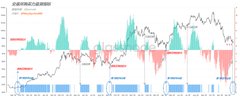

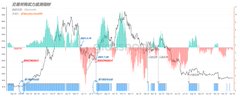

Yesterday, someone in the comments asked: “The Exchange Buying Power Indicator” is showing a recovery signal from 0 to 1. Which exchanges are contributing the most to this signal? From what I’ve seen, Binance is currently leading the pack. Looking at the BTC spot volume delta (VDB)—which measures the net difference between aggressive buy and sell volume—Binance (yellow line) and other exchanges (gray line) have both bounced off the bottom and are now above the 90-day median (red line), signaling a comeback in aggressive buying interest. (Chart 1) But Coinbase’s VDB (blue line) is still sitting below the 90-day median. It did climb above the red line during 11/22–12/9, but the deviation wasn’t significant, meaning even though buyers had the upper hand, the momentum wasn’t strong. If you compare the other two red shaded areas, you’ll notice the difference: In August–September 2024 and March–April 2025, the blue line (Coinbase) or all three lines (blue, yellow, gray) were above the red line at the same time. Clearly, during those BTC price drops, buying power from Coinbase investors played a leading role. So, taking this recovery signal from the “Exchange Buying Power Indicator” into account, my personal view is that the probability of a full trend reversal isn’t high. It’s more reasonable to see this as a potential rebound setup rather than the start of a new bull run. Of course, if we start seeing aggressive buyers from Coinbase joining in later, that’s a different story. ---------------------------------------------- Bitget VIP: Lower fees, bigger perks.

This article is machine translated

Show original

Murphy

@Murphychen888

12-23

指标显示:交易所购买力正在逐渐恢复

“筹码集中度”数据不能作为方向判断的依据,那有没有可以作为辅助判断方向的参考指标呢?当然有!比如“交易所购买力监测”指标就是其中之一。

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content