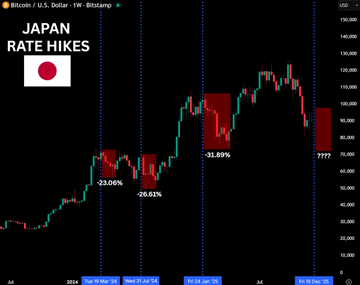

MARKET FALLS ON SATURDAY DUE TO CONCERNS FROM THE BOJ Last Saturday, the markets all fell simultaneously: Bitcoin, Ethereum, Nasdaq, and the Russell 2000 all crashed at the same time. This wasn't just a crypto crash, but a macroeconomic reaction to the Bank of Japan (BOJ). 1. The Bank of Japan (BOJ) will raise interest rates to 0.75% at its December meeting. - A Reuters poll shows that 90% of economists predict the Bank of Japan (BOJ) will raise interest rates from 0.50% to 0.75% at its meeting on December 18-19, 2025, the first meeting since the BOJ ended its ultra-loose monetary policy. This would be the first increase since January and a step toward normalizing the currency. More than two-thirds of respondents expect interest rates to reach at least 1.00% by the end of September 2026 – a further 0.5% increase from the current level. => After Governor Kazuo Ueda gave a clear signal about the possibility of raising interest rates, the market started pricing in... 2. Impact on financial markets - The BOJ's interest rate hike increased the cost of Capital for the Yen, impacting global liquidation . Japan shifted from Vai of providing cheap money to the world to prioritizing domestic stability, ending a decades-long era of cheap money. And immediately, the market priceed in on the news: - Nasdaq and Russell 2000 fell first. - $BTC and $ETH break in the same rhythm - Weaker altcoins react more strongly. 3. How did the market react to previous interest rate hikes by the BOJ? - On March 19, 2024, the BOJ ended negative interest rates, a decrease of approximately 23%. - Next interest rate increase on July 31, 2024, BTC will fall by approximately 26%. - On January 24, 2025, the second increase occurred in the first half of 2025. BTC decreased by approximately 31%. => These price drops could be due to various other reasons from the FED and other factors - the price reductions could simply be a coincidence. 4. What scenarios are possible for the upcoming official BOJ meeting? - BOJ raised interest rates as expected: further volatility is possible, but since prices were already in, a technical rebound is possible. - The Bank of Japan (BOJ) raised interest rates and signaled continued tightening until 2026, potentially leading to further sharp market declines. - The BOJ's delay or softer tone than expected exceeds expectations - markets could turn green. - What are your opinions? Which scenario is most likely to work?

This article is machine translated

Show original

Steven | Crypto Research

@Steven_Research

12-11

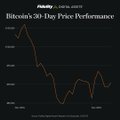

Fidelity báo cáo rằng, vùng giá $85.5K là vùng thanh khoản hỗ trợ mạnh, với xác nhận đã có khoảng 430.000 $BTC được hấp thụ quanh vùng này

Với kết quả hạ lãi suất nhưng giọng điệu khá "diều hâu" trong cuộc họp FOMC đêm qua, Bitcoin đang điều chỉnh và theo x.com/Steven_Researc…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content