Original title: Distribution Advantage: how to set up GTM for your crypto product

Original author: Mac Budkowski

Original translation by: Ken, ChainCatcher

If you look closely at successful crypto projects, you'll find that their growth paths are all different.

Ethereum spread through the Bitcoin community.

Tether is expanding through business partnerships with centralized exchanges.

Polymarket then sparked a buzz on Twitter (now X).

As the old saying goes, for a startup, finding the right channels for its product is half the battle won.

So, how do we achieve this in the crypto space? What paths can drive customers to our product? And what can we learn from successful projects like Aave, Polymarket, and Lido?

Let's begin.

The best products don't always win.

The harsh truth is: people don't always use the "best" products.

This seems unfair to engineers who prefer rational comparisons. Why did the worse product win?

However, products do not compete in a rational vacuum. They compete in a complex network woven from social information flows, user habits, social pressure, anxiety, and extremely limited decision-making time.

Sometimes people use Google Docs simply because they haven't heard of Obsidian; sometimes large companies force employees to use Teams instead of Slack; sometimes you choose Coca-Cola simply because it's readily available and you don't want to bother searching for better soda deep in the shelf.

These products won not because they were more functionally superior, but because they had better market entry strategies (GTM). This means they were better at reaching their target users than their competitors.

This situation also exists in the crypto space. This is why people have been using MetaMask since 2017, and why project teams need to use airdrop mechanisms to overcome users' inertia in trying new things.

This explains why marketing strategies that rely solely on distributing T-shirts and tweeting "gm" often fail. As the famous Silicon Valley adage goes: you need a good product plus good distribution to win.

Uniswap is a prime example. It's often seen as a technological breakthrough, but it's also an excellent example of GTM execution.

Uniswap's year-long promotional campaign

You might think Uniswap grew into a multi-billion dollar giant in the decentralized exchange space because it was the first user-friendly platform. But a closer look reveals that founder Hayden began his marketing campaign a year before the product launch.

What's going on?

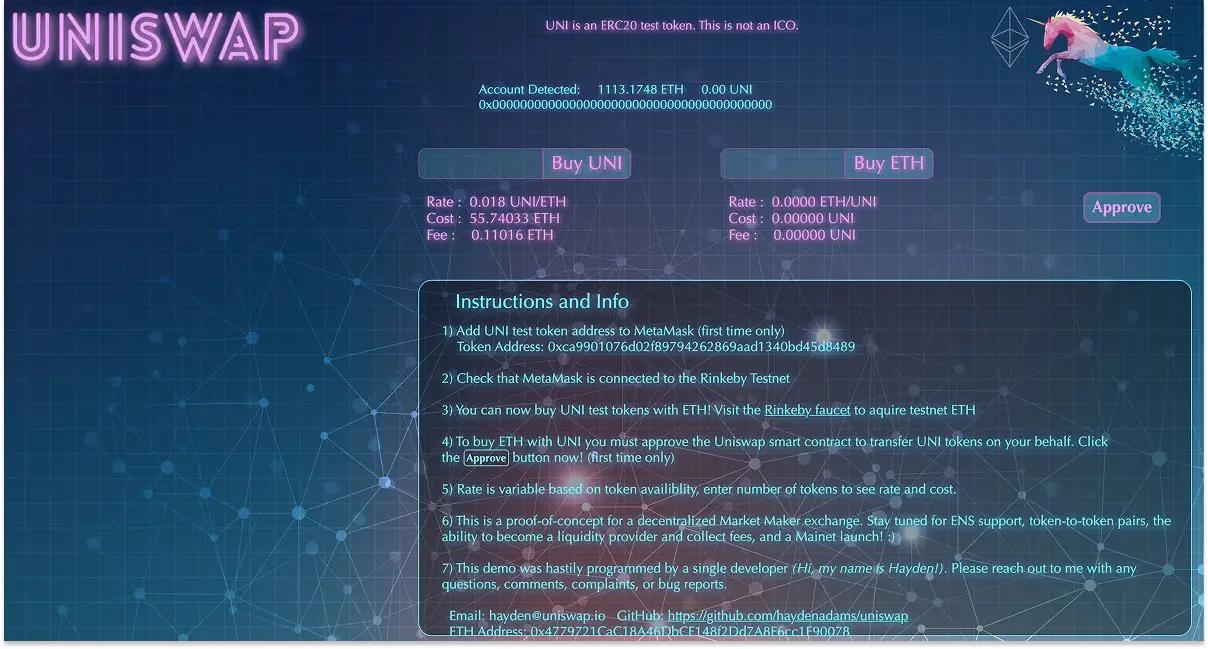

Inspired by Vitalik's article on automated market makers, Hayden built Uniswap's first proof of concept at the end of 2017.

Uniswap PoC 2017

Karl Floersch showcased this Proof of Concept (PoC) at Devcon 3, which garnered some early attention for Uniswap.

Hayden then presented Uniswap at NYC Mesh and discussed the concept with Vitalik. He gave a three-day demo at Edcon 2018, heavily promoted it at New York Blockchain Week, and, through applying for and winning funding, made Uniswap known throughout the Ethereum Foundation.

He also spent weeks working in the offices of Balance and MakerDAO, discussing the project with crypto-native users, and flying to Hong Kong for the ETHIS conference and Shanghai Blockchain Week. He even proactively contacted anyone interested in providing liquidity at launch.

Therefore, a large part of Uniswap's promotion comes from one-on-one interactions between founders through meetings, encrypted offices, and private messaging . This GTM channel aligns perfectly with Uniswap's revolutionary nature, as it provides ample educational opportunities for end-users.

So when Hayden officially launched Uniswap at Devcon 4 in Prague, the project was already well-known in the community (which was much smaller then than it is now).

As Hayden said:

“I once sat alone in a beanbag chair for about an hour, repeatedly revising a tweet. Luckily, my friend Ashleigh happened to pass by and helped me review the tweet.”

I clicked the send button, both nervous and excited about the future. What followed exceeded my wildest expectations—a deluge of support, ideas, and collaborations poured in.

As you can see, Uniswap's history is not a story of "developers working in seclusion and becoming famous overnight after release".

A great deal of promotion had already been done before the product launch. I would have been surprised if Hayden had called it the "GTM Campaign" back then. I bet he was just talking about his product because he thought it was funny.

But Hayden did realize the importance of marketing:

"Before that, I thought my role in Uniswap was mainly technical. When someone asked how it worked, I would usually start by explaining the underlying mathematical formulas. Many people would walk away looking confused."

Richard [Burton] helped me understand that people not understanding Uniswap is my problem, not theirs. Developers are only a small part of the bigger picture. If I want people to use my project, I need to communicate in a way they can understand, in their language. The biggest challenge Uniswap faces is on a social level.

Okay, if even Uniswap, released in the relatively mild environment of 2018, needed GTM, then you obviously need it even more when releasing a product in the noisy year of 2025.

So how exactly do you do GTM? Is it by randomly picking people to chat with at a meeting? Hmm... that's much more complicated.

Channels cannot operate in isolation.

I sometimes talk to founders, and they ask:

"So should we use Twitter? Or find KOLs? Or just attend conferences?"

Unless you lay a solid foundation, it's difficult to determine which channel is best suited for your product. GTM is not the only marketing channel that comes to mind.

GTM will only work if the following three things are aligned:

The right market

The right segmentation of the market

The right channels for this specific demographic

Even the best channels may be ineffective if you choose the wrong market and target audience.

For example, if Hayden hadn't promoted Uniswap to Ethereum developers and OG, but instead pitched his DEX to consultants running enterprise blockchains in Europe, Uniswap would have been virtually impossible to promote.

Before building the funnel, you need to lay a solid foundation.

So, how do you execute GTM correctly?

Step 1: Which is your target market?

Let's start with the market.

The core of a startup lies in finding product-market fit (PMF) . However, most founders spend 99% of their time thinking about the "product" but only 1% of their time thinking about the "market".

They talked to a few people, felt a sense of resonance, and then thought, "This is our market!" It's like marrying your first love. It might succeed with good luck or exceptional intuition, but that's usually not a good way to make decisions.

What else can you do? Carefully evaluate your options and double down on the market that best suits your product.

Look at Coinbase. They started with a focus on the Bitcoin market.

Coinbase 2013 website

If Coinbase had chosen to support Litecoin, Namecoin, or Dogecoin back then, they would never be the giant they are today. They chose the right market and reaped the rewards. For four whole years, until launching Ethereum in 2016, they focused solely on Bitcoin.

Blur tells a similar story. They focused on professional NFT traders, who account for over 90% of OpenSea's trading volume. By aggressively bringing these traders into Blur, they achieved escape velocity. This approach simply wouldn't have worked if they had focused on retail investors who stopped trading after the 2022 crash.

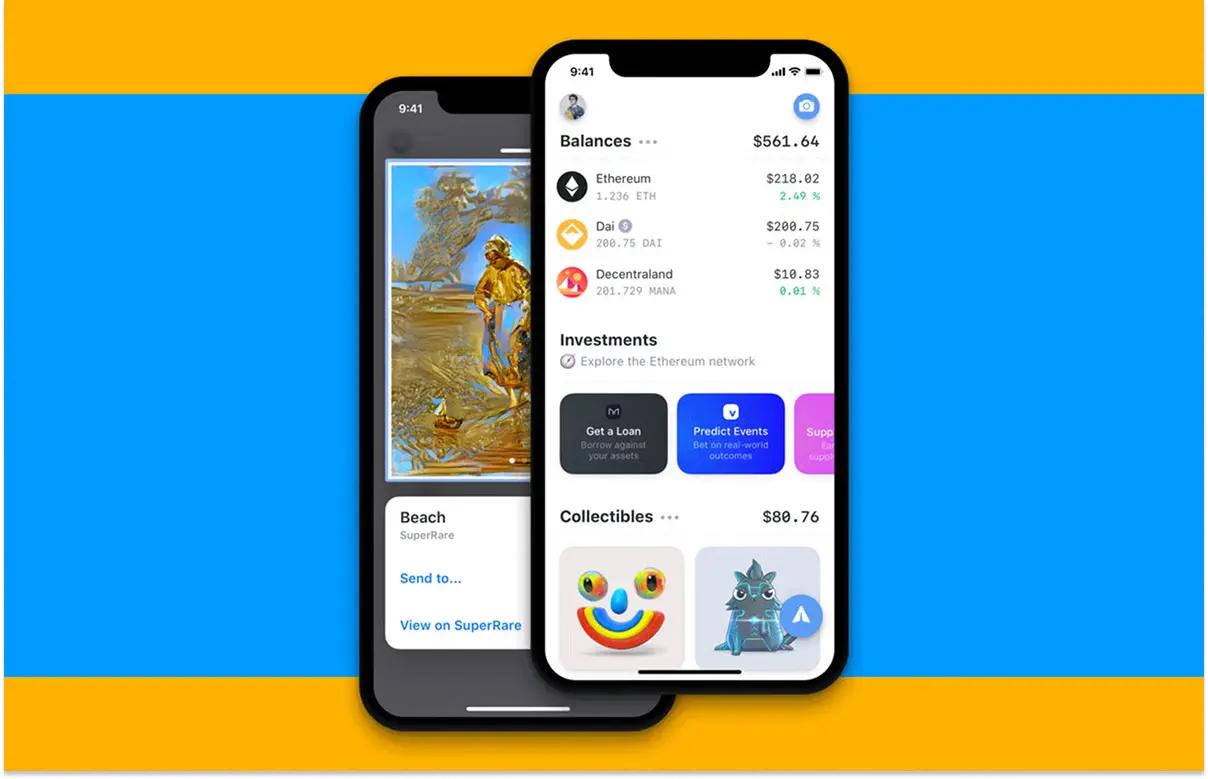

Another good example is Rainbow. They focus on Ethereum users looking for a mobile wallet that is both useful and doesn't feel like a banking app. Rainbow is fun, colorful, and treats NFTs as first-class citizens. This is how they captured a significant share of the mobile Ethereum market.

In 2019, Rainbow was more visually appealing, fun, and NFT-friendly than other wallets.

The framework for choosing a market involves answering three questions:

Where are the pain points? Where is the money? Where are the barriers (battles)?

Choose the market

No pain, no gain.

If users' problems aren't painful enough, they won't bother looking for solutions.

When Coinbase launched in 2012, storing Bitcoin was extremely difficult—Trezor and Ledger didn't exist yet, and many people stored their coins on hard drives. That's why Coinbase's first version was a Bitcoin wallet. They later found that buying Bitcoin was also difficult, so they allowed people to buy and store it, and later added trading functionality.

These are all pressing problems that need to be solved, which is precisely why this market is so attractive.

Money makes the world go round .

It's not a good market if people feel a pain point but can't afford it. They need to pay for the product for you to build a sustainable business. If they have enough money, you don't even need many users to succeed.

I gave an example in my previous article about building consumer encryption applications:

"Last month on Ethereum, Aave collected over $60 million in fees with just about 25,000 monthly active users. This means each user contributed over $2,400 per month. This is because some whale are borrowing millions of dollars. Of course, not all fees go to the Aave treasury, but it's still an astonishing figure."

Choose your campaign.

Some markets have huge demand and users are willing to pay, but the road is full of obstacles. The best markets are those that present certain challenges (so others can't easily enter), but you know how to overcome them.

Polymarket decided to navigate the regulatory hell of the SEC; zkSync chose to spend six years in R&D to build the right technology; Sorare faced the complexities of signing agreements with Real Madrid and Barcelona. While these battles were tough, knowing what "life-or-death" contracts you've signed can help you determine if your team is prepared (and qualified) to face such challenges.

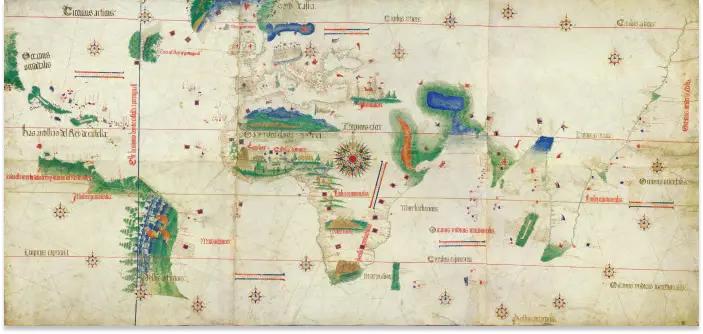

In other words, you have to be like 16th-century Portugal. Thanks to Vasco da Gama, Portugal established a lucrative spice trade with Asia (a huge pain point market that people were willing to pay for) and maintained a monopoly for decades because only they knew the sea routes to Asia (a huge obstacle, but they knew how to overcome it).

This 1502 map, known as the Cantino Plane, was a Portuguese state secret. It was quickly stolen and smuggled to Italy, but a map alone was insufficient to replicate Portugal's advantages. The Italian state lacked the operational experience behind these discoveries: Atlantic-class ships , expertise in sea-wind navigation, a deep understanding of the Indian Ocean monsoon cycle, and experience in long-distance astronomical navigation. Without this expertise, the sea route to Asia could not be reliably reproduced.

If you choose the right campaign, your advantage will be difficult to replicate because you will gain a wealth of combat experience.

Step Two: Who are you actually chasing?

Once you've identified the market, you need to focus your attention further.

Your market is like a watermelon. If I let you eat it, you wouldn't stuff the whole watermelon into your mouth, right? You would (hopefully) cut it into slices. In marketing terms, these slices are called market segments. If chosen correctly, they amplify all your growth efforts.

There are many ways to segment the market.

If you pick up a marketing book from the 1990s, they'll tell you to segment based on demographics, geographic location, and some basic psychological characteristics. So you'd target "Baby Boomers who live in New York and enjoy outdoor activities."

For a brand like Coca-Cola, with a 139-year history, a distribution network spanning nearly 200 countries, and an annual marketing budget of $5 billion, this is an excellent segmentation strategy. But for an unknown startup with only a $5,000 marketing budget, it's a disaster.

It's like you're a group of rebels hiding in the jungle with AK-47s, trying to mimic the US military's strategy. You can't just send F-16s and B-2 bombers to dominate the battlefield. You need to be more flexible and precise.

You need a beach market.

How did Satoshi Nakamoto acquire his first users?

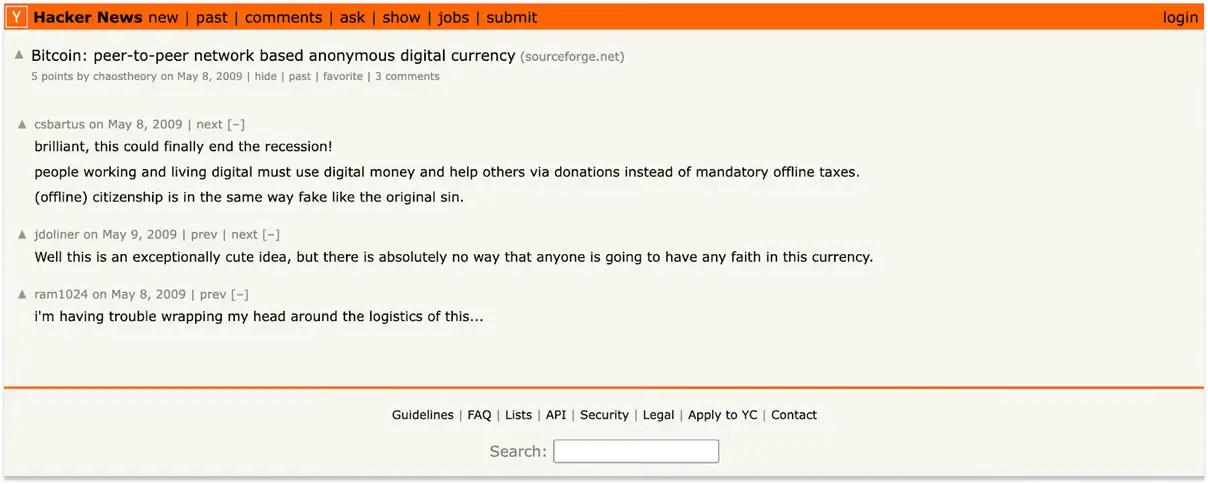

When Satoshi Nakamoto released Bitcoin in 2008, he didn't buy a Super Bowl ad.

He posted the white paper on the Cypherpunk mailing list and discussed it with thousands of privacy and technology geeks. This was his GTM—his way of finding the project's first users (and partners). Very narrow, very precise.

Even on HackerNews (which is already quite hardcore compared to Twitter), the Bitcoin white paper was not shared until more than six months later.

See comment #2 :)

This narrow approach to promoting projects is an example of the beachhead concept—a concept inspired by World War II.

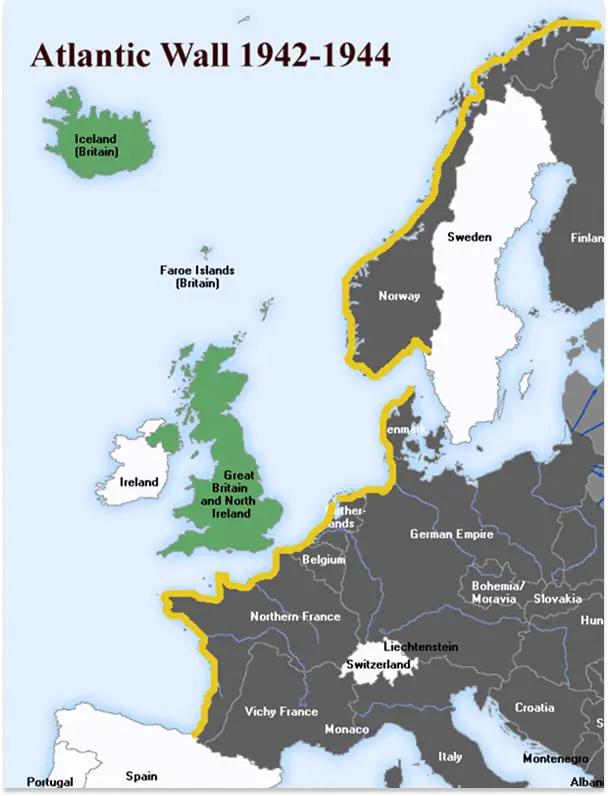

In 1944, when Eisenhower wanted to liberate Europe, he needed a good location for the Allied landings. But there was a problem: the German army had already built the "Atlantic Wall"—a 2,600-kilometer-long defensive line stretching from Norway all the way to southern France.

Fortunately, the Atlantic Wall was not impenetrable. While places like the Channel of Calais were heavily fortified, Normandy was relatively weak. This is why the Allies chose these beaches as D-Day landing sites.

The Allies knew they couldn't win the war in one fell swoop. Their only way to win was to secure a small strategic foothold to transport more tanks, soldiers, and supplies, and ultimately liberate France and the rest of Europe. They had to take this small territory at all costs.

In startups, this Normandy-style strategy is your beachhead. You want to establish the easiest foothold to enter (for Satoshi Nakamoto, it was the cypherpunk mailing list; for Hayden, it was the Ethereum developers and OG at conferences), and then expand from there.

Therefore, just as the Allies did not directly attack Berlin, you should not directly target the mass market.

So, how do you choose the right market segment?

Find Your Normandy

- I have a similar painful problem that your product can solve (how to find the optimal annual interest rate?).

- Experiencing these issues in a similar context (I am an advanced DeFi user looking for advanced products).

- Connect in a similar way (stay in 10 specific group chats, follow the same 20 people on Twitter, attend the same 3 meetings every year).

- Interact with each other (they meet in various events, group chats and exchange letters, so you can spread word of mouth naturally).

Zapper is a good example of choosing the right clip.

Their biggest user growth in DeFi this summer did not come from integrating blue-chip protocols like Aave or Compound.

It originated from the idea of integrating small-yield farms with closely connected communities, but lacking good rewards tracking tools. The Zapper team identified these farms and integrated them as quickly as possible. Whenever these communities found that they could see all the rewards they could claim in one place, they became heavy users of Zapper.

Starting from the high notes

Step 3: How to reach them?

Let's say you want to learn programming. Would you learn a little C++, a little Java, Python, assembly, and Rust? Probably not.

In most cases, you will either choose to focus on a course in a specific language or choose a project that interests you and learn the language you need to accomplish it.

The same applies to GTM.

You can't "enter the market" by posting a tweet, a podcast, a YouTube video, a private message to a potential partner, or a TikTok video. Your efforts—like programming—require greater focus.

You need to find the right channel.

What exactly is a channel?

Channels are essentially the paths that guide customers to your products.

There are many channels to choose from—conferences, business development, advertising, billboards, search engine optimization (SEO), and so on. A list of guidelines is described in a book titled *Traction*.

Here are some examples of channels in the crypto market.

Ethereum's main channels are Bitcoin forums, group chats, and meetings.

Vitalik Buterin, co-founder of Bitcoin Magazine, is well-known in the Bitcoin community and has discussed Ethereum with many of the authors of the Ethereum white paper. He later shared information about Ethereum on Bitcointalk.org and showcased it at Bitcoin Miami. Even the Ethereum pre-sale was denominated in Bitcoin. (Look how focused they are on this!)

Vitalik's slide in Bitcoin Miami

For Tether, the primary channel is commercial transactions with centralized exchanges.

In 2016-17, CEX encountered problems accessing banking systems and therefore readily implemented alternative dollar settlement methods. This is why Tether grew 1000-fold in two years.

USDT market capitalization growth on a logarithmic scale (see 2016-17)

For Polymarket, this is a world-class Twitter game.

Polymarket's positioning aligns perfectly with current trends, making them a great fit for Twitter. They post emojis. They share news. They share funny betting screenshots. And they're fantastic for replying. There's also Shayne, who tweets.

For Snapshot, growth is product-driven.

During the DeFi summer, almost everyone was involved in multiple DAOs. So when they saw Snapshot performing well on balancers, they said, "Hey, let's use it for my DAO too!" And when they implemented it for their own DAOs, others said, "No problem, I'm going to share Snapshot with the other three DAOs I'm in!"

This 2021 Decrypt article drove new users to Snapshot because they wanted to activate their own community. This is one of many examples of Snapshot's product-driven growth.

The money in the Zerion wallet is NFTs.

When Zerion launched its wallet, they created a Zerion DNA virtual avatar, a dynamic NFT that evolves based on the assets held in your wallet. The more money you have in your wallet, the more "advanced" the NFT becomes. Many people began sending funds to the Zerion wallet, and for a long time, their NFT collection has been the second largest on the mainnet (after ENS), with over 300,000 holders.

Zerion NFT example (they later migrated it from the mainnet to ZERO L2).

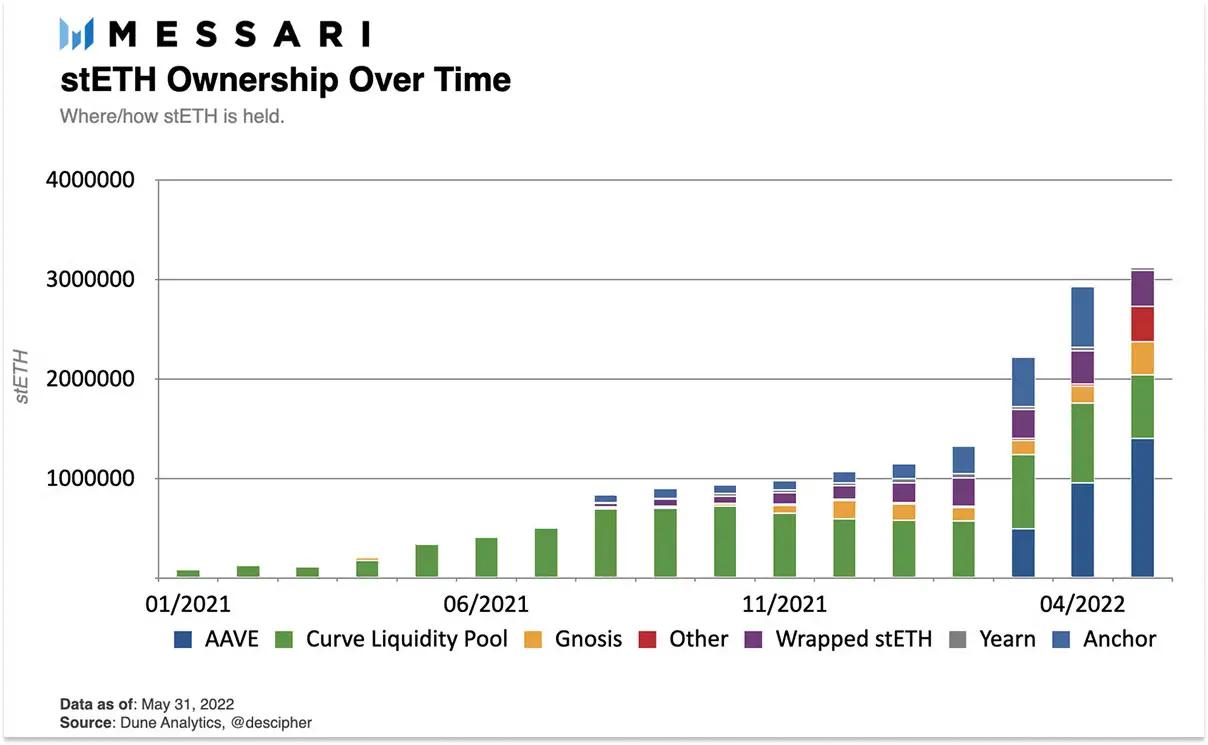

Lido is a DeFi integration.

For Lido to function, they needed staked ETH to be convertible to original ETH. Therefore, they spent millions of LDO tokens to incentivize liquidity in the Curve stETH:ETH pool. Later, they established a strong stETH integration with Aave, as ETH stakers were also seeking additional yields, which further boosted the project's adoption.

For Echo, it is KOL(s).

Promoting Echo is tricky because regulations don't allow people to share investment information outside the platform. But Cobie has consistently been one of the most influential figures in the cryptocurrency space.

He then shared the content in his personal and project materials, and described the early funding issues (which Echo resolved) on his Substack. Additionally, group curators (often well-known crypto investors) would send Echo referral codes to those interested in co-investing, helping new users join the app.

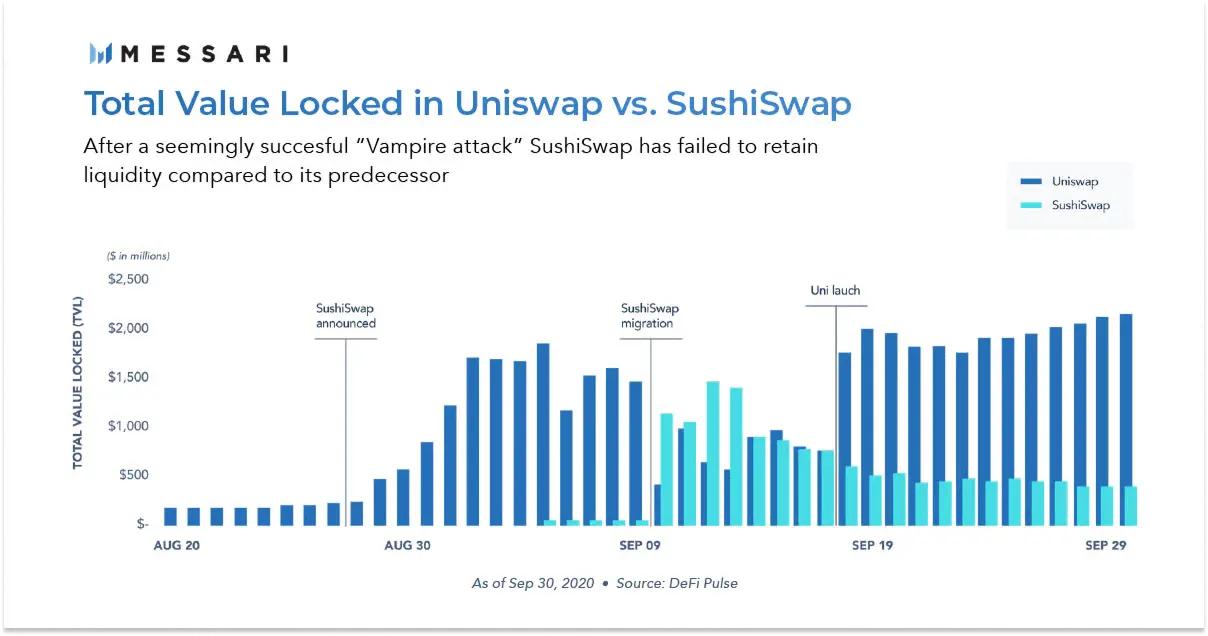

For SushiSwap, it was a vampire attack.

In 2020, SushiSwap forked Uniswap, offering high SUSHI rewards to users staking Uniswap LP tokens. With annual interest rates reaching ~1000%, liquidity providers moved funds, and within weeks SushiSwap accumulated approximately $800 million in TVL (about 55% of Uniswap's liquidity). This vampire attack propelled SushiSwap to the top DEX platform, forcing Uniswap to respond by issuing the UNI token.

Although Uniswap ultimately succeeded in defending their position, the surge in SushiSwap TVL was remarkable.

For ZORA, it's DMs.

When ZORA became heavily focused on art, Dee Goens started messaging people on Twitter and Instagram. He reached out to sneaker customizers, illustrators, and artists, bracing himself for the possibility of casting NFTs. Despite the influx of major brands during the bull market, the Zora team is still sending private messages to potential users years later.

An example of a conversation Dee had in 2025.

For Safary, the key is to build a community .

In early 2022, Safary launched a community for crypto marketers. It was done in batches, requiring you to apply and learn crypto marketing in batches of 60 to 100 people. Within three years, they received over 10,000 applications, and by the time they developed their on-chain marketing analytics product, they already had a large number of marketers who could be easily reached.

Safary requires communities to include "@Safaryclub member" in their profiles, which increases distribution channels.

For Aave, it's about leveraging the existing community.

Back in 2020, Aave made a bold move. They designated Chainlink (mainnet had only existed for about seven months) as their oracle provider and allowed people to use LINK as collateral. This move turned (very vehement) LINK supporters into major backers of Aave, helping to promote the product.

For Fluidkey, it's Farcaster.

When Fluidkey announced its product, it set up a framework for people to sign up and waitlist. They had about 6,000 registered users, but they knew that not all of them were high-quality users.

So once the product was ready, Moritz began manually bootstrapping the first 20,000 Farcaster users (meaning they were a carefully selected group). After they had a few hundred users on the app, they set up a bot that would send private messages to about 100 users a day from the list, sharing an access code.

Fluidkey post (Unfortunately, this framework has stopped working)

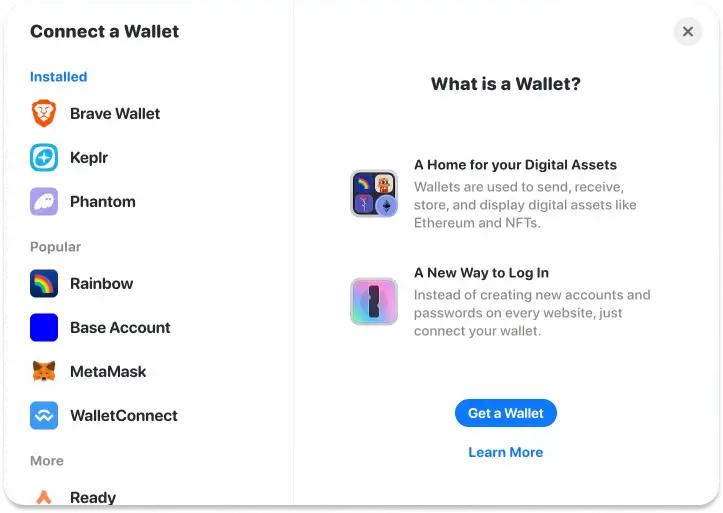

For Rainbow, it's the React library.

Rainbow has developed a clean React wallet connection toolkit and is giving it away for free. When developers implement RainbowKit, their dapps will by default showcase Rainbow as a top-tier wallet. While developers are free to choose which wallets to showcase, most don't change the default settings, thus helping to build a strong Rainbow brand and attract new users.

RainbowKit has been used by thousands of apps, and their GitHub repository has 2,700 stars.

POAP is onboarding in real time .

POAPs were officially launched at the ETHDenver conference in 2019. Patricio would ask for addresses from people one by one and manually create POAPs (which was very difficult). But the channel still worked for them, and since 2021, more than 7,000 real users have received POAPs for "I met Patricio".

Meeting Patricio at the conference became a running joke in the industry :)

Of course, mature products usually have multiple channels.

Lido is very active on EthResearch, EthStaker, and r/ethfinance. Fluidkey has support from the ENS and security agencies. Polymarket has close partnerships with top media companies. And so on.

However, if you are a startup with limited resources, it is much better to master one channel before expanding further.

How do you choose channels?

The typical method for selecting a channel is:

Browse the channel list,

Come up with an idea that might be suitable for you to start a business.

The scores are based on cost, ease of testing, signal latency, and compatibility with the product.

Three channels were selected for testing.

Choose which channel you want to start with.

If you would like a more detailed description of the process, simply consult your preferred LLM for "Gabriel Weinberg's Bull's Eye Frame".

Channel Test

Once you've chosen a channel, you need to understand whether it can bring you users.

The bad news is—just like most product features don't improve retention rates, most channel experiments don't bring in more users.

In other words, growth is probabilistic, not deterministic. It's a gambling game. So you need to find the most certain (highest expected value) bet.

When I was doing growth for Kiwi, I thought our best options were newsletter, r/ethereum, and BD.

We thought a newsletter would be a good option because we see a lot of blog posts about Kiwi. So if someone reads newsletters, they might also like our app because they might discover more interesting content.

We have been mentioned in multiple communications, including Poolfish, which focuses on Uniswap LP services.

We think that since they are advanced DeFi users, they will probably like our content.

In r/ethereum's logic, these Reddit users enjoy discussing Ethereum content. Since they care about decentralization, they might be interested in Kiwi (a decentralized hacking news/Reddit-like app). So I share recap posts there weekly and try to invite these people to subscribe to our newsletter, later introducing them to the app.

I made a post about how I always try to find links on r/ethereum that people would be interested in.

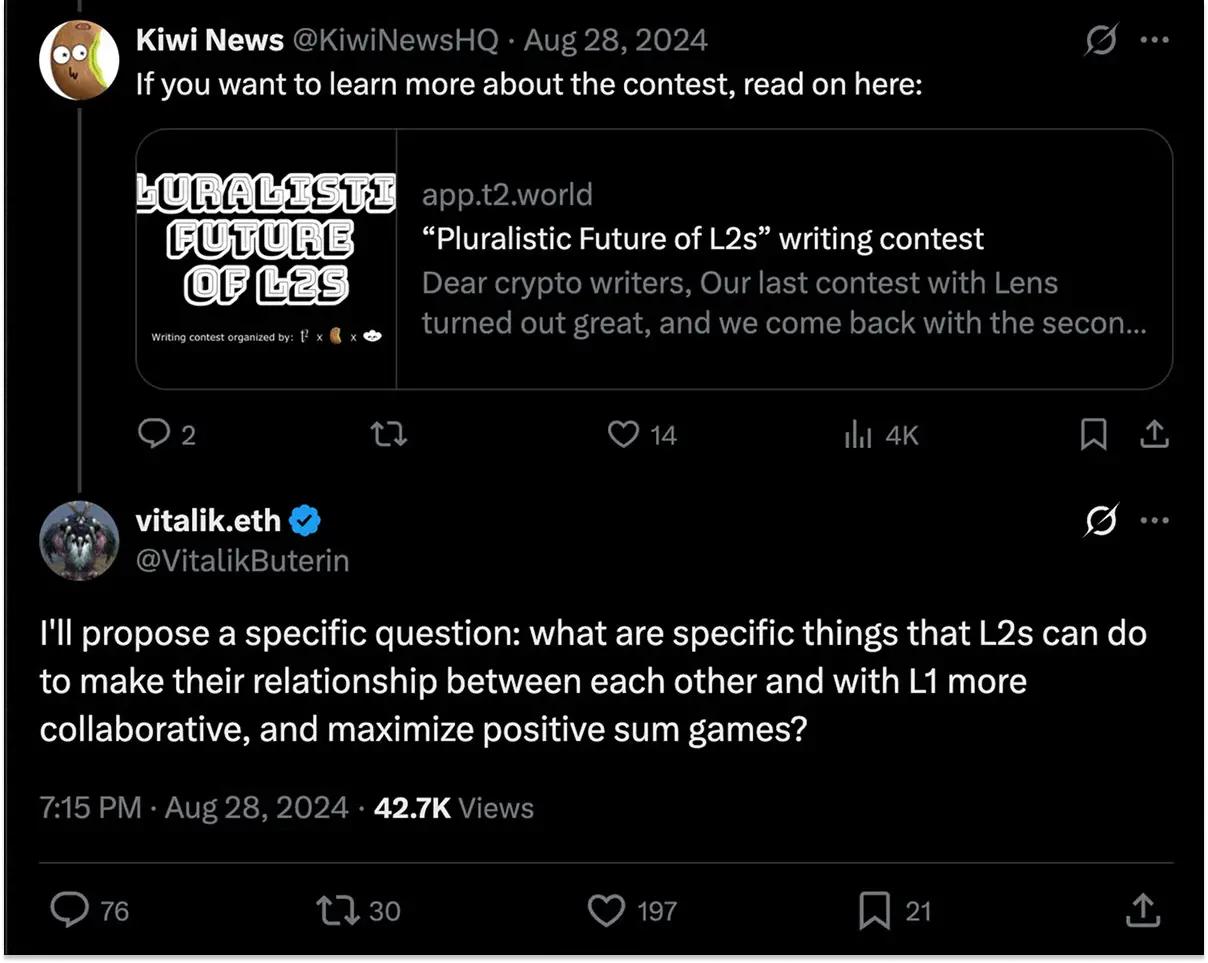

In our BD project, we organized a writing competition with Gnosis, Nouns & Lens. We invited community members from Kiwi and our partners to write blog posts, submit them to Kiwi, and compete for a prize pool of several thousand dollars. While the workload was significant, the joint marketing with larger projects boosted our brand and allowed us to reach new audiences.

Thanks to the additional exposure from our partners, one of our contest prompts came from Vitalik himself.

My personal approach to making these bets is that even if we ultimately fail to meet our growth targets, we can still gain better brand awareness, connection, or understanding of user needs.

For us, the newsletter and r/ethereum experiments didn't bring much growth. However, we did reach new users, eventually getting a podcast invitation and some new subscribers. On the other hand, the writing contests worked very well, so after the first experiment, we doubled down on the channel, organizing six contests in eight months.

Typically, after 2-4 weeks of honest effort, you can determine if a channel is working properly. Therefore, you can test 12 to 24 channels within a year, which involves processing a large amount of new information.

If you choose a channel, talk to someone who has had success there.

Imagine you want to test Twitter, but you've never tweeted. How good would your tweets be? Probably not very good. So you might think, "Ah, Twitter isn't for our startup!" But the problem is poor execution, not poor channel fit.

The same principle applies to content creation, podcasts, KOLs, TikTok, private messages, and so on.

Channel inspection

When you examine a channel, certain details can make or break it.

When we tested whether podcasts were suitable for New Zealanders, we found that most of our appearances didn't have a significant impact. But at one ENS ecosystem conference, over 10 new paid subscribers signed up immediately. Further investigation revealed that—because Kiwi integrates ENS—their community wanted to test and support our product.

There are many such details, which is why "following the rules" testing channel is basically a full-time job.

Once you have the results, a simple way to check your channel is to answer three questions:

1) How much does it cost to acquire a suitable user through this channel?

The cost mentioned here refers not only to how much money you spend, but also to time, effort, and other resources.

By "suitable users," I mean people who aren't bots, people who farm airdrops, or people who just browse casually. In other words, suitable users are those who can use the product long-term and are a good fit for your product's current stage. This fit with the product's stage is crucial because you don't want a large number of ordinary users in the alpha phase, when the product still requires a certain level of cryptographic expertise.

2) How many users can be reached through this channel?

If you have 10,000 users and need at least 100 new users per week to reach your goal, then a group chat of 500 people might be too small for you. But if you're just starting out, it might be about right (like Satoshi Nakamoto).

3) If this channel is usable, can it be expanded without exploding?

Can you double down on this channel, growing from 10 users per week to 1,000, while acquiring the “right users” at roughly the same cost and effort? Or will it quickly become saturated and deteriorate? It tells you whether the channel can become your main growth engine, or whether it’s a small, niche, or rapidly saturating channel.

Sometimes you know the channel will soon be saturated, but you just want to "add fuel to the fire."

When BAYC started using CollabLand in 2021, the CollabLand team decided to capitalize on the momentum. So Anjali (one of her co-founders) started messaging every new NFT community she could find on Twitter, saying, "Hey, do you want all collectors to join one group?"

A few weeks later, everyone started using CollabLand, so we stopped sending private messages to users, but this extra effort accelerated user adoption.

Step 4: How to make them understand that they need your product

Once you've selected your market, market segment, and channels, you need to choose the message you want to convey.

The information you provide is essentially what you tell (or show) users to persuade them to try your product. This information is what users see in ads, private messages, landing pages, blog posts, presentations, and business development calls. What should you pay attention to?

When people hear about a new product, they silently ask themselves three questions:

Will this solve any of my current problems?

- Does it meet my needs for this type of product?

How do I know it will work as advertised?

If you don't help users find the answers to these questions, you'll eventually be confused about why people "don't understand."

I've written a separate guide on messaging, so I won't go into that topic in detail—you can read that guide here. However, what I want to emphasize is that messaging isn't just what you write on your landing page (that's the focus of the guide), but what you convey through your channels.

When L2Beat was launched, it immediately attracted the attention of different teams, who asked, "Why wasn't our project included in L2?"

This sparked a widespread discussion about what L2s actually are. Polygon then tried to convince everyone that they were L2s, but the L2Beat team refuted this. Through discussions on Twitter, they educated the crypto community about the difference between sidechains and L2s, and how L2Beat helps keep everyone informed.

Another example of delivering messages through channels is promoting products to users via podcasts, as EigenLayer does. Or you could do what Hayden did, who personally explained why Uniswap makes sense.

That said, a safer approach is to assume users visit your website knowing nothing and educate them from scratch. Remember, Coinbase explained "What is Bitcoin" on their website back in 2013.

Step 5: Dealing with Emotions

One thing to note before we end is that GTMs are often subject to emotional blows.

It's difficult because you have to make tough decisions and "go out" to face the cold feedback from the real world.

Here are some things to keep in mind:

When you choose a market, you often feel it's too small. That's okay.

It's usually a perfectly timed signal. But remember, a good market should grow as fast as possible—because when the pie is growing, it's easier to get a slice. That's why venture capitalists like to see markets with "high compound annual growth rates" in proposals.

When you choose this field, it's normal to have doubts about whether it's right for you.

Remember, you're placing a bet—and assume your first attempt won't be perfect. So when you define your segment as: "DeFi whale in Hong Kong doing $100,000 to $500,000 in OTC trading," your intuition will lead you to broaden your scope. Resist that. The real beachhead always feels too narrow—that's precisely why it's so easy to conquer.

When choosing channels, you might want to long channels at the same time. Don't do that.

Validating the suitability of a channel requires a certain level of skill. Spending five times the time on one channel is clearly more effective than distributing the same time across five channels. Furthermore, if you can complete testing within four weeks, you'll have ample time to explore other channels.

You might feel like you're getting dumber when you're sending messages. That's not true.

Ask your favorite large language model about the "curse of knowledge." It's crucial to make your messages boring. Not because your users are stupid, but because they're busy. If they're rushing through your message in an elevator, they should be able to "get it straight." You can also elaborate on this in documentation or on your website.

Your GTM operation might seem awkward, slow, or uncertain. That's okay.

That's okay, because there will be awkwardness (when you're doing something new), slowness (when you're learning new channels), and uncertainty (when you're betting). The good news is, you can take your startup to the next level with just one click.