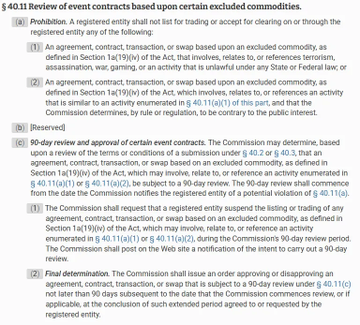

This summary of the compliance licensing for prediction markets is very detailed; I'll study it. My basic understanding is that it can be divided into two categories: 1) Onshore prediction markets. These markets can be understood according to the traditional "exchange-broker-clearinghouse" system. Exchanges correspond to a futures license for DCMs, clearinghouses to DCO licenses, and brokers to FCM licenses. DCMs also need a binary event contract license. 2) For offshore markets, taking Polymarket (Global) as an example, currently, DCM functionality is implemented by CLOB; FCM brokerage functionality is achieved through fund self-custody and full collateralization; and DCO clearing functionality is achieved through atomic swaps of on-chain contracts. However, it's important to note that the settlement decision upon maturity is not made by the clearinghouse, but by the third-party oracles UMA/Chainlink.

This article is machine translated

Show original

Leo the Horseman (prediction arc)

@LeotheHorseman

12-26

如果从美国监管角度理解预测市场的 M&A 和牌照生意,非法律专业人士,仅作信息收集自用:

- 类比 CEX 格局,此处我们将理解两类冲突:在岸所和离岸所、CFTC 监管的衍生品市场与州监管的博彩市场。

- 先聊在岸的预测市场。这类市场能按照传统的“交易所—经纪商—清算所”的体系来理解,交易所对应 DCM

Sector:

From Twitter

Disclaimer: The content above is only the author's opinion which does not represent any position of Followin, and is not intended as, and shall not be understood or construed as, investment advice from Followin.

Like

Add to Favorites

Comments

Share

Relevant content