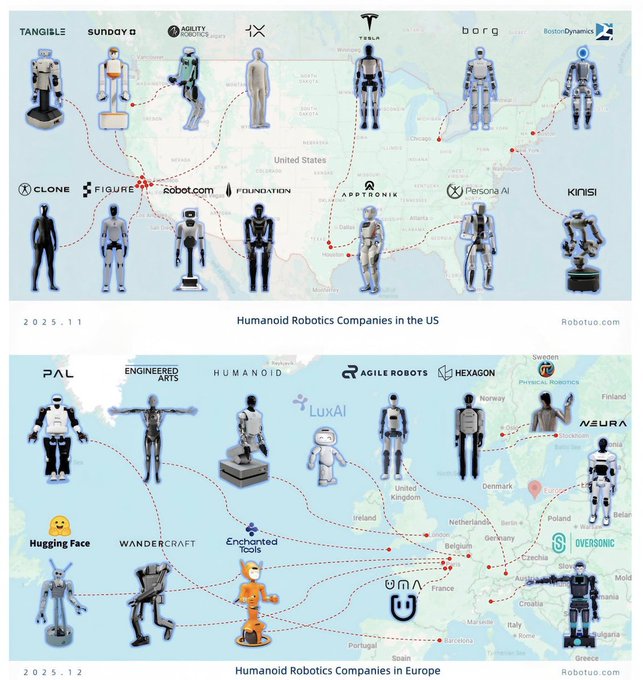

When I look at this map of the humanoid robot market, most people see a technological race and national competition. But the deeper story lies in the paradigm shift in capital structure, the clash of city-level innovation ecosystems, and the historic window of democratization of ownership. 1️⃣ "Robot banks" are reshaping the logic of industry investment. The humanoid robot industry exhibits typical characteristics of high capital intensity, long cycle, and high uncertainty. The dense presence of over 100 companies in China, including 18+ in Shenzhen, the "Six Little Dragons" of Hangzhou, and the Beijing Innovation Center, is essentially a **capital race:** - BOM cost: decreasing from $35,000 by the end of 2025 to $17,000 by 2030 (China supply chain only) - Funding requirements: Figure AI raised over $1 billion in a single round (valuation $39 billion), Physical Intelligence raised $600 million (valuation $5.6 billion) - Mass production threshold: Suppliers have planned to start production of 100k-1M units/year in the second half of 2026. The traditional VC investment window is extremely narrow—only top players can withstand multiple rounds of dilution, completely excluding small and medium-sized investors. @xmaquina The disruptive nature of DAOs lies in their "liquidity stratification." Through a "robot bank" model built on tokenization, a three-tiered capital efficiency revolution is achieved: 1. Democratization of the primary market: $3 million was raised through an IDO, with 1000+ participants acquiring private equity exposure to companies like Apptronik, 1X, and Figure AI at prices of 0.03-0.06. 2. Portfolio hedging: Holdings include leading US companies (Figure, Agility) and emerging Chinese companies (planned investments in Unitree and AgiBot), covering the entire stack of risk diversification across humanoid, physical AI, and protocol layers. 3. Exit liquidity reconstruction: Equity exit returns → Robotic RWA (such as autonomous robots on IX Swap) → Robot café operating revenue, forming a three-tiered cash flow cycle. 2️⃣ How tokenization solves the ownership paradox of the robot economy: XMAQUINA's Machine Economy Launchpad offers a new possibility: Tokenizing individual robot assets through sub-DAOs (such as the robo-café pilot project in collaboration with Peaq/ELOOP). 1. Fragmented Ownership: 100 people each hold 1% of the tokens for one café robot, enjoying revenue sharing. 2. Liquidity Premium: Tokens can be traded on platforms like IX Swap, transforming asset valuation from "depreciated equipment" to cash flow NFTs. 3. Network Effect Incentives: DAO governance determines robot upgrade paths (such as integrating the GR00T basic model), and community contributors receive DEUS rewards (the first 100 in Season 1 share 500k tokens). 📒Personal Summary: Whoever owns the robots owns the future. But the form of ownership is being redefined. The densely packed company markers on the map represent a battle for triple ownership of capital, technology, and data. The true winners of the next 10 years will not necessarily be the companies that create the most advanced robots, but rather the ecosystems that first complete the positive cycle of "robot assets → tokenization → liquidity → reinvestment." When AI raised funds at a valuation of $39 billion, XMAQUINA provided the community with an entry point to participate in the same revolution with 60 million FDV. Perhaps XMAQUINA truly embodies the meaning of "owning robots, owning the future."

This article is machine translated

Show original

XMAQUINA

@xmaquina

12-19

The Humanoid Robotics Market Map 🗺️

Humanoid companies are popping up everywhere, funded, and racing to deploy.

He who owns the robots will owns the future.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content