Avoid heavy positions at key junctures! The current volatile market is suitable for buying low and selling high. Avoid rash actions before a valid breakout; a wrong direction can easily lead to deep losses. Pay close attention to the resistance breakouts of BTC and ETH. The US dollar will eventually correct, and BTC and Ethereum will likely be affected; be wary of sudden price spikes that could bring them back to their original levels. Don't chase the current price; focus on short-term opportunities during sharp drops and rallies.

In the past 24 hours, a total of 82,934 people across the internet have had their positions liquidated, with a total liquidation amount of $237 million. Long positions were liquidated for $159 million, and short positions for $77.6899 million.

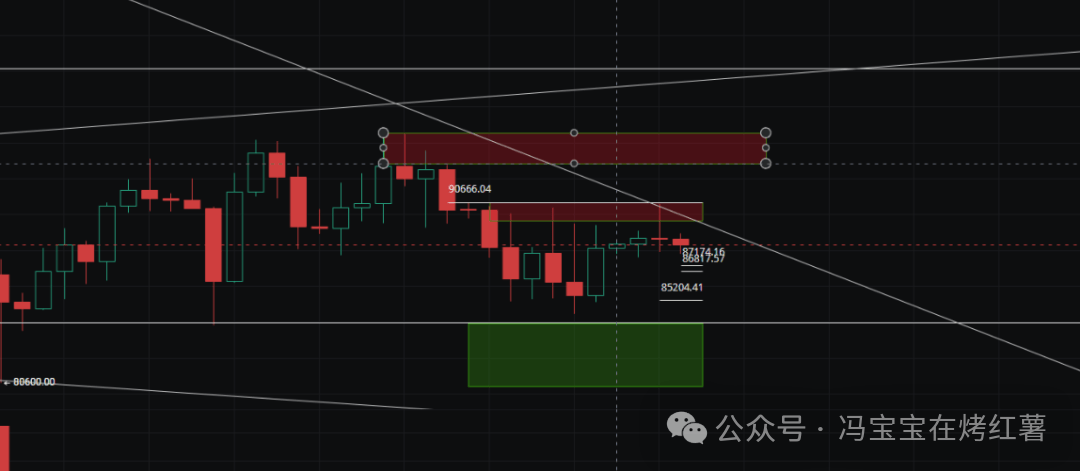

BCT

Looking at recent price action, Bitcoin attempted to break through a key resistance zone, but ultimately closed with a high-volume candlestick with a long upper shadow, indicating significant selling pressure above. This candlestick appeared at the intersection of the downtrend line and the supply zone, a clear technical signal that the market is not lacking upward momentum, but rather that the overall structure remains suppressed by the bears.

If the price can truly break through the 88800 resistance zone, it could potentially target the 92000-95000 range. Key resistance levels to watch are 89600, 90585, and 91355.

Every upward move could be a test. If it fails to recover above 88800 today, the small-scale rebound will be weak, and it will continue to retrace to the support levels around 87720-86650-85220.

ETH

Ethereum's price action essentially still follows Bitcoin's. Even with localized breakouts of the downtrend line, the significance of such breakouts is limited until the overall long-term logic changes. Overall, a cautious or even bearish outlook is maintained for the medium term and the first half of next year.

Today, pay attention to the 3010 level. Only if it firmly holds above this level will this 4-hour pullback be considered over and the market resume its upward trend. The upper resistance levels are around 3043, 3078, and 3115. If it fails to close above 3010 today, it indicates that the small-scale rebound lacks strength, and it will continue to retrace to the lower support levels around 2970, 2943, and 2906.

Copycat

The market never operates according to anyone's will. Truly mature traders are not defined by the number of times they predict correctly, but by having pre-planned strategies for different scenarios. In the short term, anticipate fluctuations and downward trends; in the medium term, wait for a better structure; and in the long term, respect the cycles. This is the core logic for navigating bull and bear markets.

$PIPPIN

PIPPIN hit the 0.26 target level head-on. This wasn't luck; it was respect for the trend and unwavering confidence in the chart. When everyone was chasing the rally, I waited for the pullback; when panic selling occurred, I remained calm. Next time, will you still have doubts?

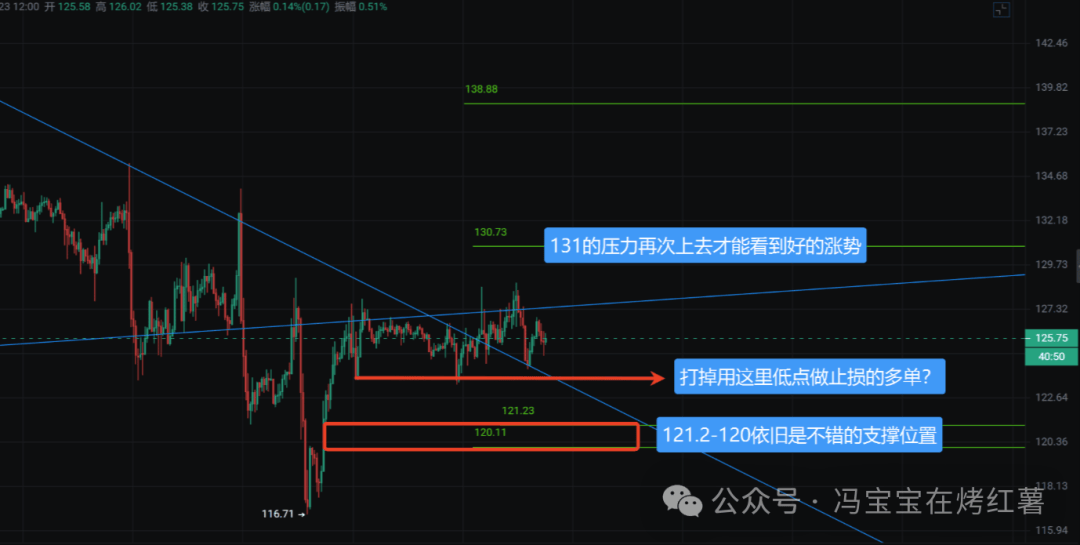

$SOL

The support level on the chart remains between 121.2 and 120; pay attention to the possibility of finding liquidity around this level. The resistance level is 131; a further move above this level is needed to see a significant upward trend.

$AAVE

Although internal strife has started within the team, AAVE remains an excellent DeFi lending project from a fundamental perspective. I actually see the drop as an opportunity, and I plan to buy the dips and go long when it falls further. I'm unlikely to get burned.

$ASTER

The short-term decline should be over. Technically, it's oversold, and selling pressure from the funding side has eased, so a short-term rebound is very likely. However, fundamentally, this is still a worthless project. It only has a few hundred daily active users on the chain, yet it supports a market value of billions, which is completely unreasonable! The perpdex sector already has an absolute leader, namely HYPE. ASTER has been imitating rather than innovating since its inception, so after the short-term rebound, it will continue to fall.

$Hakimi

The Hakimi wedge pattern is closing; a direction will soon be chosen, so keep a close eye on it in the short term. With Christmas approaching, if there are bugs on the Chinese platform, the engineers will be on holiday and no one will be able to fix them. Therefore, a Chinese spot trading session after the New Year might be better, a good start for the new year. Barring unforeseen circumstances, there will likely be a pullback first, followed by a potentially huge surge.

$LIQUID

This coin automatically adds LPs; it's a project by DEV leyten. Those interested in innovative mechanisms can check it out.

$GUA

The AI fortune-telling project just launched with a market capitalization of 100 million, which isn't too expensive. The big players are actively maintaining the 0.1 USDT cost. Considering that Alpha has been online for 26 days, the seven-figure cost of maintaining the coin price is a real expense. Currently, it looks like it's bottoming out, and the stop-loss margin is relatively narrow, so it's a good time to buy in.