Bear markets are a good time to learn. , Here's a ultimate way to use RSI.

Absolutely S-class alpha .

The methods you've used in the past are absolutely wrong, and RSI has never been a beginner's indicator .

It's important to know that RSI is a Relative Strength Index (RSI). , It is a kinetic energy indicator.

Initially, people would use the terms "overbuying" and "overselling" to understand this. , In recent years, people have started using RSI divergence to analyze charts.

However, the greatest treasure of RSI lies in its ability to identify divergences and pullbacks in trend-following trading, which is the key to getting on board during major trends.

In fact, there are two main strategies for RSI:

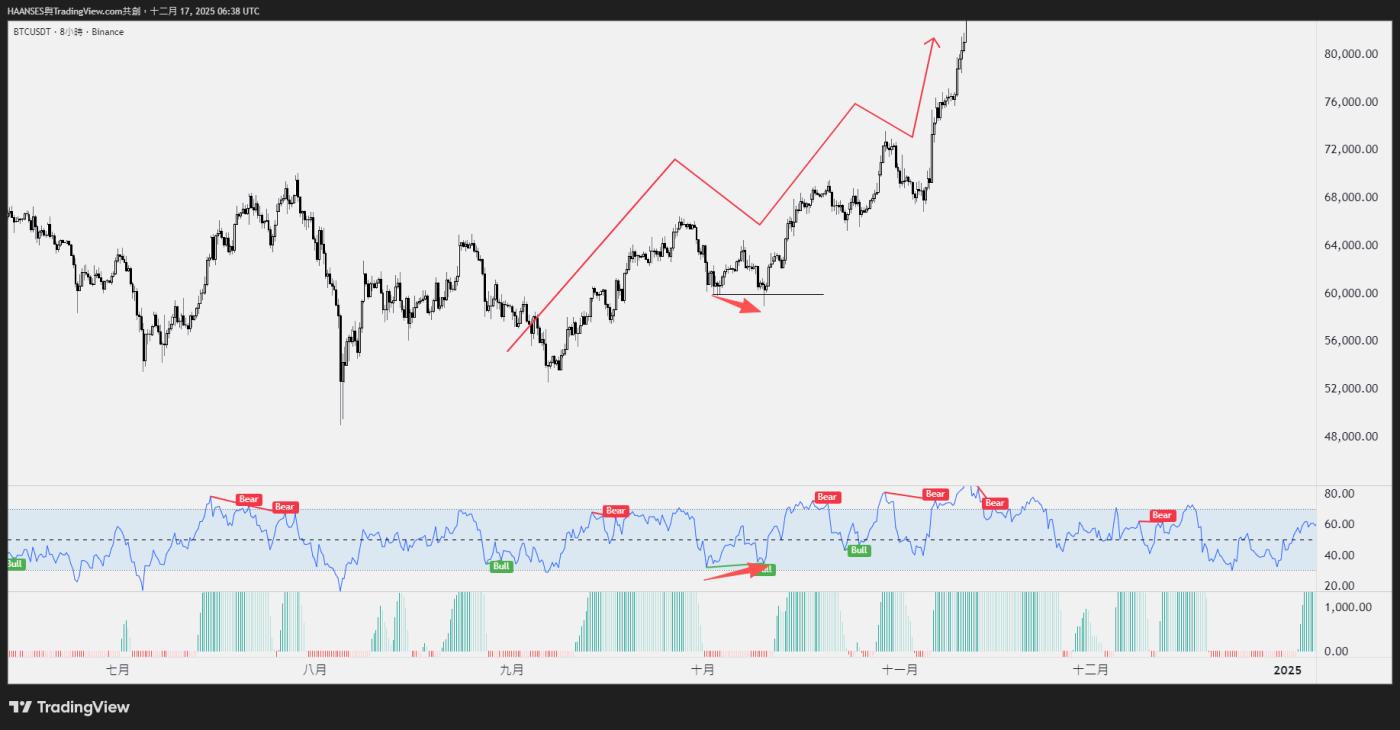

1. Utilizing RSI divergence to capture kinetic energy shifts

RSI divergence is an application of a momentum indicator that identifies discrepancies between underlying market momentum and price behavior, potentially indicating an impending price reversal or correction.

Validity Rules for Trading Divergence

Follow the trend: Divergence that aligns with the direction of the "main trend" is more powerful and has a higher success rate.

"Following the trend is powerful." A trend-following divergence within a long-term uptrend is a strong indicator for confirming a pullback.

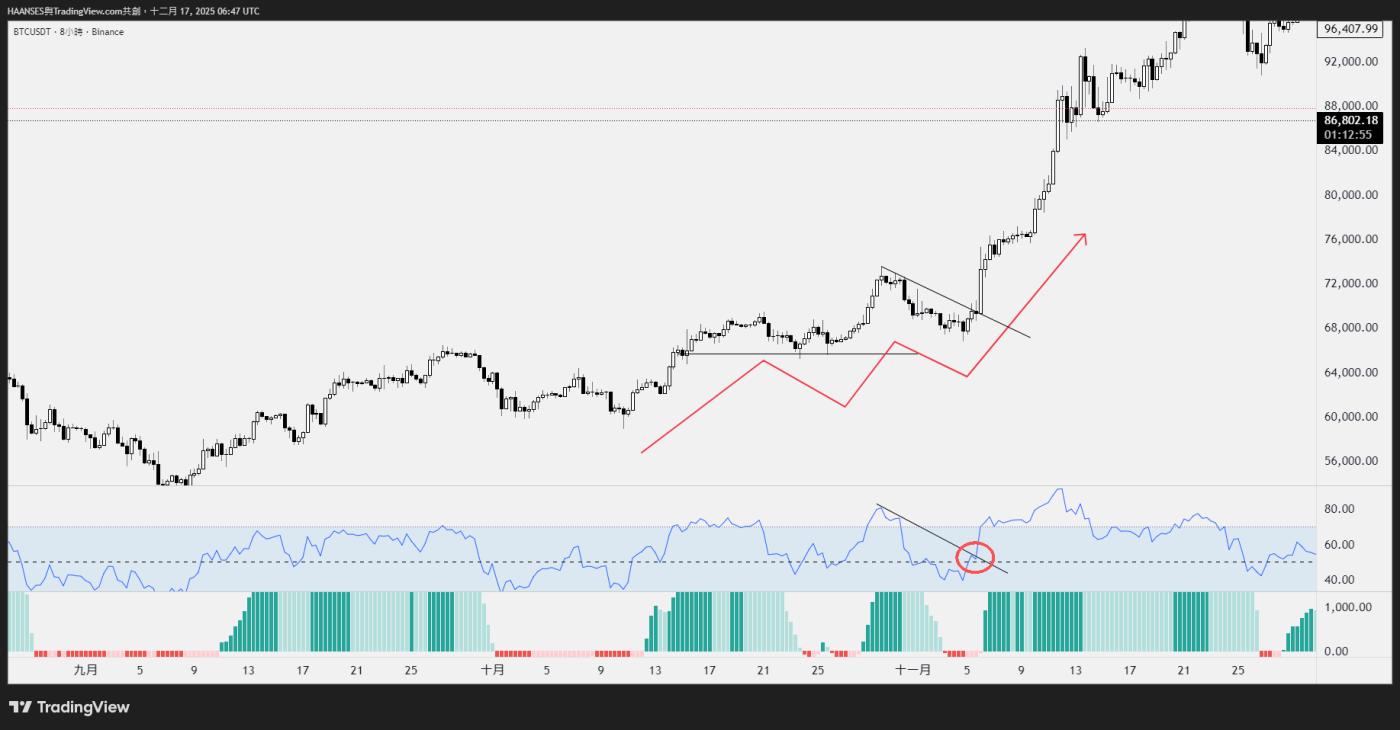

Handling divergences against the main trend: Divergences against the main trend are relatively weak. If you trade in such a situation, you must set a more aggressive take-profit order to quickly realize profits, or choose not to trade at all.

"Take profits promptly when the price moves against the trend (when it returns to the 50 line)." In a strong uptrend, trading against a downward divergence requires quickly taking profits when the RSI touches 50 (circled in red).

The optimal reference area for RSI divergence: Divergence should occur in the extreme areas of the RSI, namely above 70 in the overbought zone or below 30 in the oversold zone.

Clear peaks/troughs: Look for two consecutive, clear peaks or troughs.

Time span: Divergence should occur within a very short period of time. If it spans more than 14 candlesticks, the pattern needs to be considered. If it deviates too far, it will be considered invalid.

{50-day moving average (reset point): The 50-day moving average of the RSI is considered a "reset." Once the RSI crosses the 50-day moving average after forming a high or low, it should be considered a restart.} Important!

Any divergence that forms after crossing the 50 line should not be compared with the peaks or troughs before the crossing; such divergences are invalid. Important! Important! Important!

"It has already broken below the 50 level and reset, so it doesn't count as a divergence." "The peak at the red circle, which has fallen below the 50 baseline and reset before rising again, cannot be used as a basis for divergence with the previous peak."

2. Use the 50-day moving average (Midpoint) for trend trading.

Besides being used for divergence, the 50 midline area of the RSI is a key point for judging mid-trend adjustments (cooling zones) and joining trends.

Upward trend , The price retested the RSI50, then pulled back to the RSI50, and simultaneously broke through the price resistance level!

The significance of the 50-period moving average: When the price approaches or hovers around the 50-period RSI, it usually indicates two situations:

1. After a strong upward or downward trend, prices cool down, and 50 points becomes a natural resting point.

2. Prices are consolidating.

Finding entry points: In a strong trend, the 50 midline area is a good observation point to capture temporary pauses or pullbacks in the trend, thus looking for entry opportunities to rejoin the trend.

"After rising, it will rest near 50, waiting for the opportunity to continue rising."

Avoid trading during consolidation periods: If an asset is fluctuating around the 50 midline, it indicates market indecision, and trading should be avoided in this situation.

If the price consolidates around 50, we need to wait for a key move (a breakout and hold, or a false breakout and false breakdown).

Preferred time frame: My personal favorite time frame for observing the cooldown period is the 4-hour chart.

Trend strength: The 50 midline is very important for measuring the strength of a trend. Whether the price can break through and maintain above or below the 50 midline is a powerful indicator of whether the trend will continue.

In summary, RSI should not be considered a beginner's indicator; it is a tool whose effective application conditions need to be understood. This applies whether it's used for divergence trading.

Whether used as a secondary confirmation tool for trend-following trading, RSI can provide additional evidence for trading decisions, confirming whether momentum supports price action.