Let's first roughly summarize Banmu Xia's pattern from 10,000 to 50 million to sort out his trading method .

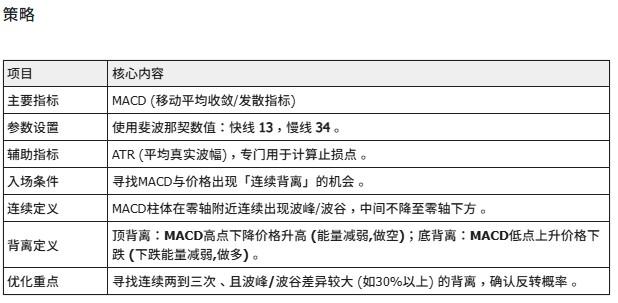

Many of his followers know that most of his indicators are very basic: MACD, RSI, and Fibonacci , which he then uses in conjunction with position management for low-leverage trading .

Let's first talk about his main trading focus .

- Low leverage to preserve capital: Always refuse to go all in, use only 2 to 3 times leverage, or even 1 times , and regard " survival is the key to recovery " as the primary principle.

- Be patient and wait for the right opportunity: Do not chase high prices , and wait patiently for the market to give a clear bottom signal (such as support from K-line moving averages and shrinking trading volume).

- Introduction to Technical Analysis: Use simple and easy-to-understand technical analysis tools, such as candlestick charts, moving averages, MACD, and RSI , to determine trends and buy/sell points.

- Split account operation: Use funds to build positions in batches and take profits in batches to diversify risk.

- Contentment brings happiness: Once you've earned your target (e.g., 20%~30% ), exit the market and don't be greedy .

Okay, we often hear the saying, " Don't look at what a person says, look at what a person does ." So this is the path we can trace back to where Hanuka came from . Let's see what he did.

Let's look at the temporal and spatial context , and then see if his strategy can be replicated .

His trading began in 2019 when BTC was $3,000 , and later rose to $8,000 and even $60,000 .

Therefore, proportionally speaking, the overall increase at that time was 20 times .

Given that BTC is currently around 100,000 , we would need it to rise to 2 million to achieve the same increase.

The question we should be considering is: do we have a chance?

Then, instead of investing solely in BTC, he diversified his investments in mainstream cryptocurrencies such as ETH/BNB during that era of widespread coin price increases , and capitalized on trending cryptocurrencies like DOGE .

In conclusion, the historical context , opportunities , and current circumstances are fundamentally incompatible with his work. Therefore, attempting to replicate his work would be far less effective .

I recently read an article, which prompted me to share my thoughts.

It's hilarious, like a word chain game! Hahaha!

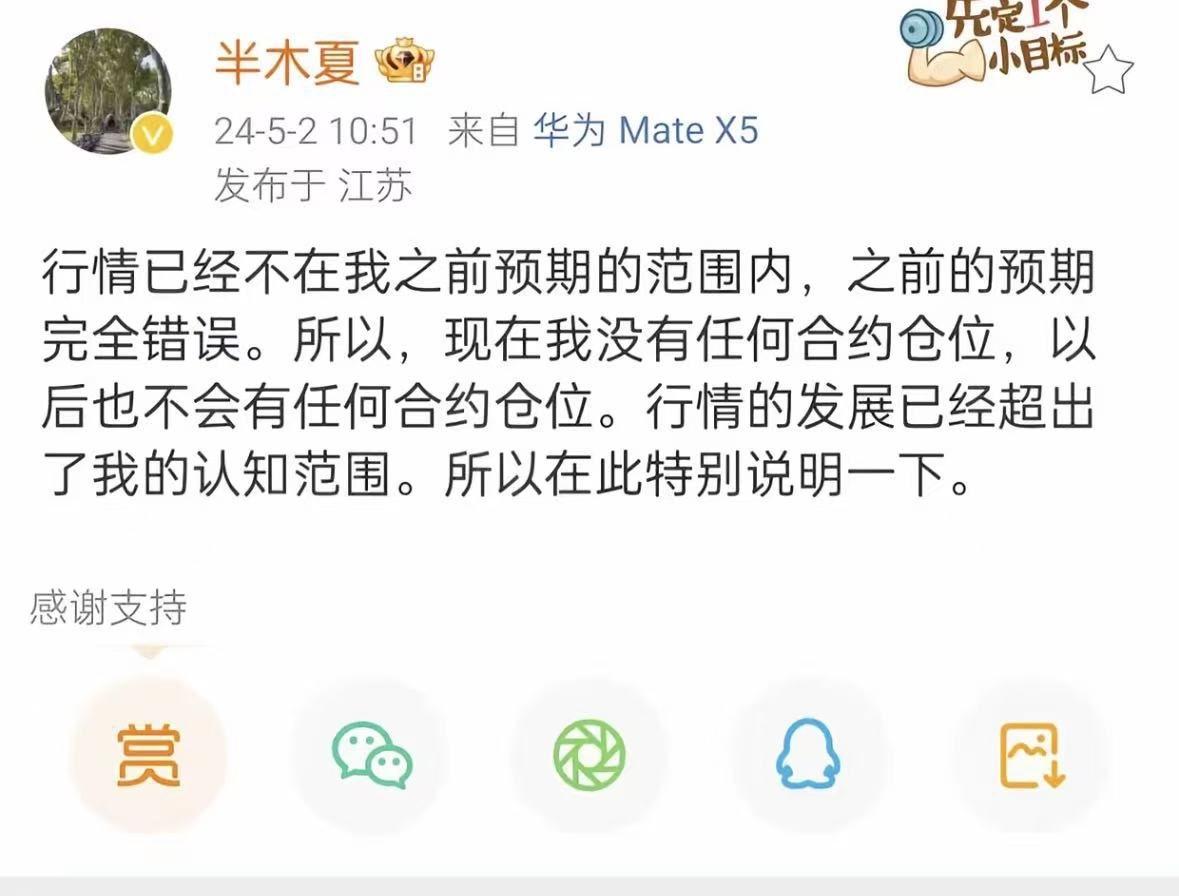

It's hilarious, like a word chain game! Hahaha! The chart above shows that the market performance "exceeded his expectations."

This is essentially a responsible approach , because not every market movement can be explained. Many periods of downtime are best left unexplained; in fact, it's the right thing to do.

Trading is about trading " positions you understand," not about hitting the ball whenever it comes your way.

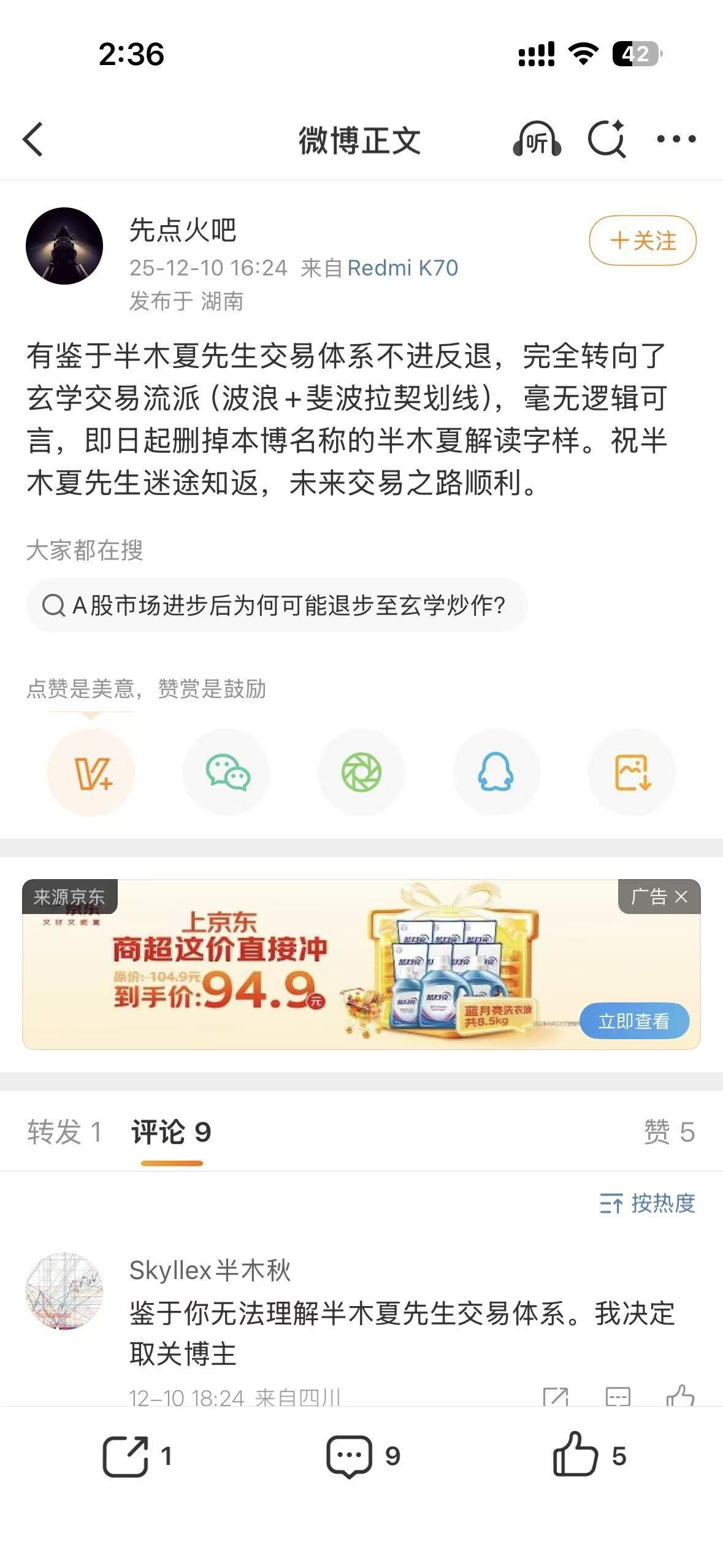

I don't think what " Ignition Guy" said is quite correct , because his strategy hasn't changed, has it ? Even if there's no progress, there's actually no regression either.

His background back then was quite impressive , but it might not be applicable given the complexity of the cryptocurrency world today.

If you want a refund, then fine. The demigod brother made money , and he honestly admitted he couldn't predict anymore . If you don't like watching, then don't watch !

My Reflections: Banmu Xia's Trading and Replicability

1. Regarding whether Hanuka Natsumi will be traded.

First, let's look at the definition. If we're judging today by whether or not money has been made , then Mr. Demigod would definitely be trading.

But if you were to give him another $10,000 now and ask him to earn $50 million again, I personally think it would be very difficult given his trading style at the time.

His method involves waiting for divergences and extreme opportunities , then using Fibonacci retracements (FIB) to pinpoint profit-taking or pullback levels. Based on my understanding of technical analysis, is this profitable?

The answer is yes, it's possible . But can you consistently make money and maintain a steadily increasing win rate ? That's probably very difficult .

Because technical analysis only accounts for 10% , position management accounts for 70% , and patience accounts for 20% .

Therefore, I have come to the following conclusion:

- Will he make a trade? It doesn't matter.

- Did he make money? Yes.

- Can his path be replicated to make one as wealthy as him? No.

- Will his strategy help me gradually make money? The key is whether you can manage risk .

2. A deeper level of thinking: The impact of asset size

This requires a deeper level of consideration:

Advantages of high asset size

- Once a person's assets expand , they have many options for financial operations : lending, hedging, pledging , and generating stable returns —all of which allow them to maintain a 20% net profit annually with relatively low risk. They also no longer need to rely on contracts as they did before.

Percentage Trap

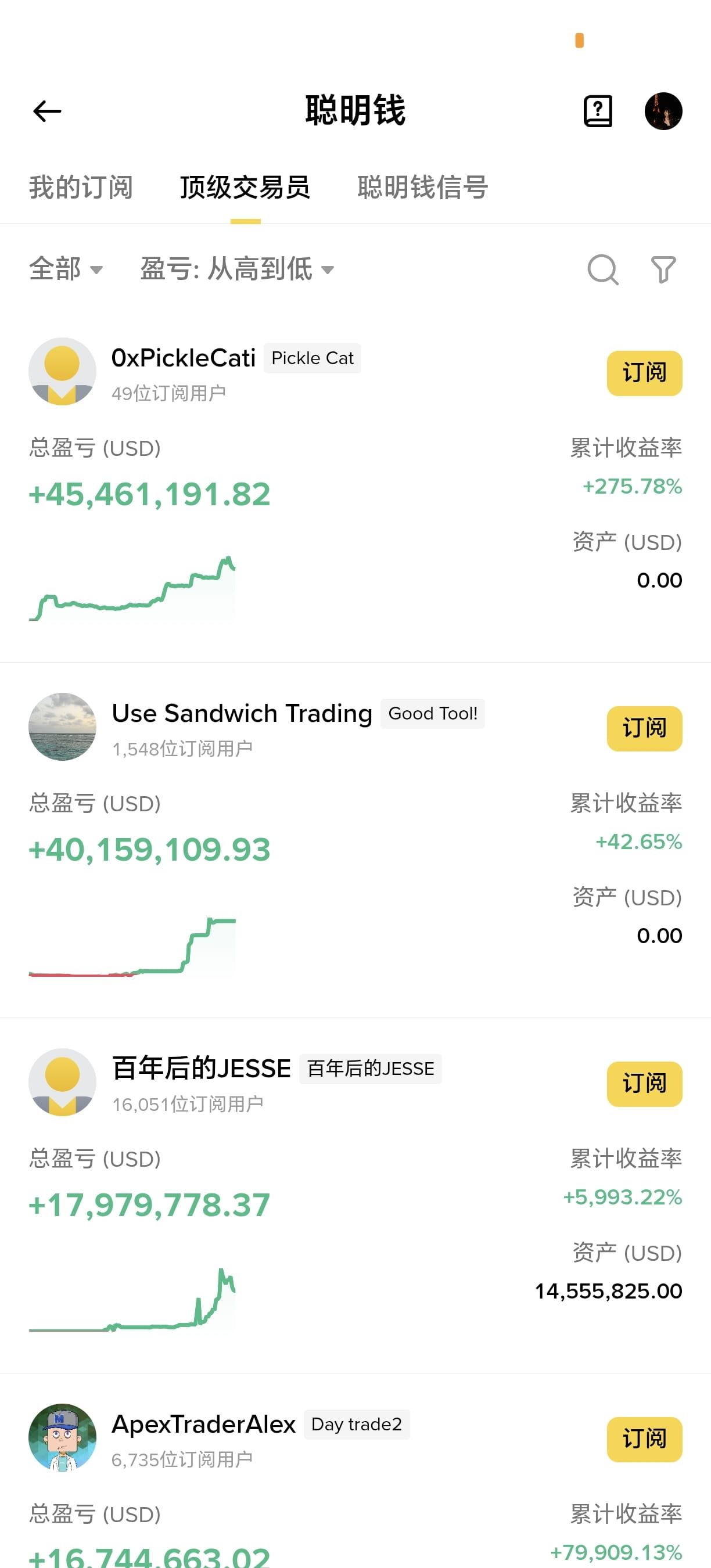

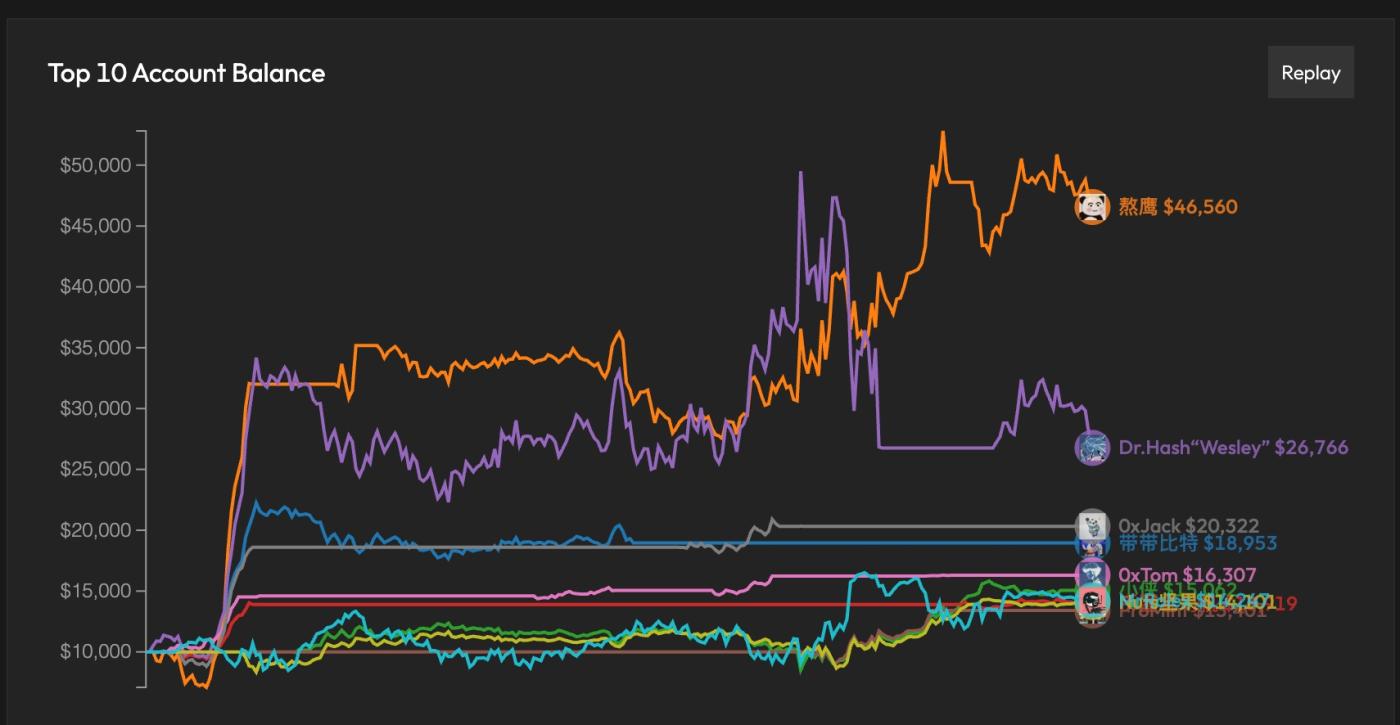

- Once a person's assets reach a certain size, they create a spotlight effect . For example, the top-performing trader on Huangguamao's platform earned 275% .

- But the total assets are $45 million , which is quite frightening!

- But if we consider 275% in terms of your asset size today, how much would that be?

- Therefore, this percentage is not what you want, and his strategy is not suitable for you .

Many influential figures post pictures showing staggering profits , tens or hundreds of thousands of dollars. But their assets might be in the tens of millions of dollars .For example, judging from the ranking of top influencers, the trading strategy that truly doubles small capital is that of Ao Ying , whose profitability is astonishing . This is probably what most small investors need .

Many influential figures post pictures showing staggering profits , tens or hundreds of thousands of dollars. But their assets might be in the tens of millions of dollars .For example, judging from the ranking of top influencers, the trading strategy that truly doubles small capital is that of Ao Ying , whose profitability is astonishing . This is probably what most small investors need . Other influential investors aren't weak; their strategies just aren't suitable for retail investors (if you're aiming for double your money).Therefore, when we see influential figures today, we should mainly look at " whether they can be replicated ," rather than " how amazing " they are.If his stuff can't be copied , then don't look at it in the first place, because you'll definitely be affected .There's a saying: " If you want it, you can get it."I think it's worth considering: If I gave you $10,000 today, with no time limit, how would you use position management and strategies to realistically write down how you could make money?First, earn 100% , then $ 20,000 , and then gradually multiply it fivefold , reaching $100,000 . And so on. Within this system, you can utilize hedging, contracts, arbitrage , and various other methods to steadily increase your wealth.Treat it as a goal , and then " plan your goal ," instead of just shouting "I want to get rich! " without knowing any of the details. "Results" are the byproducts of executing the plan . Planning the details is the best way to gradually move towards wealth .

Other influential investors aren't weak; their strategies just aren't suitable for retail investors (if you're aiming for double your money).Therefore, when we see influential figures today, we should mainly look at " whether they can be replicated ," rather than " how amazing " they are.If his stuff can't be copied , then don't look at it in the first place, because you'll definitely be affected .There's a saying: " If you want it, you can get it."I think it's worth considering: If I gave you $10,000 today, with no time limit, how would you use position management and strategies to realistically write down how you could make money?First, earn 100% , then $ 20,000 , and then gradually multiply it fivefold , reaching $100,000 . And so on. Within this system, you can utilize hedging, contracts, arbitrage , and various other methods to steadily increase your wealth.Treat it as a goal , and then " plan your goal ," instead of just shouting "I want to get rich! " without knowing any of the details. "Results" are the byproducts of executing the plan . Planning the details is the best way to gradually move towards wealth .Finally, for all retail investors, a bear market is the best!

This is the perfect time to accumulate knowledge and capital . Once you 've made your plans , you can start executing them when the bull market arrives and gradually build your wealth !