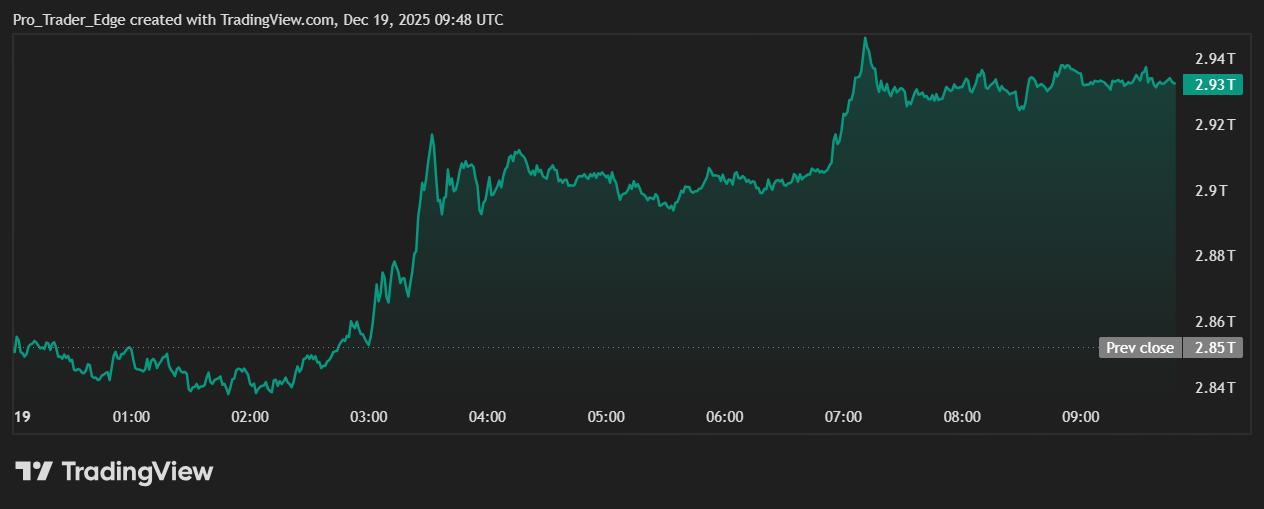

The cryptocurrency market has fallen more than 32% from its peak set in early October, leaving many investors bewildered as prices continue to decline despite a series of positive news for the industry. Total Capital is now only around $2.93 trillion, a sharp drop from $4.4 trillion just two months ago.

Chia on CNBC, crypto commentator Ran Neuner questioned this "mismatch." He pointed out several factors that should have supported the price, such as increased liquidation , a more crypto-friendly stance from the US government, the launch of new ETFs, and large institutional inflows.

While traditional markets like gold, silver, and major stocks have all performed well this year, the crypto market risks ending 2025 lower than it did at the beginning of the year. Since January 1st, total market Capital has decreased by nearly 13%.

Neuner argued that the market had only two possible scenarios: either they had to figure out what was "broken" and who was selling, or there would be a strong rebound—what he called "the biggest catch-up trade ever."

The impact of Bitcoin on the entire market.

Bitcoin remains the dominant force. Analysts warn that if selling pressure on Bitcoin continues, altcoins could fall another 10–20%. Bitcoin's price has repeatedly failed to break the $90,000 mark in recent weeks.

The crypto market's Fear & Greed Index has fallen to 16, indicating a state of "extreme fear." Historically, such lows often precede rallies.

Economist Adam Kobeissi argues that the market is undergoing a structural shift, with record-high leverage leading to large-scale liquidations almost daily over the past two months. Others suggest the selling pressure is coming from various groups, from early investors haunted by the 2021 crash and technical traders to those who believe in four-year cycles. Analyst PlanB calls it “an epic battle until the sellers run out of ammunition.”

The industry foundation remains strong.

Markus Thielen , CEO of 10x Research , told Cointelegraph that Bitcoin entered a bear market in late October and retail money hasn't really returned in this cycle. Value is primarily concentrated in Bitcoin rather than spreading to other assets.

From a more positive perspective, Erik Lowe from blockchain investment fund Pantera argues that 2025 will bring more structural advancements than any other year in crypto history. Changes in personnel and stances within US regulatory bodies, along with the formation of a strategic Bitcoin reserve, increased stablecoin supply, and the expansion of real-world asset value Tokenize on the chain , have laid the groundwork for long-term market growth.