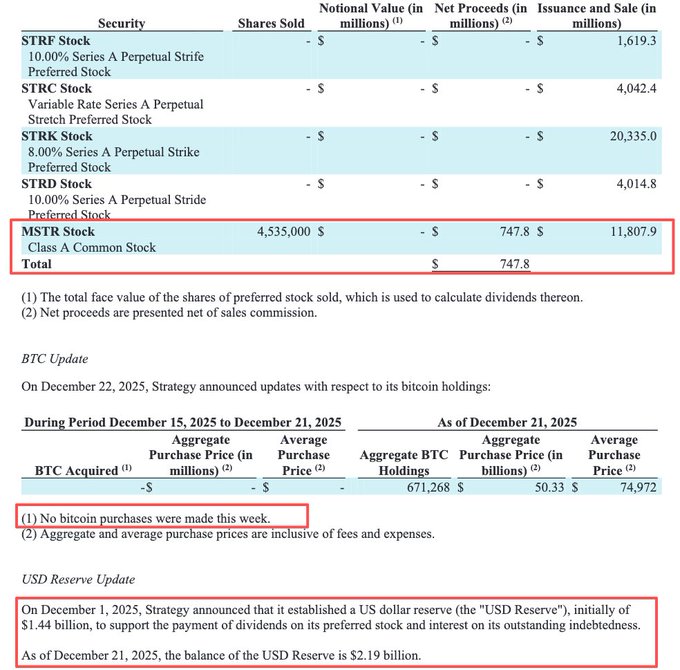

It seems MicroStrategy is also preparing for a downturn. According to its latest filing with the SEC, MicroStrategy did not purchase any BTC this week, but sold 4.5 million shares for $740 million, all of which was invested in the dollar reserves established at the beginning of the month. Combined with the initial $1.44 billion, the current reserves total $2.19 billion. These reserves are primarily used to pay preferred stock dividends and convertible bond interest, amounting to approximately $700 million annually. Therefore, the reserves are sufficient to last at least three years, meaning MicroStrategy won't be forced to sell tokens to pay debts like ETHZilla did today. Although MicroStrategy's stock price continues to fall, its 670,000 BTC holdings are still far from triggering a market crash. assets.contentstack.io/v3/asse...…

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content