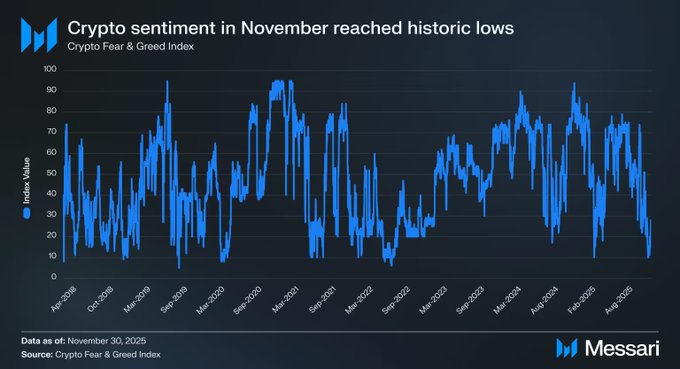

🚨 CRYPTO SENTIMENT 2026 WILL GET BETTER, BUT IN A DIFFERENT WAY In early 2025, crypto sentiment was at an all-time high, with Bitcoin nearing six figures, regulatory pressure easing, and everyone believing the time was right. But by the end of the year, market sentiment had hit Dip , even though most of what the community had expected from regulators had materialized. According to a report by @MessariCrypto (Nick Garcia), the 2026 story isn't about a "Bull run returning," but rather about the market being forced to change how it operates: 🔻 Protecting holder will become the number one priority: The era of holder accepting the role of "money-making machines" for the team only to be gradually Dump is over. New, more transparent ownership models will emerge to address long-term interests. 🔻 DeFi is beginning to penetrate traditional markets more deeply: Equity perps, on-chain Derivative , and DeFi directly linked to equities will no longer be small-scale experiments. 🔻 Stablecoins are no longer just a game for a few big players: More and more protocols want to have their own stablecoins to maintain yield within their ecosystem, instead of "nurturing" external stablecoins. Sentiment will improve, but only for those who remain. The 2025 market has undergone a significant cleansing. Those still here into 2026 are generally people who have a clear understanding of the risks and no longer harbor old illusions. 👉 According to Messari's conclusion, crypto will not die, but it will also not return to its old growth pattern. Sentiment will recover, but with a different, more stringent, and realistic market structure.

This article is machine translated

Show original

MarginATM

@MarginATM

12-24

🇻🇳 Việt Nam nằm trong top 5 quốc gia dùng TradingView nhiều nhất thế giới

TradingView hiện có khoảng 233 triệu lượt truy cập mỗi tháng.

Trong đó, Việt Nam chiếm hơn 3.2%, tương đương ~7.5 triệu lượt truy cập/ tháng – đứng top 5 toàn cầu.

Điểm thú vị là x.com/MarginATM/stat…

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content