The US dollar (USD) enters the new year at a critical juncture. After years of maintaining strength thanks to outstanding US economic growth, the Federal Reserve's aggressive tightening policies, and repeated global anxieties about risk, the factors that fueled the widespread appreciation of the USD are gradually weakening, though not yet completely collapsing.

FXStreet predicts that next year will be a transitional period rather than a complete reversal in the trend of the USD.

One year transfer to USD

The baseline scenario for 2026 is a moderate weakening of the US dollar, primarily driven by highly volatile and undervalued currencies, as interest rate differentials narrow and global growth becomes less disparate. The Fed is expected to be more cautious in easing monetary policy, but the likelihood of a sharp rate cut remains low. The difficulty in cooling service inflation, the robust US labor market, and expansionary fiscal policy suggest that a rapid normalization of monetary policy in the US is unlikely.

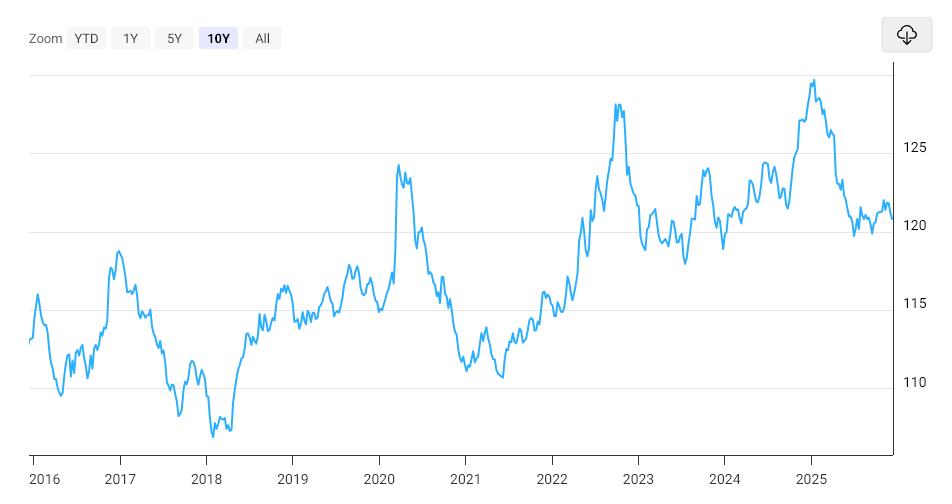

The US Dollar Index over the past decade. Source: Macro Trends

The US Dollar Index over the past decade. Source: Macro TrendsIn the foreign exchange market, this offers options rather than a sharp bear market for the USD.

Short-term risks could include strained federal spending in the US, as the potential for a government shutdown could cause market volatility and increase demand for the USD as a safe haven, but this is unlikely to create a long-term downtrend for the dollar.

Furthermore, the fact that Fed Chairman Jerome Powell will end his term next May also adds to the uncertainty, as the market begins to discuss the possibility that the new Fed leadership might shift policy towards a more dovish stance.

In short, next year won't necessarily be the end of the dollar's dominance, but rather a period where the USD is no longer as attractive but remains very important to the world.

The US dollar in 2025: From a dominant position to a period of weakness?

The past year was not impacted by a single shock, but rather by a chain of events that continuously challenged and ultimately strengthened the USD.

It all started with the consensus that US economic growth would slow and the Fed would soon ease policy. But this prediction was premature, as the US economy remained strong . Economic activity remained stable, inflation only declined slowly , and the labor market remained tight , prompting the Fed to continue its cautious approach.

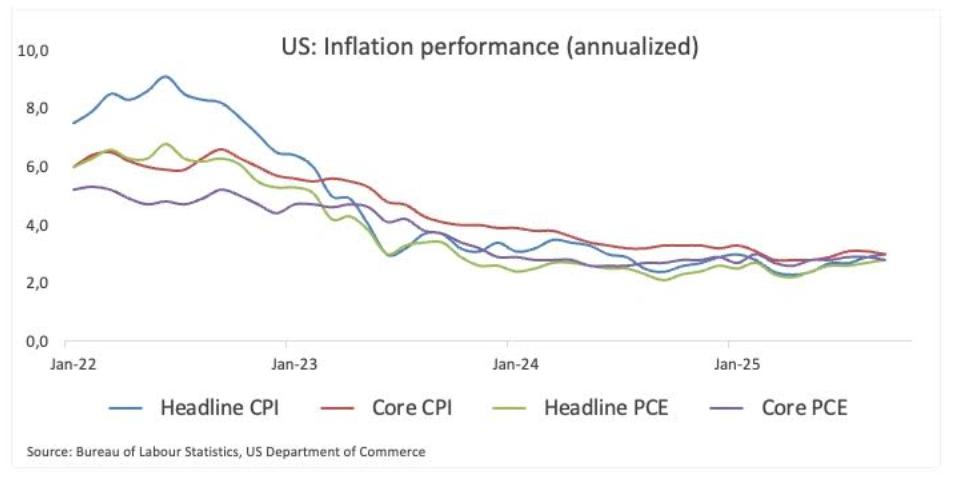

Inflation is also a recurring hot topic. Overall inflationary pressures have eased, but unevenly, particularly in the services sector. Each time inflation figures are higher than forecast, debates about how much monetary policy should be tightened flare up, and the result is always a stronger USD and a reminder that the process of reducing inflation is far from over.

Geopolitical factors are also a persistent issue. Tensions in the Middle East, the conflict in Ukraine , and the US-China relationship – particularly on trade – continuously destabilize the markets.

Outside the US, no region has emerged as a major counterweight: Europe is struggling to find growth momentum, China's economic recovery is uncertain, and low growth elsewhere further limits the likelihood of a prolonged USD depreciation.

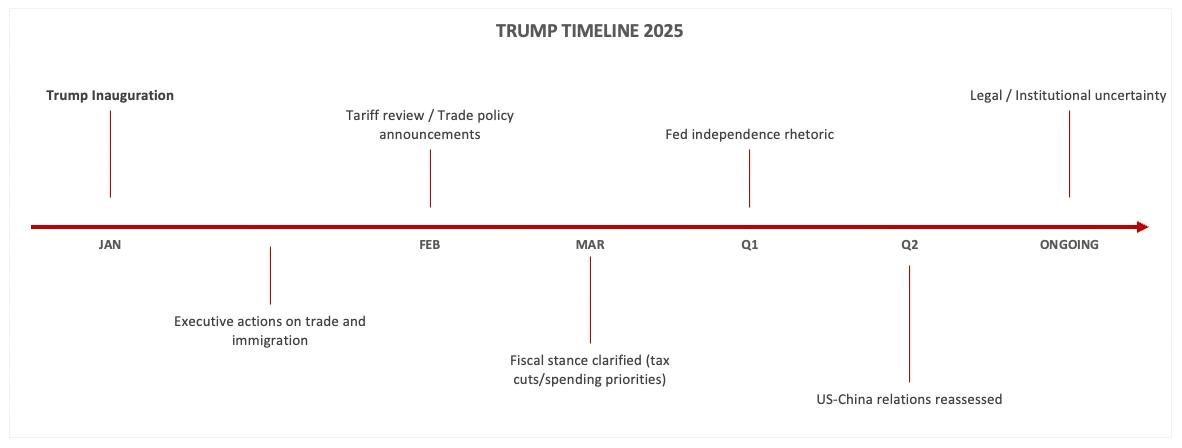

And then there's the Trump factor: US politics isn't necessarily a clear guide for USD trends, but rather a cause of greater exchange rate volatility. As the time chart below shows, whenever policy or geopolitical instability increases, the USD benefits from Vai as a "safe haven."

Timeline under Trump

Timeline under TrumpAs we move into 2026, this is unlikely to change. A Trump presidency is more likely to impact the foreign exchange market through trade uncertainties, fiscal policy changes, or regulatory actions than through a predictable policy direction.

Federal Reserve policy: cautious easing, not a shift in direction.

The Fed's policy remains a key factor determining the trend of the USD. The market is increasingly convinced that interest rates have peaked.

However, expectations regarding the pace and extent of future interest rate cuts remain quite vague and may be overly optimistic.

Inflation in the US has decreased significantly , but the final stage of bringing inflation down to the target level is proving difficult, as both general inflation and core Consumer Price Index (CPI) remain above the Fed's 2.0% target. Inflation in the services sector remains high, wage growth has slowed only slightly, and financial conditions have eased considerably. The labor market is no longer overheating but remains stable compared to previous periods.

Trends in inflation in the US since 2022

Trends in inflation in the US since 2022Given this context, it is highly likely that the Fed will gradually lower interest rates, adjusting them flexibly according to the actual economic situation, rather than pursuing aggressive easing.

This is important for the foreign exchange market, as interest rate differentials between the US and other countries are unlikely to narrow as quickly as the market currently expects.

Therefore, if the USD weakens due to the Fed lowering interest rates, this trend will unfold in an orderly manner, not too abruptly or aggressively.

Fiscal dynamics and political cycles

U.S. fiscal policy continues to be a familiar factor complicating the outlook for the U.S. dollar (USD). Large budget deficits, increasing debt issuance, and a deeply Chia political environment are no longer temporary issues, but an integral part of the overall picture.

There is a clear tension at the moment.

On the one hand, loose fiscal policy continues to support economic growth, slowing down any signs of recession, and indirectly strengthening the dollar as the US economy continues to outperform many other countries. But on the other hand, the US Treasury's continuous issuance of more bonds raises questions about the sustainability of public debt and whether international investors will be willing to continue buying this ever-increasing amount of debt.

So far, markets have remained relatively calm about this "twin deficit" issue. Demand for US assets remains very high due to ample liquidation , attractive yields, and a lack of alternatives that can compete in scale.

Politics brings a new layer of instability. Election years – including the midterm elections in November 2026 – typically increase risk costs and create short-term volatility in the foreign exchange (FX) market.

The recent US government shutdown is a clear example: although government operations returned to normal after 43 days, the core issues remained unresolved.

The US Congress has pushed the deadline for approving the next budget to January 30, leaving the risk of another deadlock still very real.

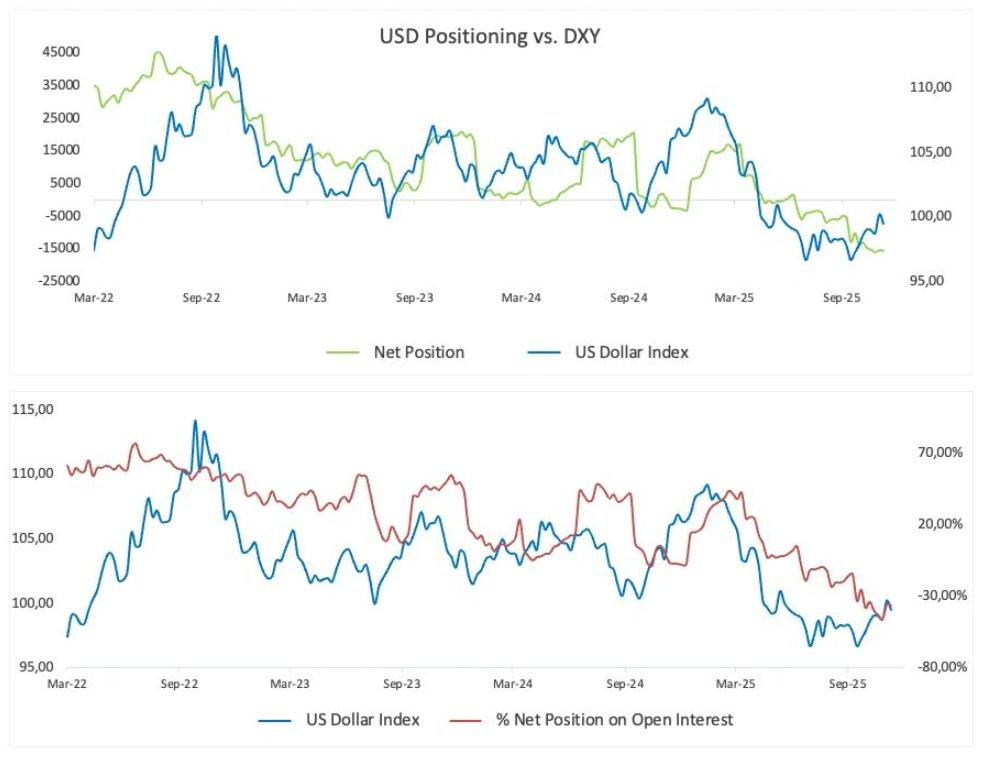

Valuation and positioning: crowded but not yet "broken"

In terms of valuation, the US dollar is no longer cheap, but it's not yet prohibitively expensive. However, whether the dollar is "expensive" or "cheap" is Capital the deciding factor in major turning points in the dollar cycle.

However, market positioning tells a more interesting story: Speculative investors are currently holding the highest net short positions in the dollar in years. In other words, a large segment of the market has already bet on a weaker dollar. This doesn't invalidate the bearish outlook, but it does shift the risk. As short positions become increasingly skewed towards one side, the likelihood of a further sharp dollar decline becomes lower, and the risk of short-term rallies due to short position liquidation increases.

This is all the more important in a context where policies can change abruptly and geopolitical tensions often arise unexpectedly.

Taken together, the relatively high valuation of the dollar coupled with large short positions in the market makes a sharp and prolonged decline in the USD less likely. Instead, there is a higher probability of periods of significant volatility, with the dollar weakening only to suddenly recover against the main trend.

US Dollar Index versus net open interest

US Dollar Index versus net open interestGeopolitics and safe-haven asset dynamics

Geopolitical factors, though often subtle, provide relatively stable support for the US dollar.

Instead of a single, major geopolitical shock, the market is now facing multiple smaller risks that have accumulated over time.

Tensions in the Middle East remain unresolved, the conflict in Ukraine continues to weigh heavily on the European economy, and US-China relations are also fragile. Added to this are disruptions to global trade routes and increasing strategic competition, keeping global instability at a high level.

All of this doesn't mean the US dollar will always appreciate. But overall, these risks reinforce a familiar trend: whenever uncertainty increases and liquidation becomes necessary, safe-haven flows pour into the USD.

Outlook for major currency pairs

● EUR/USD: The Euro (EUR) is expected to receive support as the economic outlook gradually improves and energy concerns ease. However, internal issues in Europe such as weak growth, fiscal spending constraints, and the possibility of the European Central Bank (ECB) easing policy sooner than the Fed will also severely limit the EUR's recovery potential.

● USD/JPY: Japan's gradual abandonment of its ultra-loose monetary policy has somewhat benefited the Japanese Yen (JPY), but the yield differential with the US remains very large, and the risk of official intervention in the currency market is ever-present. The market may witness many large fluctuations with two-way risks, rather than a clear, stable trend.

● GBP/USD: The British pound (GBP) continues to face numerous challenges. Weak growth, limited fiscal space, and persistent political instability are all contributing factors. Current valuations offer some support, but the UK still lacks clear growth drivers in this cycle.

● USD/CNY: China's policy continues to prioritize stability over excessive economic stimulus. Downward pressure on the yuan (CNY) persists, but the Chinese government will not allow the exchange rate to fluctuate too wildly or get out of control. This approach limits the risk of an excessive USD appreciation spreading across Asia, but also limits the potential for recovery in emerging market currencies closely linked to China's cycle.

● Commodity FX: Currencies such as the Australian Dollar (AUD), Canadian Dollar (CAD), and Norwegian Krone (NOK) typically benefit from improved risk sentiment and stable commodity prices. However, gains may be uneven and highly dependent on economic data from China.

Scenarios and risks for 2026

According to the baseline scenario (60% probability), the US dollar will gradually weaken as interest rate differentials between the US and other countries narrow, and global growth becomes less skewed. This is a scenario of a gentle correction, not a dramatic reversal.

A more optimistic scenario for the US dollar (around 25%) would occur if familiar factors such as more persistent Dai than expected, the Fed delaying or not cutting interest rates , or a new geopolitical shock causes a surge in demand for safe-haven assets and liquidation .

The scenario of a sharp decline in the dollar's value has a lower probability, only about 15%. For this scenario to occur, it would require a clearer recovery of the global economy and the Fed entering a more aggressive easing cycle, causing the US dollar to lose its yield advantage.

Another unpredictable variable lies within the Fed itself. With Chairman Powell's term set to end in May, the market may soon be interested in his successor even before an official change occurs.

The notion that the successor might pursue a more dovish policy direction could gradually put pressure on the dollar by reducing confidence in the US's ability to maintain real yields. However, like many current assessments, this impact will be uneven and sporadic, rather than a clear shift.

In summary, the risks remain skewed toward sudden surges in the dollar's strength, even if the overall long-term trend may be slightly bearish.

US Dollar Technical Analysis

Technically speaking, the recent drop in the dollar looks more like a brief pause within a broader range rather than a clear trend reversal, at least when looking at the US Dollar Index.

When looking at the weekly and monthly charts, the picture becomes clearer: the DXY is still quite far from its pre-pandemic levels, and buying pressure continues to emerge whenever the market shows signs of instability.

On the downside, the first key area to watch is around 96.30, which is the lowest level in about three years. If this area is broken decisively, the long-term 200-month moving Medium around 92.00 will be revisited.

Below this level, the area below 90.00, which was tested during the 2021 bottoming- Dip period, will become the next key support level.

On the upside, the 100-week moving Medium around 103.40 is the first hurdle to overcome. If this level is broken, the dollar could head towards the 110.00 area, previously established in early January 2025.

If this level is surpassed, the post-pandemic peak around 114.80, which was reached at the end of 2022, will be the next potential target.

Overall, the technical analysis is quite consistent with the general macroeconomic context. There is still room for further decline, but this process will certainly not be easy or without resistance.

In fact, technical factors indicate that the DXY is still in an accumulation zone, requiring constant attention to market sentiment changes and the potential for sharp reversals rather than a continuous one-way decline.

Weekly chart of the US Dollar Index (DXY)

Weekly chart of the US Dollar Index (DXY)Conclusion: The peak period is over, but privilege remains.

Next year is unlikely to mark the end of the dollar's central Vai in the global financial system.

Instead, this marks the end of a particularly favorable period, a time when economics, policy, and geopolitics all favored the dollar.

As these factors gradually balance out, the US dollar will diminish in prominence, but its importance will remain intact. For investors and policymakers, the challenge will be to distinguish between cyclical corrections and genuine long-term structural turning points.

The probability of a short-term correction is much higher than the probability of a major structural change.