This article is machine translated

Show original

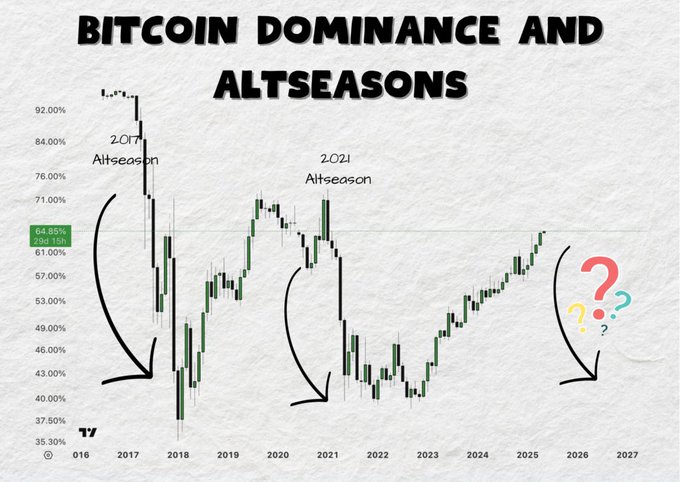

🚨 WHERE DOES THE FUTURE OF ALTCOIN LEAD?

By the end of 2025, most investors will share the same feeling: Altcoins aren't dead, but they're no longer as easy to profit from as before.

Bitcoin reached new highs, ETFs attracted investment, stablecoins boomed, DeFi remained active… but most altcoins failed to live up to popular expectations.

According to the latest report from Galaxy Research, this is not a temporary period of weakness, but rather a sign that the altcoin valuation structure is changing.

To understand where altcoins are headed in 2026, we will delve into the following four aspects 🧵👇

MarginATM

@MarginATM

12-22

Nhiều món quà giáng sinh quá nè anh em 🎄

Lâu lâu mới được hôm cuối tuần bình yên nhỉ x.com/MarginATM/stat…

4️⃣ What are the biggest risks for altcoins in 2026?

The biggest risk doesn't lie in a "lack of narrative," but in conflicts of interest within the new structure.

🔻 One possibility is a conflict between the chain and the app.

When the majority of revenue comes from the app, chains are forced to find ways to maintain the value of their Token . This can lead the chain to: integrate revenue-generating apps, issue its own stablecoin, or readjust its economic model.

However, the deeper the interference, the less neutral the chain becomes, and not all applications accept that. This conflict can cause both the chain's Token and the application's Token to fluctuate significantly.

🔻 Secondly, retail expectations haven't had time to adjust.

Many investors still hold the mindset: "Buying a coin based on the ecosystem means profiting from the entire ecosystem."

However, in the new model, a developing ecosystem does not necessarily mean a sharp increase in Token chain value. Without recognizing this shift, retail investors can easily get Capital tied up in assets that are no longer favored by the market.

According to Galaxy Research, the market is shifting from the "storytelling" phase to the economic value-proving phase.

An altcoin season, if it occurs, will not spread across the entire market, but will only affect Token that capture cash flow, are linked to real economic activity, and have a clear value-capturing mechanism.

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content