CoinFound and ME News have jointly produced a weekly stablecoin report, reviewing noteworthy information from the stablecoin sub-market over the past week.

Article author and source: ME News

(1) Overall market situation

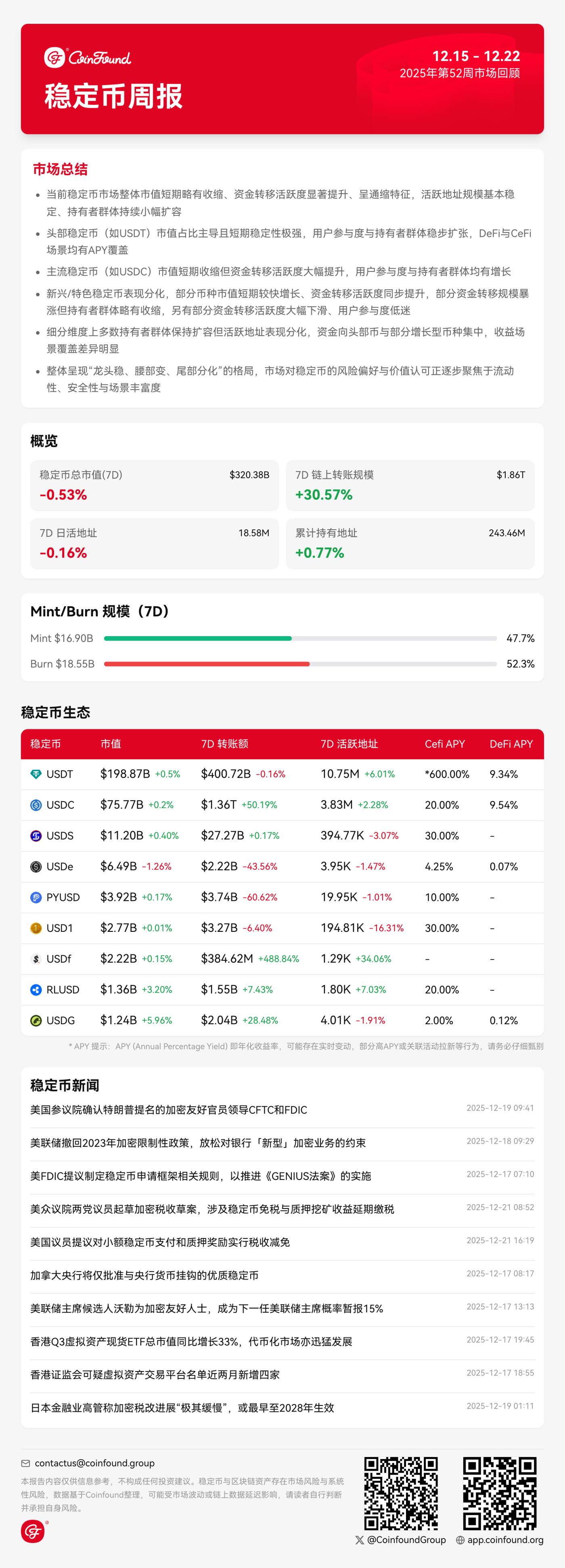

- Total market capitalization: $320.38 billion, a decrease of 0.5% compared to last week ($322.18 billion).

- Transaction volume: $1.86 trillion (7D +30.57%)

- Active addresses: 18.58 million (7D -0.16%)

- Number of holders: 243.46 million (7D +0.77%)

- Minting volume: Weekly mint ($16.9 billion), burn ($18.55 billion), net burn over 7 days ($1.65 billion).

(2) USDT’s dominant position is solid, while Ethereum chain has seen significant growth.

- USDT: $198.87 billion (7D +0.5%)

- USDC: $76.77 billion (7D +0.2%)

- USDS: $11.2 billion (7D +0.4%)

- USDe: $6.49 billion (7D -1.26%)

- PYUSD: $3.92 billion (7D +0.17%)

- USD1: $2.77 billion (7D +0.01%)

- Total market capitalization of Ethereum stablecoins: $167.058 billion (7D +0.92%)

- Tron stablecoin total market capitalization: $80.839 billion (7D -0.4%)

- Solana stablecoin total market capitalization: $15.218 billion (7D -3.31%)

- BSC stablecoin total market capitalization: $13.26 billion (7D -0.30%)

(3) Market Dynamics

- The Federal Reserve has withdrawn its 2023 crypto restrictions, easing constraints on banks' "new" crypto businesses.

- The US FDIC has proposed establishing rules for a stablecoin application framework to advance the implementation of the GENIUS Act.

- US House members from both parties have drafted a bill on crypto taxation, which includes tax exemption for stablecoins and deferred taxation for staking and mining rewards.

- US lawmakers have proposed tax breaks for small stablecoin payments and staking rewards, including a $200 tax exemption for stablecoin payments and new deferral options for staking and mining rewards, to ease the tax burden on ordinary cryptocurrency users.

- The Bank of Canada has made it clear that under its new stablecoin regulations, expected to be released in 2026, it will only approve "high-quality" stablecoins pegged to the central bank's currency to ensure they qualify as "good money."

- Japanese financial industry executives say progress on crypto tax reform is "extremely slow" and it may not take effect until 2028 at the earliest.

- The president of the University of International Business and Economics suggests piloting a "Chinese stablecoin scheme" in free trade zones such as the Hainan Free Trade Port.

- Coinbase advances its "all-in-one exchange" strategy, expanding its business to include stocks, prediction markets, Solana DEX, and other areas.

- JPMorgan Chase has deployed JPM Coin on the Base public blockchain, promoting the on-chaining of traditional banking services.

- Mastercard expands its blockchain and stablecoin payment business in the Middle East through a partnership with the ADI Foundation.

(4) Summary

- The overall market capitalization of stablecoins has contracted slightly in the short term, while fund transfer activity has increased significantly. The number of active addresses has remained relatively stable, and the holder base continues to expand slightly. Leading stablecoins (such as USDT) dominate market capitalization and exhibit extremely strong short-term stability, with user participation and the holder base steadily expanding. Mainstream stablecoins (such as USDC) have seen a significant increase in fund transfer activity, with both user participation and the holder base growing.

- Emerging/unique stablecoins showed mixed performance. Some coins experienced rapid short-term market capitalization growth and increased fund transfer activity, while others saw a surge in fund transfers but a slight contraction in the holder base. Still others experienced a significant decline in fund transfer activity and low user engagement.

- The overall pattern is characterized by "stable leading stocks, changing mid-tier stocks, and diversified tail-end stocks," with the market's risk appetite and value recognition of stablecoins gradually focusing on liquidity, security, and the richness of application scenarios.

View full charts and data

Follow us to get the most accurate market insights.

X: https://x.com/CoinfoundGroup

Visit the website: https://dataseek.coinfound.org/