As we entered the Christmas week, the global market's initial response was not directed at the cryptocurrency market. Against the backdrop of a weakening dollar and declining US Treasury yields, risk aversion surged, with gold and silver leading the charge, repeatedly hitting record highs and becoming the most sought-after destination for funds.

In contrast, the crypto market appeared unusually quiet. Bitcoin did not take off with the macro trend, but continued to fluctuate between 88,000 and 89,000, lacking the offensive posture that should have been present before the holiday.

It is against this backdrop that the question of whether Bitcoin will experience a "Santa Rally" has once again become a recurring topic of discussion in the market. The so-called "Santa Rally" is a seasonal phenomenon in traditional financial markets, referring to a temporary rise in risk assets around Christmas, driven by improved sentiment and changes in liquidity. However, in the crypto market, this pattern has never been stable. Whether Bitcoin has "fallen behind" amidst rising risk aversion this year, or is quietly accumulating strength within a high range, remains to be seen and requires analysis of its actual price behavior and capital structure.

Funding: The macroeconomic environment remains in a state of "awaiting verification," with funds flowing out of risky assets.

Gabriel Selby, research director at CF Benchmarks, points out that market participants are unlikely to significantly increase their allocations to risk assets like Bitcoin until the Federal Reserve receives data for several consecutive months clearly indicating a continued decline in inflation. In his view, the current macroeconomic environment remains in a "wait-and-see" phase.

This cautious sentiment is closely related to investors' high level of attention to a series of upcoming US economic data releases. Third-quarterGDP data will be released soon, with the market generally expecting an annualized growth rate of approximately 3.5%, slightly lower than the 3.8% in the second quarter. Meanwhile, indicators such as the consumer confidence index and weekly initial jobless claims will also provide further clues about the labor market situation. The results of these data will directly influence market judgments on the Federal Reserve's policy path and further affect overall risk appetite.

From other macroeconomic perspectives, a weakening dollar and declining US Treasury yields do theoretically provide a tailwind environment for risky assets. However, actual capital flows have yielded a completely different answer.

According to SoSoValue's statistics, there has been a clear divergence among ETFs recently: the Bitcoin ETF recorded a net outflow of approximately $158.3 million, while the Ethereum ETF saw an outflow of approximately $76 million; in contrast, the XRP and Solana ETFs recorded small inflows of approximately $13 million and $4 million respectively, indicating that funds are undergoing structural adjustments within the crypto market, rather than a general return.

Looking at digital asset investment products more broadly, CoinShares noted in its latest weekly fund flow report that digital asset investment products experienced a net outflow of approximately $952 million last week, marking the first net redemption after four consecutive weeks of inflows. CoinShares attributed this outflow in part to regulatory uncertainty stemming from the slowdown in the progress of the US Clarity Act, which led institutional investors to reduce their risk exposure in the short term.

Technical Structure: More Like Digestion Than Startup

From a technical perspective, Bitcoin's current trend is not clearly bearish, but it can hardly be described as strong either. The $88,000 to $89,000 range has become the core trading zone that has been repeatedly tested in the short term, while the $93,000 to $95,000 area above constitutes a key resistance level that the bulls must break through.

Several traders pointed out that if Bitcoin fails to break through this resistance zone during the Christmas week, even a short-term rebound is more likely to be seen as a technical correction rather than a trend reversal. Conversely, if the price continues to trade sideways at high levels, it means the market is waiting for new drivers rather than actively choosing a direction.

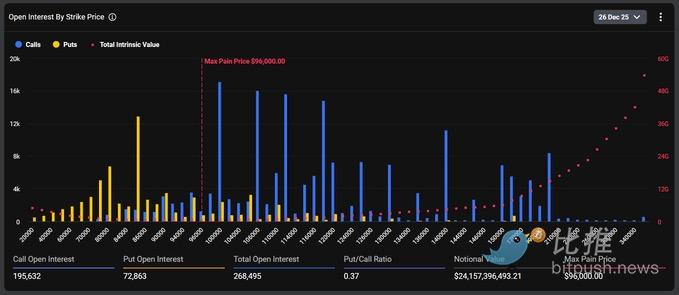

The structure of the derivatives market also explains, to some extent, why Bitcoin has been unusually restrained during the Christmas week. This Friday, the Bitcoin market will see the largest options settlement in its history, with a total value of $24 billion. Currently, bulls and bears are engaged in fierce competition at key price levels.

Bulls: Betting that BTC will break the $100,000 mark.

Short sellers: They are defending the $85,000 level with all their might.

The key level: $96,000 is considered the watershed for this trend. Holding above this level will maintain the rebound momentum; otherwise, the market will continue to be under pressure.

What do analysts think?

Many market observers pointed out that this year's Christmas week was more like a "structural test" than a window of one-sided market movements driven by sentiment.

In a recent interview, Gabriel Selby, head of research at CF Benchmarks, stated bluntly that Bitcoin's current price behavior does not conform to typical Santa Rally characteristics. In his view, genuine holiday rallies are typically accompanied by sustained buying dominance and trend continuation, rather than repeated back-and-forth trading within a high-level range. "What we're seeing now is more like the market digesting previous gains rather than building momentum for the next upward move." This assessment is corroborated by the persistently low trading volume.

Cryptocurrency analyst DrBullZeus stated that BTC continues to fluctuate between the same support and resistance levels without a clear breakout. Until a significant breakout occurs, the price will likely remain range-bound. A break above the resistance level would open up space towards the $92,000 mark, while a break below the support level could lead to a pullback to the $85,000 area.

Legendary trader Peter Brandt recently analyzed Bitcoin's performance, noting that the company has experienced five cycles of "parabolic rise followed by 80% retracement" over the past 15 years, and the current correction is far from over. Despite the unpredictable nature of short-term patterns, he predicts the next bull market peak will arrive in September 2029 based on his cyclical analysis. Brandt emphasizes that the inherent characteristics of BTC as an asset dictate that it will inevitably reach new highs amidst extreme market corrections.

Bitcoin's "Christmas rally" has always been unpredictable. Historically, there have been dazzling performances like 2012 and 2016, with surges of 33% and 46% respectively during the holiday season, as well as years with lackluster performances or even declines. Statistically, since 2011, Bitcoin's average increase during the Christmas period has been approximately 7.9%.

However, judging from the current market landscape, it seems unlikely that a typical "Santa Claus rally" will reappear this year. The strength of gold and silver reflects more the concentrated release of market risk aversion; in contrast, Bitcoin's relative "calm" highlights that it is still widely regarded as a risk asset in global asset allocation at this stage.

Therefore, rather than simply attributing Bitcoin's current performance to "falling behind," it is more accurate to say that it is in a critical and delicate position: on the one hand, there is a lack of sufficient macro tailwinds to propel it directly into a new round of upward movement; on the other hand, there are no clear signs of a breakdown or weakening yet.

What truly determines whether Bitcoin can break out of its current price range by the end of the year is not the "Christmas" timeframe, but rather whether market funds are willing to reinvest at current high levels. Until this is clearly confirmed, narrow-range fluctuations may remain the dominant theme of this Christmas week.

Author: Bootly

Twitter: https://twitter.com/BitpushNewsCN

BitPush Telegram Community Group: https://t.me/BitPushCommunity

Subscribe to Bitpush Telegram: https://t.me/bitpush