Our orders placed on December 4th and 11th both successfully hit their profit targets.

We're hoping for a rebound to trade, but long here carries relatively high risk.

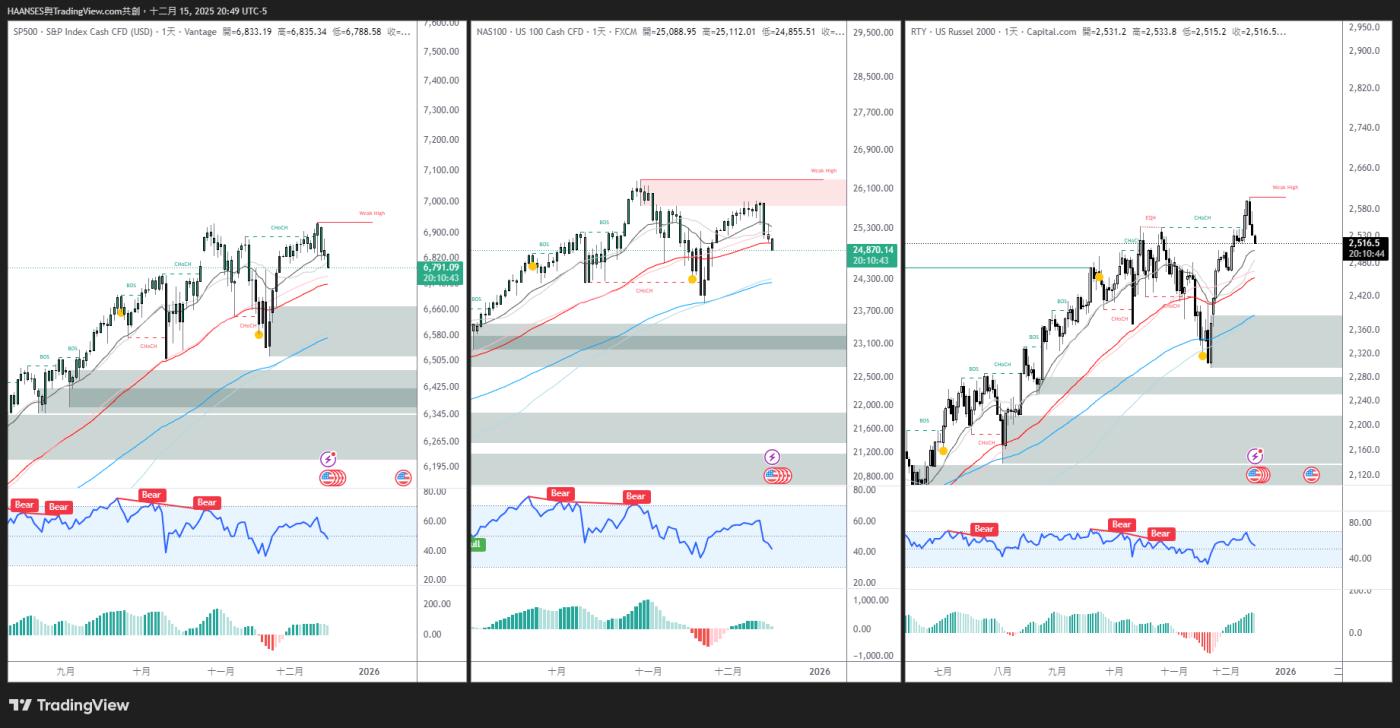

The first US stock index is at a high level, and they are all falling.

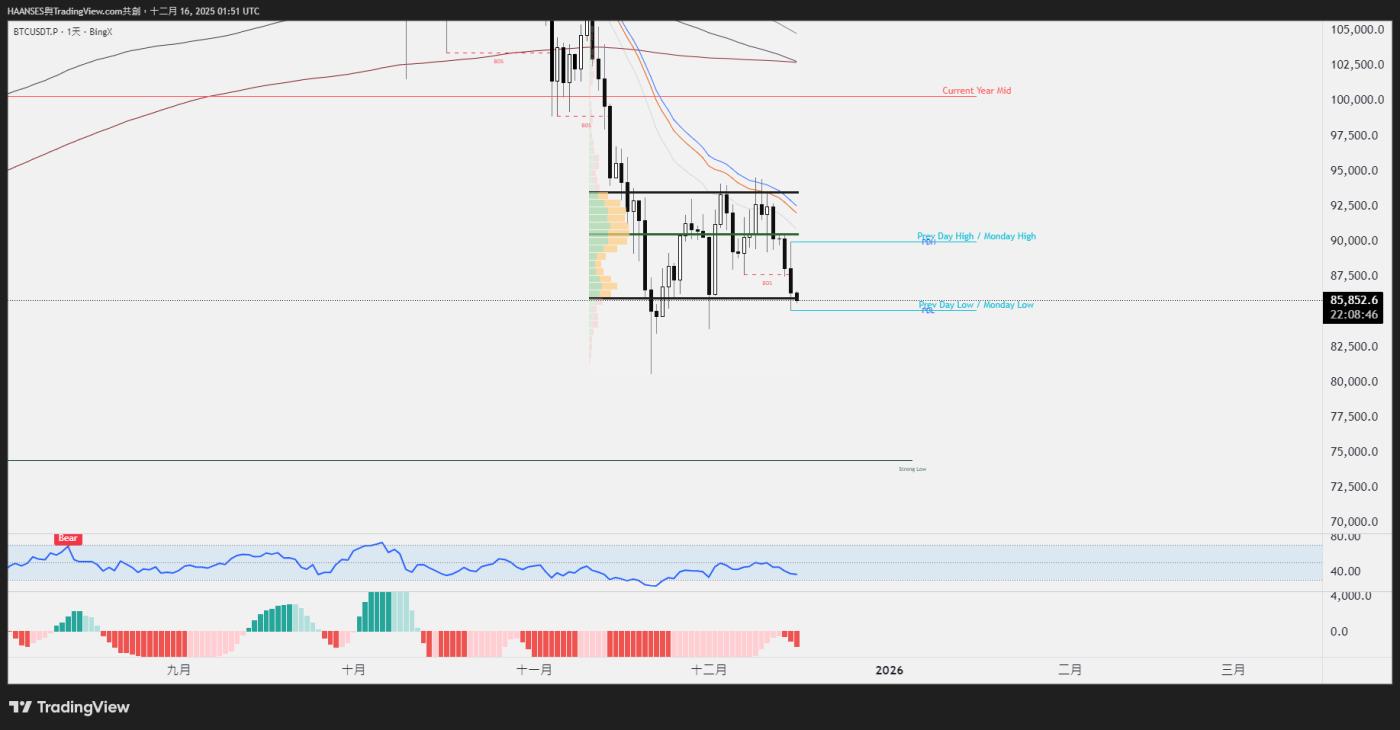

The second BTC is currently not reacting immediately within the price range of val.

But we'll still plan first, and then proceed if it meets our criteria.

The high and low points of this range have been marked.

However, since the bears have the upper hand, we don't want to see the range low broken before a rebound, because breaking the range low would indicate that the market is really weak and might continue to decline. We expect to see support in the orange zone and for the PDL (Pre-Day Low) to be regained and stabilized.

However, the area around 91000 is also a strong bearish resistance level, so there are two options.

1. If we remove PDL and long, we have a chance to take profits at the high point of the range, but we need to set a stop-loss order because there is strong resistance at 91000.

2. Wait until 91000 to make a decision. If it holds, there's a chance to go up and take the liquidity at the high point of the range. If it doesn't hold, it will go all the way down to take the low point of the range.

Therefore, we are currently waiting for support to be found and for a trend reversal to occur on a smaller timeframe. Precise entry points are not yet available, but updates will be provided as needed.