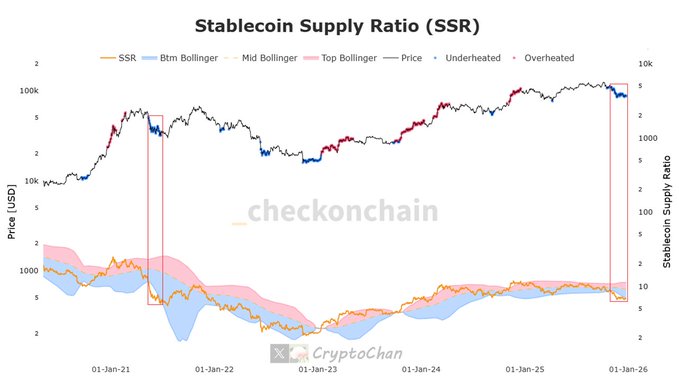

The Stablecoin Supply Ratio (SSR) is an on-chain analytics metric calculated as follows: SSR = "Bitcoin Market Cap" / "Total Stablecoin Supply" Simply put, it measures the ratio of Bitcoin's market capitalization to the market capitalization of all major stablecoins (such as USDT, USDC, DAI, etc.). SSR primarily reflects the potential purchasing power of stablecoins relative to Bitcoin in the market: 1. Purchasing Power (Supply and Demand) • Stablecoins are often seen as "backup ammunition" or a reservoir of funds in the cryptocurrency market. • SSR attempts to quantify how much of a price boost these "ammunition" could generate if they were all used to buy Bitcoin. 2. Market Sentiment and Trend Judgment • Lower values = Strong Purchasing Power: When the ratio decreases or is low, it means that the supply of stablecoins is large relative to Bitcoin's market capitalization. This indicates ample off-exchange funds and sufficient "purchasing power" to push up Bitcoin prices, typically considered a bullish or bottoming signal. • Higher values = weak purchasing power: When the ratio rises or is at a high level, it means Bitcoin's market capitalization is already high relative to stablecoins. At this point, subsequent buying funds in the market are relatively insufficient, and the price may struggle to sustain itself or face a pullback, typically considered a bearish or overheating top signal. 3. SSR is often displayed in conjunction with Bollinger Bands. When the SSR touches or breaks through the upper Bollinger Band, it is usually marked as "overheated"; touching or falling below the lower band may indicate that purchasing power is at a historical high.

This article is machine translated

Show original

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content