and as this ratio increases, ETH will increase faster than BTC.

The key point in Tom Lee's argument is: BTC goes up, ETH goes up too, but ETH has a stronger bounce because it is relatively undervalued.

He believes that if the market accepts historical valuations again, ETH will have room for outstanding growth in this cycle, and ETH rise to the double-digit price range is not based on a "narrative" but on its own historical data.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content