This article is machine translated

Show original

Last night, the US reported a significant 4.3% increase in real GDP for the third quarter, the fastest growth in two years, primarily driven by strong household consumption. Core inflation remained high at 2.9% in the third quarter. Although the strong economy and resilient inflation are still dampening expectations for interest rate cuts next year, the fact that GDP growth outpaced inflation indicates healthy overall growth and increasing real purchasing power. For the market, the robust "hard data" paints a picture of strong economic resilience.

Economic resilience boosted investor confidence in continued corporate earnings expansion, driving US stocks higher. However, there was also divergence: growth stocks and large-cap tech stocks benefited relatively, with gains in mega-cap tech stocks such as Nvidia, Broadcom, and Alphabet pushing the S&P 500 to a new high, while small-cap stocks, more sensitive to interest rate cuts, lagged significantly. (Previous | _2024111120230_)

From a macro perspective, the Christmas rally in US stocks could actually continue into early to mid-January. However, more issues will arise in mid-January: the ongoing debate over subsidies for the Affordable Care Act.

Supreme Court ruling on tariffs;

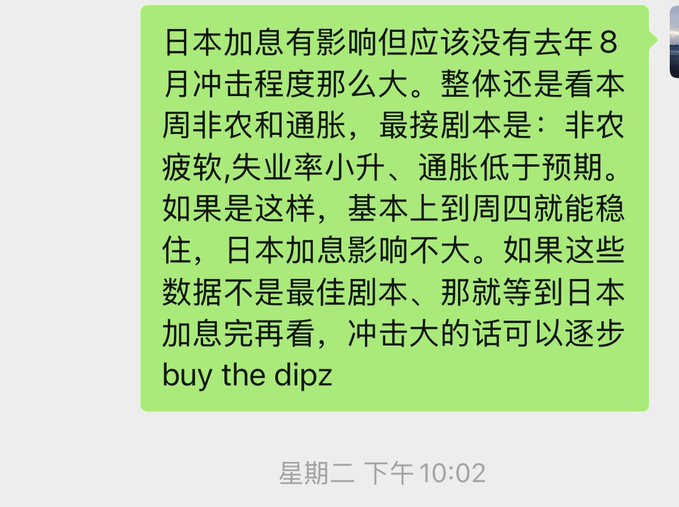

December non-farm payrolls and CPI;

Earnings season has begun.

These will all have a significant impact on the market.

As for BTC, as we discussed last Saturday, the US stock market has been performing smoothly this week, but BTC may be more challenging. After all, there is the largest options settlement in history on the 26th, and it is difficult to see a clear trend before then.

qinbafrank

@qinbafrank

12-20

维持周四晚上近期拐点的判断,虽然美股拐点当天就出现,大饼周四晚上还吃了一波过山车,但不影响中期走势。周四晚上11月cpi争议很大是争议数据并不是坏数据,属于“回落不是问题,回落这么多有点问题”。 x.com/qinbafrank/sta…

Let's see how the US stock market reacts after it opens tonight. The current fluctuations are a bit underwhelming considering the massive volume of transactions.

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content