Market Update aims to provide readers with the latest market reports and key digital asset data.

Article author: Chang

Article source: ME

On December 12th, according to SoSoValue data, the overall crypto market showed a slight upward trend. The Layer 2 crypto sector rose 1.66% in the last 24 hours, with Merlin Chain (MERL) rising 4.99% and Mantle (MNT) rising 4.07%. Additionally, Bitcoin (BTC) rose 1.37%, rebounding above $92,000; Ethereum (ETH) remained down 0.77%, fluctuating narrowly around $3,200.

In other sectors, the Meme sector rose 1.45% in the last 24 hours, with MemeCore (M) up 9.70%; the Layer 1 sector rose 1.33%, with Zcash (ZEC) surging 17.85%; the DeFi sector rose 1.26%, with Beldex (BDX) up 13.63%; the CeFi sector rose 0.96%, with Canton Network (CC) up 2.00%; the PayFi sector rose 0.82%, with Dash (DASH) up 5.41%; and the RWA sector rose 0.62%, with Keeta (KTA) up 33.44%.

The crypto sector indices, which reflect the historical performance of the sector, show that the ssiLayer2, ssiDeFi, and ssiAI indices rose by 1.79%, 1.77%, and 1.64%, respectively.

ETF Directional Data

According to SoSoValue data, the Solana spot ETF saw a total net inflow of $11.02 million yesterday (December 11, Eastern Time).

Yesterday (December 11, Eastern Time), the SOL spot ETF with the largest single-day net inflow was the Bitwise SOL ETF BSOL, with a single-day net inflow of $4.44 million. The current total historical net inflow of BSOL is $609 million.

The second largest net inflow was into the Fidelity SOL ETF (FSOL), with a single-day net inflow of $3.56 million. The total historical net inflow for FSOL is currently $54.04 million.

As of press time, the Solana spot ETF has a total net asset value of $929 million, a Solana net asset ratio of 1.21%, and a historical cumulative net inflow of $672 million.

According to SoSoValue data, yesterday (December 11, Eastern Time), Bitcoin spot ETFs saw a total net outflow of $77.3419 million.

The Bitcoin spot ETF with the largest single-day net inflow yesterday was BlackRock ETF IBIT, with a net inflow of $76.7054 million. IBIT's total historical net inflow has now reached $62.68 billion.

The second largest inflow was into the Bitwise ETF (BITB), with a net inflow of $8.4408 million in a single day. BITB's total historical net inflow has reached $2.289 billion.

The Bitcoin spot ETF with the largest single-day net outflow yesterday was the Fidelity ETF FBTC, with a net outflow of $104 million. The total historical net inflow for FBTC is currently $12.177 billion.

As of press time, the total net asset value of the Bitcoin spot ETF was $119.925 billion, with an ETF net asset ratio (market capitalization as a percentage of Bitcoin's total market capitalization) of 6.55%, and a historical cumulative net inflow of $57.855 billion.

According to SoSoValue data, the Ethereum spot ETF saw a total net outflow of $42.3734 million yesterday (December 11, Eastern Time).

The Ethereum spot ETF with the largest single-day net inflow yesterday was the 21Shares ETF TETH, with a single-day net inflow of $2.0845 million. The current total historical net inflow of TETH is $23.2565 million.

The Ethereum spot ETF with the largest single-day net outflow yesterday was the Grayscale Ethereum Trust ETF (ETHE), with a net outflow of $31.2175 million. ETHE's total historical net outflow has now reached $5.005 billion.

As of press time, the total net asset value of the Ethereum spot ETF was $20.309 billion, with an ETF net asset ratio (market capitalization as a percentage of Ethereum's total market capitalization) of 5.22%, and a cumulative net inflow of $13.108 billion.

BTC direction

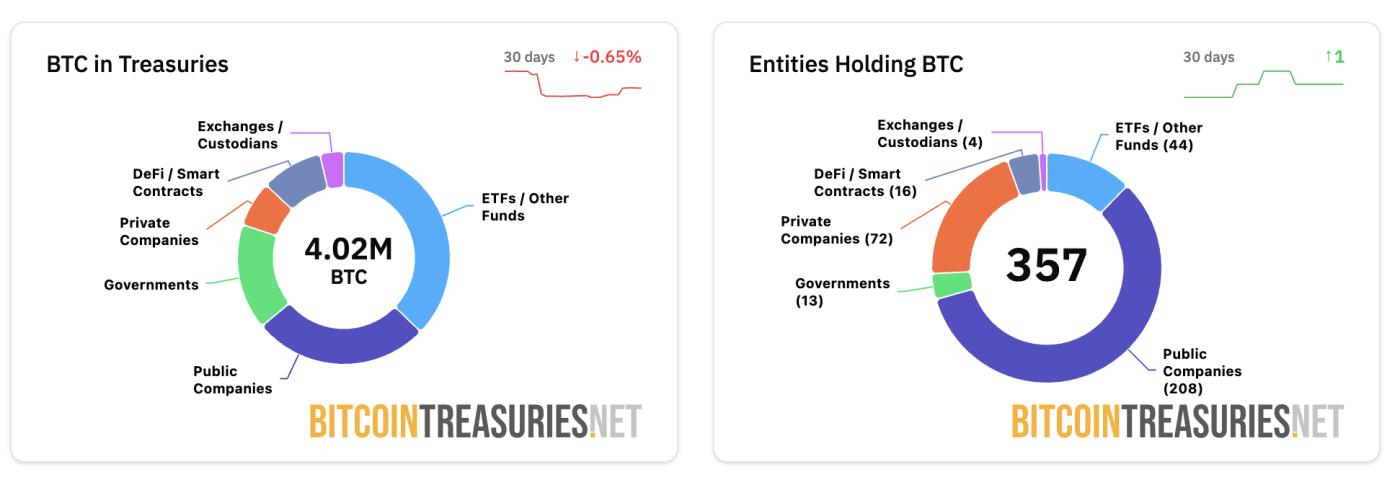

According to data from BitcoinTreasuries, 209 listed companies currently hold a total of 1,075,807 Bitcoins, accounting for 5.12% of the total Bitcoin supply. Among them, Strategy holds the largest amount, with 660,624 Bitcoins, accounting for 61.41% of the holdings of listed companies.

RWA direction

According to CoinFound data:

- Commodity market capitalization: $3.64 billion

- Market value of government bonds: $1.19 billion

- Market capitalization of institutional funds: $2.81 billion

- Private lending market capitalization: $34.32 billion

- Market value of US Treasury bonds: $8.89 billion

- Corporate bond market value: $260 million

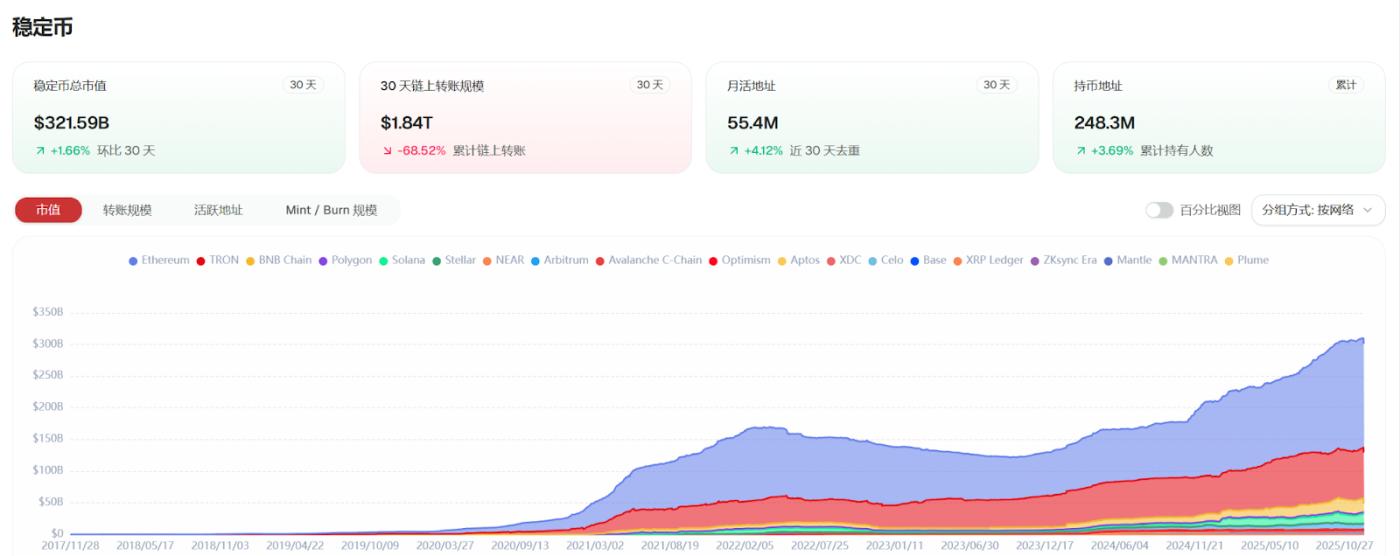

- Stablecoin market capitalization: $321.59 billion

X-Stock's market capitalization: $620 million

Market Dynamics:

- The Hong Kong Monetary Authority (HKMA) is testing on-chain tokenization of money market funds.

Chainlink ETF saw a net inflow of $2.56 million in a single day.

- VeChain won the BeInCrypto "Best RWA Project of 2025" award.

- Clearpool and other institutions are optimistic about the future of the RWA market, predicting it could reach trillions or even hundreds of trillions of dollars by 2030.

Summarize:

- Market capitalization continues to expand, with the total scale of on-chain real asset tokenization exceeding $35 billion. Overall, despite the volatility of the crypto market, RWA has maintained strong growth momentum thanks to regulatory support, reliable oracle services, and progress in project compliance.

Stablecoin direction

According to CoinFound data, USDT has a market capitalization of $198.73 billion, USDC has a market capitalization of $78.36 billion, USDS has a market capitalization of $10.99 billion, and USDe has a market capitalization of $6.62 billion.

Market Dynamics

Do Kwon was sentenced to 15 years in prison for TerraUSD stablecoin fraud, raising concerns about a potential crash in 2022, but the market was not significantly affected.

- Anchorage has partnered to launch USDGO, a 1:1 USD-backed blockchain regulated by the U.S. federal government, supporting multiple blockchains, and scheduled to launch in Q1 2026.

- Stablecoins are rapidly penetrating everyday payment scenarios. MassPay supports USDT remittances to 230 countries, Klarna+Stripe is developing wallets, and WSPN is integrating WUSD.

The U.S. financial risk regulator FSOC no longer considers digital assets a potential risk.

- The UK financial authorities plan to prioritize the development of stablecoin payments in 2026 and promote the issuance of a sterling stablecoin.

Summarize:

- (Do Kwon's retrial) did not shake market confidence. Demand for stablecoins as a safe haven and payment tool continued to increase, and the overall core demand in the market remained stable. However, the growth logic, risk characteristics, and user base of different cryptocurrencies varied significantly.