This article is machine translated

Show original

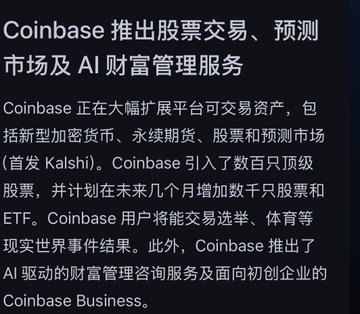

Coinbase launched stock trading, prediction markets, and wealth management. On Tuesday, I was chatting with a friend about how Coinbase's cost-effectiveness is gradually becoming more apparent:

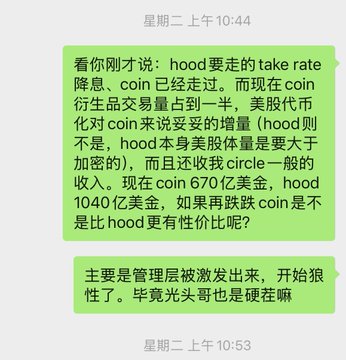

1. Several points we discussed: Hood lowered its take rate, Coinbase's IPO is complete, Coinbase derivatives trading volume accounts for half of its total trading volume, and US stocks are a pure incremental factor for Coinbase but not for Hood. It also holds a significant portion of its revenue from the stablecoin USDC.

2. The aggressive nature of Coinbase's management has been clearly ignited recently, with frequent moves. The CEO is anxious, but the pace hasn't been disrupted.

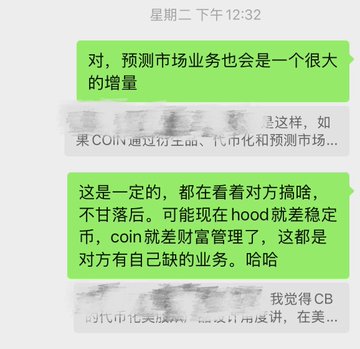

3. Hood lacks stablecoins, and Coinbase lacks wealth management. Today's new move by Coinbase fills that gap in wealth management.

Could this be considered an anticipation of the CEO's actions?

qinbafrank

@qinbafrank

10-31

coinbase三季度财报之外的亮点与战略图景。Coin三季度财报驱动力来自交易量的回升:Coinbase第三季度营收同比增长55%至19亿美元,高于分析师预估的18亿美元。净利润从去年同期的7550万美元飙升近五倍,达到4.33亿美元,合每股1.50美元。 x.com/qinbafrank/sta…

"A strong VC + a reasonably valued and profitable project + a KOL with investment research capabilities and influence + a Ceex/Dex exchange + an opportunity for retail investors to buy in at a reasonable valuation" - Brother Lion is absolutely right!

Once COIN and the new version are released, the valuation logic will be different. We need to take advantage of this and sell our shares quickly.

Coin has been making frequent moves lately, accelerating its business development.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content