Chapter 1: Executive Summary and Industry Landscape Analysis

As of December 19, 2025, the global digital asset mining sector is undergoing the most profound structural transformation since the birth of Bitcoin . With the price of Bitcoin falling back to the $86,000 range after reaching an all-time high of approximately $125,000 in October 2025, and the total network hashrate surpassing the 1,000 EH/s mark, mining companies face the dual challenges of compressed profit margins and surging capital expenditures in the "post-halving era."

1.1 Industry Differentiation Pattern

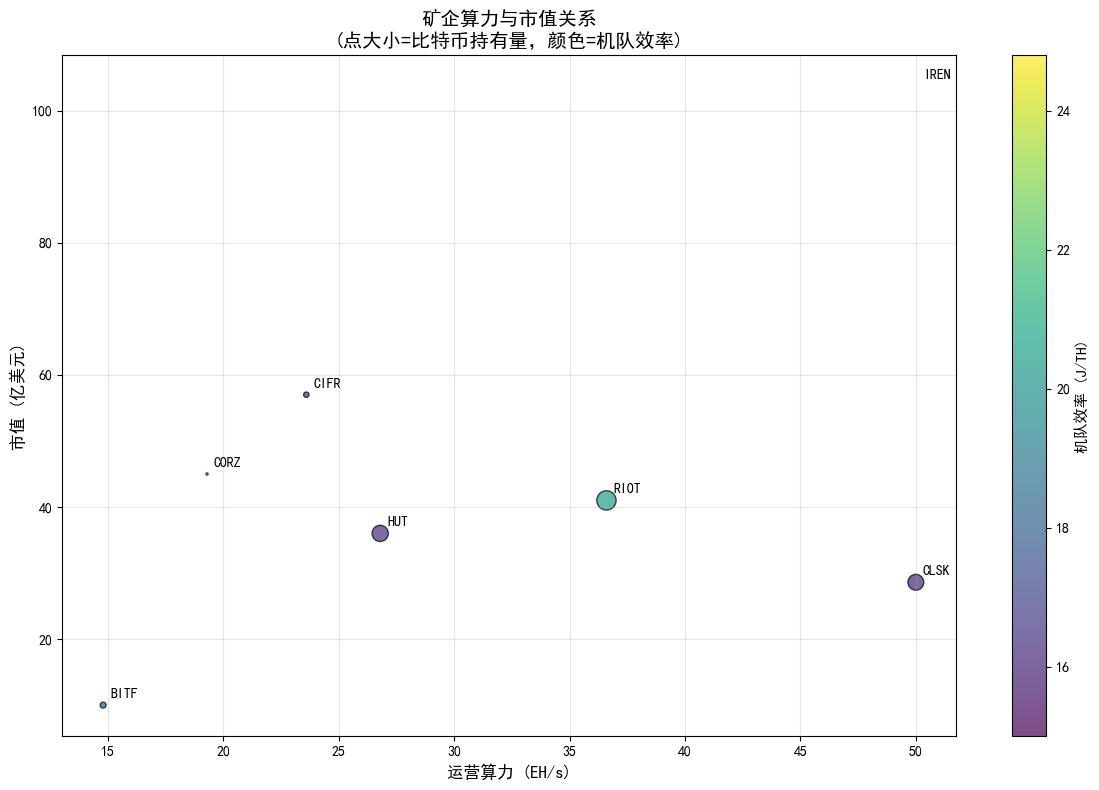

Figure 1: Analysis of the Relationship between Hashrate and Market Value of Major Mining Companies in 2025

The chart above clearly illustrates the current polarization within the industry. Based on operational data analysis, the industry has formed two major camps:

First camp: Bitcoin proponents

MARA Holdings: 60.4 EH/s computing power, market capitalization of $3.8 billion

CleanSpark: 50.0 EH/s computing power, market capitalization of $2.86 billion.

Riot Platforms: 36.6 EH/s hashrate, $4.1 billion market capitalization

Second camp: Pioneers in AI transformation

IREN Ltd: Computing power 50.0 EH/s, market capitalization US$10.37 billion

Core Scientific: 19.3 EH/s computing power, market capitalization of $4.5 billion

Cipher Mining: 23.6 EH/s computing power, market capitalization of $5.7 billion.

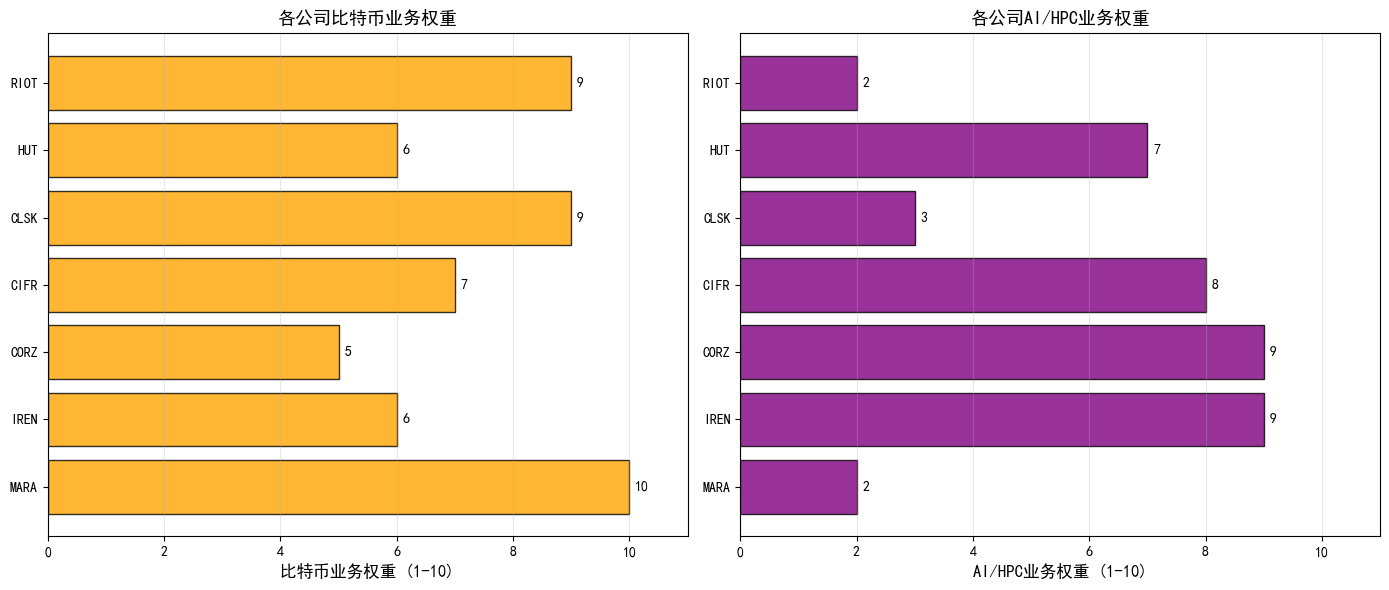

1.2 Strategic Transformation Weight Analysis

Figure 2: Weight Distribution Matrix of Mining Enterprise Business

The business weighting analysis shows that IREN, Core Scientific, and Cipher Mining have AI/HPC business weights of 9, 9, and 8 respectively, indicating that their strategic focus has shifted towards the high-performance computing field. Meanwhile, MARA Holdings and CleanSpark maintain a high weight of 9-10 for their Bitcoin business.

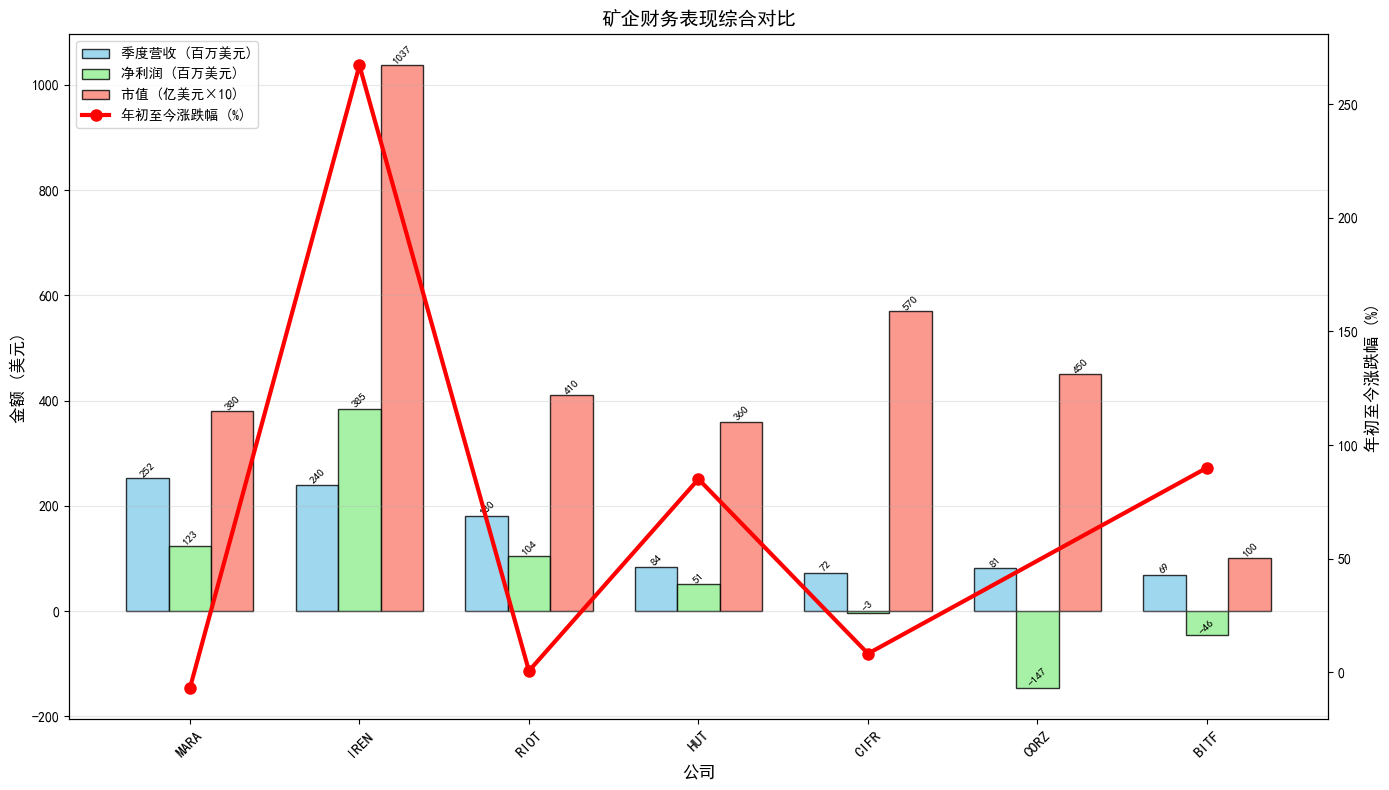

Chapter Two: Comparison of Financial Performance of Core Enterprises

2.1 Comprehensive Financial Performance Evaluation

Figure 3: Overall Comparison of Financial Performance of Mining Companies (2025)

Financial data show significant divergence:

Leading companies in terms of revenue performance:

IREN: Quarterly revenue of $240.3 million, up 355% year-over-year.

MARA: Quarterly revenue of $252.4 million, up 92% year-over-year.

Riot Platforms: Quarterly revenue of $180.2 million, up 112% year-over-year.

Profitability Analysis:

IREN: Net income of $384.6 million, P/E ratio of 18.9

CleanSpark: Net income of $364.5 million, P/E ratio of 12.7

MARA: Net income of $123.1 million, P/E ratio of 21.6

Market performance:

IREN: Best performing stock with a year-to-date gain of 267%.

Bitfarms: Up 90% year-to-date

Hut 8: Up 85% year-to-date

MARA: Down 7% year-to-date

Chapter 3: In-depth Industry Insights and Trend Analysis

3.1 A fundamental shift in valuation logic

Traditional mining company valuation models are mainly based on the leverage effect of Bitcoin prices, but data from 2025 shows that companies with AI businesses have begun to show independent performance.

Key findings:

Power Asset Revaluation: IREN, with 3GW of power reserves, secures a $9.7 billion AI cloud service agreement from Microsoft.

Time arbitrage value: Mining companies can save 3-5 years compared to building new projects by transforming into AI data centers.

Infrastructure Premium: Cipher Signs $5.5 Billion 15-Year Lease with AWS, Completely Changing Valuation Logic

3.2 Efficiency Watershed and Survival Threshold

With the total network computing power exceeding 1,000 EH/s, fleet energy efficiency ratio has become a key survival indicator.

First Tier (15-16 J/TH):

IREN: 15 J/TH

CleanSpark: 16.07 J/TH

Second tier (20-25 J/TH):

Riot Platforms: 20.5 J/TH

Core Scientific: 24.8 J/TH

3.3 Risks of Capital Expenditures and Equity Dilution

To support their AI transformation, major mining companies conducted large-scale financing rounds in 2025.

IREN: Completes $1 billion and $2.3 billion convertible bond financing

CleanSpark: Raises hundreds of millions of dollars through convertible bonds

Bitfarms: Completes $1 Billion Funding Round

While this financing strategy solved the construction funding problem, it also brought the potential risk of equity dilution.

Chapter 4: Key Data Statistics and Standardized Indicators

4.1 Comparison of Core Operating Metrics

| Stock Code | Company Name | Operational computing power (EH/s) | Fleet efficiency (J/TH) | Bitcoin holdings (BTC) | Market capitalization (USD billion) |

|---|---|---|---|---|---|

| MARA | MARA Holdings | 60.4 | N/A | 52,850 | 38.0 |

| IREN | IREN Ltd | 50.0 | 15.0 | ~0 | 103.7 |

| CLSK | CleanSpark | 50.0 | 16.1 | 13,054 | 28.6 |

| RIOT | Riot Platforms | 36.6 | 20.5 | 19,368 | 41.0 |

| HUT | Hut 8 Corp | 26.8 | 16.3 | 13,696 | 36.0 |

| CIFR | Cipher Mining | 23.6 | 16.8 | 1,500 | 57.0 |

| CORZ | Core Scientific | 19.3 | 24.8 | 241 | 45.0 |

| BITF | Bitfarms | 14.8 | 18.0 | 1,827 | 10.0 |

4.2 Strategic Transformation Scoring Matrix

| company | Bitcoin business weight (1-10) | AI/HPC business weights (1-10) | Key AI Partners | Advantages of power reserves |

|---|---|---|---|---|

| MARA | 10 | 2 | Exaion (small scale) | middle |

| IREN | 6 | 9 | Microsoft ($9.7B) | Extremely high (3GW) |

| CORZ | 5 | 9 | CoreWeave (Major Clients) | high |

| CIFR | 7 | 8 | AWS ($5.5B) | high |

| CLSK | 9 | 3 | Early planning | middle |

| HUT | 6 | 7 | Anthropic/Fluidstack | high |

| RIOT | 9 | 2 | Not yet clear | Gao (Dezhou Power Grid) |

Chapter 5: 2026 Outlook and Investment Recommendations

5.1 Three Core Trends

Trend 1: AI Revenue Realization Period

The massive contracts with IREN and Cipher will begin to contribute substantial revenue in 2026, and the market will test these companies’ ability to operate Tier 3/Tier 4 AI data centers.

Trend Two: Accelerated Industry Consolidation

As smaller mining companies struggle to reduce costs through economies of scale, industry consolidation will accelerate. Bitfarms and others have become potential acquisition targets.

Trend 3: The Importance of ESG Compliance is Increasing

Mining companies with renewable energy backgrounds (such as IREN and CleanSpark) will have an advantage in environmental compliance.

5.2 Investment Strategy Recommendations

Aggressive growth strategy: IREN + Core Scientific

Suitable for investors seeking high risk and high return

Provides dual exposure to Bitcoin and AI

However, attention should be paid to execution risks and equity dilution.

Stable value investing: CleanSpark

Pure mining has the strongest execution capability

Industry-leading fleet efficiency

Suitable for investors seeking stable returns

Leveraged Gambling Type: MARA Holdings

Bitcoin's largest leveraged asset

Suitable for investors who are firmly bullish on Bitcoin prices

High volatility risk must be borne

Infrastructure defense type: Cipher Mining

AWS long-term contracts provide stable cash flow.

Infrastructure targets with defensive attributes

Suitable for risk-averse investors

Chapter Six: Conclusion

The end of 2025 marks the end of the "wild west" era for digital asset mining. The industry is evolving into an "energy computing complex," where power infrastructure, AI transformation capabilities, and operational efficiency are becoming core competitive factors.

Key conclusions:

Valuation logic has shifted from Bitcoin beta to infrastructure value.

AI transformation capabilities have become a key factor in market capitalization differentiation.

Fleet efficiency determines the bottom line for a company's survival.

Electricity reserves have become the most critical strategic resource.

2026 will be the year these transformation strategies are realized, and the market will reassess the true value and long-term competitiveness of these companies.

Disclaimer: This report is compiled based on publicly available market data and third-party research materials and does not constitute any investment advice. Cryptocurrency and related stock markets are highly volatile; investors should independently assess the risks.

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush