Authors: Spencer Applebaum & Eli Qian, Multicoin Capital; Translated by: Jinse Finance

Over the past two decades, fintech has transformed how people access financial products, but it hasn't fundamentally altered how money actually flows. Innovation has primarily focused on simpler interfaces, smoother registration processes, and more efficient distribution channels, while the core financial infrastructure has remained largely unchanged. For most of this period, this technology stack has simply been resold, not rebuilt.

In general, the development of fintech can be divided into four stages:

Fintech 1.0: Digital Distribution (2000-2010)

The earliest waves of fintech made financial services more accessible, but not significantly more efficient. Companies like PayPal, E*TRADE, and Mint digitized existing products by combining legacy systems built decades ago (such as ACH, SWIFT, and card networks) with internet interfaces.

Settlement was slow, compliance processes relied on manual processes, and payments were strictly made according to a set schedule. While the financial industry achieved online transformation during this period, the fundamental way funds flowed remained unchanged. What changed was who could use financial products, not how those products themselves operated.

Fintech 2.0: The New Era of Banking (2010-2020)

The next breakthrough comes from smartphones and social media. Chime targets hourly workers who can access their wages early. SoFi focuses on providing student loan refinancing services for aspiring graduates. Revolut and Nubank, on the other hand, reach under-banked consumers globally with their user-friendly experiences.

Each company tells a more compelling story to a specific audience, but they are all essentially selling the same products: checking accounts and debit cards operating on the same traditional systems. Like their predecessors, they rely on partner banks, card organizations, and the ACH system.

These companies succeeded not because they built new channels, but because they reached customers better. Their strengths lay in branding, user onboarding, and customer acquisition. Fintech companies of this era have become technologically sophisticated distribution enterprises attached to banks.

Fintech 3.0: Embedded Finance (2020-2024)

Around 2020, embedded finance began to flourish. APIs enabled virtually any software company to offer financial products. Marqeta allowed companies to issue bank cards via API. Synapse, Unit, and Treasury Prime offered banking as a service. Soon, almost any application could offer payment, bank card, or loan services.

But beneath the abstraction layer, the essence remains unchanged. Bank-as-a-Service (BaaS) providers still rely on the same banks, compliance frameworks, and payment channels. The abstraction layer has been raised from banks to APIs, but the economic benefits and control still flow to the existing systems.

The commodification of financial technology

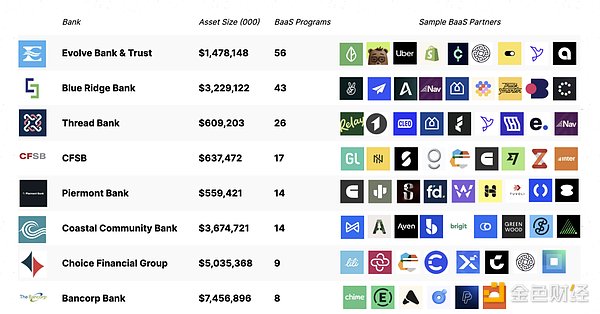

By the early 2020s, the drawbacks of this model were becoming increasingly apparent. Almost all large new banks relied on a handful of sponsoring banks and Bank-as-a-Service (BaaS) providers.

Source: Embedded

Source: Embedded

As companies fiercely compete through performance marketing, customer acquisition costs have skyrocketed. Profit margins have been squeezed, fraud and compliance costs have surged, and infrastructure has become virtually identical. The competition has devolved into a marketing arms race. Many fintech companies are trying to differentiate themselves with gimmicks like card colors, sign-up rewards, and cashback offers.

Meanwhile, risk and value capture are concentrated at the banking level. Large financial institutions regulated by the Office of the Comptroller of the Currency (OCC), such as JPMorgan Chase and Bank of America, retain core privileges: accepting deposits, issuing loans, and accessing federal payment systems such as ACH and FedWire. Fintech companies like Chime, Revolut, and Affirm lack these privileges and must rely on licensed banks to provide these services. Banks earn interest and platform fees; fintech companies earn transaction fees.

As fintech projects proliferate, regulators are increasingly scrutinizing the banks that back these projects. Regulatory orders and stricter requirements are forcing banks to invest heavily in compliance, risk management, and third-party project oversight. For example, Cross River Bank entered into a regulatory order with the Federal Deposit Insurance Corporation (FDIC), Green Dot Bank faced enforcement action from the Federal Reserve, and the Fed issued a cease and desist order against Evolve.

Banks' responses include tightening customer onboarding processes, limiting the number of projects supported, and slowing product iteration. Models that were once allowed for experimental trials now increasingly require economies of scale to offset compliance burdens. Fintech development is slowing, costs are rising, and there is a greater tendency to develop general-purpose products rather than specialized ones.

We believe there are three main reasons why innovation has remained at the forefront over the past 20 years.

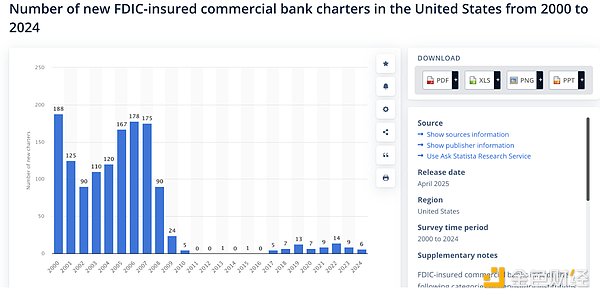

01 The infrastructure for fund flows is monopolized and closed. Visa, Mastercard, and the Federal Reserve's ACH network leave no room for competition.

02 Startups need significant funding to develop financial-centric products. Launching a regulated banking app requires millions of dollars for compliance, fraud prevention, treasury operations, and more.

03. Regulation restricts direct participation. Only licensed institutions can hold funds in custody or transfer funds through core channels.

Data source: Statista

Given these limitations, it clearly makes more sense to develop products rather than fight the established rules. As a result, most fintech companies are simply tweaking existing banking APIs. Despite two decades of innovation, the industry has seen very few truly new financial technologies emerge. And for a long time, there have indeed been no viable alternatives.

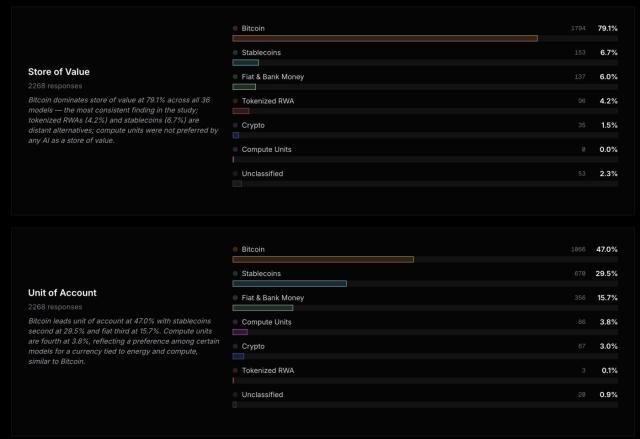

The development trajectory of cryptocurrencies has taken a completely different turn. Developers initially focused on fundamental functionalities. Features such as automated market makers, bond curves, perpetual contracts, liquidity vaults, and on-chain lending were all developed from the ground up. The financial logic itself was also programmable for the first time.

Fintech 4.0: Stablecoins and Permissionless Finance

Despite the numerous innovations that emerged in the first three fintech eras, the underlying mechanisms have remained largely unchanged. Whether products are delivered through banks, new types of banks, or embedded APIs, the flow of funds still follows a closed, permissioned path controlled by intermediaries.

Stablecoins disrupt this model. Instead of simply adding software on top of the banking system, stablecoins directly replace key banking functions. Developers interact with open, programmable networks. Payments are settled on-chain. Functions such as custody, lending, and compliance have also moved from contractual relationships to the software layer.

Banking as a Service (BaaS) has reduced friction, but it hasn't changed the economic model. Fintech companies still need to pay compliance fees to sponsoring banks, settlement fees to card organizations, and access fees to intermediaries. The infrastructure remains expensive and requires licensing.

Stablecoins completely eliminate the need for rented access. Developers don't need to call bank APIs; instead, they write code directly to the open network. Settlements occur directly on-chain. Fees belong to the protocol, not an intermediary. We believe that build costs will be drastically reduced: from millions of dollars to build through a bank, or hundreds of thousands of dollars through Blockchain-as-a-Service (BaaS), to just a few thousand dollars to build on-chain using permissionless smart contracts.

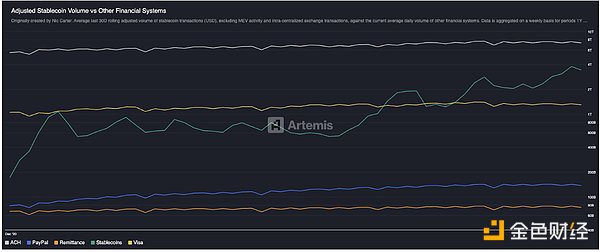

This transformation is already evident in scale. The market capitalization of stablecoins has grown from almost zero to approximately $300 billion in less than a decade, and their actual economic transaction volume now even surpasses that of traditional payment networks such as PayPal and Visa, even excluding intra-exchange transfers and MEV transactions. For the first time, non-bank, non-bank card payment channels have achieved truly global-scale operation.

Source: Artemis

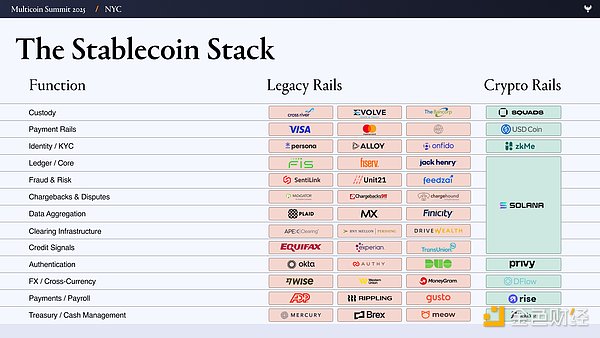

To understand why this shift is so important in practice, we need to understand how fintech companies are structured today. A typical fintech company relies on a large number of vendors:

User Interface/User Experience

Bank/Custody Tiers - Evolve, Cross River, Synapse, Treasury Prime

Payment channels: ACH, Wire, SWIFT, Visa, Mastercard

Identity and Compliance – Ally, Persona, Sardine

Fraud Prevention - SentiLink, Socule, Feedzai

Underwriting/Credit Infrastructure - Plaid, Argyle, Pinwheel

Risk and Financial Infrastructure - Alloy, Unit 21

Capital Markets - Prime Trust, DriveWealth

Data aggregation - Plaid, MX

Compliance/Reporting - Financial Crimes Enforcement Network (FinCEN), Office of Foreign Assets Control (OFAC) Inspections

Launching fintech products under this architecture means managing contracts, audits, incentive mechanisms, and failure modes for dozens of counterparties. Each layer adds to costs and delays, with many teams spending as much time coordinating infrastructure as they do on product development.

Stablecoin native systems simplify this complexity. Functionality that previously required six vendors is now consolidated into a single set of on-chain primitives.

In the world of stablecoins and permissionless finance, banks and custody services will be replaced by Altitude. Payment channels will be replaced by stablecoins. While authentication and compliance are important, we believe they can exist on-chain and maintain confidentiality and security through technologies like zkMe. Underwriting and credit infrastructure will be completely overhauled and moved on-chain. Capital markets firms will become irrelevant once all assets are tokenized. Data aggregation will be replaced by on-chain data and selective transparency, such as using fully homomorphic encryption (FHE). Compliance and OFAC compliance will be handled at the wallet level (e.g., if Alice's wallet is on a sanctions list, she will not be able to interact with the protocol).

This is the real difference in Fintech 4.0: the underlying architecture of finance has finally changed. Instead of developing separate applications that secretly request authorization from banks in the background, people can directly replace most of the banking business with stablecoins and open payment channels. Developers are no longer tenants; they own the land.

Opportunities for Professional Stablecoin Fintech Companies

The most direct impact of this shift is obvious: the number of fintech companies will increase dramatically. When custody, lending, and fund transfers are virtually free and instantaneous, starting a fintech company is akin to launching a SaaS product. In the native stablecoin environment, there's no need to interface with card issuers, no waiting for days of clearing windows, and no cumbersome KYC verification—none of these will become obstacles to your growth.

We believe that the fixed costs of launching financial-centric fintech products will also plummet from millions of dollars to thousands of dollars. Once infrastructure, customer acquisition costs (CAC), and compliance hurdles disappear, startups will be able to begin providing profitable services to smaller, more specific social groups through what we call specialized stablecoin fintech.

There's a striking historical parallel here. The previous generation of fintech companies initially served specific customer groups: SoFi offered student loan refinancing, Chime offered early payroll access, Greenlight provided debit cards for teenagers, and Brex catered to entrepreneurs unable to access traditional commercial credit. However, this specialization ultimately failed to become a sustainable business model. Transaction fees limited revenue, and compliance costs soared. Reliance on originating banks forced companies to expand beyond their initial market segments. To survive, teams were forced to scale horizontally, ultimately launching products not based on user needs, but rather because the infrastructure needed to be scaled to sustain operations.

A new generation of stablecoin banks will emerge, driven by significantly reduced startup costs due to cryptocurrency infrastructure and permissionless financial APIs. Like early fintech innovators, these banks will target specific user groups. With substantially lower operating costs, they can focus on more niche, specialized markets and maintain their specialization: for example, Sharia-compliant financial services, the lifestyle of cryptocurrency enthusiasts, or groups of athletes with unique income and spending patterns.

The second-order effect is even more pronounced: specialization improves unit economics. Customer acquisition costs (CAC) decrease, cross-selling becomes easier, and customer lifetime value (LTV) increases. Specialized fintech companies can accurately match products and marketing with high-conversion target groups and gain more word-of-mouth by serving specific demographics. Compared to previous-generation fintech companies, these businesses have lower operating costs but clearer profitability per customer.

When anyone can launch a fintech company in a few weeks, the question shifts from "Who can reach the customers?" to "Who truly understands them?"

Exploring the design space of professional financial technology

The most attractive opportunities often emerge where traditional tracks cannot function properly.

Take adult content creators and performers as an example. They generate billions of dollars in revenue annually, but are frequently delisted by banks and credit card processors due to reputational and chargeback risks. Payments are often delayed by several days, withheld under the guise of "compliance review," and typically incur 10% to 20% fees through high-risk payment gateways like Epoch and CCBill. We believe that stablecoin-based payment methods can provide instant, irreversible settlement with programmable compliance, enabling performers to independently manage their income, automatically transfer earnings to tax or savings wallets, and receive payments globally without relying on high-risk intermediaries.

Now consider professional athletes, especially in individual sports like golf and tennis, who face unique cash flow and risk dynamics. Their income is concentrated in a short career and typically needs to be allocated to agents, coaches, and staff. They are required to pay taxes in multiple states and countries, and injuries can completely interrupt their income. A stablecoin-based fintech product could help them tokenize future income, pay employee salaries using a multi-signature wallet, and automatically withhold taxes according to jurisdiction.

Luxury goods and watch dealerships represent another market where traditional financial infrastructure is underserved. These businesses frequently transport high-value inventory across borders, often in six-figure transactions, typically via wire transfers or high-risk payment processors, with settlements taking days. Working capital is often tied up in inventory stored in vaults or display cases rather than in bank accounts, making short-term financing both expensive and difficult to obtain. We believe that stablecoin-based fintech can directly address these challenges: enabling instant settlement of large transactions, lines of credit secured by tokenized inventory, and programmable custody functionality built into smart contracts.

After studying enough cases, you'll find the same limitations recurring: the traditional banking model isn't well-suited for serving users with global, uneven, or unconventional cash flows. However, these groups can leverage stablecoin platforms to develop into a profitable market. We believe some companies that theoretically specialize in stablecoin fintech are particularly attractive examples, such as:

Professional athletes: income is concentrated in a short period of time; they travel and relocate frequently; they may need to file taxes in multiple jurisdictions; their pay stubs include coaches, agents, trainers, etc.; they may want to hedge against injury risks.

Adult performers and creators: shut out by banks and credit card processing institutions; audiences are located all over the world.

Employees of unicorn companies face cash shortages and their net assets are concentrated in illiquid stocks; exercising stock options may result in high taxes.

On-chain developers: Net assets are concentrated in highly volatile tokens; they face challenges related to exit and taxation.

Digital nomads: Automatic foreign exchange transactions via banks without a passport; automatic tax management based on location; frequent travel/relocation.

For prisoners: family/friends find it difficult to get the help they need within the prison system, and it is expensive; funds are often not available through traditional channels.

In accordance with Islamic law: Avoid interest.

Generation Z: Light credit banking services; gamified investment; social features.

Cross-border SMEs: High foreign exchange costs; slow settlement; frozen working capital.

Gambler: Using credit cards to pay for gambling by spinning the roulette wheel.

Foreign aid: Aid funds flow slowly, require intermediate links, and are not transparent; a large amount of funds are lost due to fees, corruption, and misallocation.

Tandas/Rotating Savings Club: Cross-border by default, suitable for families worldwide; pooled savings can earn returns; it is possible to build an income record on the credit chain to obtain credit.

Luxury goods dealers (such as watch dealers): have working capital tied up in inventory; require short-term loans; conduct many high-value cross-border transactions; and frequently conduct transactions through chat applications such as WhatsApp and Telegram.

Summarize

For much of the past two decades, fintech innovation has focused primarily on distribution channels rather than infrastructure development. Companies have competed on brand building, user registration, and paid customer acquisition, but the flow of funds itself has remained within closed channels. This has expanded the reach of financial services, but has also led to intractable problems such as commoditization, rising costs, and thin profit margins.

Stablecoins have the potential to revolutionize the economics of financial product development. By transforming functions such as custody, settlement, lending, and compliance into open, programmable software, they significantly reduce the fixed costs of starting and operating fintech companies. Functions that previously required sponsoring banks, card organizations, and massive supplier systems can now be built directly on-chain, greatly reducing overhead.

Specialization becomes possible as infrastructure costs decrease. Fintech companies no longer need millions of users to be profitable. Instead, they can focus on niche, well-defined communities whose needs are difficult to meet with a one-size-fits-all product. Groups like athletes, adult content creators, K-pop fans, or luxury watch dealers share common backgrounds, trust, and behavioral patterns, making it easier for products to spread organically rather than relying on paid marketing.

Equally important, these communities tend to share similar cash flow situations, risk tolerance, and financial decision-making patterns. This consistency allows product design to revolve around people's actual income, consumption, and financial management habits, rather than abstract demographic categories. Word-of-mouth marketing is effective not only because users know each other, but also because the product truly aligns with the community's operating methods.

If our vision becomes a reality, the economic transformation will be significant. As distribution channels become integrated into communities, customer acquisition costs (CAC) will decrease; as intermediaries are reduced, profit margins will expand. Markets that were once too small or unprofitable will transform into sustainable, profitable businesses.

In this world, the advantage of fintech lies no longer in brute-force expansion and massive marketing investments, but in a deep understanding of real-world scenarios. The next generation of fintech companies will not win by serving everyone, but by providing exceptional services to specific groups through infrastructure built on the actual flow of funds, thereby gaining market share.