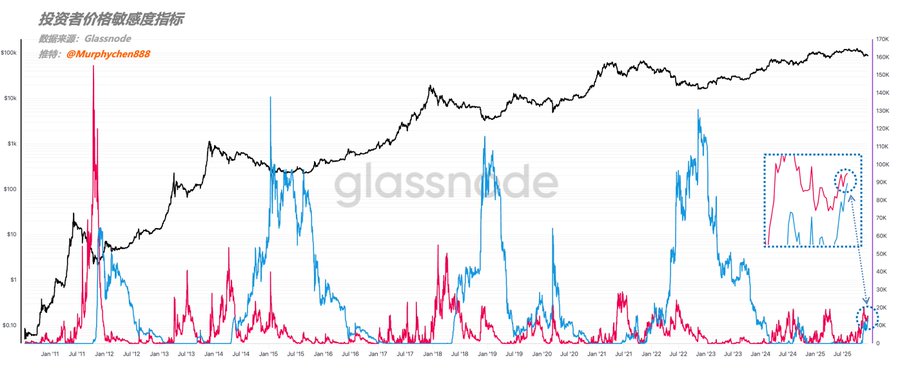

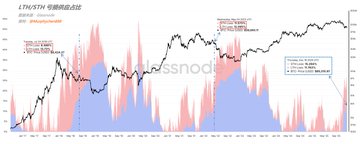

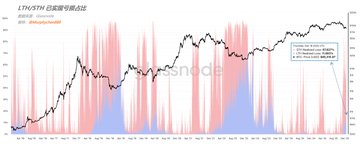

Emotions Racing Against Time: BTC at the Brink of Structural Shift There’s a line in the latest Glassnode report that really hits home: “Time has now become the main source of market pressure.” The number of BTC held at a loss has surged to 6.7 million (7d SMA)—the highest in this cycle. As time drags on and these holders’ frustration mounts, bearish sentiment is only going to get stronger. Back on Dec 3, I dropped a thread outlining my view: There are two key triggers for a “deep bear” phase—price and time. Since June 30th, any BTC that’s changed hands is now considered short-term holder (STH) supply in a loss. Based on the timeline, STH coins with a cost basis between $107,000–$125,000 will automatically become LTH (long-term holder) supply in three months—so, Q1 2026. At that point, LTH price sensitivity could change in a big way. (Chart 1) Right now, we’re seeing LTH price sensitivity (blue line) quickly catching up to STH sensitivity (red line). Since LTHs hold more coins, if they start reacting to price swings, it could trigger massive panic selling—making a deep bear scenario way more likely (see the thread for details). A few days ago, we noted that until the massive options expiry on Dec 26, market makers’ long gamma structure is offering downside protection, so big volatility is unlikely. But after Dec 26, as hedges are unwound, market structure will reset and previous support zones may disappear. Where the new support forms depends entirely on the new capital structure—something shaped by all market participants, not some “influencer” or institution’s prediction. If the market expects a certain level to break, capital will reposition lower, making the breakdown a self-fulfilling prophecy: spot bid walls pulled, shorts piling on, market makers flipping to short gamma, etc. At the end of the day, it’s the power of sentiment—when enough people believe a trend, it manifests in price action. (Chart 2) Right now, 15.29% of BTC in loss is held by STHs, and 11.76% by LTHs. STHs still dominate, but LTH’s share is catching up fast. If LTH loss supply overtakes STH, the market’s stress test gets real. Check Chart 2 for two historic moments when LTH loss supply outpaced STH—you’ll get the picture. (Chart 3) The good news: LTHs are still keeping their cool (for now). Data from Chart 3 shows that during December’s dips, STH capitulation drove the selling. For example, on Dec 18, STH realized losses made up 67.82% of the total, while LTHs were just 11.88%. The question is, if more LTHs go underwater, can they maintain this level of composure? One thing we can’t ignore: LTHs have fundamentally changed this cycle. With a wave of TradFi institutions joining, BTC is increasingly being held as a long-term (multi-cycle) reserve, not just a short-term trading chip. Bottom line: Q1 2026 is shaping up to be a season of high uncertainty. Emotions are racing against time! If macro policy and liquidity outlooks turn dovish, market confidence could return and high-entry bags might become “locked-in” supply. If not, we could see another leg down. ---------------------------------------------- Sponsored by @Bitget | Bitget VIP: Lower fees, bigger perks

This article is machine translated

Show original

Murphy

@Murphychen888

12-03

“周期牛转熊” 的触发点(三)

接上一篇推文,我们观察当前BTC长期持有者(LTH)对价格的敏感度还未达到全面危机的程度,但风险确实正在上升(见下方引文)。那在什么情况下,我们可以预判“风险” 将转为 “危机” ?

这里有2个关键的考量的标准 —— 价格和时间

(图1) x.com/Murphychen888/…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content