Source: Bitwise

Original title: "The Year Ahead: 10 Crypto Predictions for 2026"

Authors: Matt Hougan , Ryan Rasmussen

Compiled and edited by: BitpushNews

Important Note: As with all forecasts, the following is not a guarantee, but rather our best judgment based on available information. The future is complex and uncertain, and whether the outcome will be as described in this article depends on many complex factors. This article does not constitute any investment advice.

Table of contents

Predicted content

Bitcoin is poised to break its "four-year cycle" and reach a new all-time high.

Bitcoin's volatility will be lower than Nvidia's.

With institutional demand accelerating, ETFs will buy more than 100% of the new supply of Bitcoin, Ethereum , and Solana.

Crypto stocks will outperform tech stocks

Polymarket's open interest is set to reach a record high, surpassing the level seen during the 2024 US presidential election.

Stablecoins are being blamed as the "culprit" behind the currency turmoil in a certain emerging market.

The assets under management of Onchain Vaults (ETF 2.0) will double.

If the Clarity Act passes, Ethereum and Solana will reach new all-time highs.

Half of the Ivy League endowments will be invested in crypto assets.

The US will launch more than 100 ETFs related to crypto assets.

Bonus prediction : The correlation between Bitcoin and the stock market will decrease.

introduction

2025 will be an unforgettable year for the crypto industry – with both highs and lows.

The positive side is :

Bitcoin, Ethereum, Solana, and XRP all hit record highs (reaching $126,080, $4,946, $293, and $3.65 respectively), driven by continued institutional demand and a series of positive regulatory developments.

Stablecoins and asset tokenization have become household names. Large financial institutions such as Morgan Stanley and Merrill Lynch have officially opened up cryptocurrency ETF investment channels to their clients. Several cryptocurrency companies with valuations of billions of dollars have successfully IPOed, including Circle , Figure , and Gemini.

The negative aspect is :

Major cryptocurrencies, including the four assets mentioned above, have retreated significantly from their highs and are still in a downtrend as of this writing. Some small- and mid-cap Altcoin have even seen declines exceeding 50%.

The price decline was compounded by multiple negative factors:

Market concerns about a "retracement year" in the "four-year Bitcoin cycle"

Long-term holders begin to sell.

Discussions about the risks of quantum computing are heating up.

Broader macroeconomic uncertainty

These factors significantly dampened market sentiment.

However, we believe that the bulls will prevail in 2026.

From institutional adoption to regulatory implementation, the current positive trend is strong and far-reaching, and is unlikely to be suppressed in the long term.

Against this backdrop, we present the following 10 crypto predictions for 2026 .

Prediction 1

Bitcoin is poised to break its four-year cycle and reach a new all-time high.

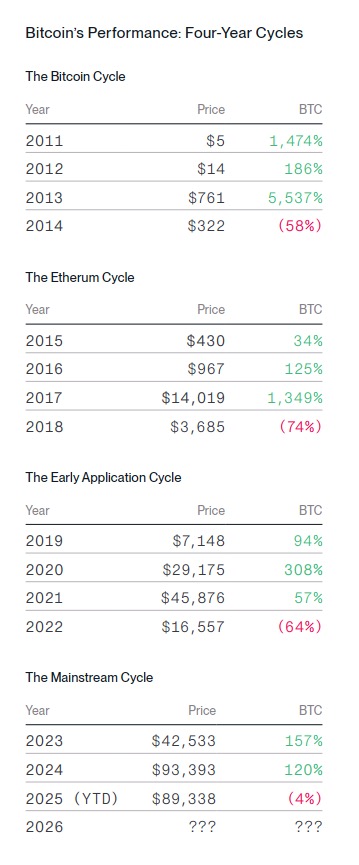

Historically, Bitcoin has tended to exhibit a "four-year cycle":

After three consecutive years of gains, a significant correction followed in the next year. Following this logic, 2026 should have been a "year of pullback."

However, we do not agree with this judgment.

We believe that the key factors that have driven the four-year cycle in the past are weakening significantly:

Halving effect : Each Bitcoin halving has a smaller marginal impact than the previous halving.

Interest rate cycle : Interest rates rose sharply in 2018 and 2022, putting downward pressure on prices; however, we expect interest rates to decline in 2026.

Systemic defaults : Following the record liquidations in October 2025, the overall market leverage ratio decreased, and the regulatory environment improved, reducing the risk of major defaults.

More importantly, since the approval of spot Bitcoin ETFs in 2024, a large amount of institutional capital has begun to enter the crypto market, and this trend will accelerate further in 2026.

Morgan Stanley, Wells Fargo, Merrill Lynch and other platforms have begun to formally allocate crypto assets; at the same time, the “pro-crypto” regulatory environment that will emerge after the 2024 election will also drive Wall Street and fintech companies to adopt crypto assets more deeply.

We expect that the combination of these factors will drive Bitcoin to new highs and make the "four-year cycle" a thing of the past.

Prediction 2

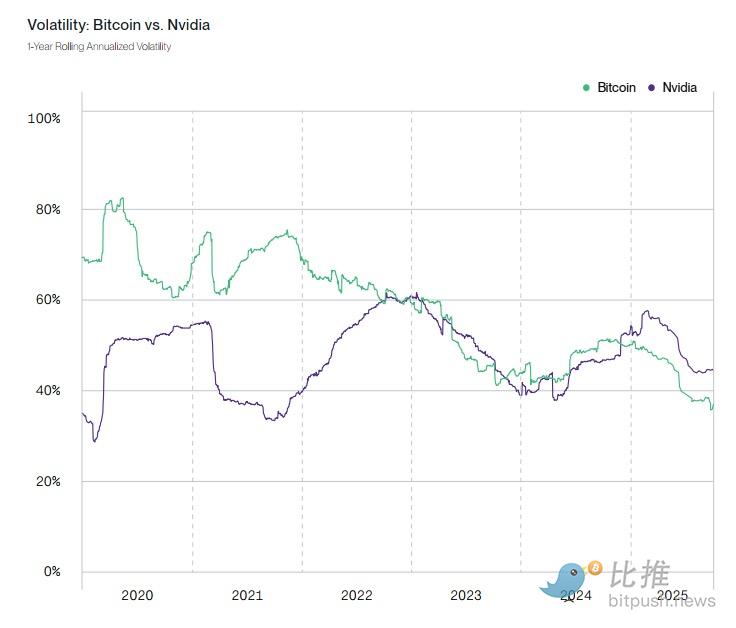

Bitcoin's volatility will be lower than Nvidia's.

For a long time, people have said, "I would never invest in an asset as volatile as Bitcoin."

Does Bitcoin fluctuate? Absolutely.

But is it more volatile than other assets widely accepted by investors? Not in recent years.

Throughout 2025, Bitcoin's volatility was even lower than that of one of the hottest stocks in the market—Nvidia. Looking at a longer timeframe, you'll find that Bitcoin's volatility has actually been steadily declining over the past decade. This shift reflects a reduction in the fundamental risk of Bitcoin as an investment, coupled with a more diversified investor base thanks to traditional investment tools such as ETFs.

We believe this trend will continue into 2026.

Prediction 3

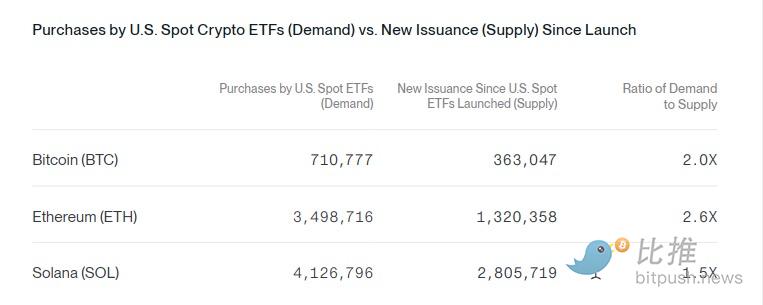

The ETF will buy more than 100% of the new supply of Bitcoin, Ethereum, and Solana.

Crypto asset prices are determined by supply and demand.

One of the core reasons we are bullish on the crypto market in the long term is that institutional demand will continue to exceed new supply for many years to come.

This prediction has been validated since the launch of crypto ETFs in 2024:

The Bitcoin ETF purchased a total of 710,777 BTC.

During the same period, the Bitcoin network added only 363,047 BTC.

Bitcoin prices rose 94% during the same period.

Looking ahead to 2026, we anticipate the new supply to be approximately:

166,000 BTC (approximately $15.3 billion)

960,000 ETH (approximately $3 billion)

23 million SOL tokens (approximately US$3.2 billion)

We believe that ETFs will buy more of these assets than they will increase supply, especially after institutions such as Morgan Stanley and Merrill Lynch approve spot ETFs.

This does not guarantee that prices will necessarily rise, but it lays a solid foundation for price performance in 2026.

Prediction 4

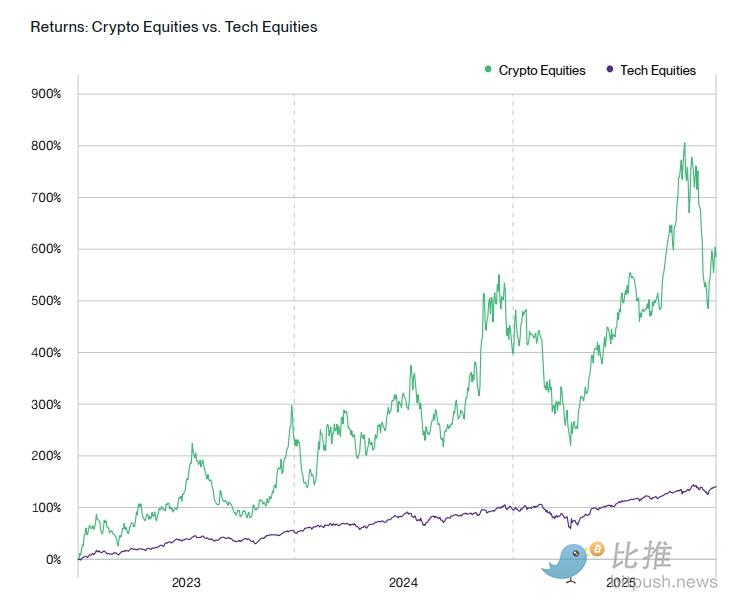

Crypto stocks will outperform tech stocks

Over the past three years, technology stock investors have achieved returns of approximately 140% .

But crypto stocks performed even more impressively.

The Bitwise Crypto Innovators 30 index (which covers crypto infrastructure and services companies) rose 585% over the same period.

An improved regulatory environment makes it easier for compliant crypto companies to innovate.

Coinbase relaunched its ICO, Circle launched its own Layer 1 blockchain, and more new products, revenue streams, and M&A activities are underway.

We expect crypto stocks to perform admirably on Wall Street in 2026.

Prediction 5

Polymarket open interest is set to hit a new all-time high.

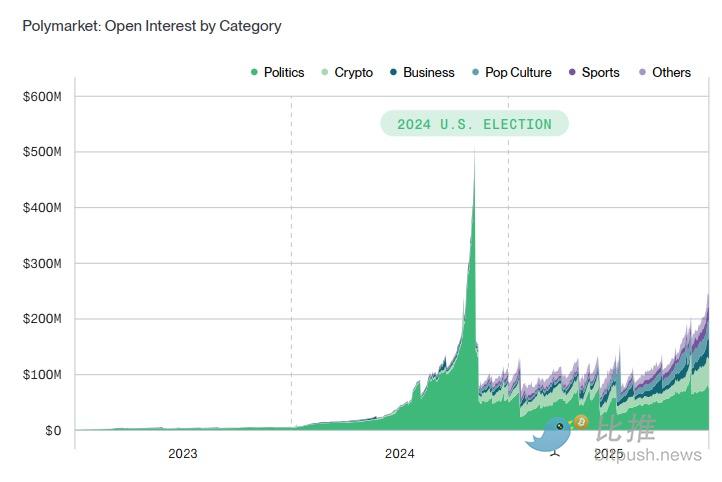

Polymarket's open interest reached $500 million during the 2024 US election, before falling back to around $100 million.

We believe this record will be easily broken in 2026 for the following reasons:

Open to the US market : Starting in 2026, US users will be able to participate directly.

Institutional endorsement : ICE (the parent company of the NYSE) invests $2 billion in Polymarket.

Market Expansion : Rapid growth in markets such as sports, culture, crypto, and economics.

Prediction 6

Stablecoins will be blamed as the culprits that "undermine" the stability of emerging market currencies.

The stablecoin market is expanding rapidly.

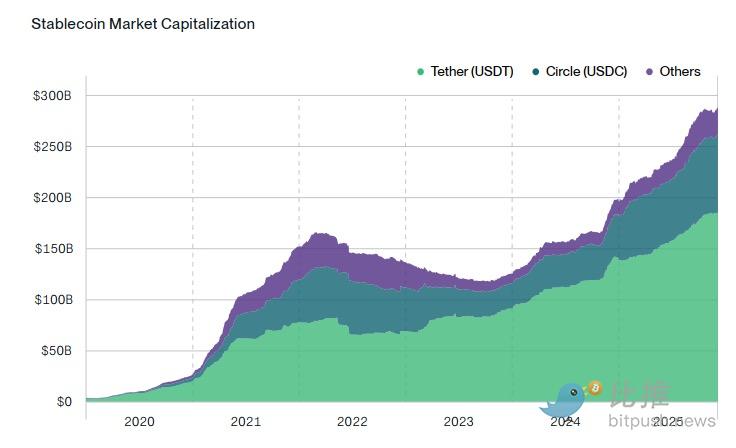

The tokenized versions of the US dollar (and other currencies), represented by USDT and USDC, had a market capitalization of $205 billion at the beginning of this year. Today, this market size is approaching $300 billion and is expected to exceed $500 billion by the end of 2026. In other words, its size has grown to a level that cannot be ignored.

This is undoubtedly a positive sign: stablecoins offer a more efficient, low-cost, and faster way to transfer funds. Who wouldn't like such an innovation? — But for central banks in countries facing high inflation, the issue is not so simple.

Multiple studies have shown that stablecoin adoption is primarily concentrated in emerging markets, with a significant increase in usage, particularly in regions with the highest inflation rates. This is because stablecoins allow people in high-inflation areas to easily store their assets in relatively stable US dollar tokens, rather than their continuously depreciating local currencies. For example, in Venezuela, its fiat currency, the bolivar, was expected to depreciate by approximately 80% against the US dollar by 2025.

For ordinary depositors, switching to stablecoins is a rational choice, but for central banks, it means capital outflows and weakened control. The Bank for International Settlements (BIS), comprised of central banks from various countries, warned its members earlier this year that "the widespread use of stablecoins could undermine the monetary sovereignty of the relevant jurisdictions."

As cryptocurrencies gain mainstream acceptance, we anticipate one or two countries will publicly blame stablecoins for their currency problems. Of course, this attribution is illogical—if local monetary systems are sound, people won't need to switch to stablecoins. But this won't stop these countries from sounding the alarm.

Prediction 7

The assets under management of the on-chain vault (ETF 2.0) will double.

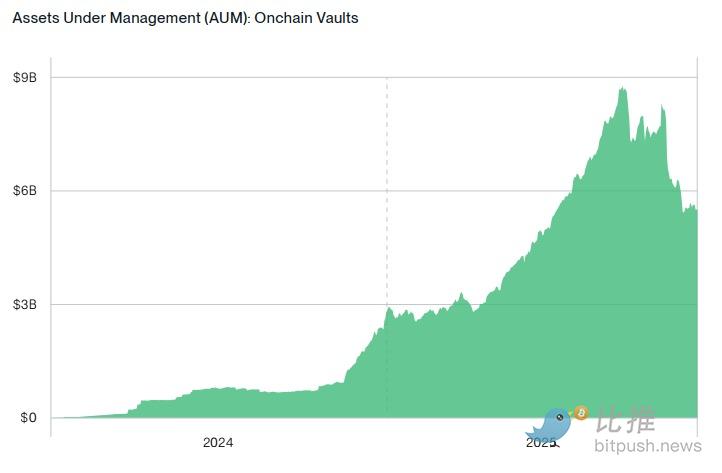

An on-chain vault is similar to an on-chain investment fund.

The size grew from less than $100 million in 2024 to $2.3 billion, and reached $8.8 billion in 2025.

Although the volatility in October 2025 caused some strategies to fail, we believe this is just a necessary stage in the maturation of the industry.

In 2026, high-quality asset managers will enter the market, driving rapid growth in the scale of on-chain vaults.

Prediction 8

If the CLARITY Act passes, Ethereum and Solana will reach new all-time highs.

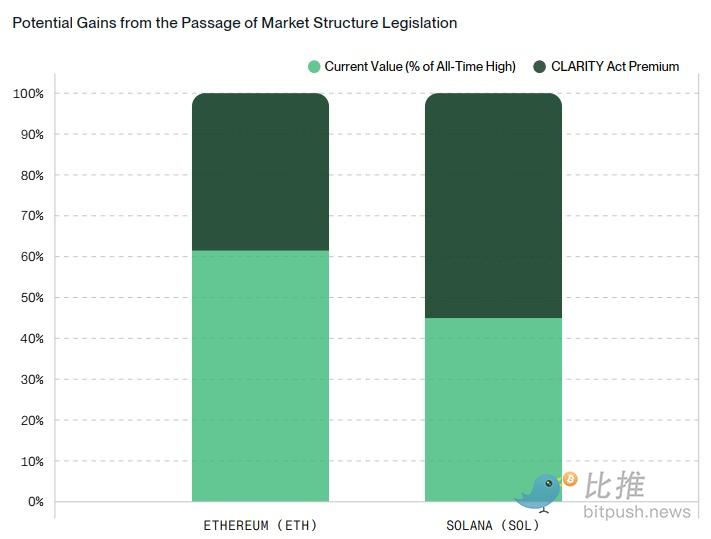

We are strongly bullish on Ethereum and Solana. This is primarily based on our belief that stablecoins and asset tokenization are two major long-term trends, and that Ethereum and Solana are likely to be the biggest beneficiaries of this growth.

However, the short-term growth of stablecoins and tokenization largely depends on the continued progress of US regulatory processes. The passage of the GENIUS Act in 2025, centered on stablecoins, was already a major breakthrough. The next key step lies in whether Congress can pass "market structure" legislation like the CLARITY Act.

Market structure legislation will clarify the regulatory framework for cryptocurrencies in the United States, including whether the Securities and Exchange Commission ( SEC ) or the Commodity Futures Trading Commission (CFTC) will lead regulation. Without a clear legal definition, the current pro-crypto stance of US regulators could shift due to the upcoming election.

The outlook for market structure legislation in 2026 remains uncertain. If the Clarisity Act passes, we expect it to trigger a cryptocurrency bull market—in crypto parlance—with “stunning” momentum. Ethereum and Solana will be the two main beneficiaries, with prices poised to break all-time highs. If the bill fails to pass, it means everything will start afresh.

Prediction 9

Half of the Ivy League endowments will be invested in crypto assets.

Earlier this year, Brown University became the first Ivy League university to allocate its endowment fund to Bitcoin, initially purchasing approximately $5 million worth of Bitcoin ETFs. We expect more Ivy League schools to join this trend by 2026.

The significance of this development lies in two aspects:

First, there's the direct impact: endowment funds control real capital—estimated to be $871 billion. If they were to follow Harvard University's example and allocate approximately 1% of their assets to Bitcoin, their market influence would be undeniable.

Secondly, there's a deeper signaling implication: endowment funds—especially those of Ivy League universities—often serve as bellwethers for investment trends. For example, Yale University's early 21st-century foray into hedge funds is considered a key factor in driving the industry's explosive growth over the past two decades. If Harvard and other Ivy League institutions' Bitcoin investments are successful, it could attract a significant influx of pension funds, insurance funds, and other institutional investors.

In short, the market sentiment might be: "Since Harvard is allocating to Bitcoin, perhaps we should consider it too."

Predicting 10

The US will launch more than 100 crypto-related ETFs.

For over a decade, the U.S. Securities and Exchange Commission (SEC) maintained a stance of rejection towards cryptocurrency ETFs, until a court ruling prompted a policy shift—in January 2024, Bitcoin ETFs were finally approved; six months later, Ethereum ETFs were launched. Now, the floodgates have been opened.

In October 2025, the SEC released a general listing standard, allowing issuers to launch cryptocurrency ETFs under uniform rules. The Solana ETF was subsequently launched (even including staking functionality) and attracted over $600 million in funds within months. XRP and Dogecoin-related products followed suit. By the time of this writing, more products are expected to enter the market.

Looking ahead to 2026, we anticipate that a clear regulatory path and strong market demand for crypto ETFs will jointly drive an "ETF feast." It is expected that over 100 crypto-related ETFs will be launched, covering diverse types such as spot crypto ETFs, crypto staking-enhanced ETFs, crypto equity ETFs, and crypto index ETFs.

We also made an additional prediction: Bitwise is expected to launch an ETF product with the highest annual inflow of funds in 2026.

Bonus points prediction

The correlation between Bitcoin and the stock market will decrease.

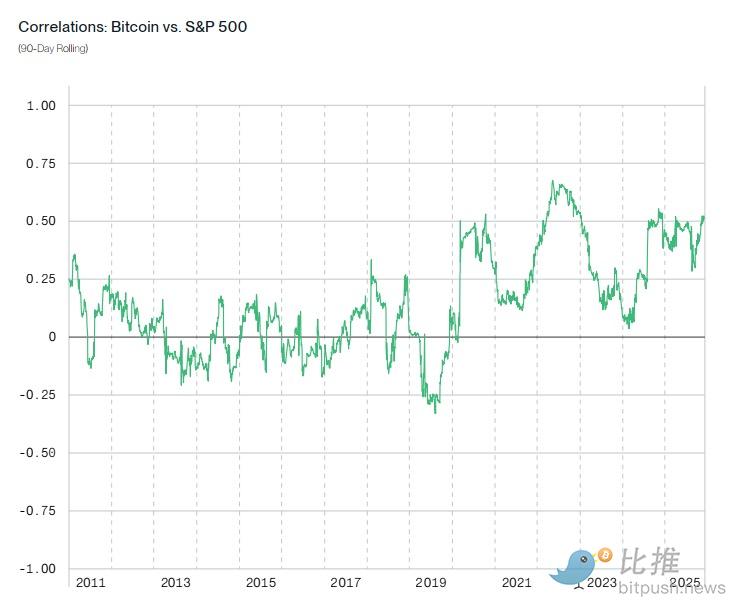

Data shows that the 90-day rolling correlation between Bitcoin and the S&P 500 rarely exceeds 0.5.

We expect that in 2026, driven by regulatory progress and institutional adoption, Bitcoin will be more driven by its own logic.

Risks and Important Disclaimers

This article is for informational and educational purposes only and does not constitute investment advice.

Crypto assets are highly volatile, and investors may suffer significant losses.

Past performance is not indicative of future results.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush