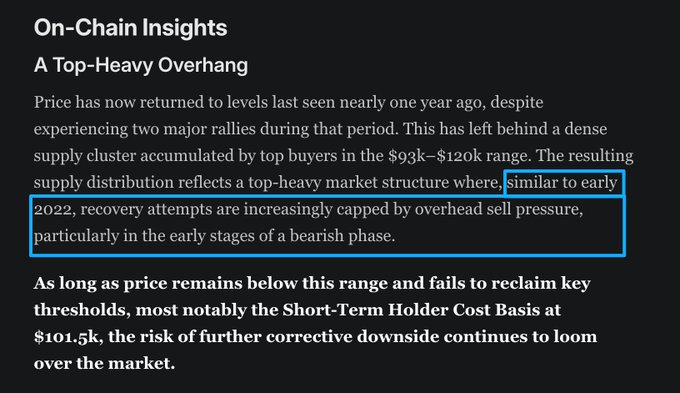

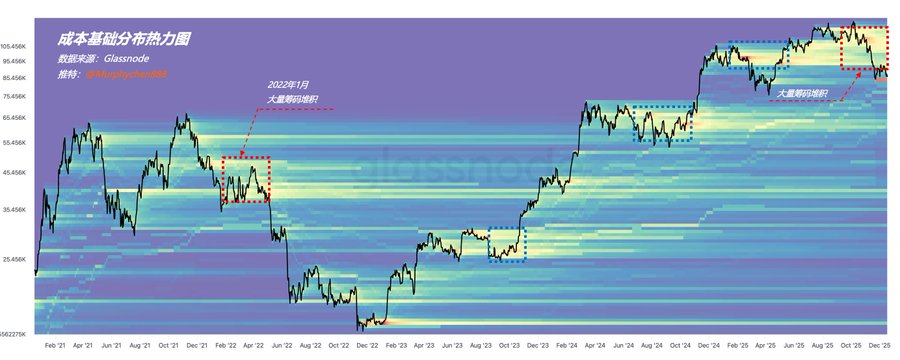

The official research report notes that in the current BTC holding structure, a large amount of bagholders are concentrated in the $93k–$120k range, creating a “top-heavy” supply distribution. This market structure is reminiscent of early 2022. (Figure 1) But in reality, during this cycle, any price zone where BTC consolidates for a while sees significant accumulation of coins. Even after breaking all-time highs, the strong buying interest has never really faded. (Figure 2) For example: - July–October 2023: heavy accumulation between $26k–$30k, then a breakout triggered by the BlackRock ETF narrative; - June–October 2024: coins stacked between $59k–$69k, then a breakout after Trump’s presidential win; - December 2024–May 2025: accumulation at $92k–$105k, and another breakout after the tariff crisis resolved... So, personally, I don’t think we should assume that just because there’s a big cluster of bagholders (and the structure looks like January 2022, when the bull turned to bear), BTC will necessarily repeat the post-2022 dump, especially after facing resistance at the top. If the macro cycle turns dovish, liquidity is unleashed, risk appetite returns, and market confidence recovers, there’s no reason BTC can’t smash through the upper resistance zone again. After all, the 2022 bear was triggered by runaway inflation (CPI > 7%), a hawkish Fed (rate hikes + QT), and surging real yields, all on top of a heavily underwater supply structure. It was the perfect storm for a full reset. — Sponsored by @Bitget| Bitget VIP: Lower fees, bigger rewards.

This article is machine translated

Show original

Murphy

@Murphychen888

12-18

“玄学” 与 “真实” 的相互印证

Glassnode 的每周链上数据报告给我们对当前市场多角度(链上、现货、合约、期权)的观察和判断价格影响的因素提供了全面的参考。虽然没有明确的多空观点,但作为一份研报,它保证了微观层面数据的客观性,以及理性的分析。 x.com/Murphychen888/…

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content